This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5013-SC Schedule C

for the current year.

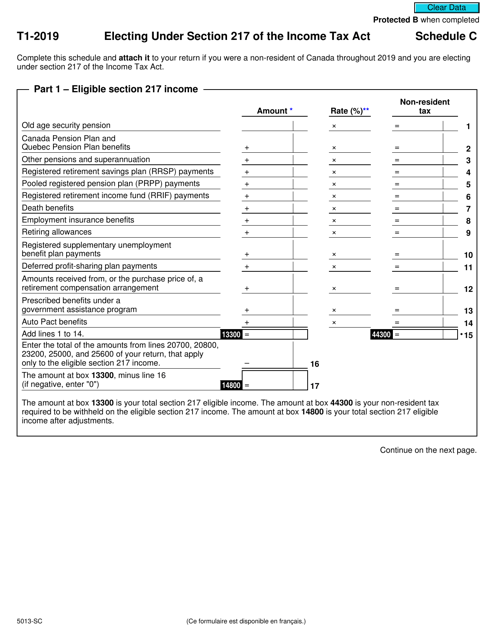

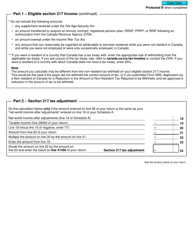

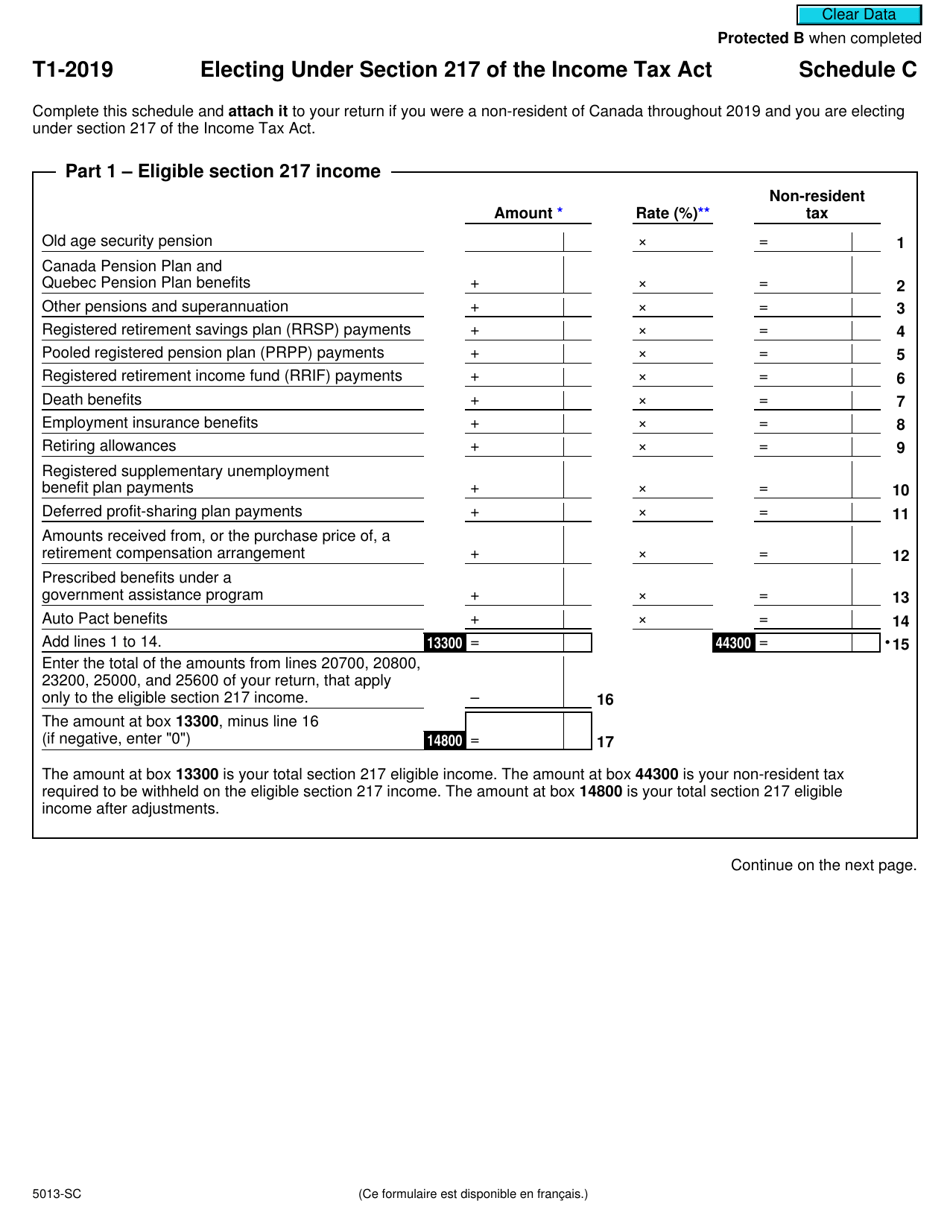

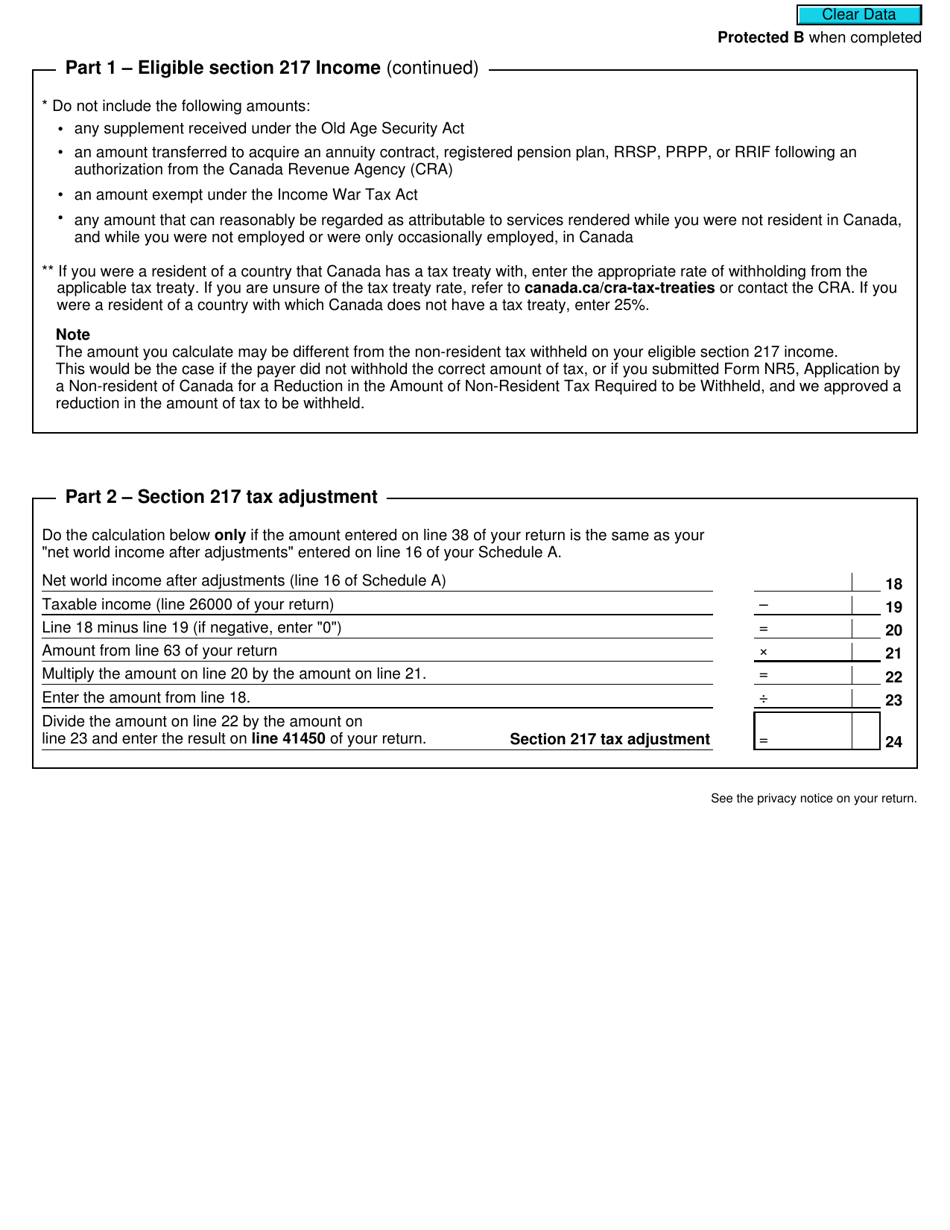

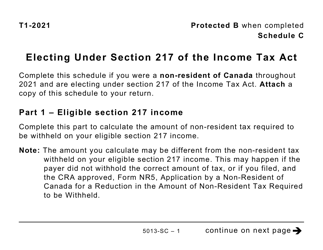

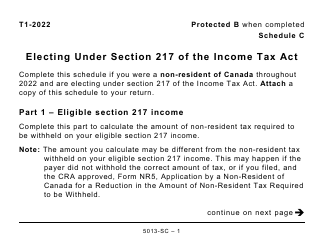

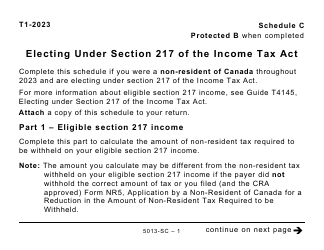

Form 5013-SC Schedule C Electing Under Section 217 of the Income Tax Act - Non-residents of Canada - Canada

Form 5013-SC Schedule C is used by non-residents of Canada to elect their tax treatment under Section 217 of the Income Tax Act. It is specifically for individuals who are not residents of Canada but have employment income from Canadian sources.

FAQ

Q: What is Form 5013-SC?

A: Form 5013-SC is a tax form for non-residents of Canada who are electing under Section 217 of the Income Tax Act.

Q: Who should use Form 5013-SC?

A: Non-residents of Canada who are electing under Section 217 of the Income Tax Act should use Form 5013-SC.

Q: What is Section 217 of the Income Tax Act?

A: Section 217 of the Income Tax Act allows non-residents of Canada to elect to be taxable on their Canadian-source income only.

Q: What does Schedule C on Form 5013-SC refer to?

A: Schedule C on Form 5013-SC refers to the calculation of net income from employment in Canada.

Q: Is Form 5013-SC only for individuals?

A: No, Form 5013-SC can be used by both individuals and partnerships.

Q: Are there any other attachments required with Form 5013-SC?

A: Yes, supporting documents such as T4 slips and other income statements should be attached to Form 5013-SC.

Q: What happens after filing Form 5013-SC?

A: After filing Form 5013-SC, the taxpayer will be notified of any tax payable or refundable.

Q: Can Form 5013-SC be filed electronically?

A: No, Form 5013-SC cannot be filed electronically and must be filed by mail.