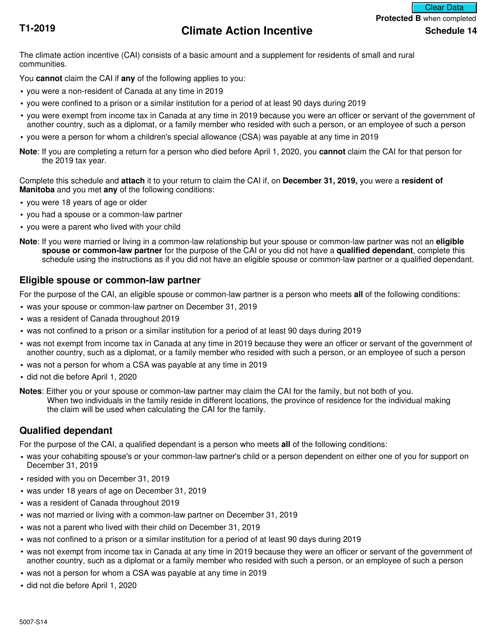

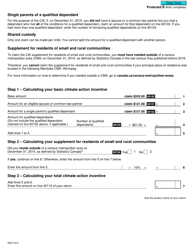

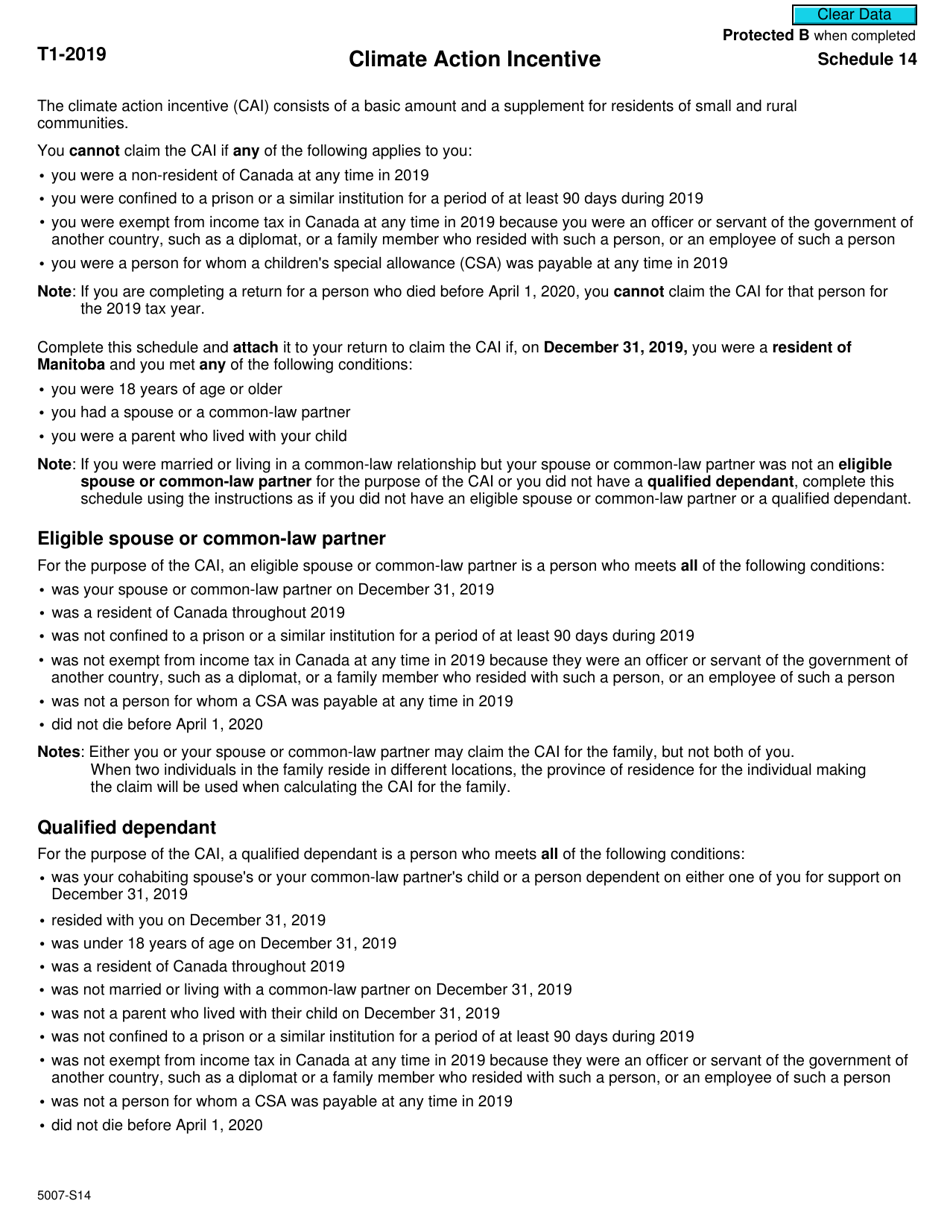

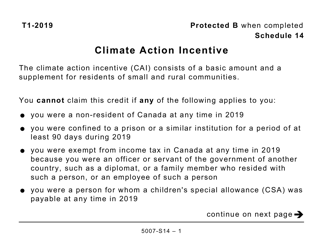

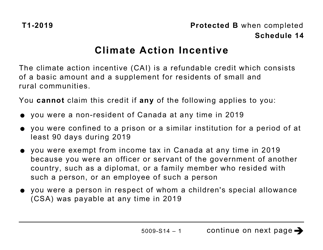

Form 5007-S14 Schedule 14 Climate Action Incentive - Canada

Form 5007-S14 Schedule 14 Climate Action Incentive is used for claiming the Climate Action Incentive in Canada. This incentive is a refundable tax credit provided to residents of certain provinces in recognition of the carbon pricing system.

Individuals who are Canadian residents and eligible for the Climate Action Incentive can file Form 5007-S14 Schedule 14 in Canada.

FAQ

Q: What is Form 5007-S14?

A: Form 5007-S14 is Schedule 14 of the Canadian tax return that deals with the Climate Action Incentive.

Q: What is the Climate Action Incentive?

A: The Climate Action Incentive is a program introduced by the Canadian government to encourage individuals and families to take action against climate change.

Q: Who is eligible for the Climate Action Incentive?

A: Residents of provinces that have the federal carbon pricing system in place are eligible for the Climate Action Incentive.

Q: Do I need to fill out Form 5007-S14?

A: If you are eligible for the Climate Action Incentive, you need to fill out Form 5007-S14 to claim the incentive on your tax return.