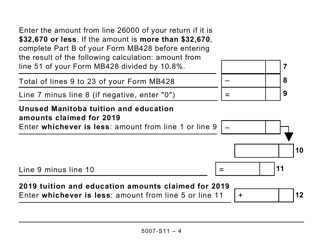

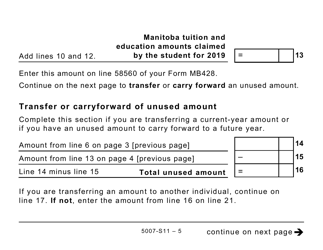

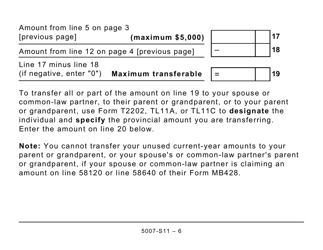

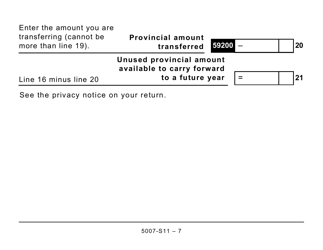

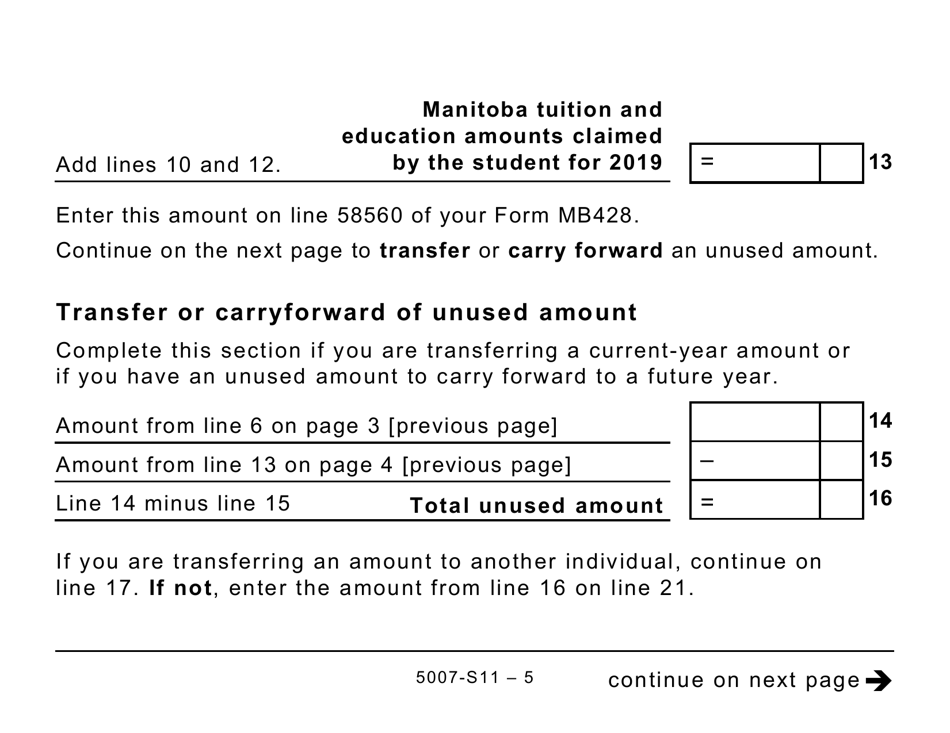

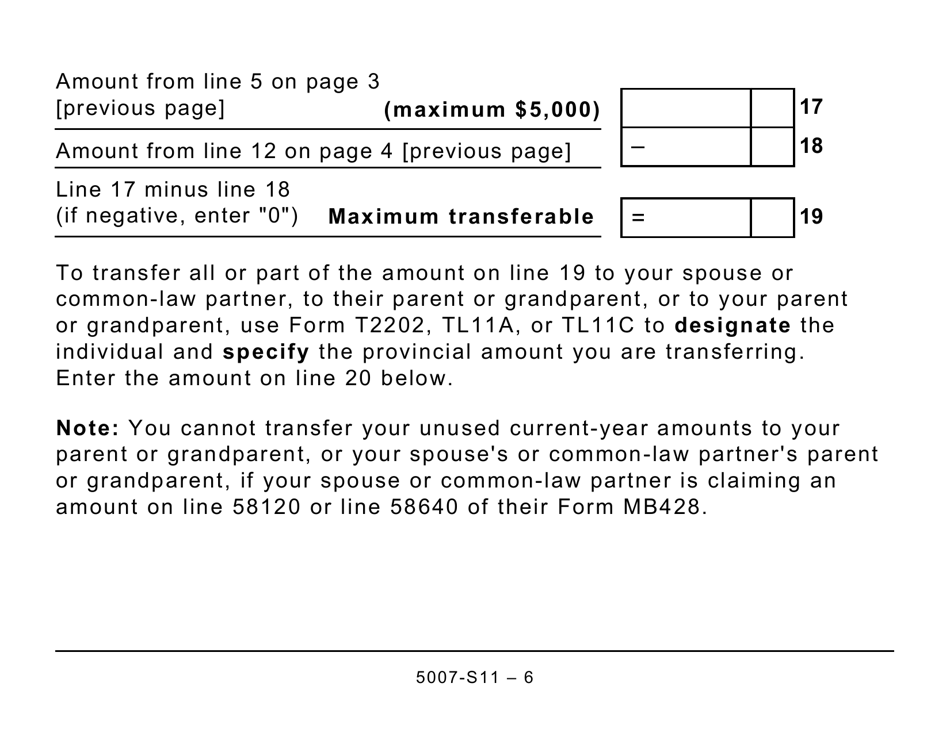

