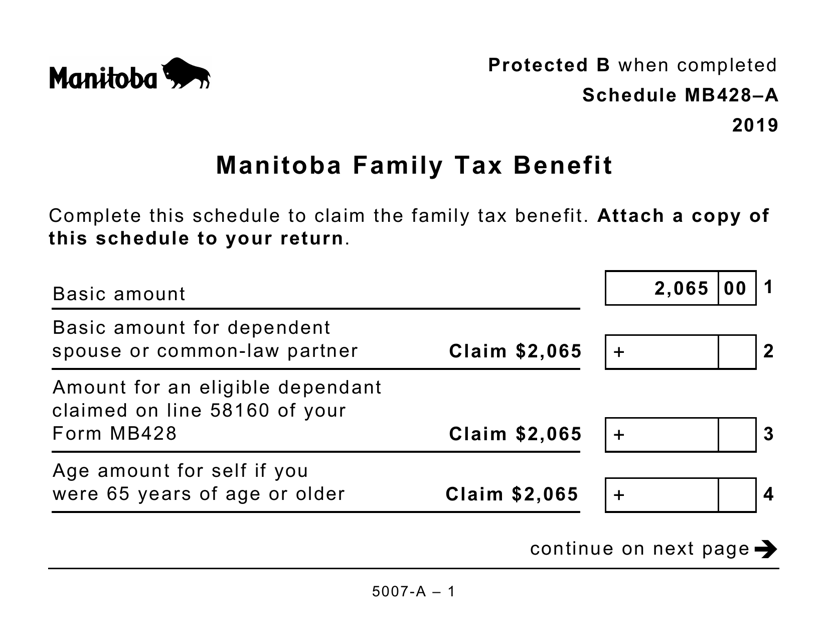

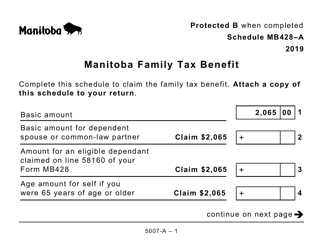

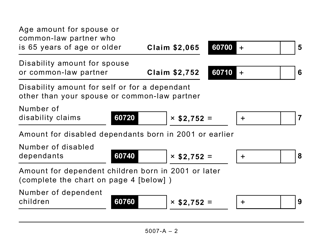

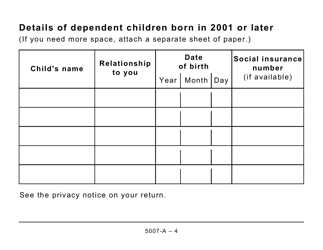

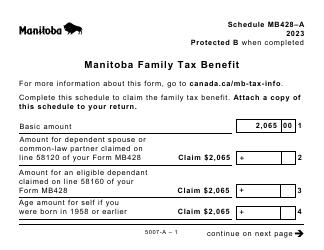

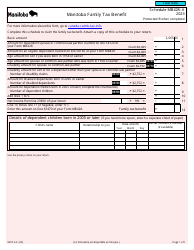

Form 5007-A Schedule MB428-A Manitoba Family Tax Benefit (Large Print) - Canada

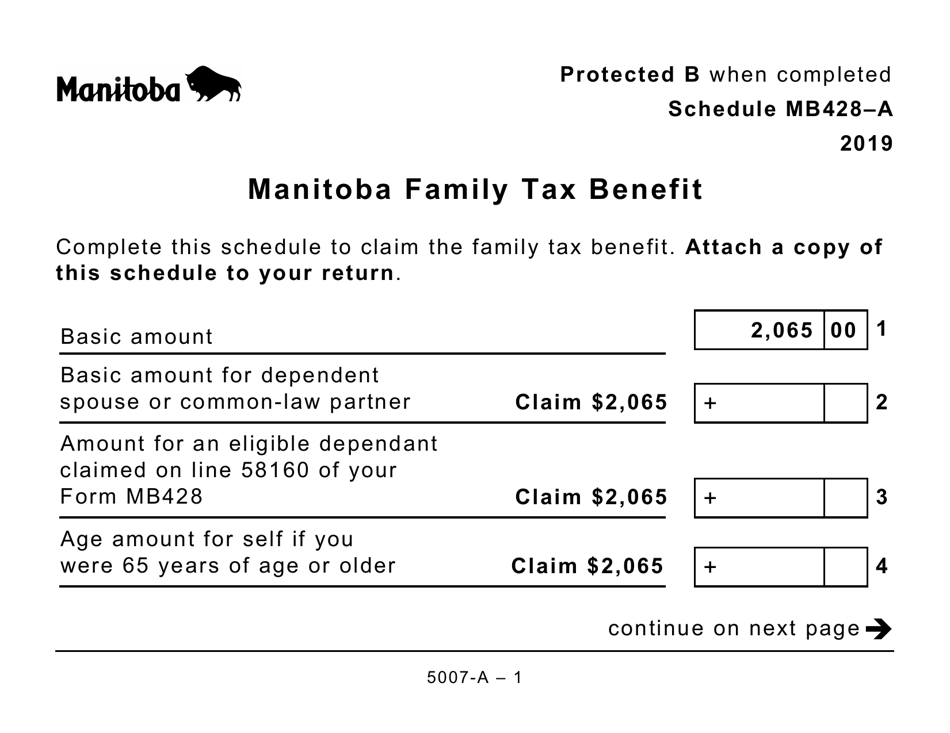

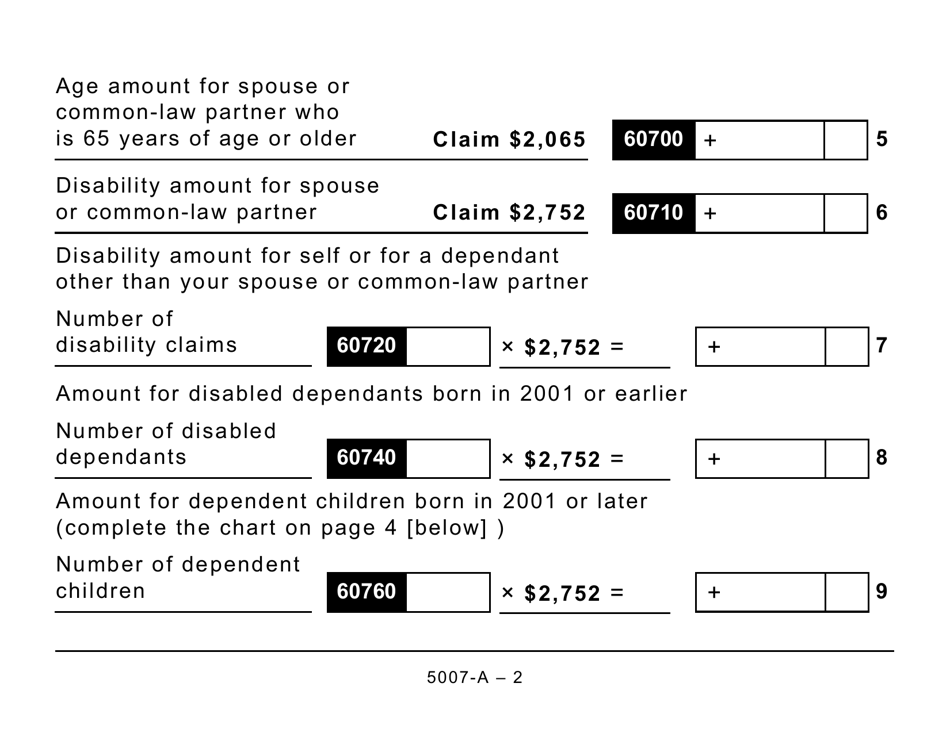

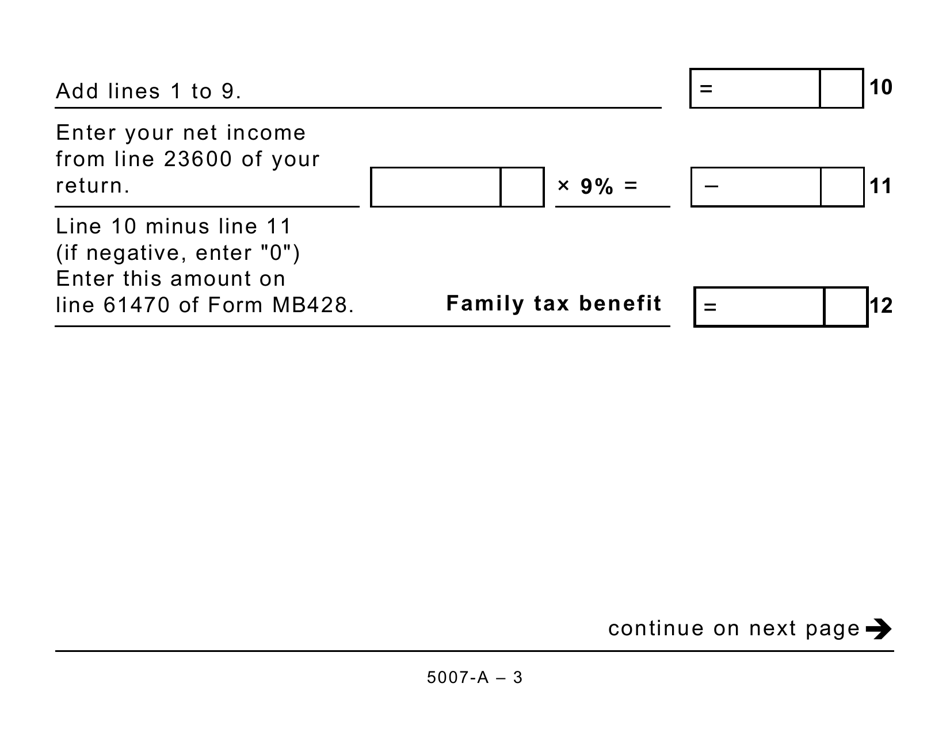

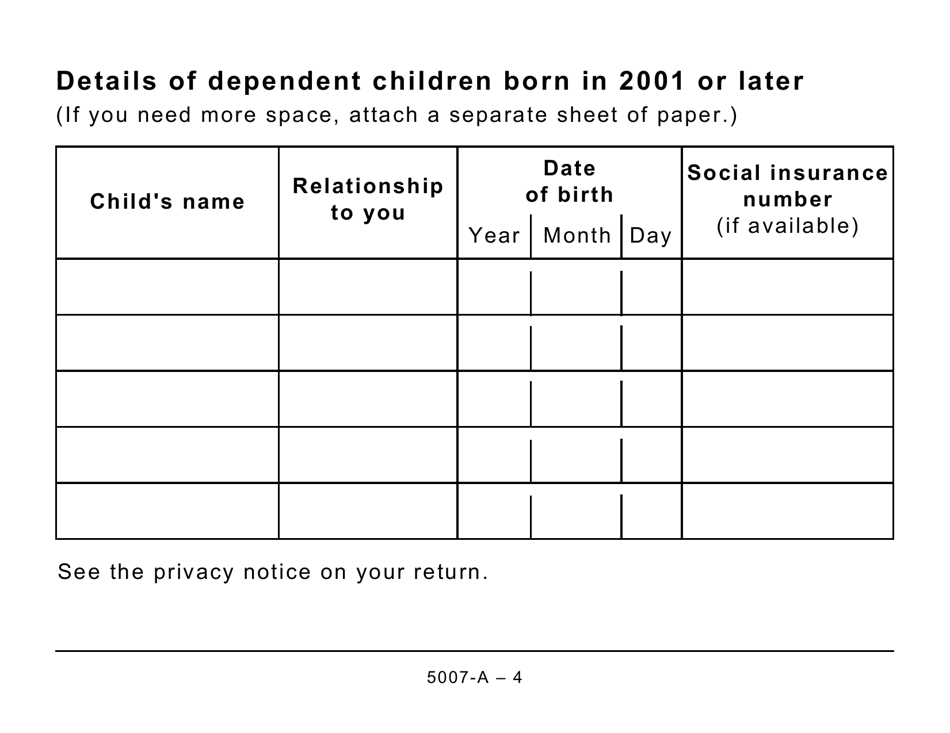

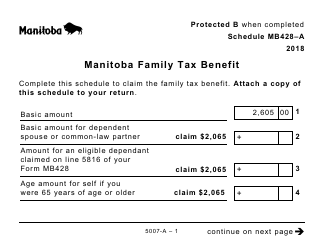

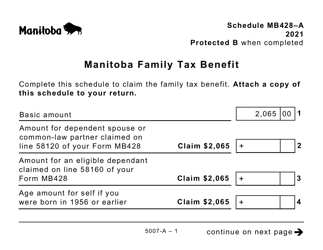

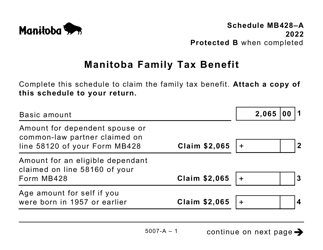

Form 5007-A Schedule MB428-A Manitoba Family Tax Benefit (Large Print) is used in Canada for claiming the Manitoba Family Tax Benefit. It is meant for individuals and families who