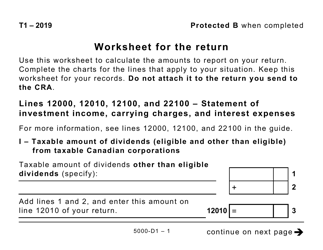

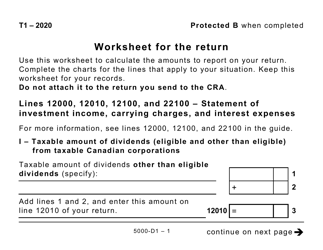

This version of the form is not currently in use and is provided for reference only. Download this version of

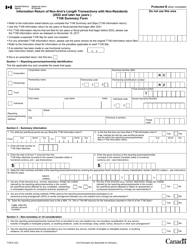

Form 5013-D1

for the current year.

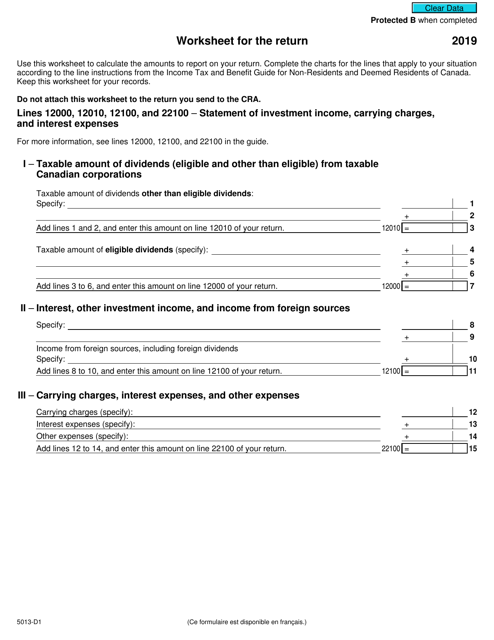

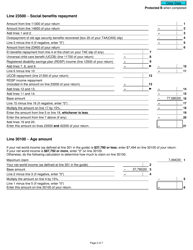

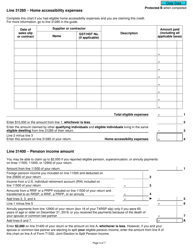

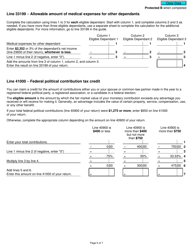

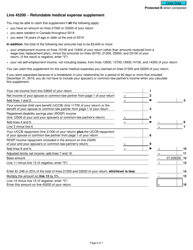