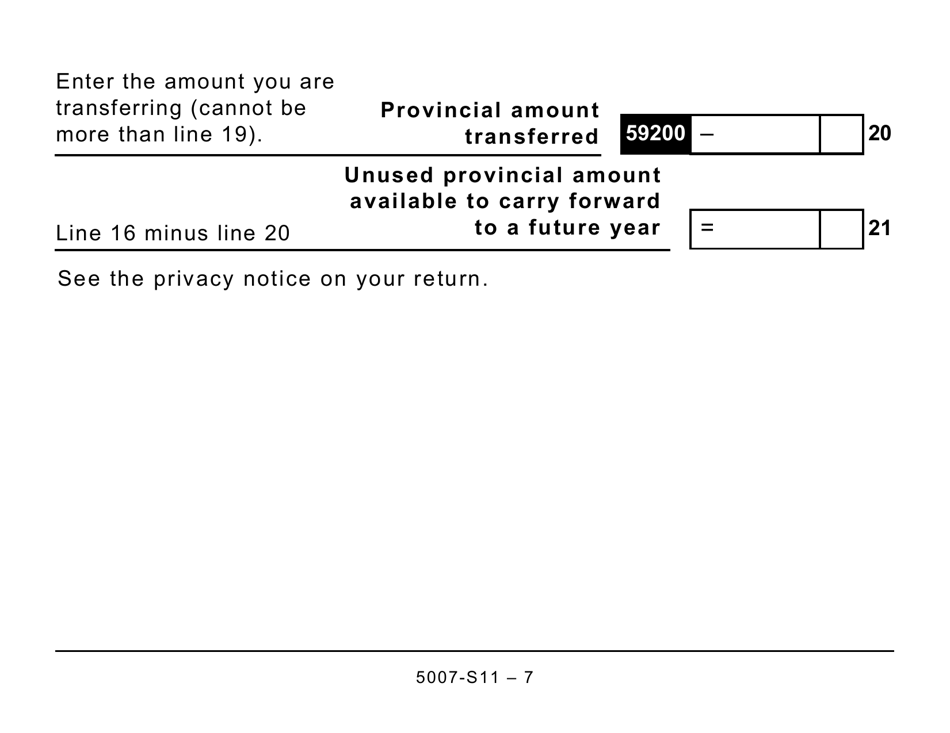

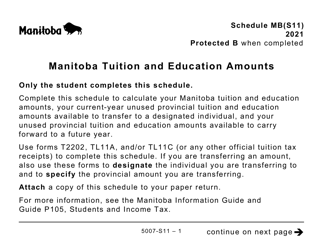

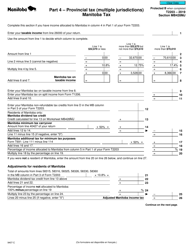

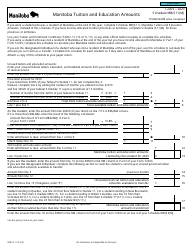

Form 5007-S11 Schedule MB(S11) Provincial Tuition and Education Amounts - Manitoba (Large Print) - Canada