reside in Manitoba and meet certain eligibility criteria to receive financial assistance to help with the cost of raising children.

The Form 5007-A Schedule MB428-A Manitoba Family Tax Benefit (Large Print) in Canada is filed by individuals who are applying for the Manitoba Family Tax Benefit.

FAQ

Q: What is Form 5007-A Schedule MB428-A?

A: Form 5007-A Schedule MB428-A is a tax form used in Canada to claim the Manitoba Family Tax Benefit.

Q: Who is eligible to claim the Manitoba Family Tax Benefit?

A: Residents of Manitoba who have a low to modest income and meet certain eligibility criteria can claim the Manitoba Family Tax Benefit.

Q: What is the purpose of the Manitoba Family Tax Benefit?

A: The Manitoba Family Tax Benefit provides financial assistance to eligible families in Manitoba to help them with the cost of raising children.

Q: Do I need to file Form 5007-A Schedule MB428-A?

A: You need to file Form 5007-A Schedule MB428-A if you meet the eligibility criteria and want to claim the Manitoba Family Tax Benefit.

Q: What documents do I need to complete Form 5007-A Schedule MB428-A?

A: To complete Form 5007-A Schedule MB428-A, you will need information about your income, deductions, and any other relevant supporting documents as specified in the form instructions.

Q: Is the Manitoba Family Tax Benefit taxable?

A: No, the Manitoba Family Tax Benefit is not taxable.

Q: How long does it take to process Form 5007-A Schedule MB428-A?

A: The processing time for Form 5007-A Schedule MB428-A can vary, but it typically takes several weeks to receive a decision from the CRA.