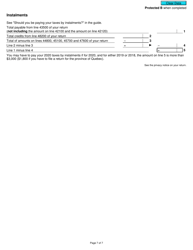

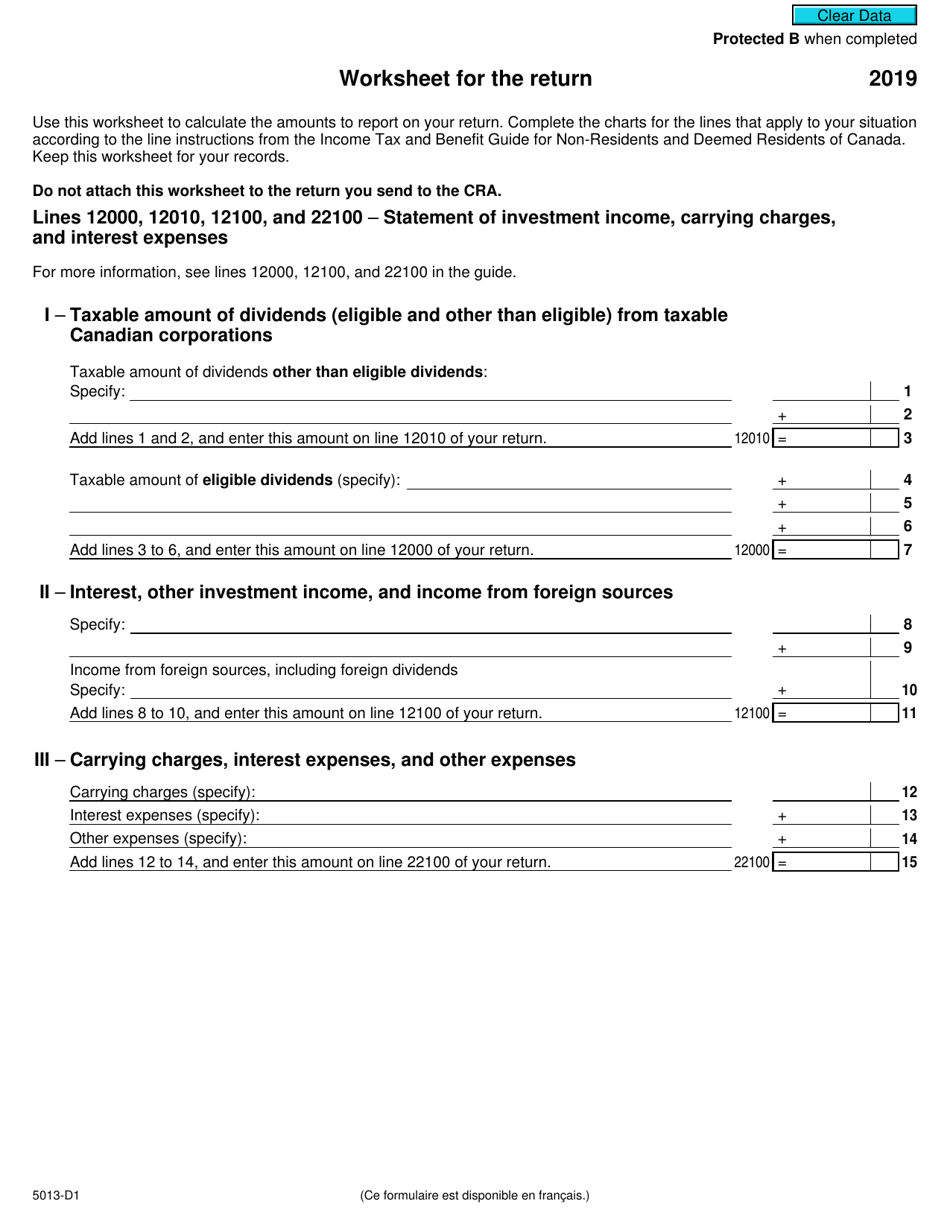

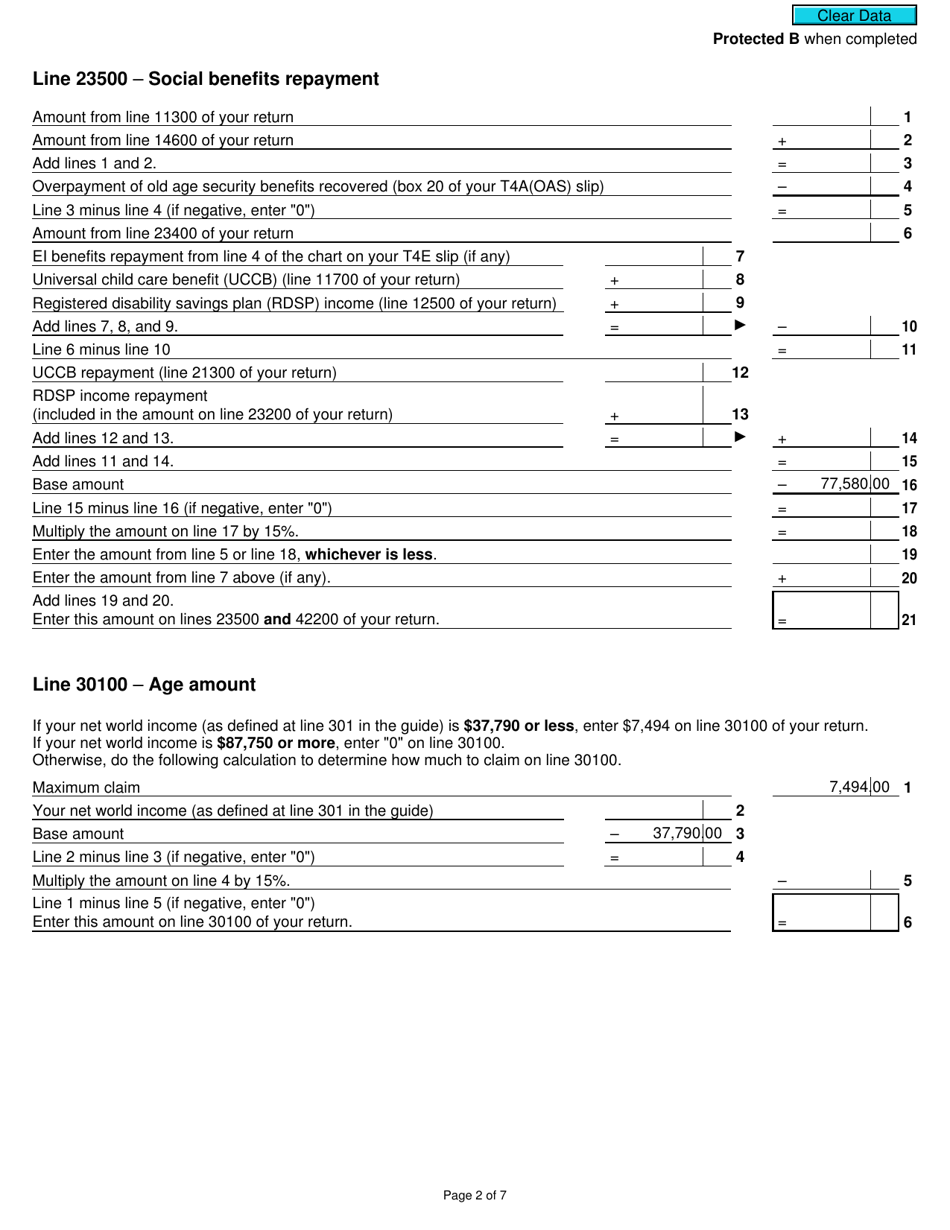

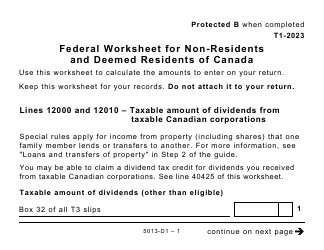

Form 5013-D1 Worksheet for the Return - Non-residents and Deemed Residents of Canada - Canada

FAQ

Q: What is the Form 5013-D1?

A: Form 5013-D1 is a worksheet for the return specifically designed for non-residents and deemed residents of Canada.

Q: Who should use Form 5013-D1?

A: Form 5013-D1 should be used by non-residents and deemed residents of Canada.

Q: What is a non-resident of Canada?

A: A non-resident of Canada is an individual who does not have significant residential ties in Canada during a tax year.

Q: What is a deemed resident of Canada?

A: A deemed resident of Canada is an individual who is treated as a resident of Canada for tax purposes, even if they don't have significant residential ties.

Q: What is the purpose of Form 5013-D1?

