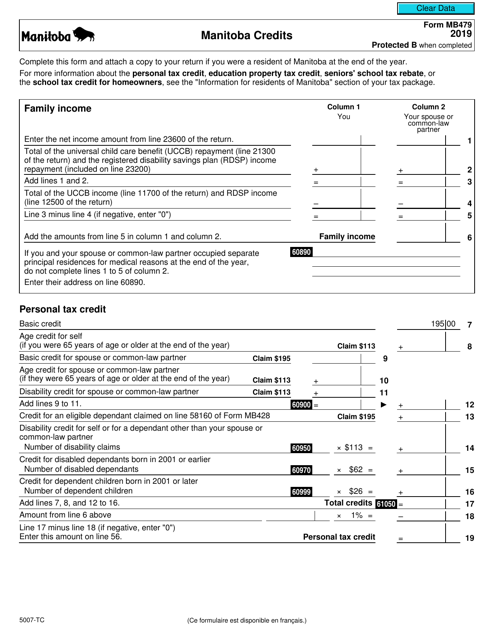

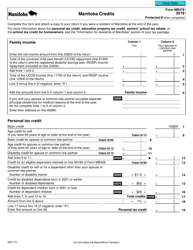

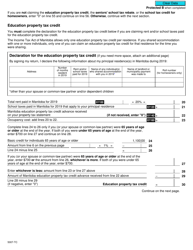

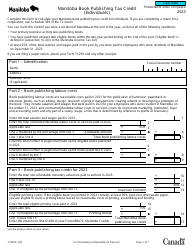

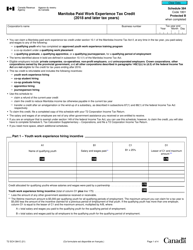

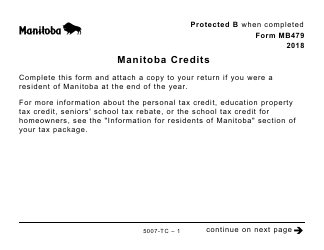

Form MB479 (5007-TC) Manitoba Credits - Canada

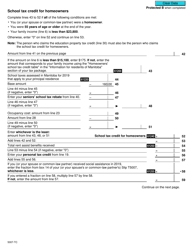

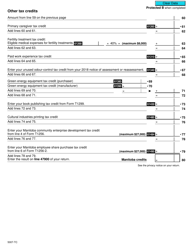

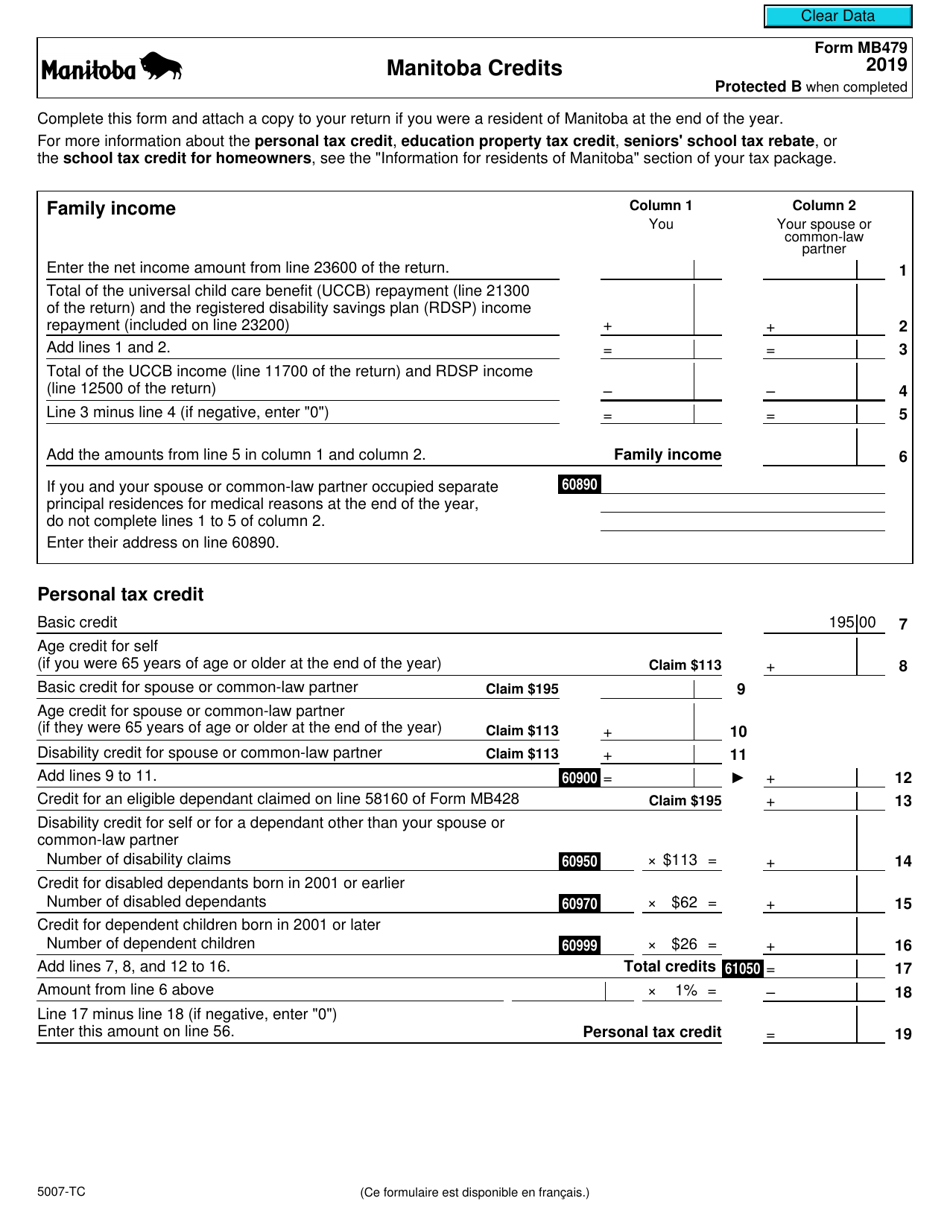

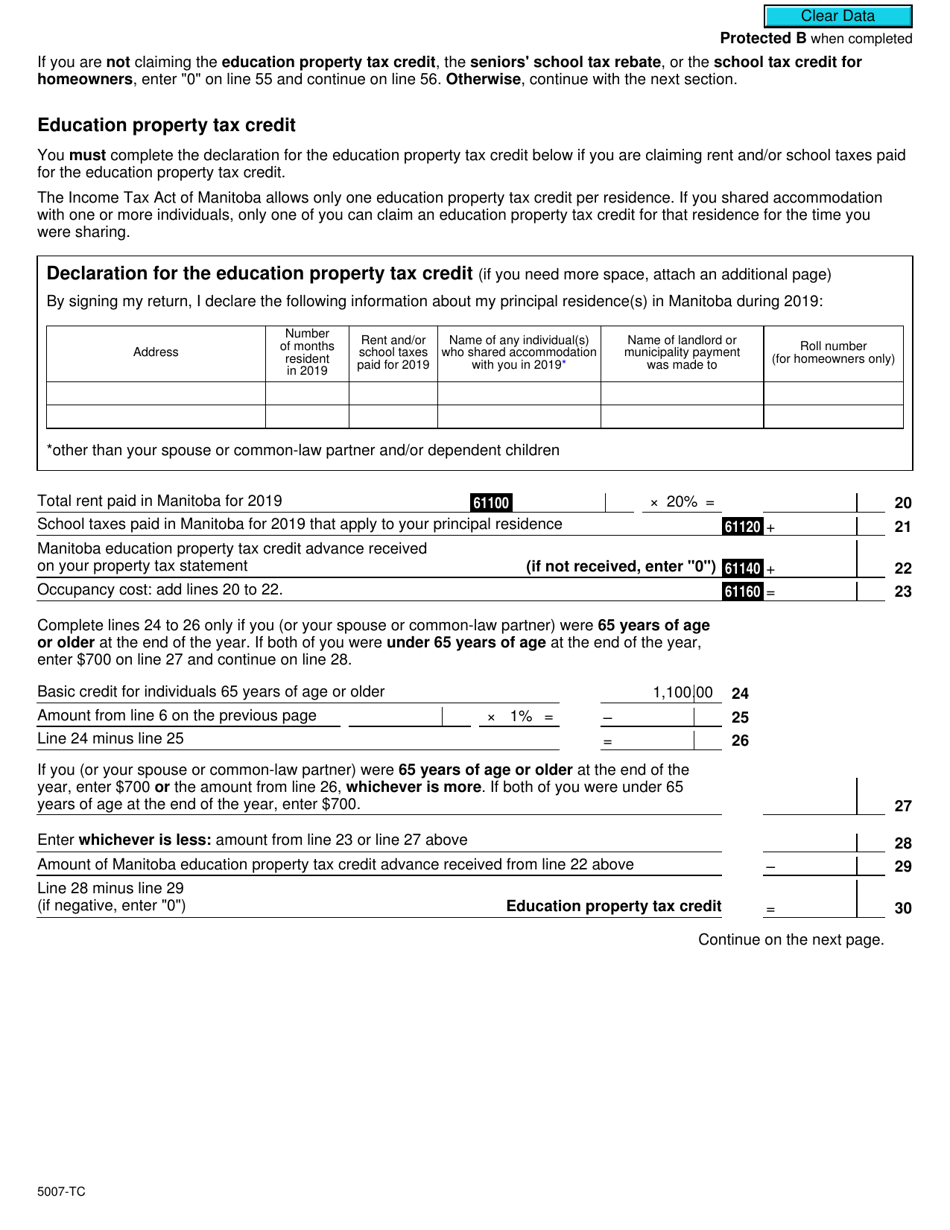

