This version of the form is not currently in use and is provided for reference only. Download this version of

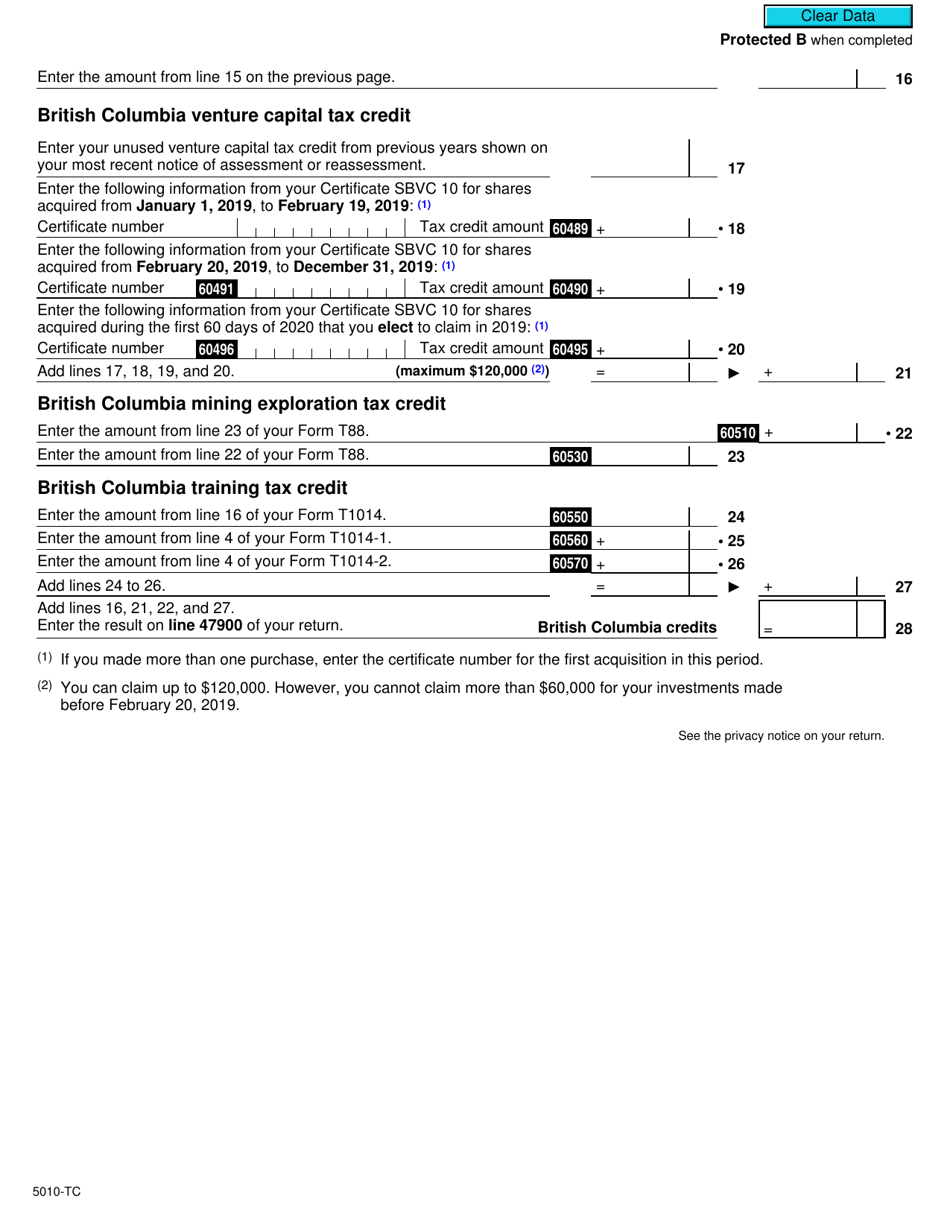

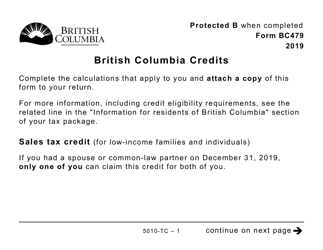

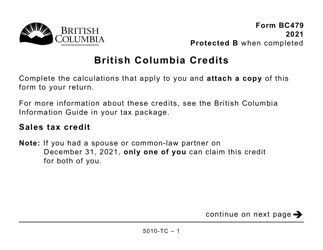

Form 5010-TC (BC479)

for the current year.