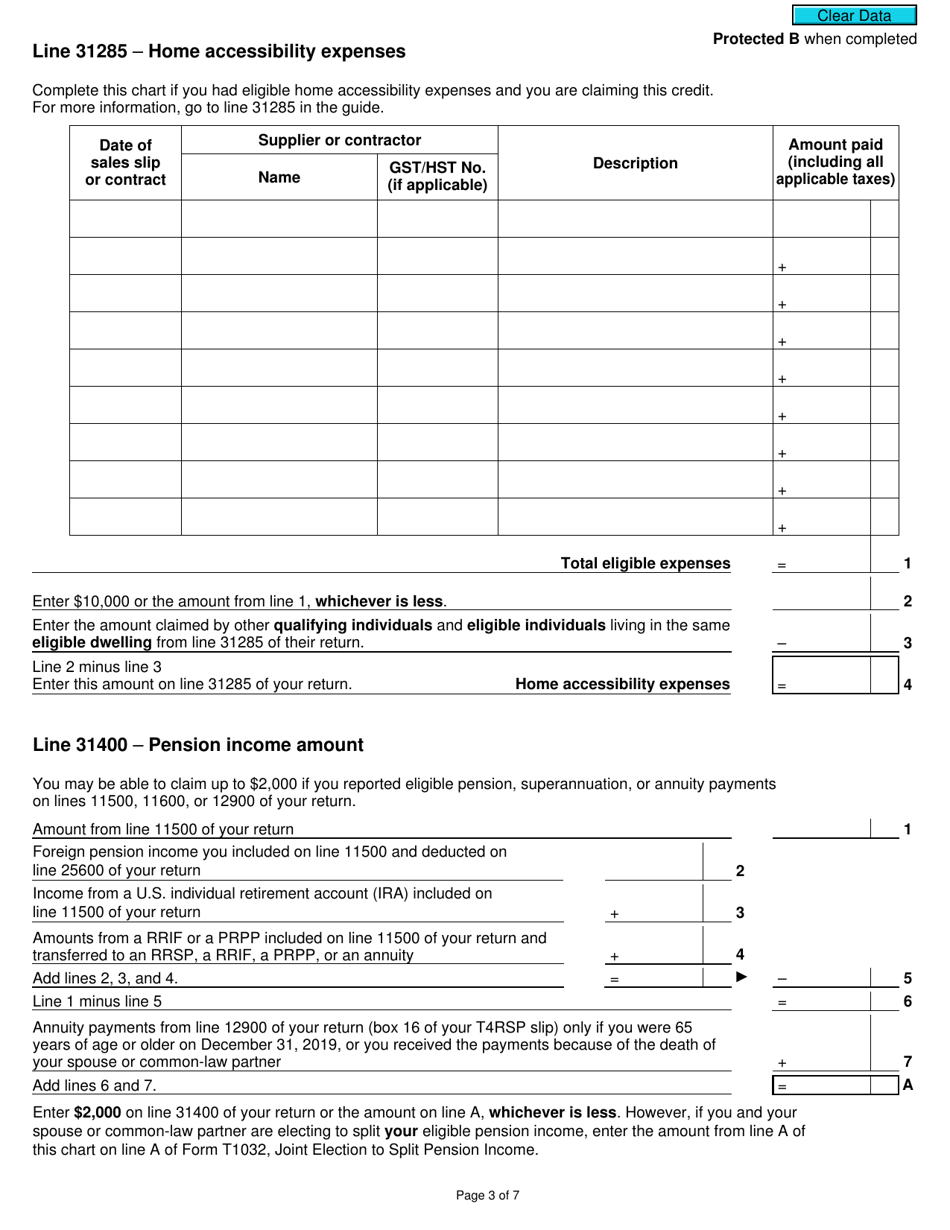

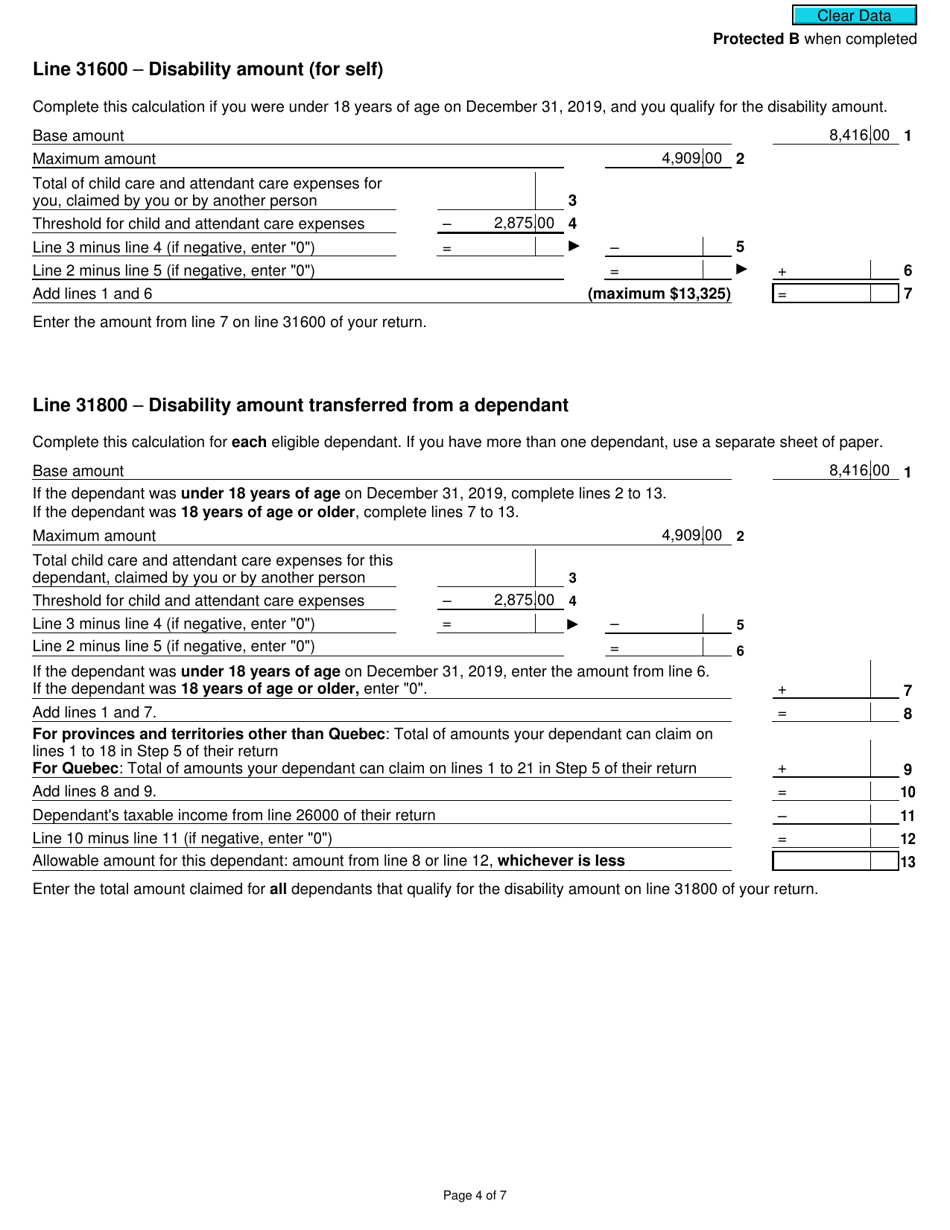

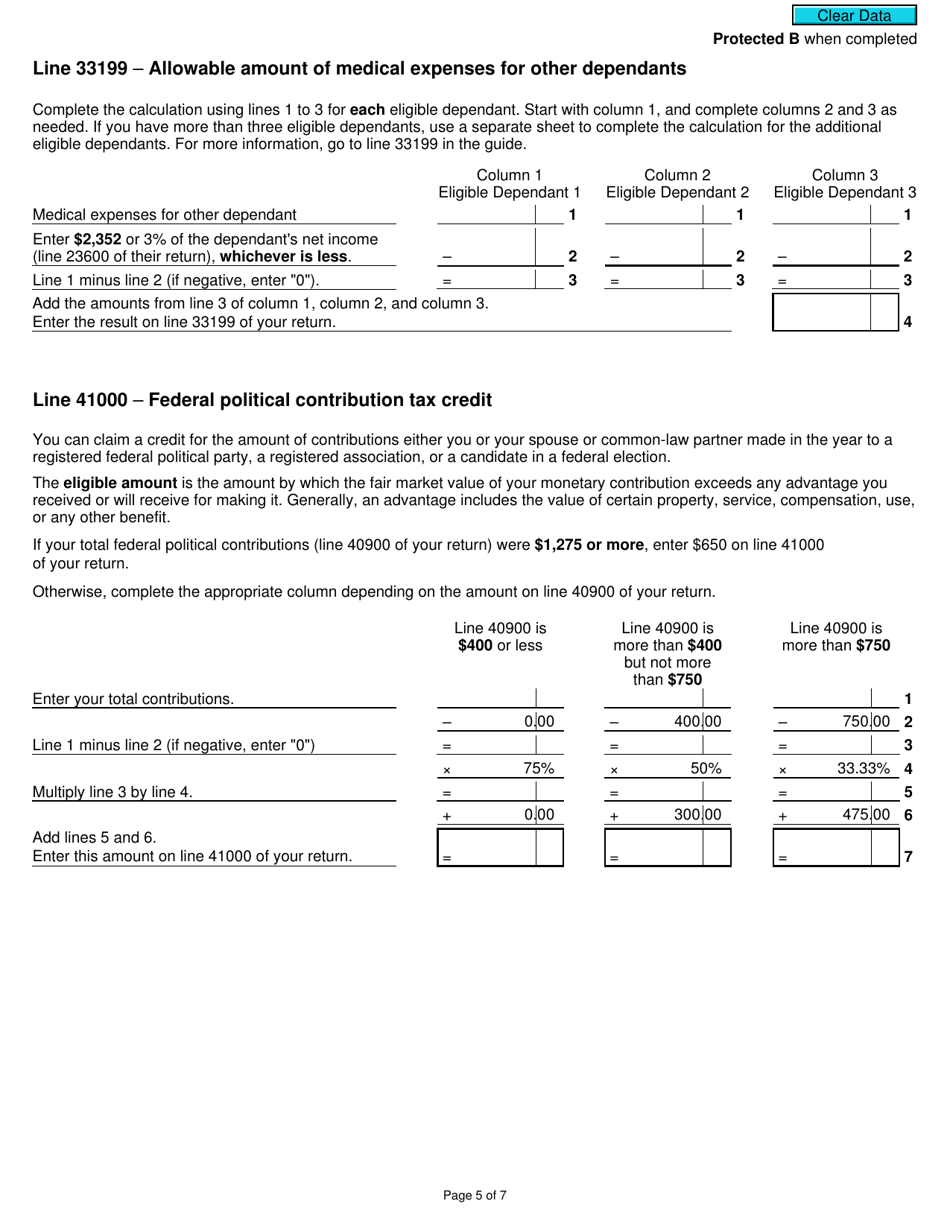

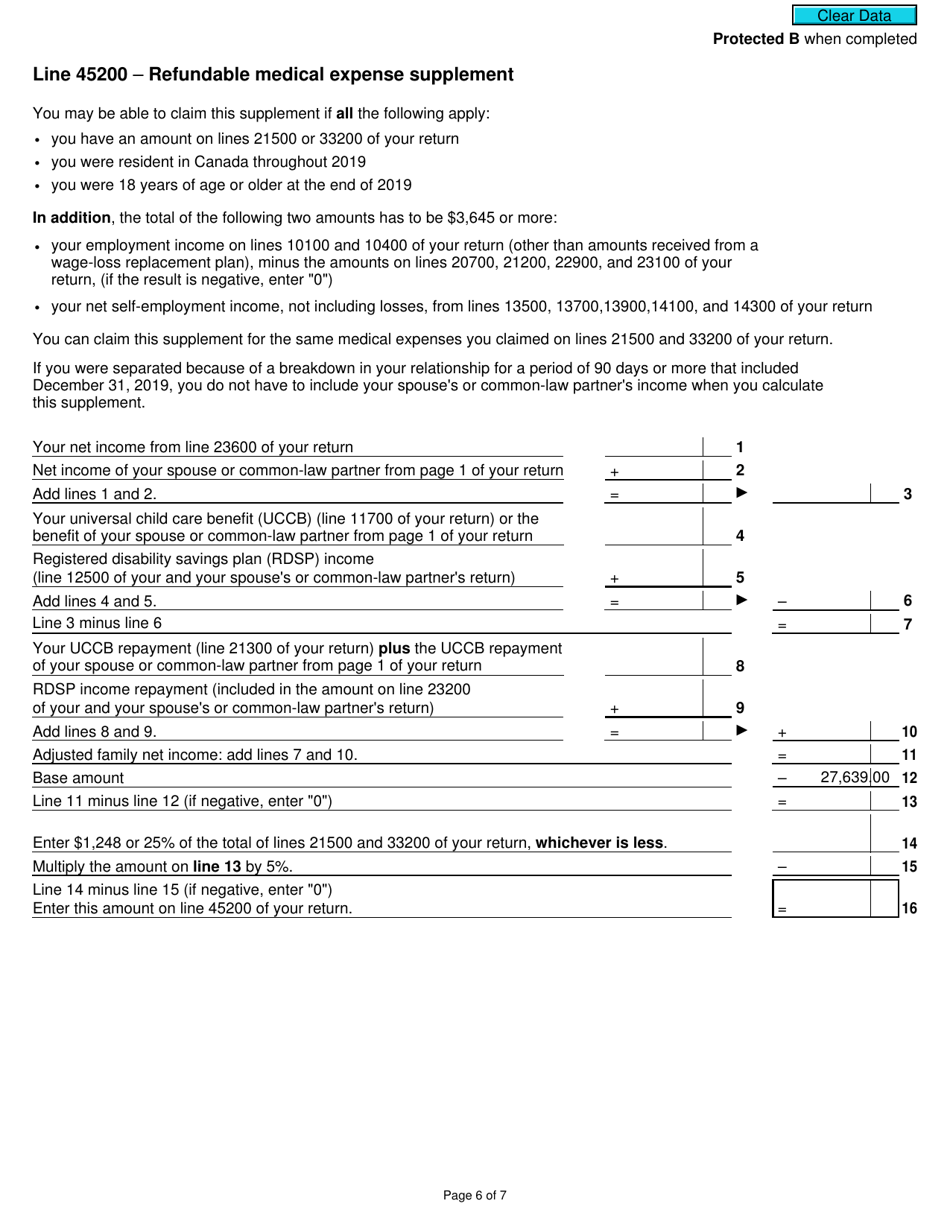

A: The purpose of Form 5013-D1 is to calculate the tax liability and claim any applicable deductions or credits for non-residents and deemed residents of Canada.

Q: What information is required on Form 5013-D1?

A: Form 5013-D1 requires information related to the individual's income, deductions, credits, and tax withheld in Canada.

Q: Is Form 5013-D1 the same as Form 1040?

A: No, Form 5013-D1 is specifically for non-residents and deemed residents of Canada, while Form 1040 is used by US residents for their federal income tax return.

Q: Are there any specific rules or regulations for non-residents and deemed residents of Canada?

A: Yes, non-residents and deemed residents of Canada are subject to certain tax rules and regulations that may be different from those applying to Canadian residents.

Q: Do non-residents and deemed residents of Canada have to file a tax return?

A: Yes, non-residents and deemed residents of Canada are generally required to file a tax return if they have income from Canadian sources or if they want to claim any deductions or credits.