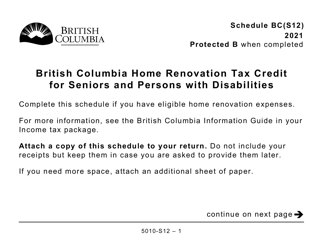

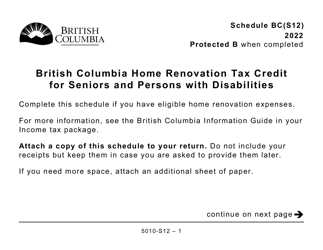

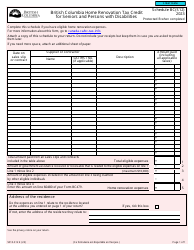

Form 5010-S12 Schedule BC(S12) British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities (Large Print) - Canada

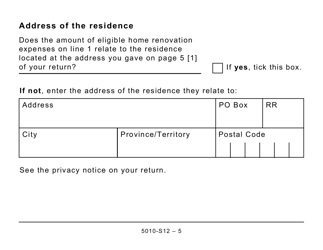

Form 5010-S12 Schedule BC(S12), also known as the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities, is a tax credit form in Canada. It is used to claim tax credits for eligible home renovation expenses incurred by seniors and persons with disabilities in the province of British Columbia.

The Form 5010-S12 Schedule BC(S12) British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities (Large Print) in Canada is filed by eligible individuals who qualify for the home renovation tax credit.

FAQ

Q: What is Form 5010-S12 Schedule BC?

A: Form 5010-S12 Schedule BC is a tax form in Canada for claiming the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities.

Q: Who is eligible for the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities?

A: Seniors and persons with disabilities in British Columbia are eligible for this tax credit.

Q: What is the purpose of the Home Renovation Tax Credit?

A: The purpose of the Home Renovation Tax Credit is to provide financial assistance for home renovations to make residences more accessible and safe for seniors and persons with disabilities.

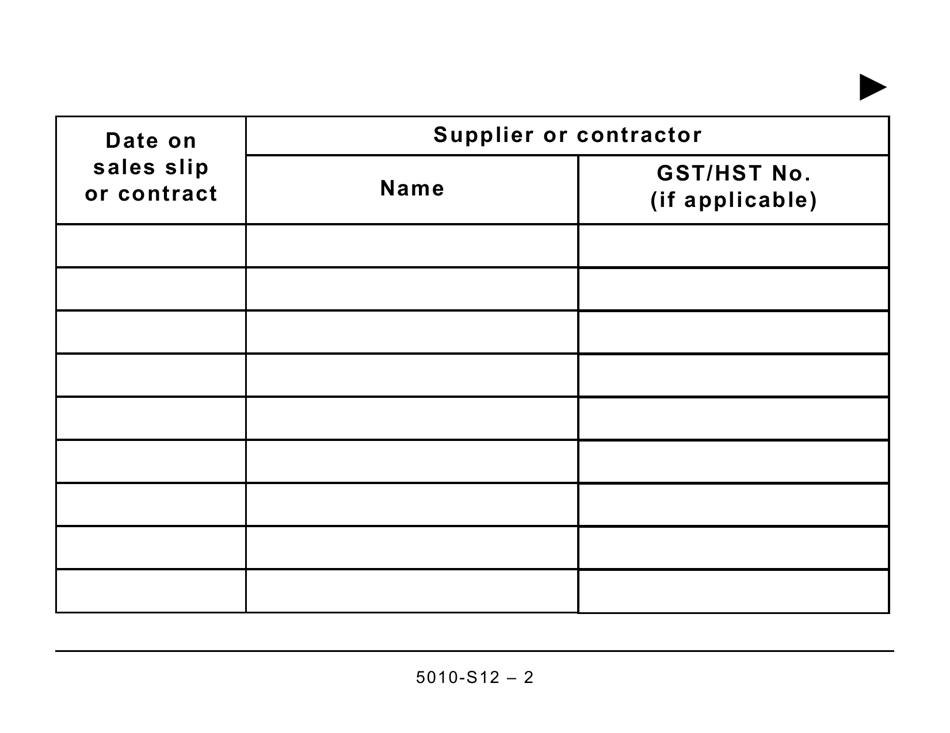

Q: What types of renovations are eligible for the tax credit?

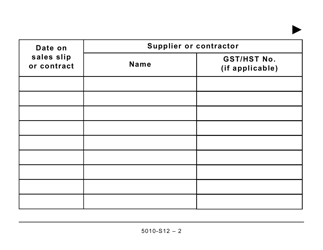

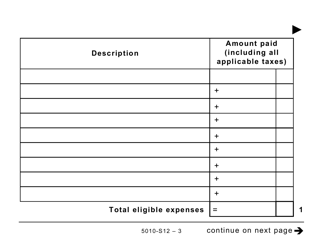

A: Renovations that improve accessibility, mobility, and safety in a residence are eligible for the tax credit. Examples include installing grab bars, ramps, or widening doorways.

