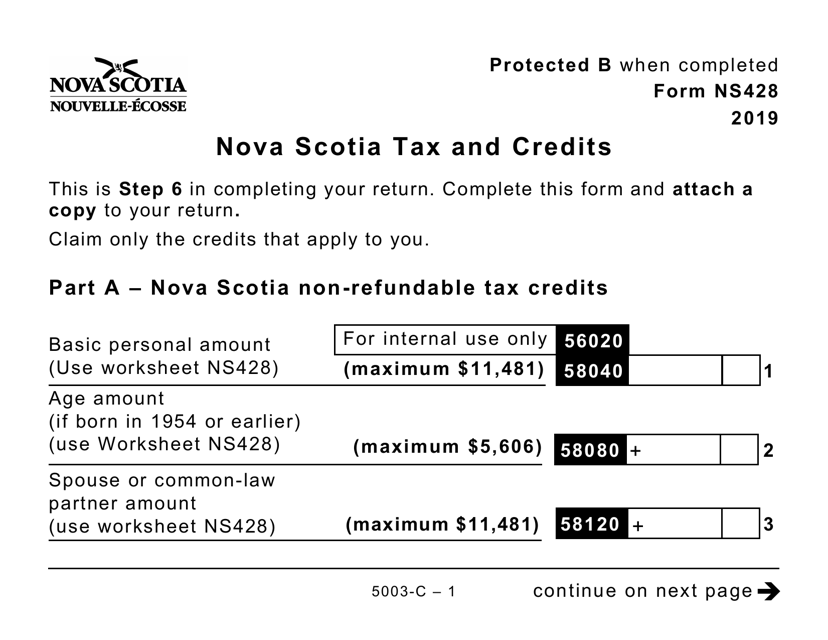

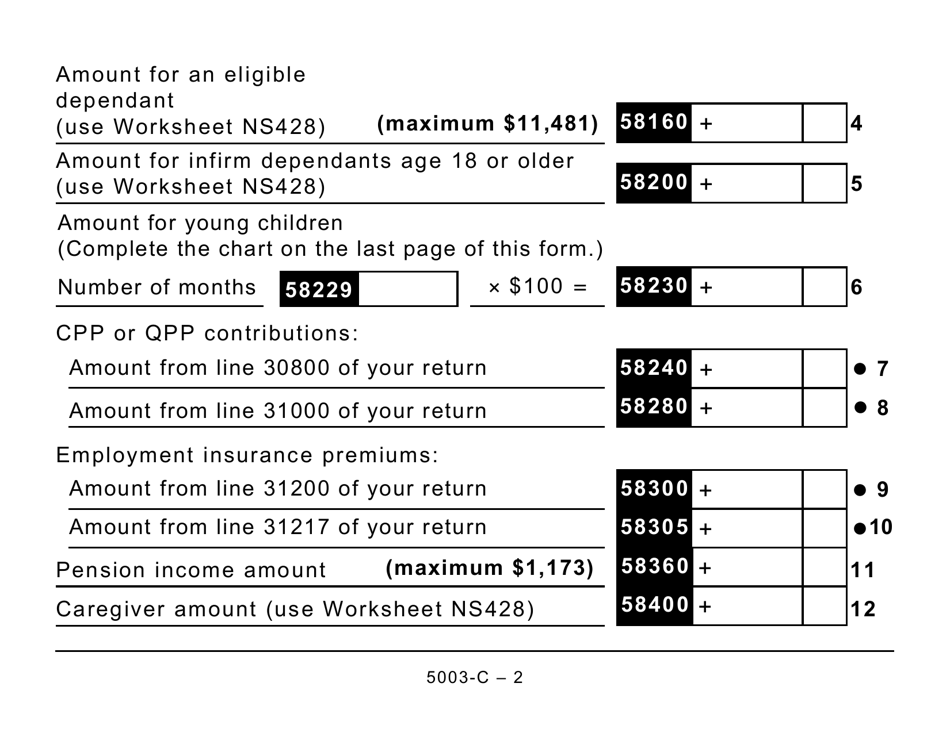

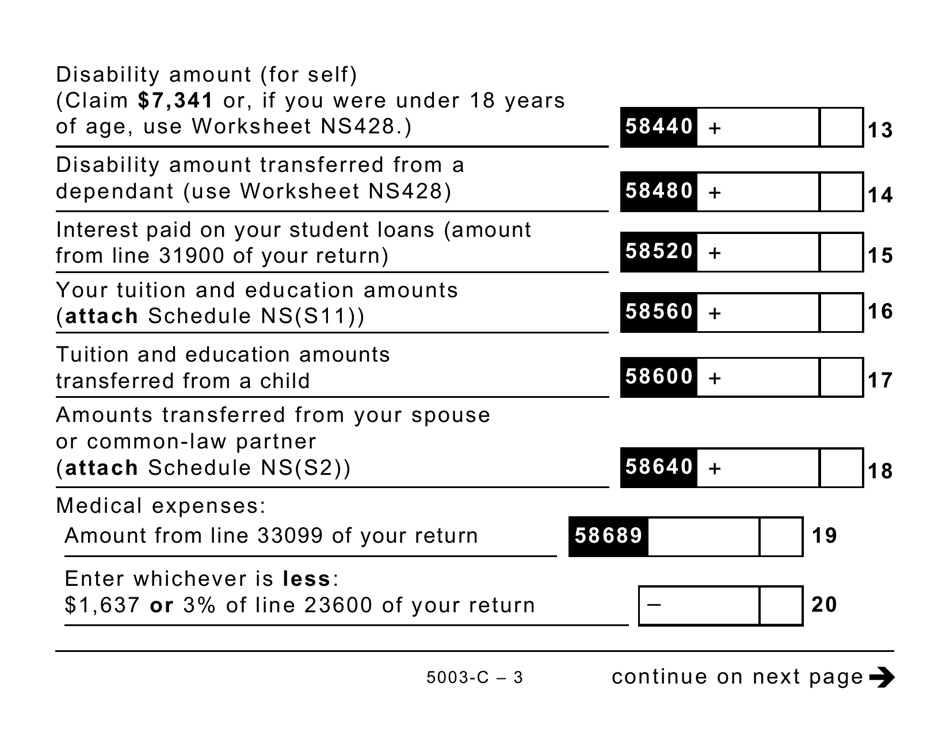

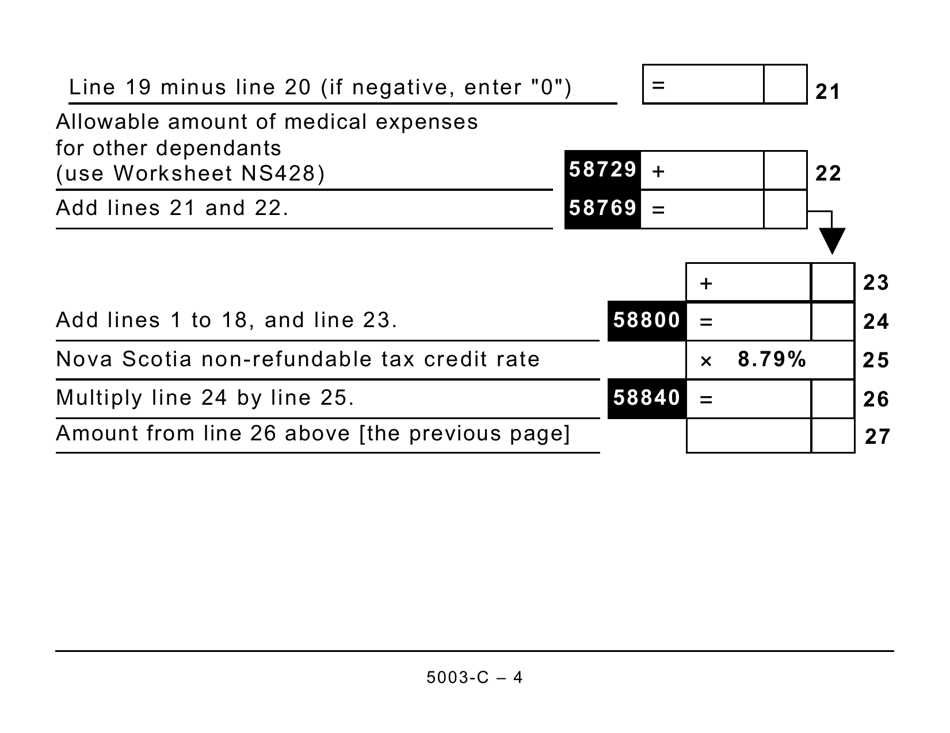

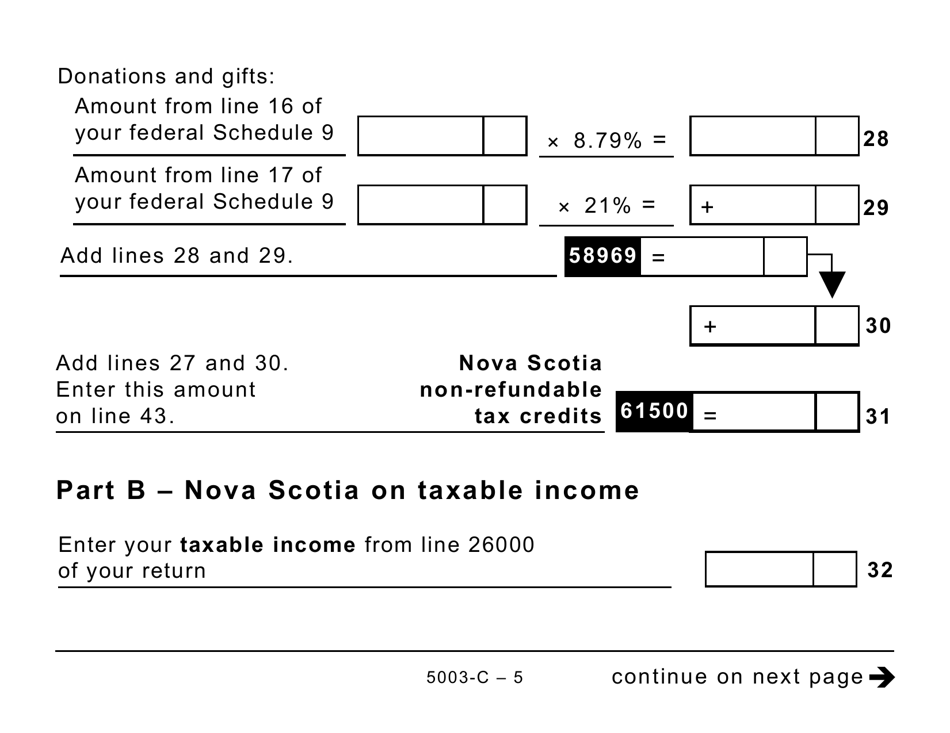

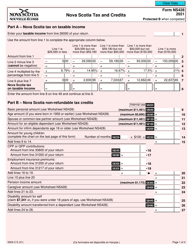

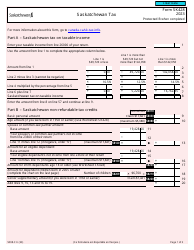

Form NS428 (5003-C) Nova Scotia Tax and Credits (Large Print) - Canada

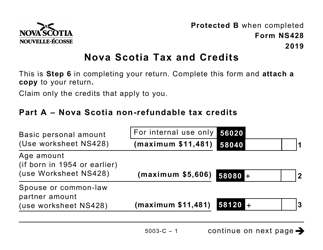

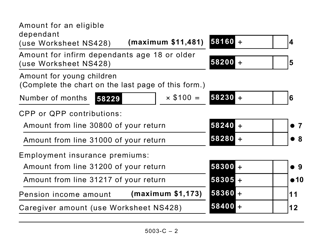

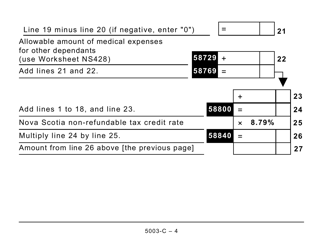

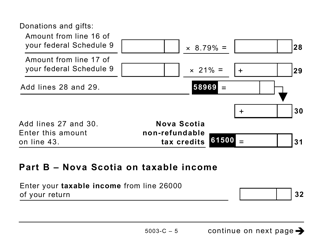