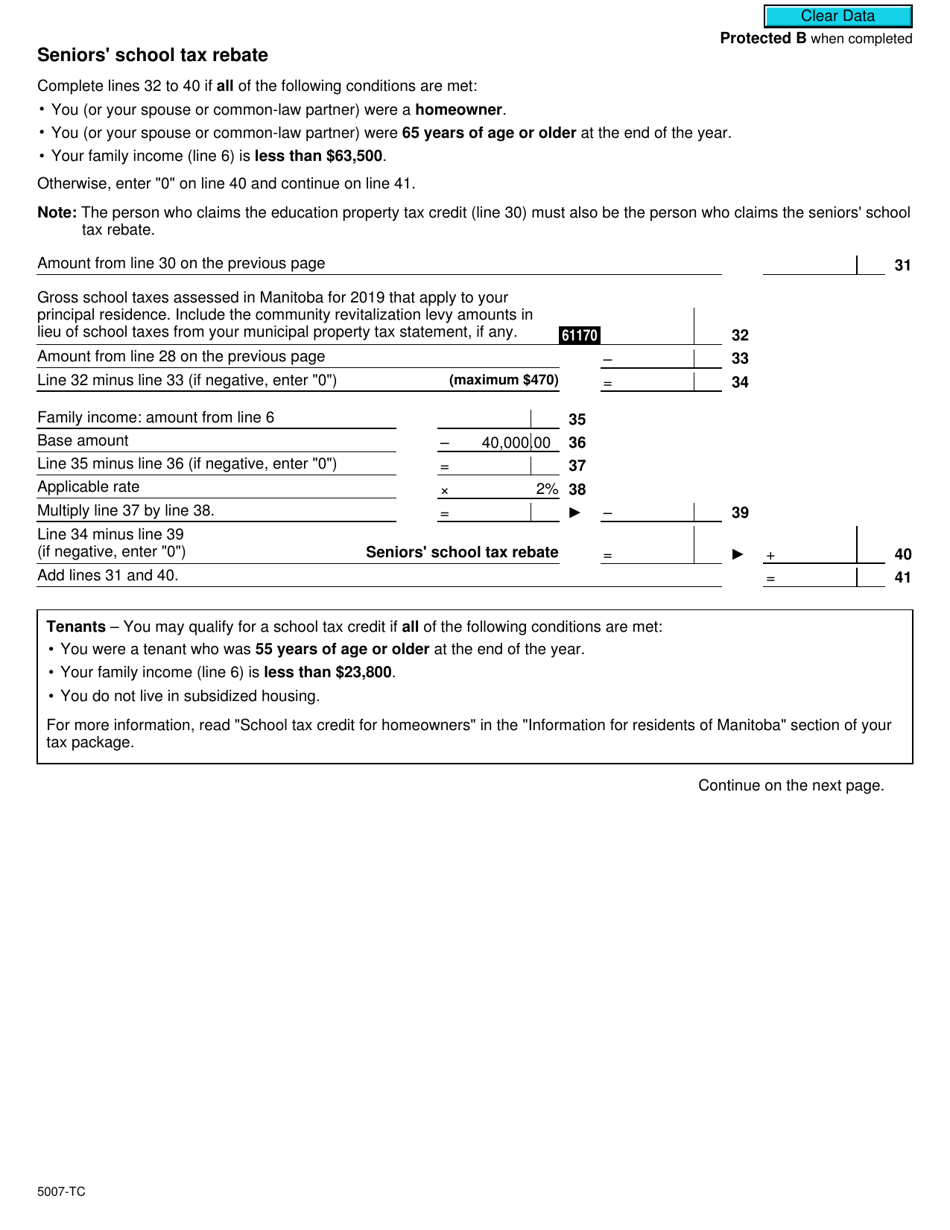

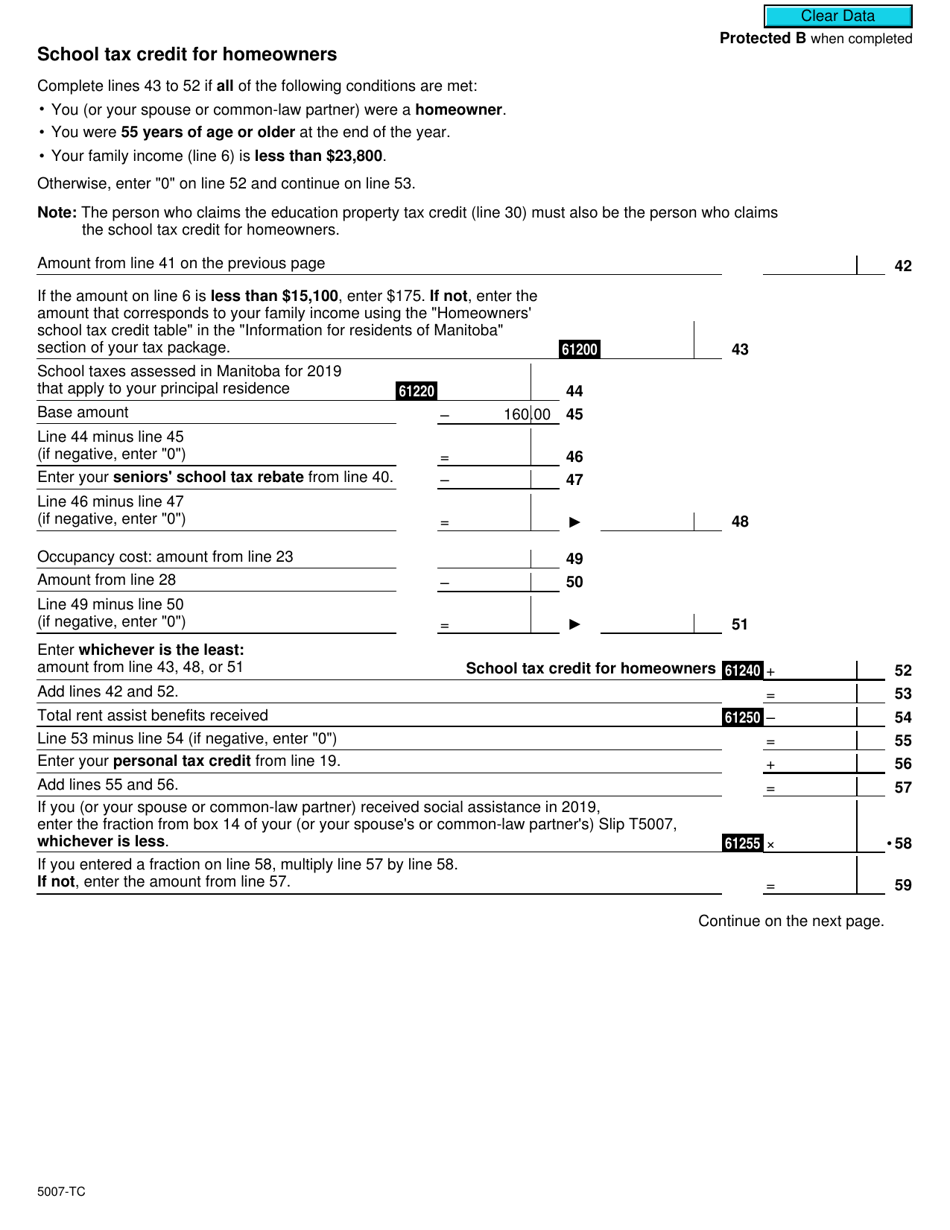

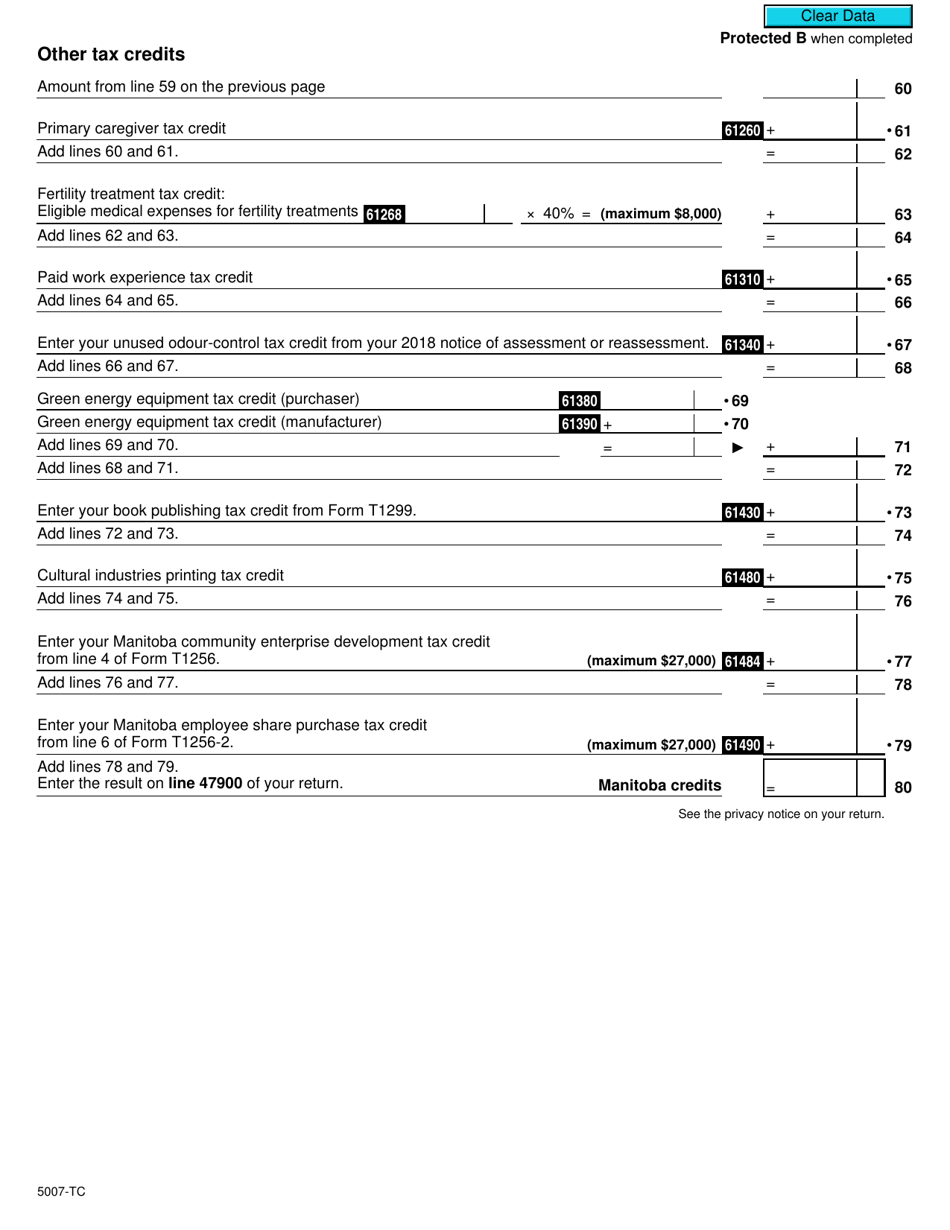

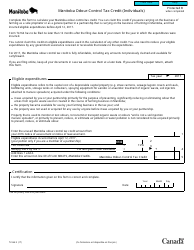

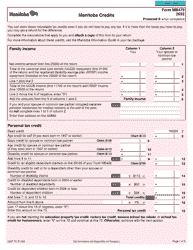

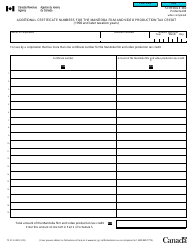

Form MB479 (5007-TC), also known as "Manitoba Credits - Canada," is used by residents of Manitoba to claim various credits on their federal income tax return. This form allows Manitobans to claim credits such