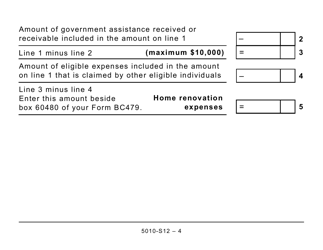

Q: How much is the tax credit?

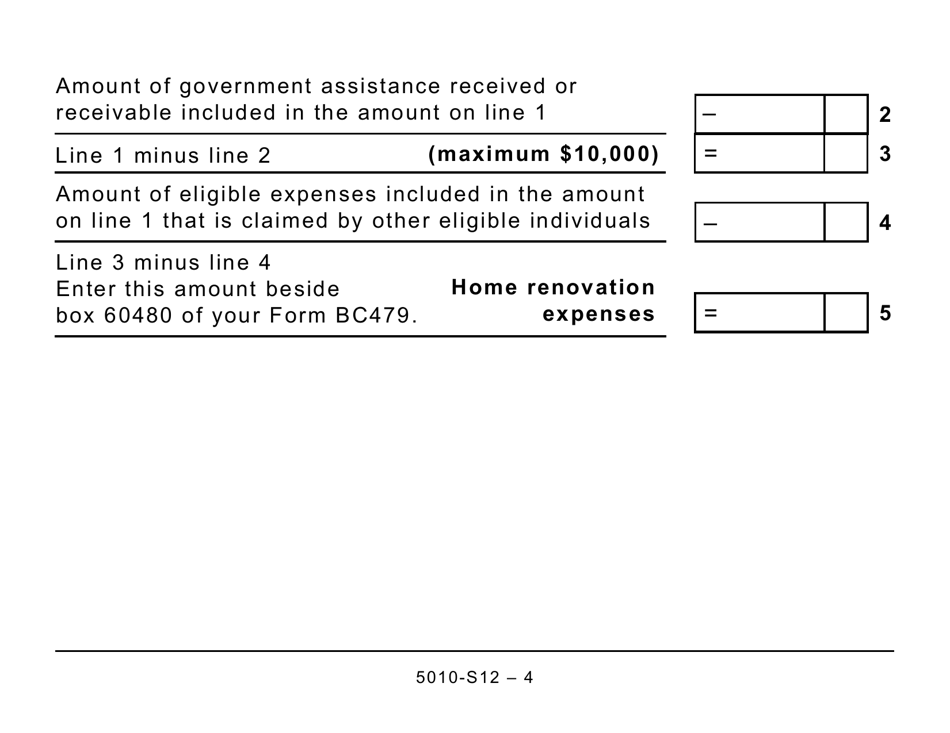

A: The tax credit is equal to 10% of eligible renovation expenses, up to a maximum of $10,000.

Q: How do I claim the British Columbia Home Renovation Tax Credit?

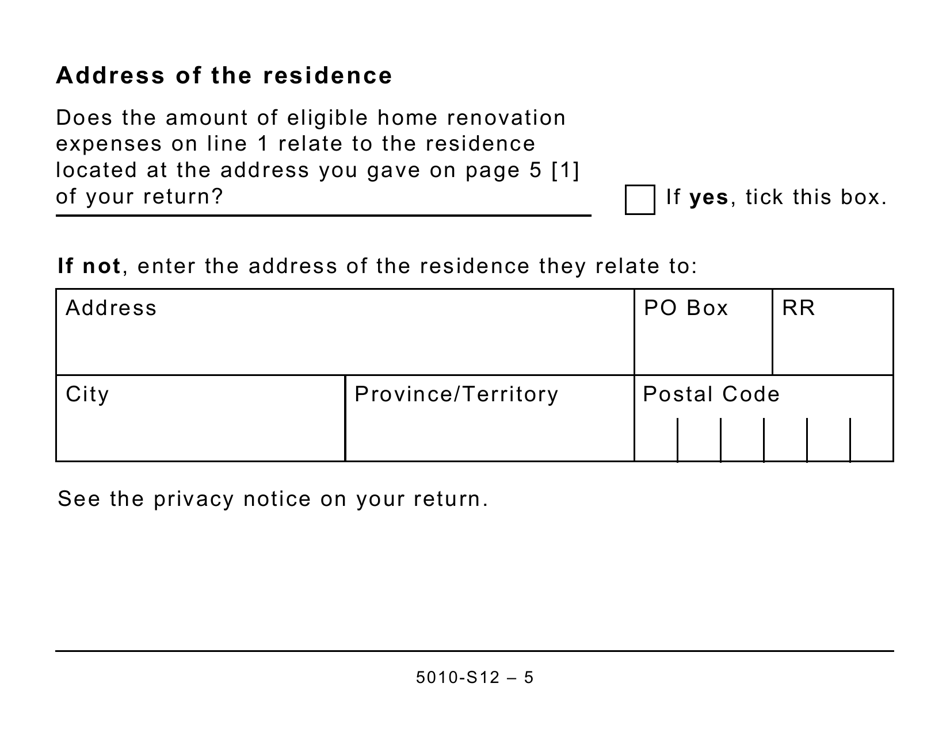

A: To claim the tax credit, you need to complete and submit Form 5010-S12 Schedule BC along with your income tax return.