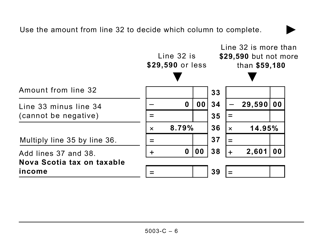

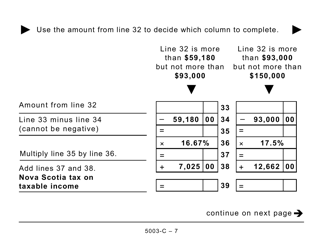

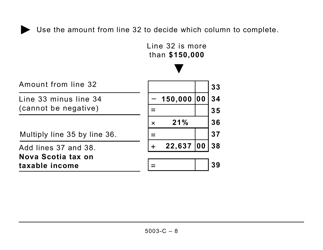

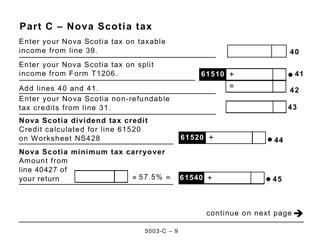

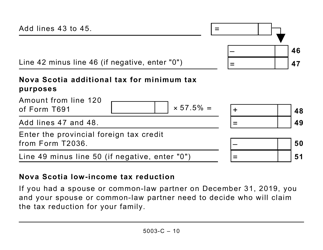

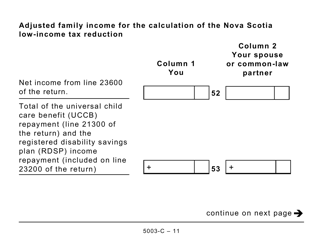

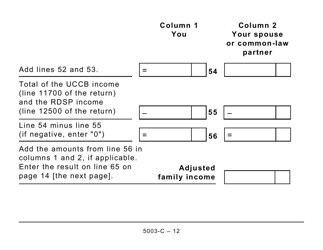

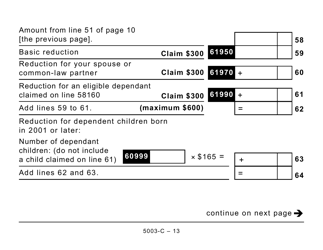

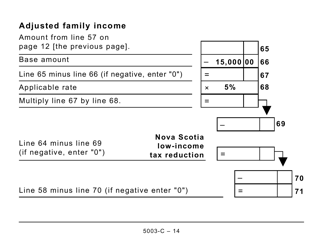

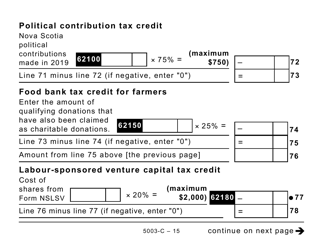

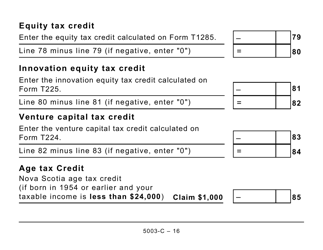

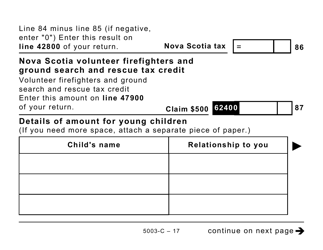

