This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5007-S11 Schedule MB(S11)

for the current year.

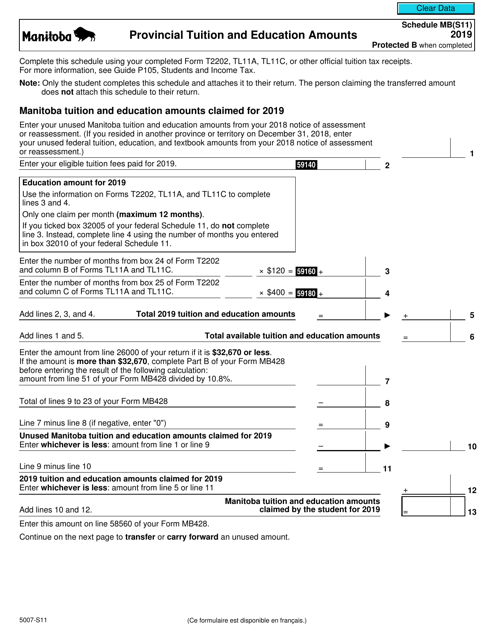

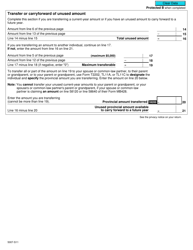

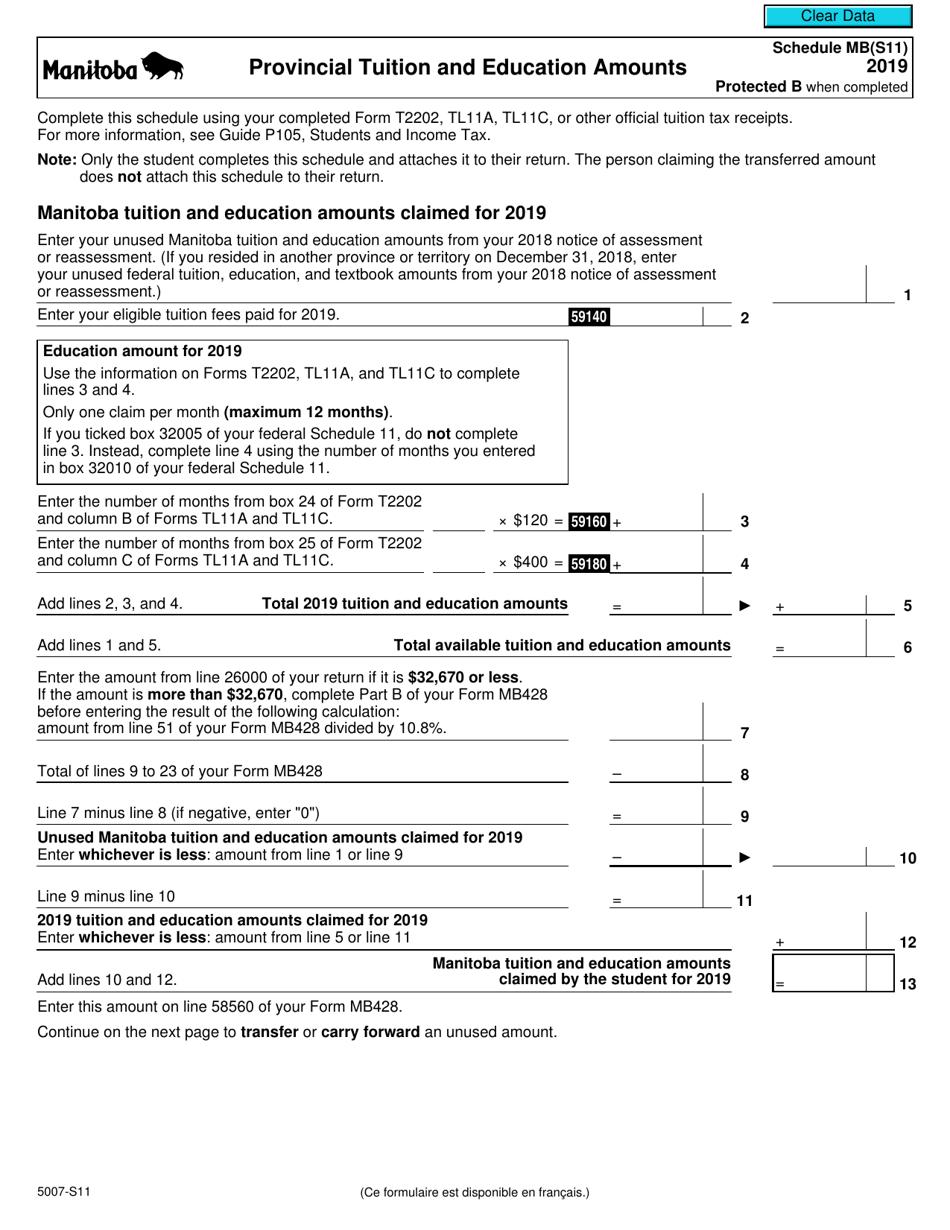

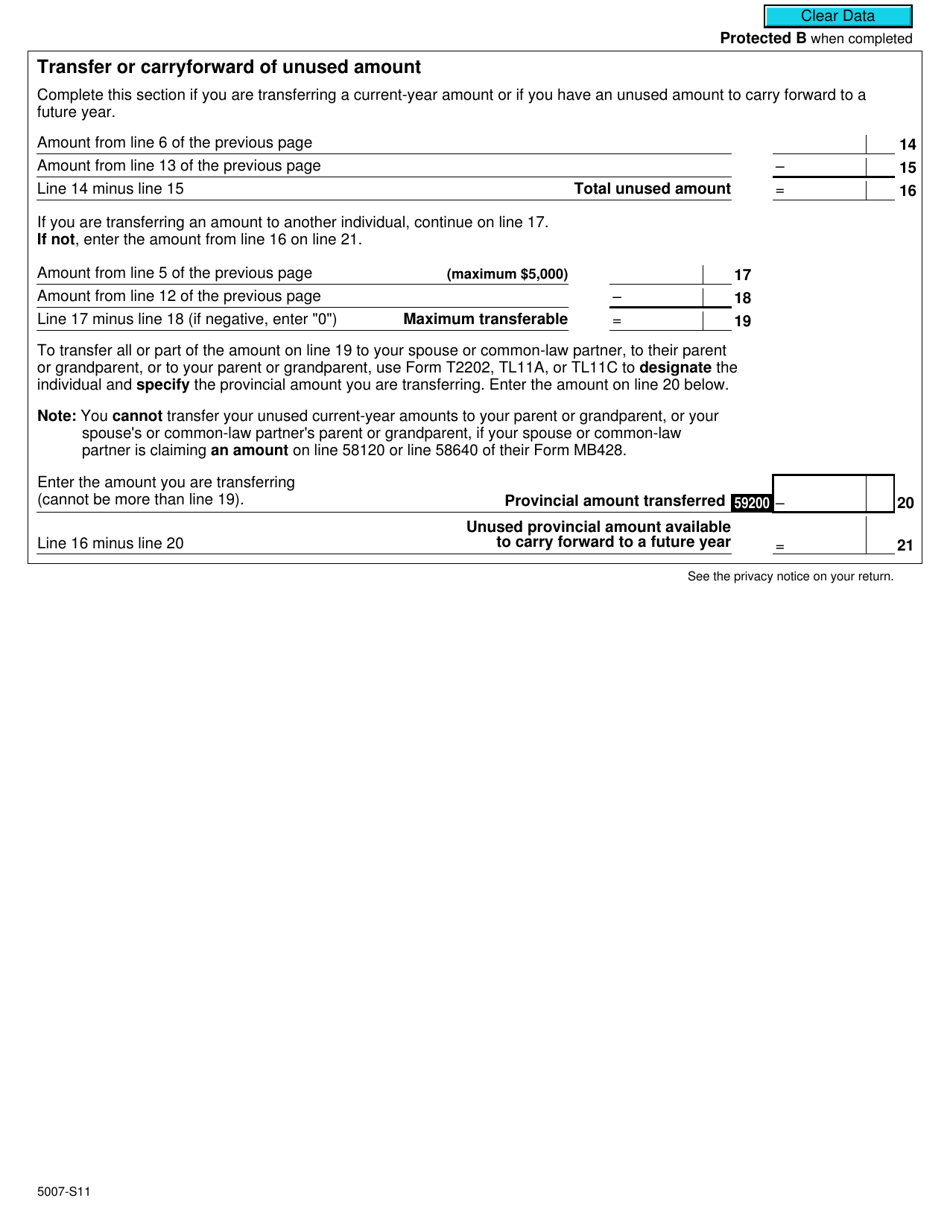

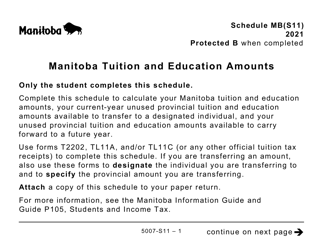

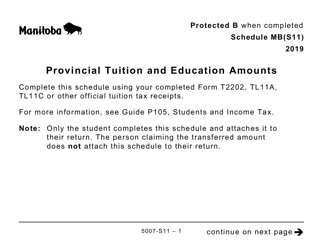

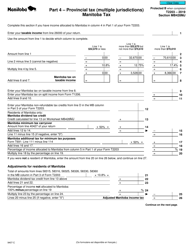

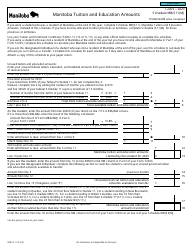

Form 5007-S11 Schedule MB(S11) Provincial Tuition and Education Amounts - Manitoba - Canada

Form 5007-S11 Schedule MB(S11) is used to claim provincial tuition and education amounts specifically for residents of Manitoba, Canada. This form helps individuals in Manitoba obtain tax credits for eligible educational expenses.

The student or their parent or guardian would typically file the Form 5007-S11 Schedule MB(S11) Provincial Tuition and Education Amounts in Manitoba, Canada.

