This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5001-S2 Schedule NL(S2)

for the current year.

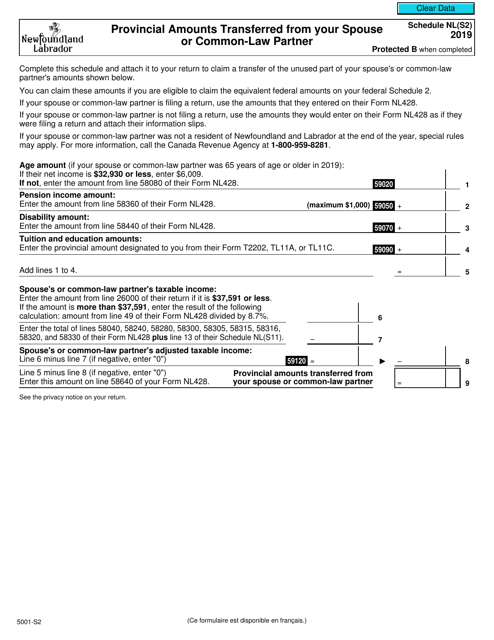

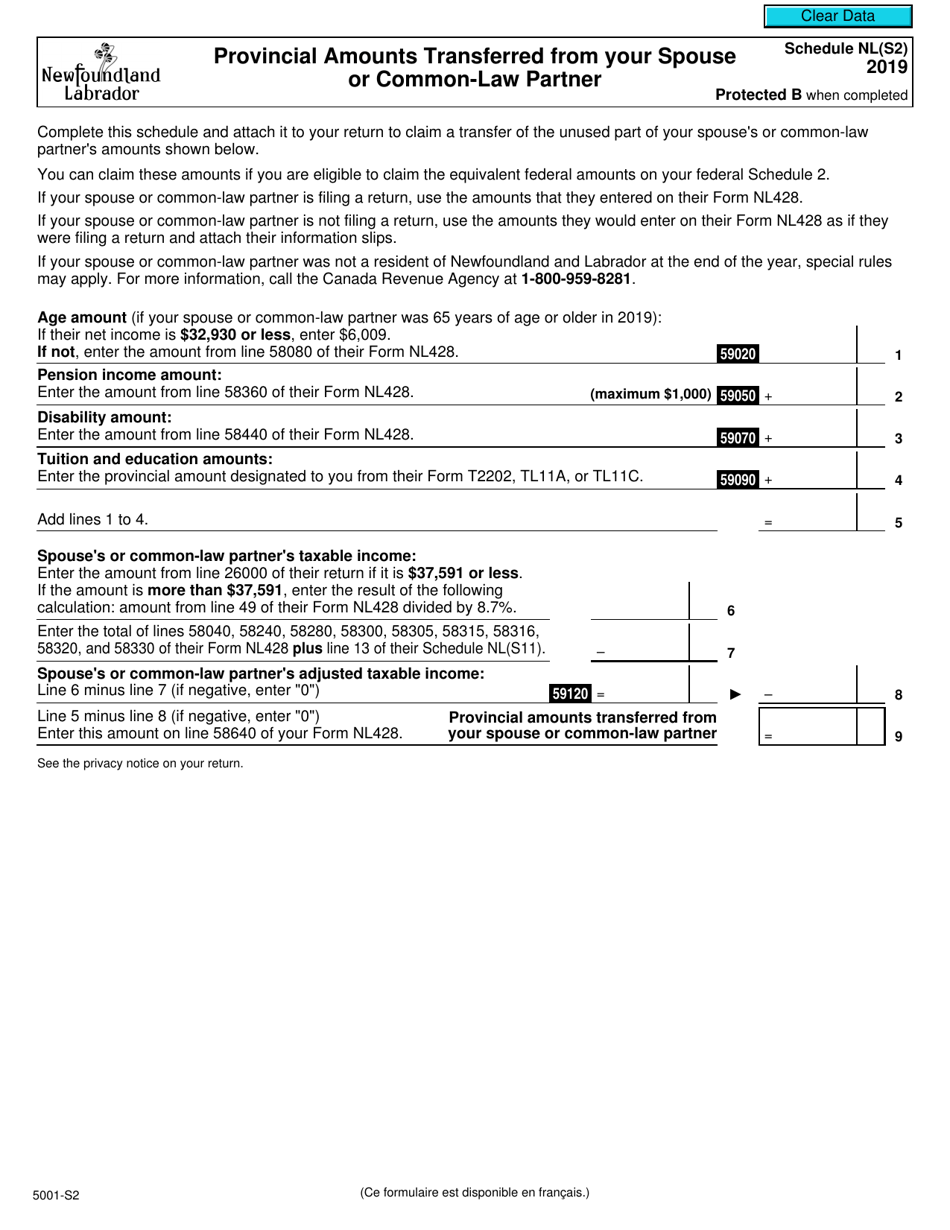

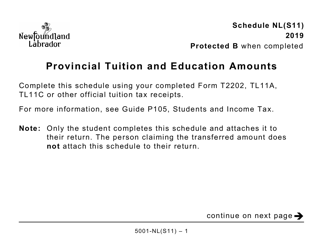

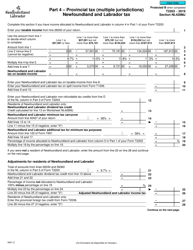

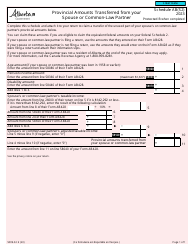

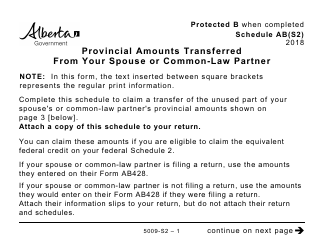

Form 5001-S2 Schedule NL(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner - Newfoundland and Labrador - Canada

Form 5001-S2 Schedule NL(S2) is used to report provincial amounts transferred from your spouse or common-law partner in Newfoundland and Labrador, Canada. It is used to calculate the provincial tax credits and deductions that you can claim on your tax return.

FAQ

Q: What is Form 5001-S2 Schedule NL(S2)?

A: Form 5001-S2 Schedule NL(S2) is a tax form used in Newfoundland and Labrador, Canada.

Q: What is the purpose of Form 5001-S2 Schedule NL(S2)?

A: The purpose of Form 5001-S2 Schedule NL(S2) is to report provincial amounts transferred from your spouse or common-law partner.

Q: Who needs to fill out Form 5001-S2 Schedule NL(S2)?

A: You need to fill out Form 5001-S2 Schedule NL(S2) if you want to claim provincial amounts transferred from your spouse or common-law partner in Newfoundland and Labrador.

Q: Is Form 5001-S2 Schedule NL(S2) specific to Newfoundland and Labrador?

A: Yes, Form 5001-S2 Schedule NL(S2) is specific to Newfoundland and Labrador as it is used to report provincial amounts for that province.

Q: Do I need to file Form 5001-S2 Schedule NL(S2) if I don't live in Newfoundland and Labrador?

A: No, you do not need to file Form 5001-S2 Schedule NL(S2) if you do not live in Newfoundland and Labrador. It is specific to that province.

Q: When is the deadline to file Form 5001-S2 Schedule NL(S2)?

A: The deadline to file Form 5001-S2 Schedule NL(S2) is usually the same as the deadline for your income tax return, which is April 30th, unless it falls on a weekend or holiday, in which case it would be the next business day.