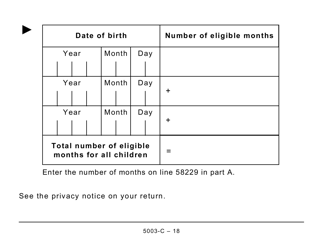

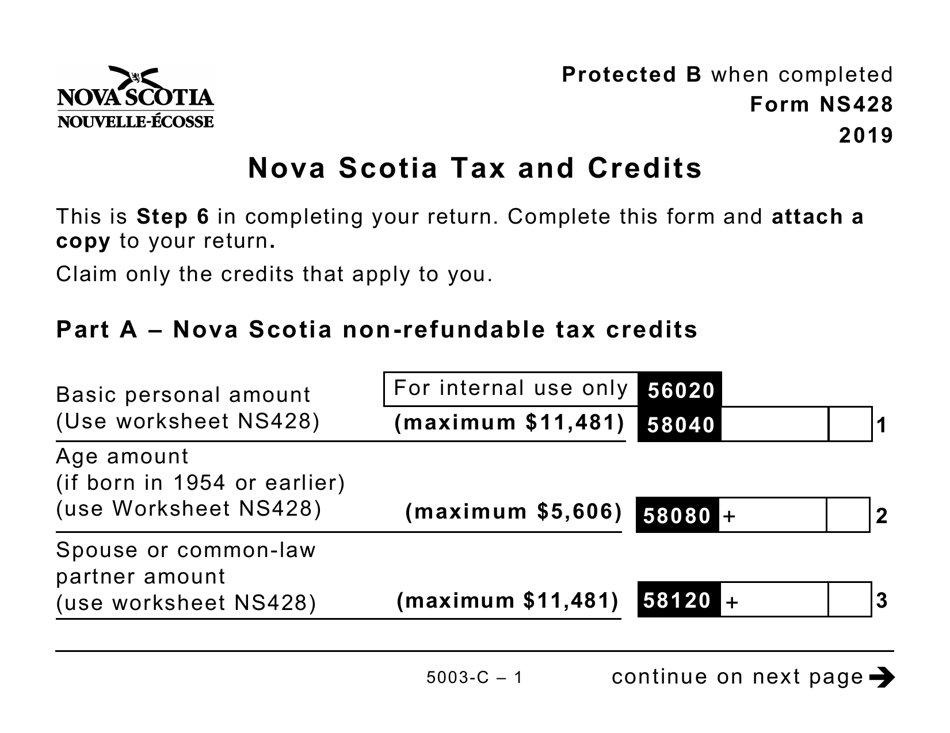

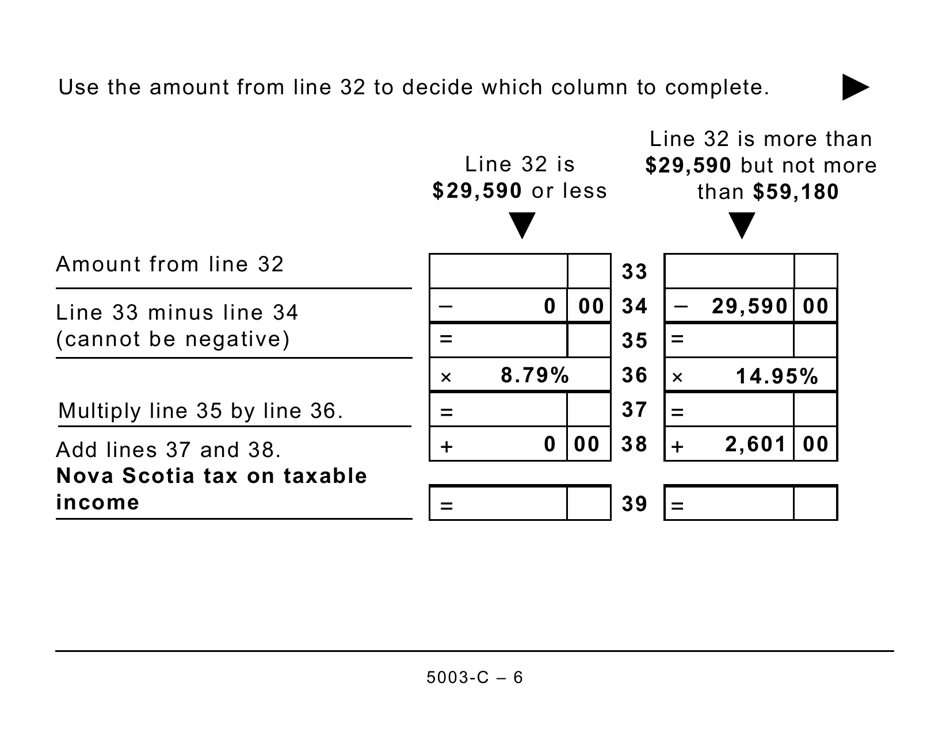

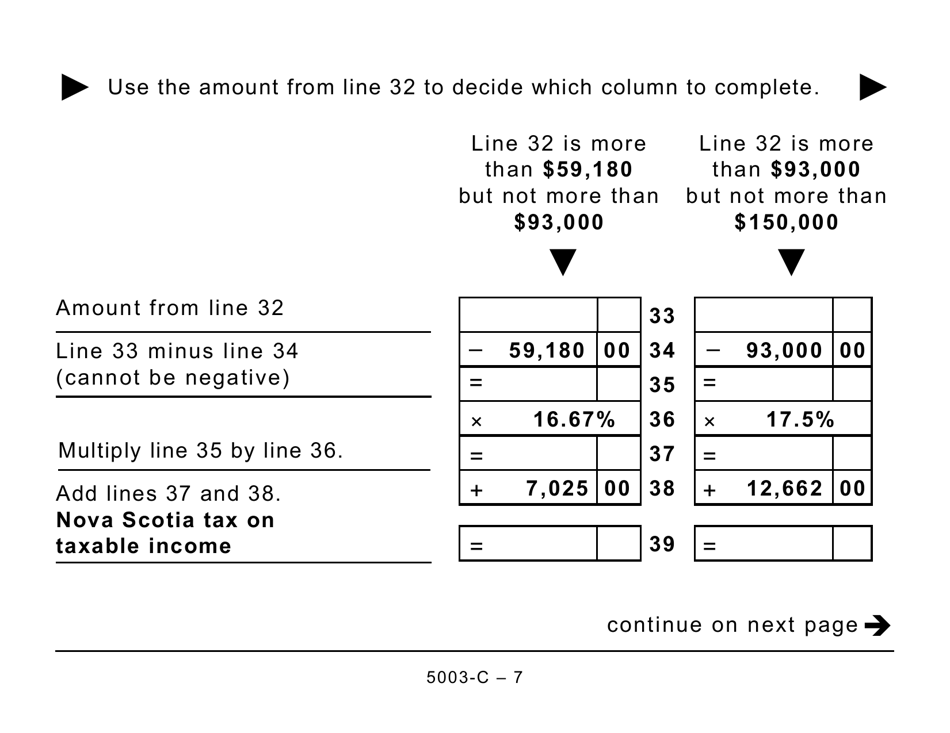

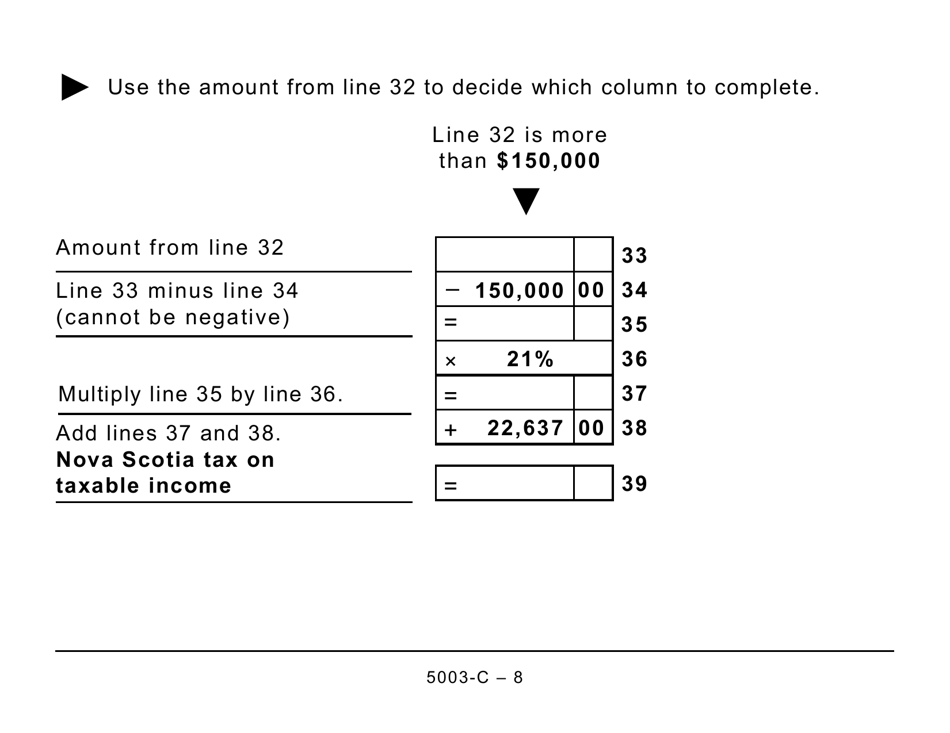

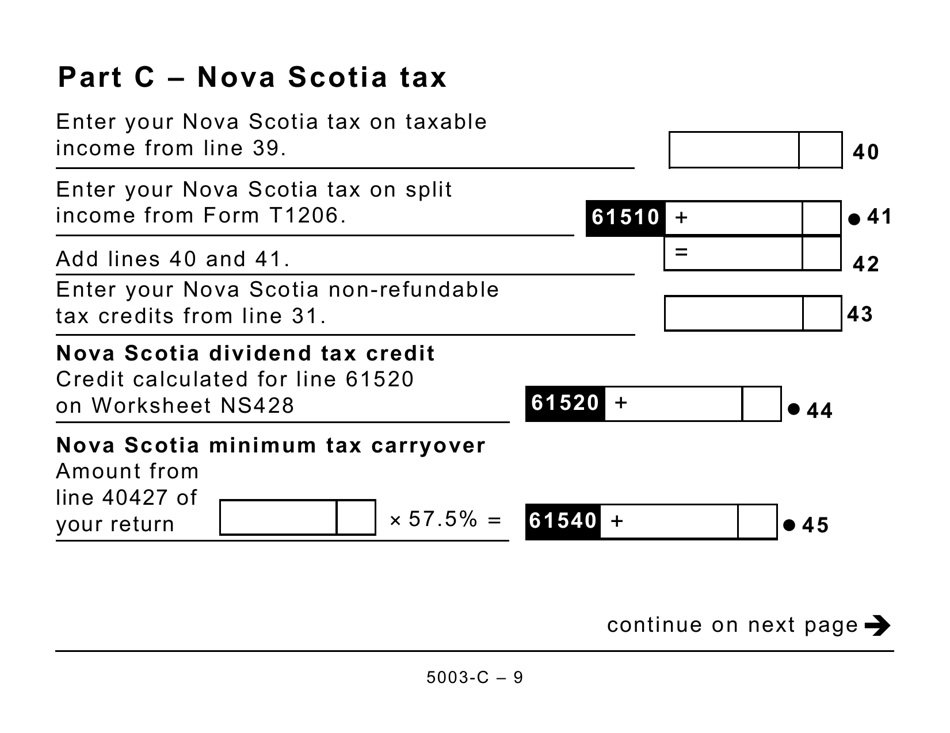

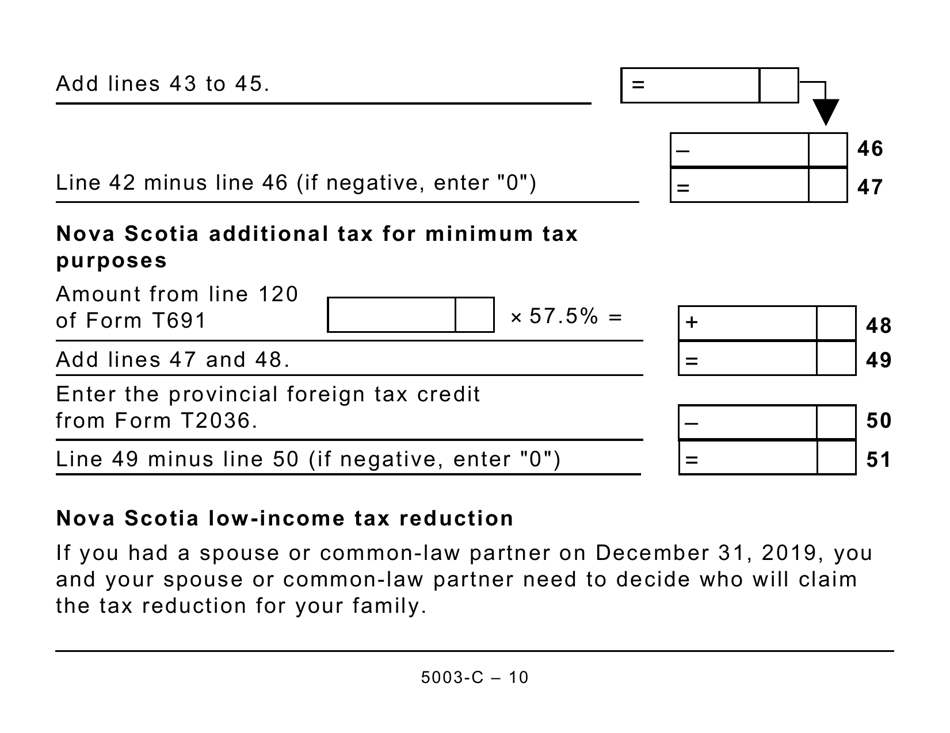

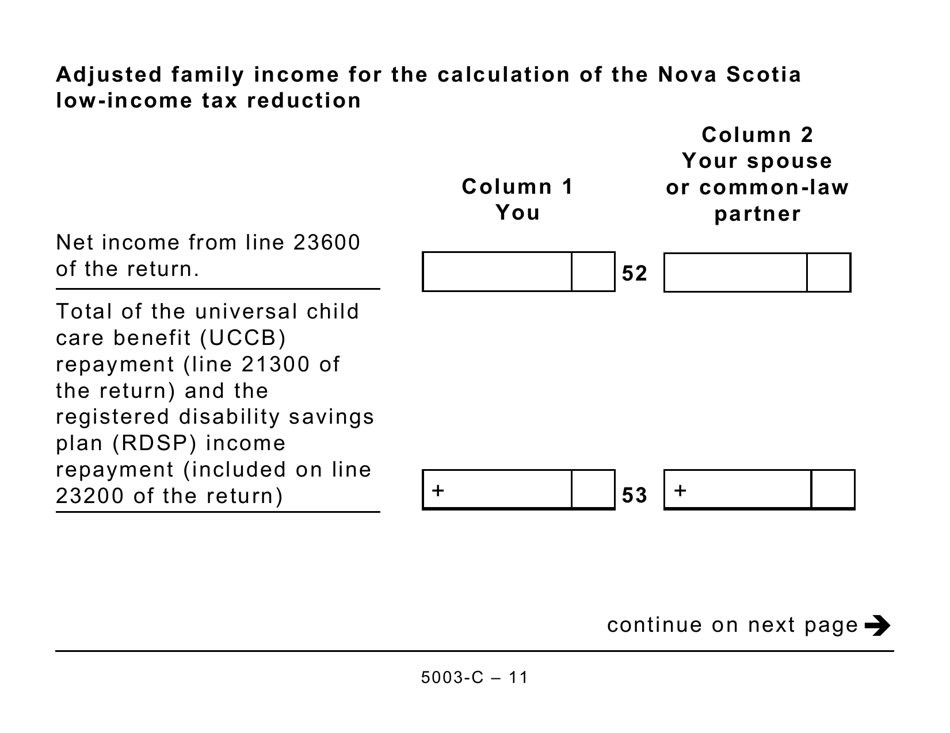

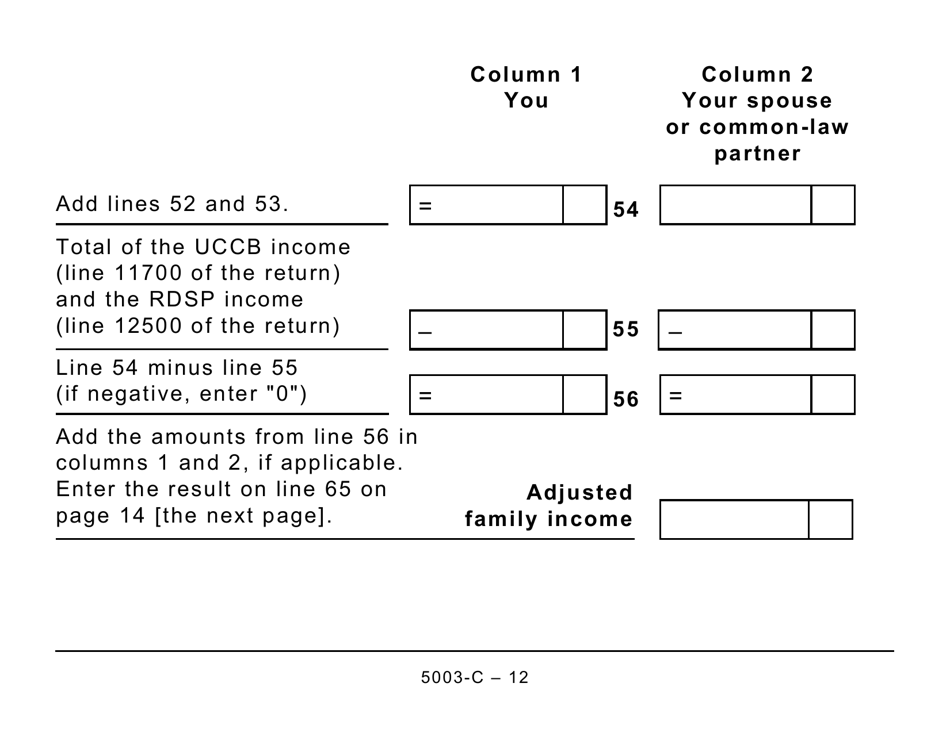

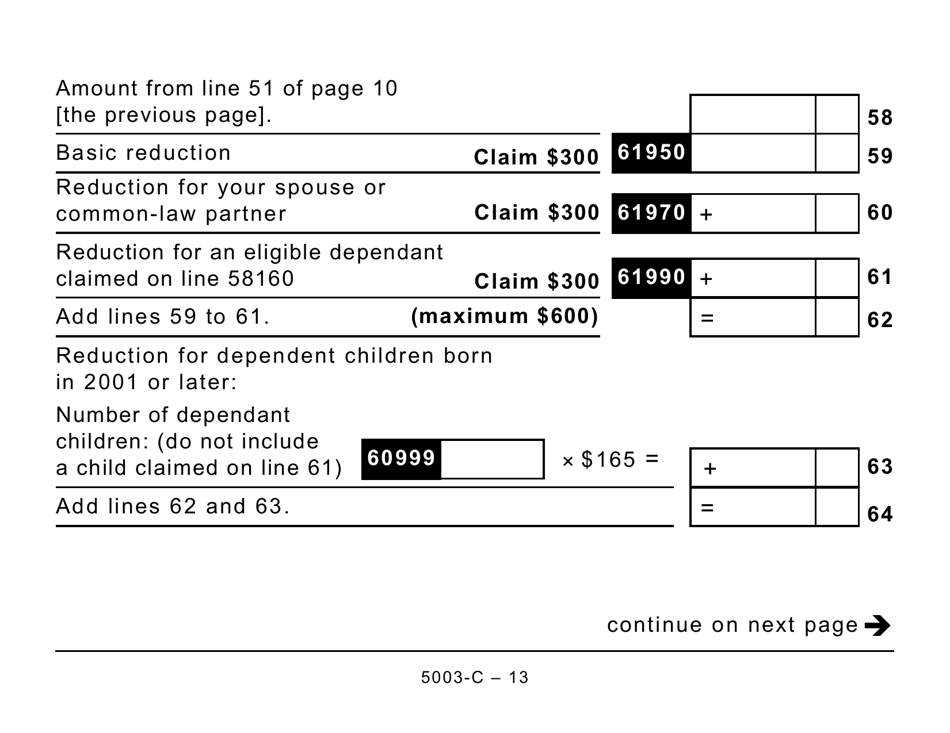

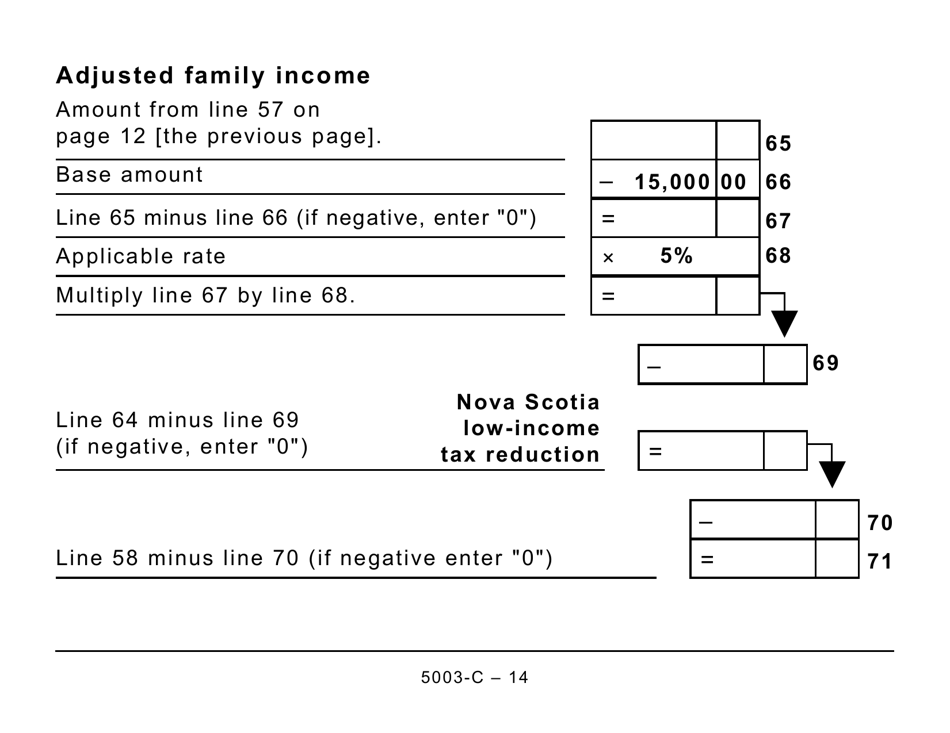

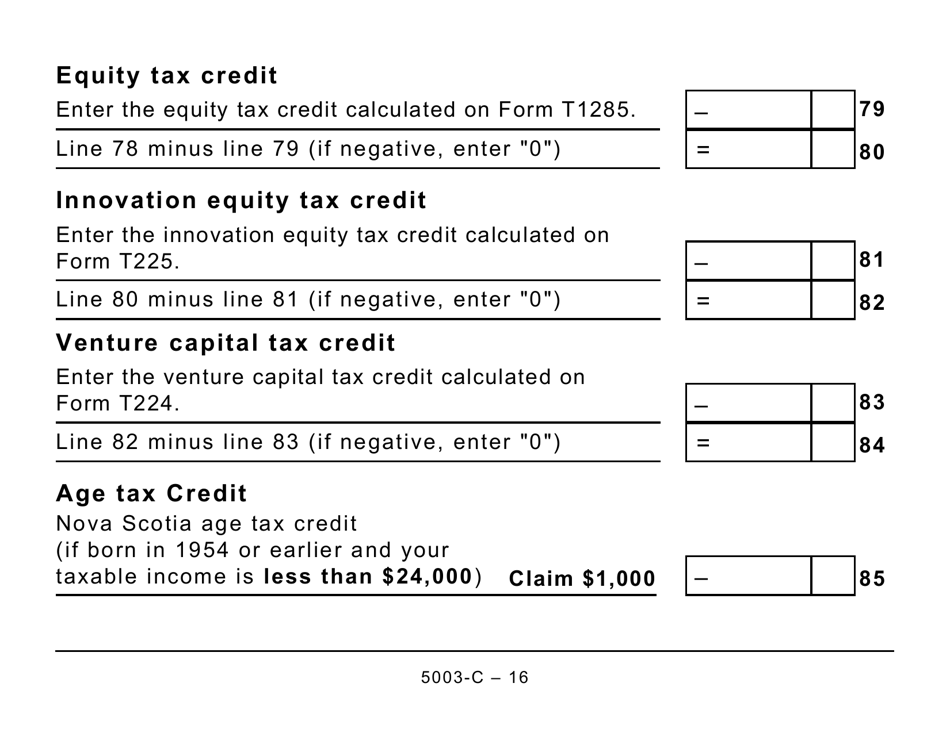

