This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5010-S2 Schedule BC(S2)

for the current year.

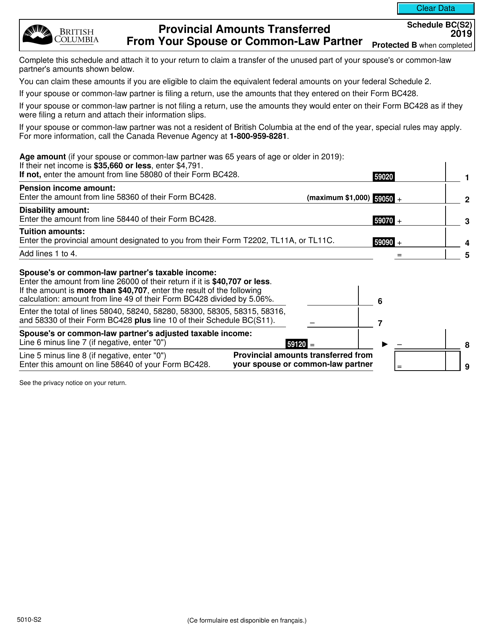

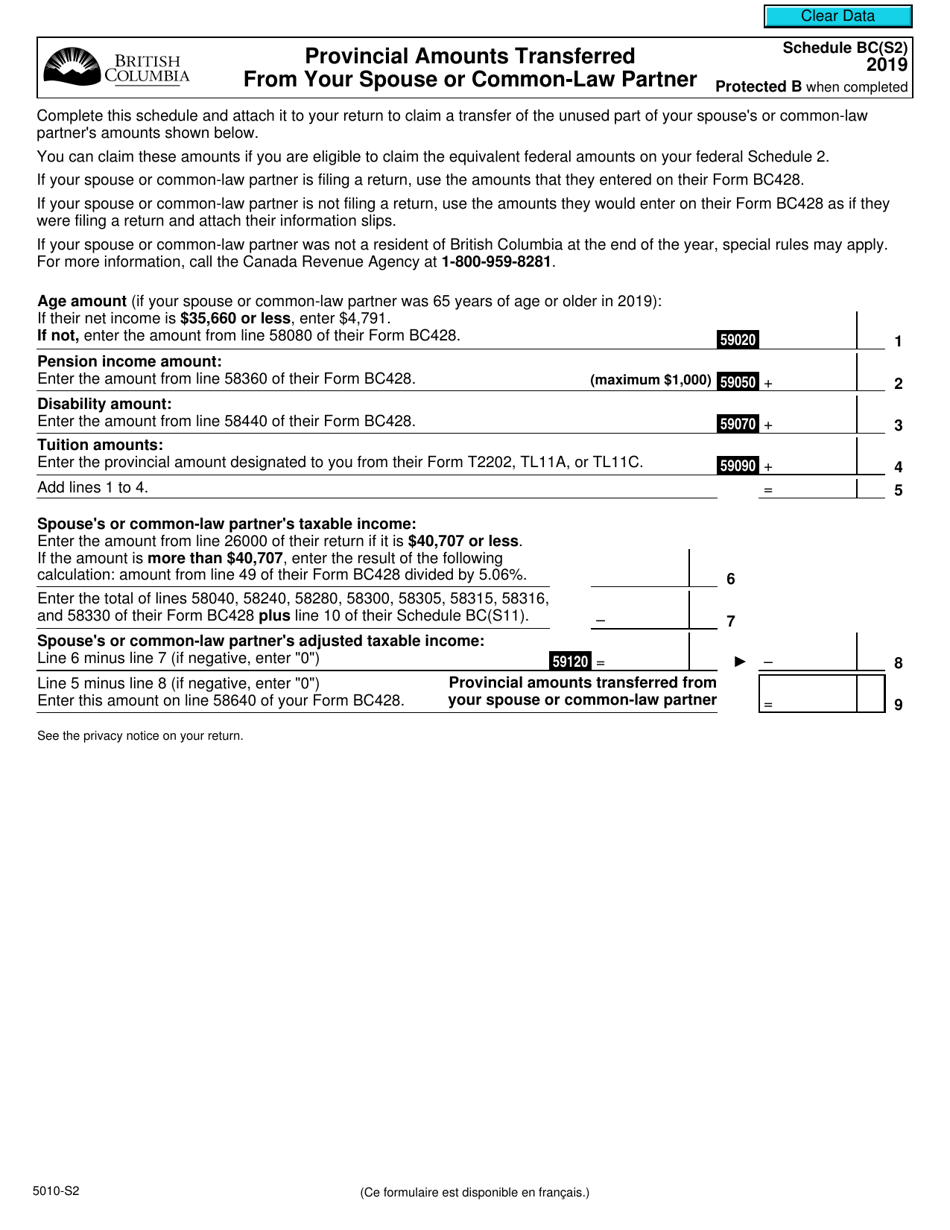

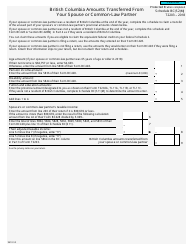

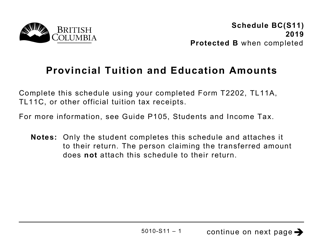

Form 5010-S2 Schedule BC(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner - British Columbia - Canada

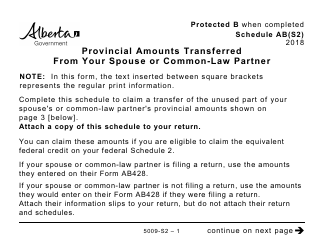

Form 5010-S2 Schedule BC(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner in British Columbia, Canada is used to report the provincial amounts that are transferred from your spouse or common-law partner. This form is specific to residents of British Columbia and helps determine the total provincial tax amount that can be transferred to your return from your spouse or common-law partner's return. The transferred amounts may include certain tax credits or deductions that your spouse or common-law partner is eligible for but cannot fully utilize. By transferring these amounts, you may be able to reduce your overall tax liability.

The Form 5010-S2 Schedule BC(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner in British Columbia, Canada, is typically filed by individuals who are residents of British Columbia and have a spouse or common-law partner. This form is used to claim provincial credits and deductions that can be transferred from your spouse or common-law partner.

FAQ

Q: What is Form 5010-S2 Schedule BC(S2)?

A: Form 5010-S2 Schedule BC(S2) is a tax form used in British Columbia, Canada to report provincial amounts transferred from your spouse or common-law partner.

Q: What is the purpose of Form 5010-S2 Schedule BC(S2)?

A: The purpose of Form 5010-S2 Schedule BC(S2) is to calculate and report any provincial amounts transferred from your spouse or common-law partner for tax purposes in British Columbia, Canada.

Q: Who needs to fill out Form 5010-S2 Schedule BC(S2)?

A: You need to fill out Form 5010-S2 Schedule BC(S2) if you are a resident of British Columbia, Canada and have transferred provincial amounts from your spouse or common-law partner.

Q: Are there any deadlines for filing Form 5010-S2 Schedule BC(S2)?

A: The deadline for filing Form 5010-S2 Schedule BC(S2) is the same as the deadline for filing your income tax return in British Columbia, Canada, which is generally April 30th of each year, unless it falls on a weekend or holiday, in which case the deadline is the next business day.