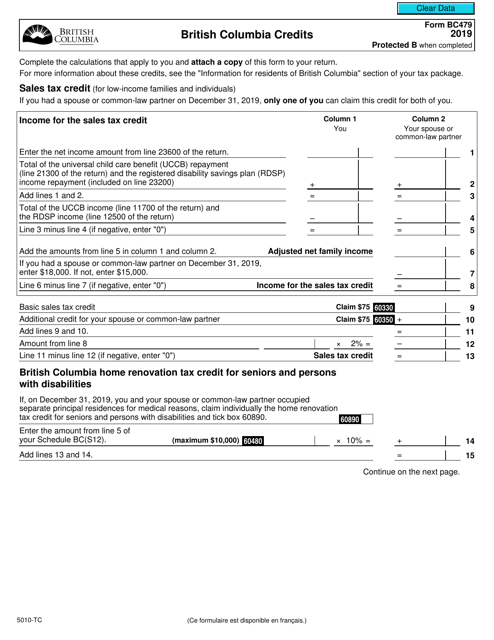

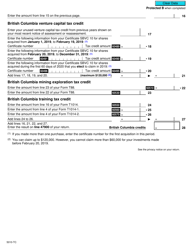

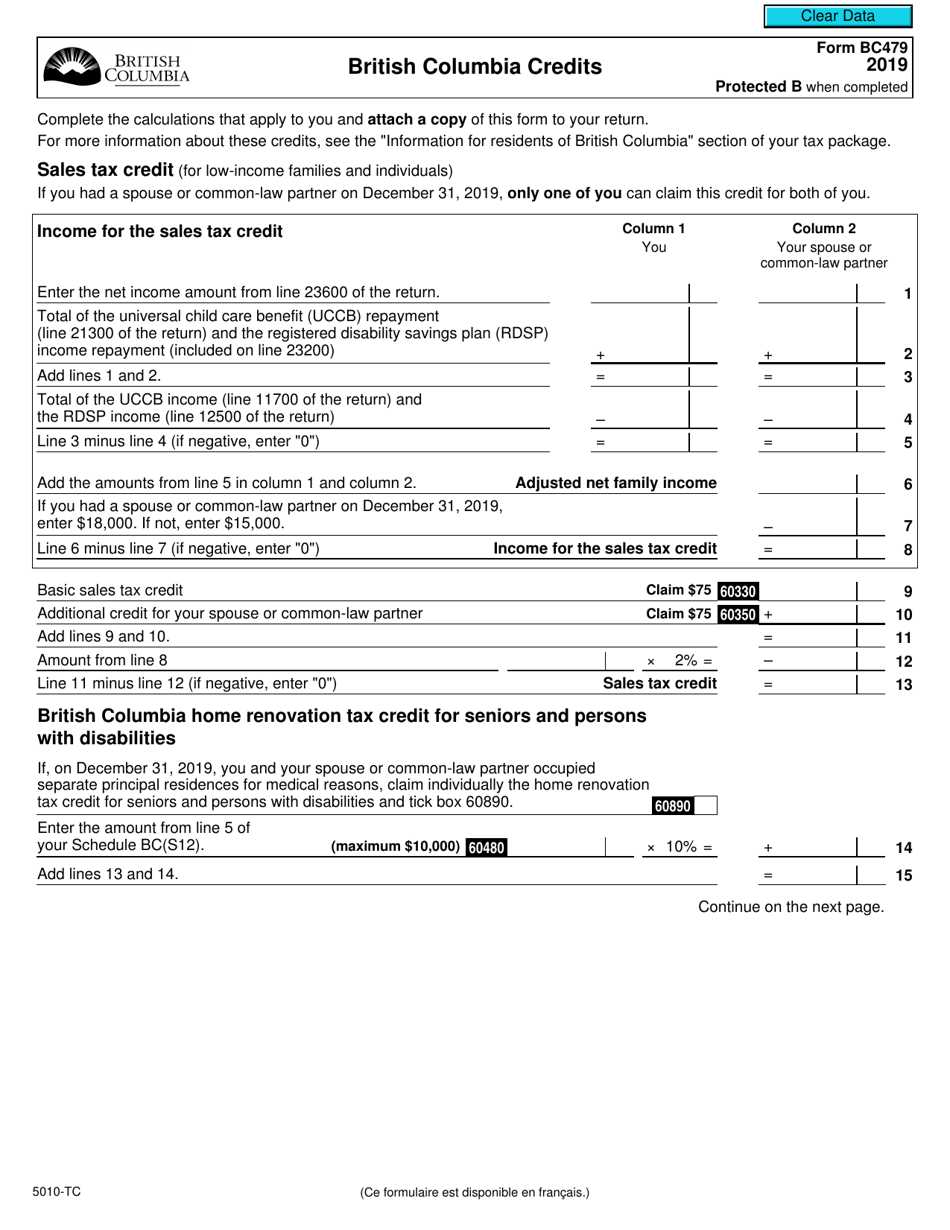

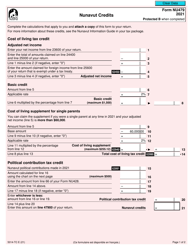

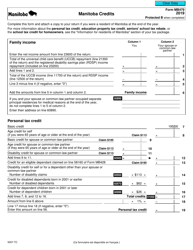

Form 5010-TC (BC479) British Columbia Credits - Canada

Form 5010-TC (BC479) is used in British Columbia, Canada to claim provincial tax credits.

The Form 5010-TC (BC479) for British Columbia Credits in Canada is filed by the individual taxpayer.

FAQ

Q: What is Form 5010-TC (BC479)?

A: Form 5010-TC (BC479) is a tax form used to claim British Columbia tax credits in Canada.

Q: Who can use Form 5010-TC (BC479)?

A: Residents of British Columbia who are eligible for specific tax credits can use Form 5010-TC (BC479).

Q: What are the British Columbia tax credits?

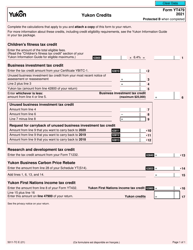

A: The British Columbia tax credits include the BC low-income climate action tax credit, BC education coaching tax credit, BC seniors home renovation tax credit, and BC volunteer firefighters' tax credit.

Q: Is Form 5010-TC (BC479) mandatory?

A: Filing Form 5010-TC (BC479) is not mandatory, but it is necessary if you want to claim the British Columbia tax credits.

Q: What documentation do I need to include with Form 5010-TC (BC479)?

A: You may need to include supporting documents such as receipts or certificates depending on the tax credit you are claiming.

Q: When is the deadline to file Form 5010-TC (BC479)?

A: The deadline to file Form 5010-TC (BC479) is usually April 30th of the following year, but it may vary depending on your individual circumstances.