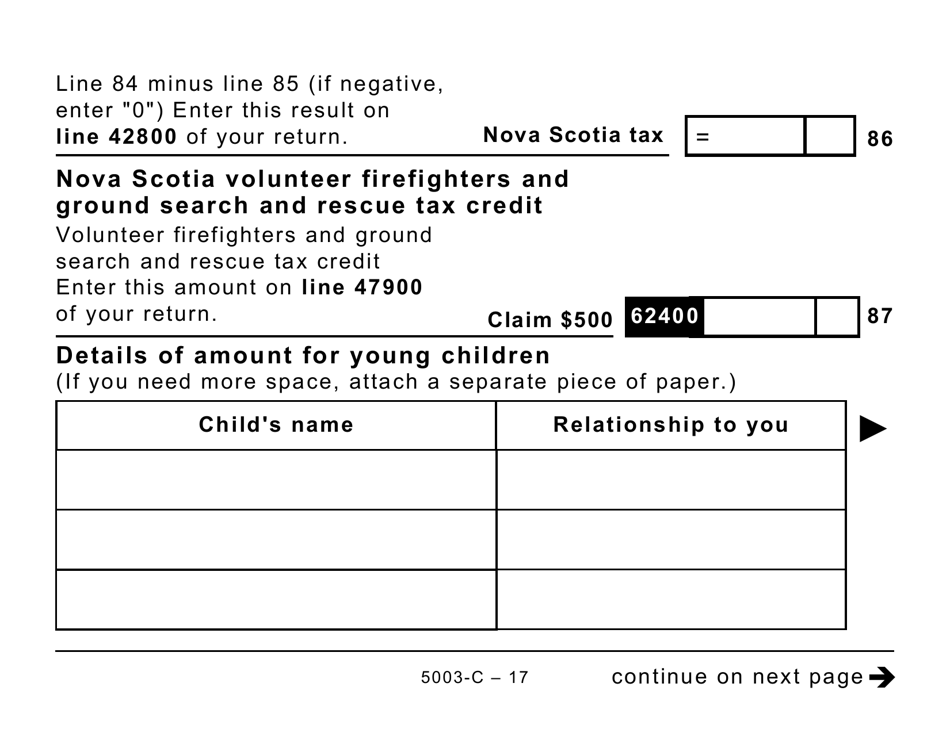

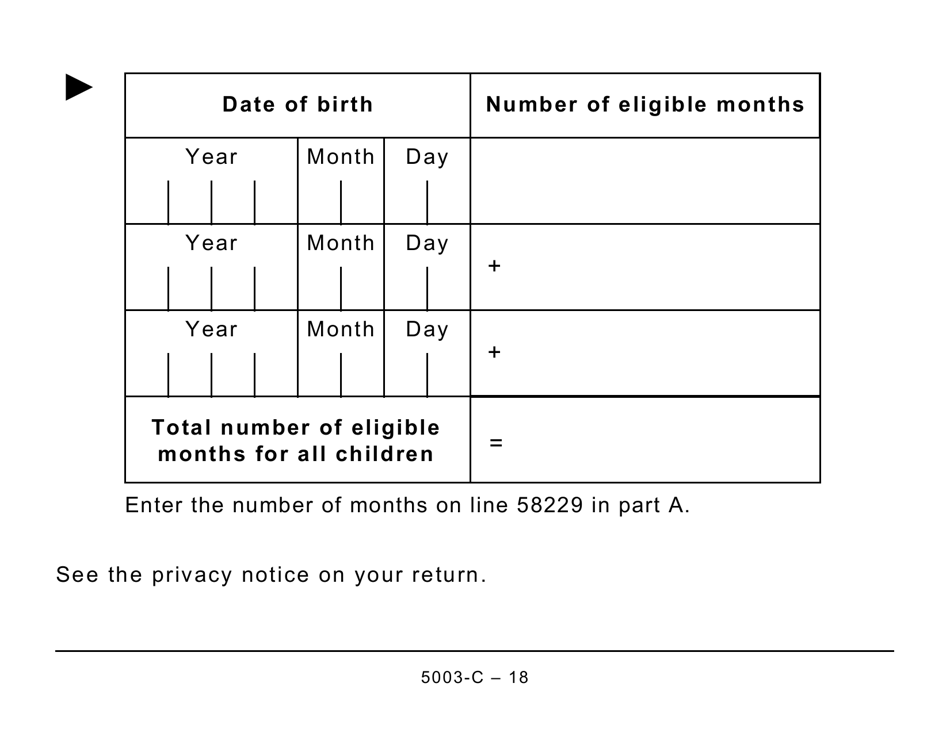

Form NS428 (5003-C) is a tax form used in Canada specifically for the residents of Nova Scotia. It is designed to calculate your provincial tax and various credits that you may be eligible for in Nova Scotia. This form is used to report your income, deductions, and determine the amount of tax you owe or the refund you may receive from the provincial government in Nova Scotia. It is important to accurately complete this form to ensure compliance