FAQ

Q: What is Form 5007-S11?

A: Form 5007-S11 is a schedule used to calculate provincial tuition and education amounts for residents of Manitoba.

Q: What does Schedule MB(S11) refer to?

A: Schedule MB(S11) refers to the specific form used by residents of Manitoba to claim provincial tuition and education amounts.

Q: What are provincial tuition and education amounts?

A: Provincial tuition and education amounts are tax credits that can be claimed by residents of Manitoba to reduce their income tax liability.

Q: Who can use Form 5007-S11?

A: Form 5007-S11 can be used by residents of Manitoba who have incurred eligible tuition and education expenses.

Q: How do I claim provincial tuition and education amounts?

A: To claim provincial tuition and education amounts, you need to fill out Form 5007-S11 and submit it along with your income tax return.

Q: Are there any eligibility requirements for claiming provincial tuition and education amounts?

A: Yes, there are eligibility requirements for claiming provincial tuition and education amounts. You must be a resident of Manitoba and have incurred eligible tuition and education expenses.

Q: What are eligible tuition and education expenses?

A: Eligible tuition and education expenses include tuition fees, textbooks, and other necessary educational materials.

Q: Can I claim both federal and provincial tuition and education amounts?

A: Yes, you can claim both federal and provincial tuition and education amounts, but you need to use the appropriate forms for each.

Q: Do provincial tuition and education amounts vary by province?

A: Yes, provincial tuition and education amounts vary by province. The amounts you can claim may be different if you are a resident of a province other than Manitoba.