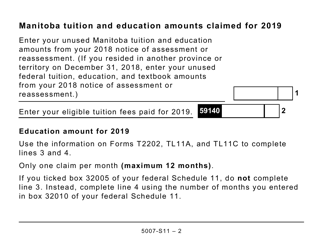

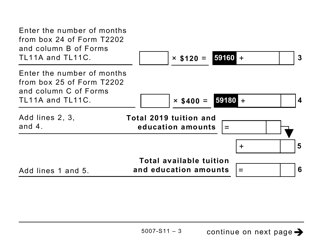

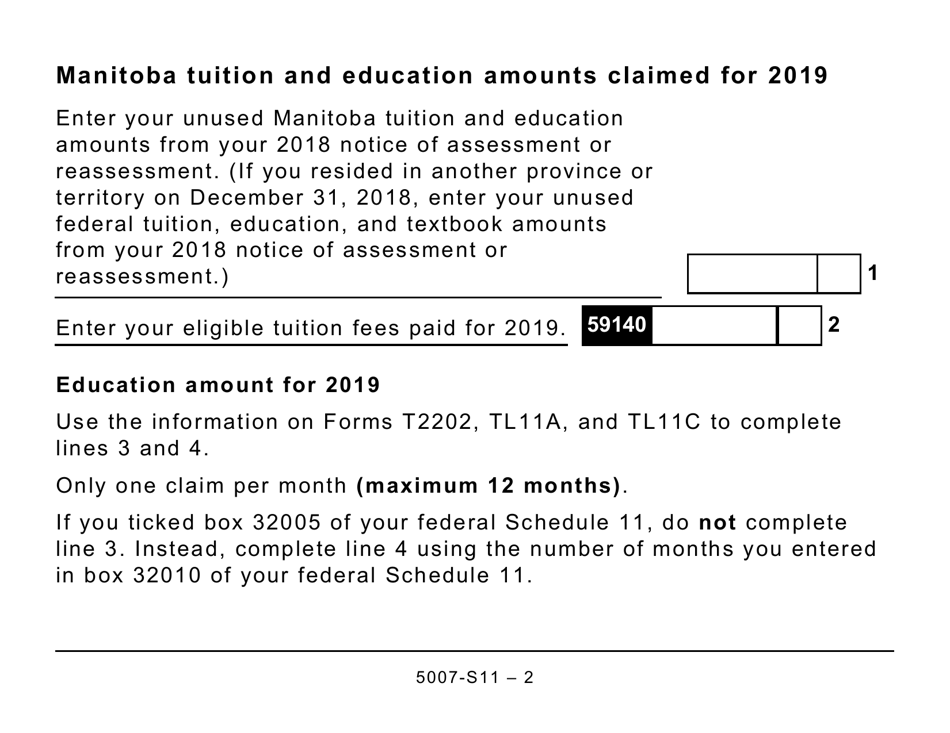

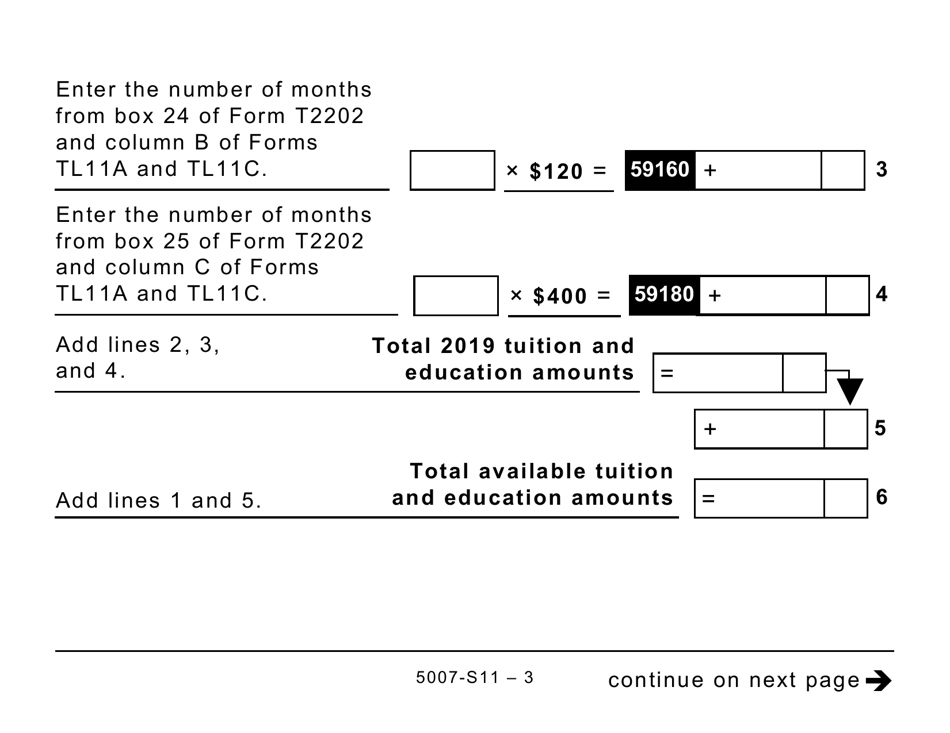

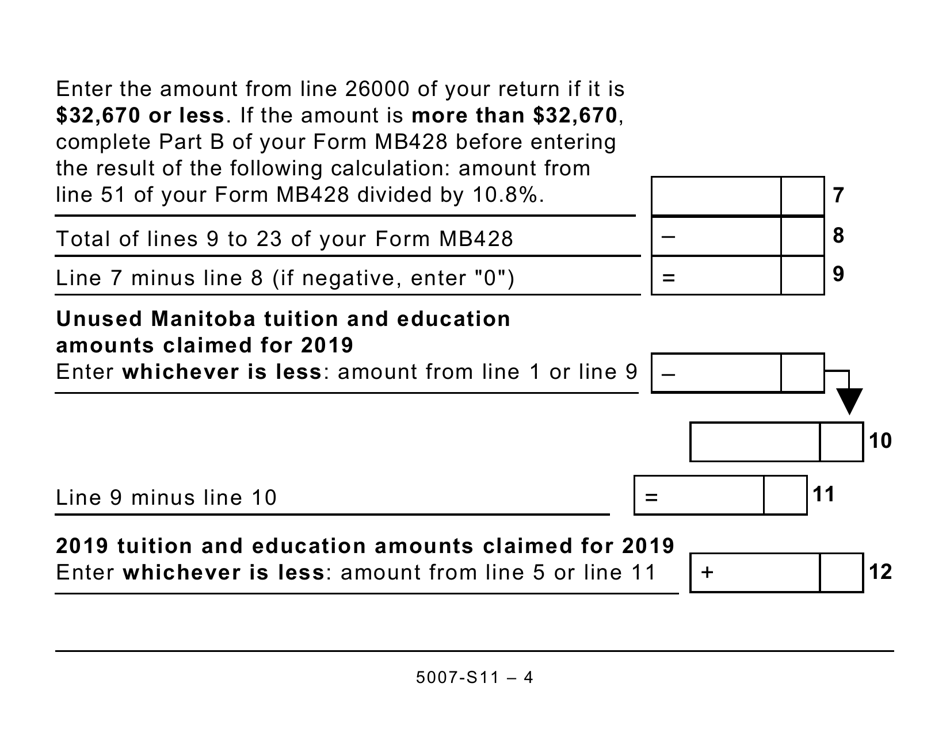

Form 5007-S11 Schedule MB(S11) Provincial Tuition and Education Amounts - Manitoba (Large Print) - Canada is used to claim the provincial tuition and education amounts specific to Manitoba. It allows residents of Manitoba to calculate and report the eligible expenses related to education for tax purposes.

The individual who is claiming the provincial tuition and education amounts in Manitoba (Canada) files the Form 5007-S11 Schedule MB(S11).

FAQ

Q: What is Form 5007-S11 Schedule MB(S11)?

A: Form 5007-S11 Schedule MB(S11) is a document used to claim provincial tuition and education amounts in Manitoba.

Q: What are provincial tuition and education amounts?

A: Provincial tuition and education amounts are credits that can be claimed to reduce your tax payable based on your education costs.

Q: Who can claim provincial tuition and education amounts?

A: Canadian residents who are studying in Manitoba can claim provincial tuition and education amounts.

Q: What is the purpose of Schedule MB(S11)?

A: The purpose of Schedule MB(S11) is to calculate and claim the provincial tuition and education amounts in Manitoba.

Q: Is Form 5007-S11 Schedule MB(S11) specific to Manitoba?

A: Yes, Form 5007-S11 Schedule MB(S11) is specific to claiming provincial tuition and education amounts in Manitoba.

Q: Is the Large Print version of Schedule MB(S11) available?

A: Yes, the Large Print version of Schedule MB(S11) is available for visually impaired individuals.

Q: Is there a deadline to submit Schedule MB(S11)?

A: Yes, the deadline to submit Schedule MB(S11) is the same as the deadline for filing your income tax return, which is usually April 30th.

Q: Can I claim provincial tuition and education amounts for previous years?

A: Yes, you can usually claim provincial tuition and education amounts for up to four years prior to the current tax year.

Q: Can I claim both federal and provincial tuition and education amounts?

A: Yes, you can claim both federal and provincial tuition and education amounts if you are eligible for both.