as the Climate Action Incentive, caregiver credit, volunteer firefighter credit, and more. It is used to calculate and provide information about these credits that may be available to Manitobans.

The Form MB479 (5007-TC) Manitoba Credits in Canada is typically filed by individual taxpayers who are claiming certain tax credits in the province of Manitoba.

FAQ

Q: What is Form MB479 (5007-TC)?

A: Form MB479 (5007-TC) is a tax form used in Manitoba, Canada to claim tax credits.

Q: What are Manitoba Credits?

A: Manitoba Credits are tax credits available to residents of Manitoba, Canada to reduce their tax liability.

Q: Who can claim Manitoba Credits?

A: Residents of Manitoba, Canada who meet the eligibility criteria for specific tax credits can claim Manitoba Credits.

Q: What types of tax credits are available on Form MB479 (5007-TC)?

A: Form MB479 (5007-TC) includes tax credits such as the Child Care ExpensesTax Credit, Home Buyers' Amount, and Medical Expenses Tax Credit.

Q: When is the deadline to file Form MB479 (5007-TC)?

A: The deadline to file Form MB479 (5007-TC) is usually April 30th of the following year, unless otherwise stated.

Q: Can I claim Manitoba Credits if I live in a different province?

A: No, Manitoba Credits are specifically for residents of Manitoba, Canada.

Q: What supporting documents do I need to submit with Form MB479 (5007-TC)?

A: You may need to submit supporting documents such as receipts or statements to validate your claims for certain tax credits.

Q: Can I file Form MB479 (5007-TC) electronically?

A: Yes, you can file Form MB479 (5007-TC) electronically if you are using certified tax software.

Q: What if I made a mistake on my Form MB479 (5007-TC)?

A: If you made a mistake on your Form MB479 (5007-TC), you should contact the Canada Revenue Agency for guidance on how to correct it.