Form 5007-S14 Schedule 14 Climate Action Incentive - Manitoba (Large Print) - Canada

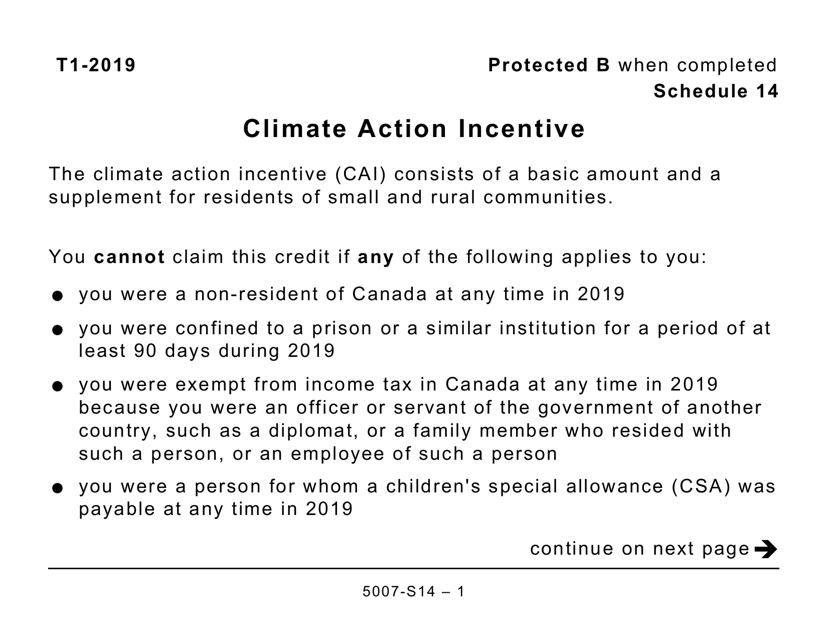

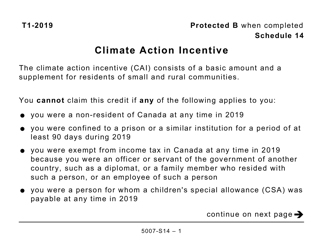

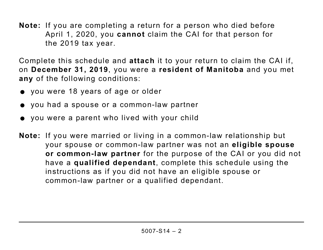

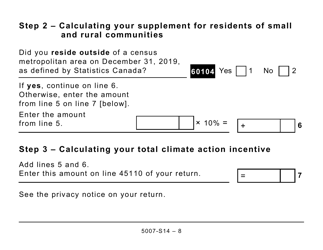

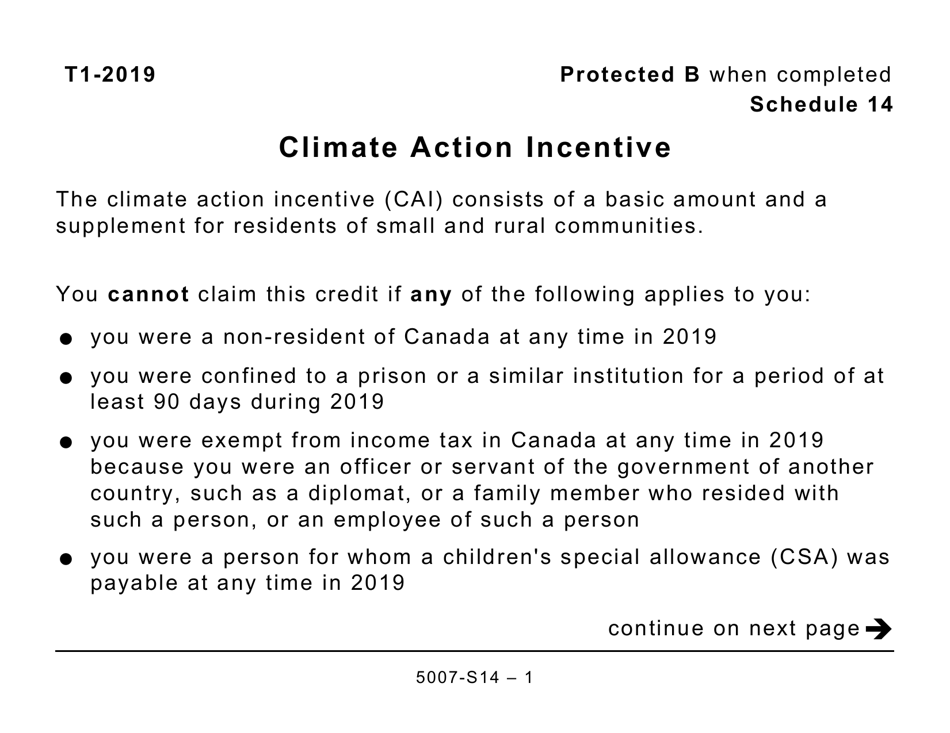

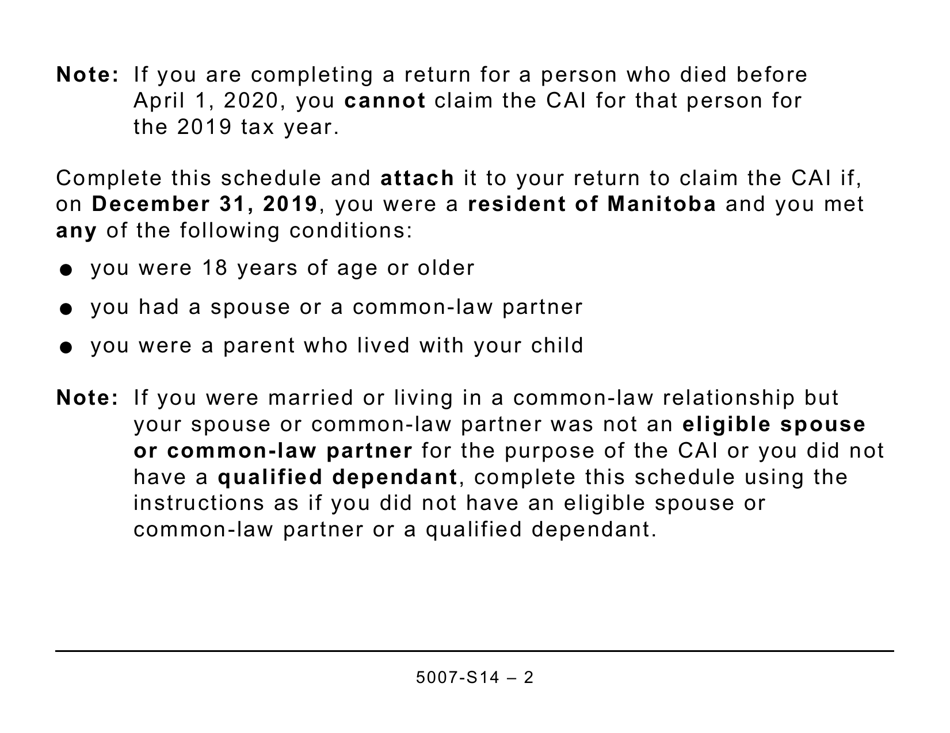

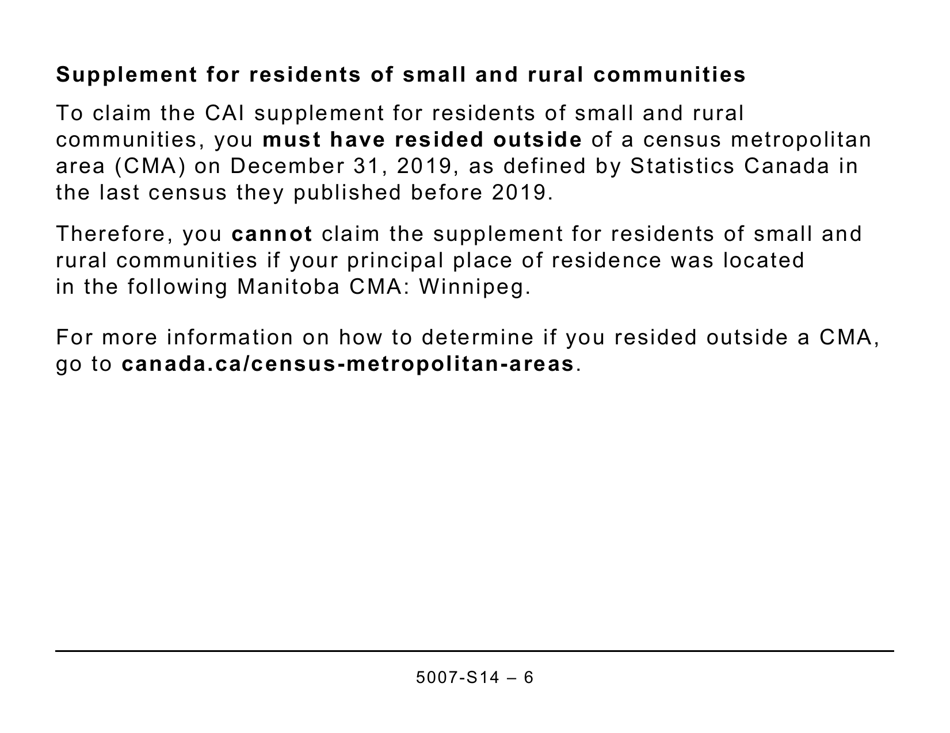

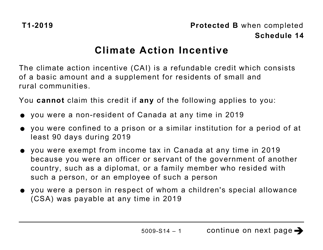

Form 5007-S14 Schedule 14 Climate Action Incentive - Manitoba (Large Print) is a Canadian government form used to claim the Climate Action Incentive in Manitoba. It provides tax credits to individuals and families as a way to encourage actions that help reduce greenhouse gas emissions and fight climate change.