with the tax laws and to make sure you take advantage of any applicable credits to minimize your overall tax liability.

The Form NS428 (5003-C) Nova Scotia Tax and Credits (Large Print) is filed by residents of Nova Scotia, Canada who are required to report their income and claim any tax credits specific to the province.

FAQ

Q: What is Form NS428 (5003-C)?

A: Form NS428 (5003-C) is a tax form used in Nova Scotia, Canada for reporting income and claiming tax credits.

Q: Who needs to fill out Form NS428 (5003-C)?

A: Residents of Nova Scotia who have income to report and are eligible for any of the available tax credits must fill out Form NS428 (5003-C).

Q: What is the purpose of Form NS428 (5003-C)?

A: The purpose of Form NS428 (5003-C) is to calculate your provincial tax liability in Nova Scotia and claim any applicable tax credits.

Q: When is the deadline for filing Form NS428 (5003-C)?

A: The deadline for filing Form NS428 (5003-C) is the same as the federal tax deadline, which is usually April 30th of the following year.

Q: Can Form NS428 (5003-C) be filed electronically?

A: Yes, Form NS428 (5003-C) can be filed electronically using NETFILE or EFILE services, or through certified tax software.

Q: What are some common tax credits that can be claimed on Form NS428 (5003-C)?

A: Some common tax credits that can be claimed on Form NS428 (5003-C) include the Nova Scotia tax credit, the low-income tax reduction, the Nova Scotia political contribution tax credit, and the volunteer firefighters' tax credit.

Q: Do I need to include supporting documents with Form NS428 (5003-C)?

A: You generally do not need to include supporting documents when filing Form NS428 (5003-C). However, it is advisable to keep all relevant documents in case the CRA requests them for verification.

Q: What happens if I don't file Form NS428 (5003-C)?

A: If you are required to file Form NS428 (5003-C) and fail to do so, you may face penalties and interest charges from the CRA. It is important to file your taxes accurately and on time to avoid any penalties.