The Form 5007-S14 Schedule 14 Climate Action Incentive in Manitoba (Large Print) in Canada is filed by eligible individuals and families who qualify for the Climate Action Incentive rebate program.

FAQ

Q: What is Form 5007-S14 Schedule 14 Climate Action Incentive?

A: Form 5007-S14 Schedule 14 Climate Action Incentive is a tax form in Canada.

Q: What is the purpose of Schedule 14 Climate Action Incentive?

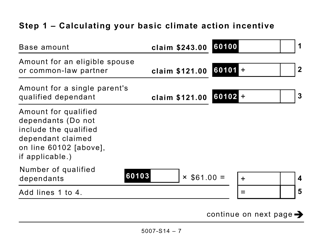

A: The purpose of Schedule 14 Climate Action Incentive is to calculate and claim the climate action incentive amounts for the province of Manitoba.

Q: Who is eligible to use Form 5007-S14 Schedule 14 Climate Action Incentive?

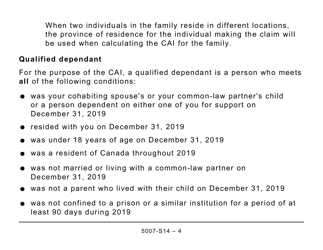

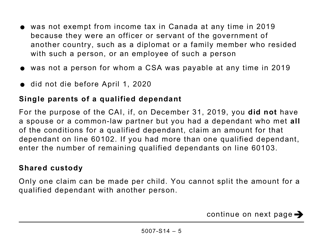

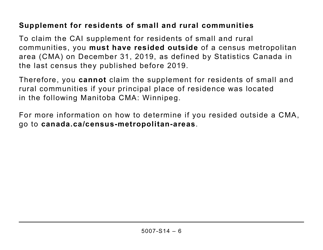

A: Residents of Manitoba who meet certain criteria are eligible to use Form 5007-S14 Schedule 14 Climate Action Incentive.

Q: What are the climate action incentive amounts?

A: The climate action incentive amounts vary depending on various factors such as family size and income.

Q: What should I do with completed Schedule 14 Climate Action Incentive?

A: Completed Schedule 14 Climate Action Incentive should be attached to the individual income tax and benefit return when filing.