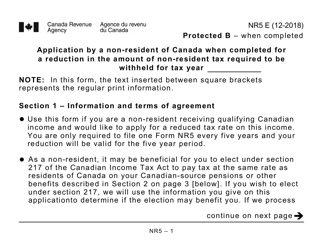

This version of the form is not currently in use and is provided for reference only. Download this version of

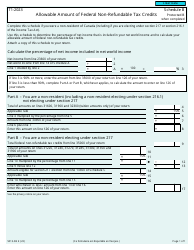

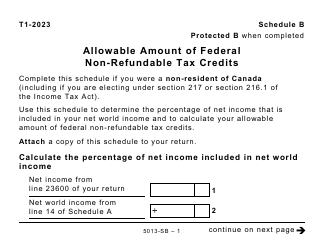

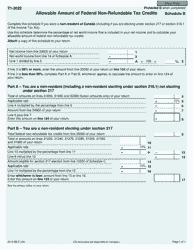

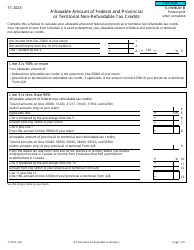

Form 5013-SB Schedule B

for the current year.

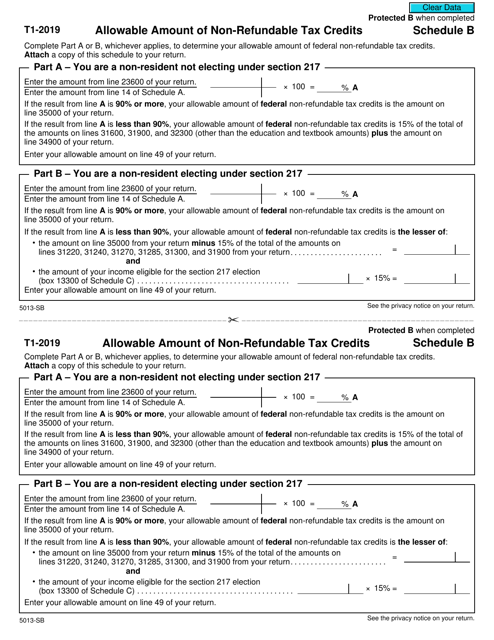

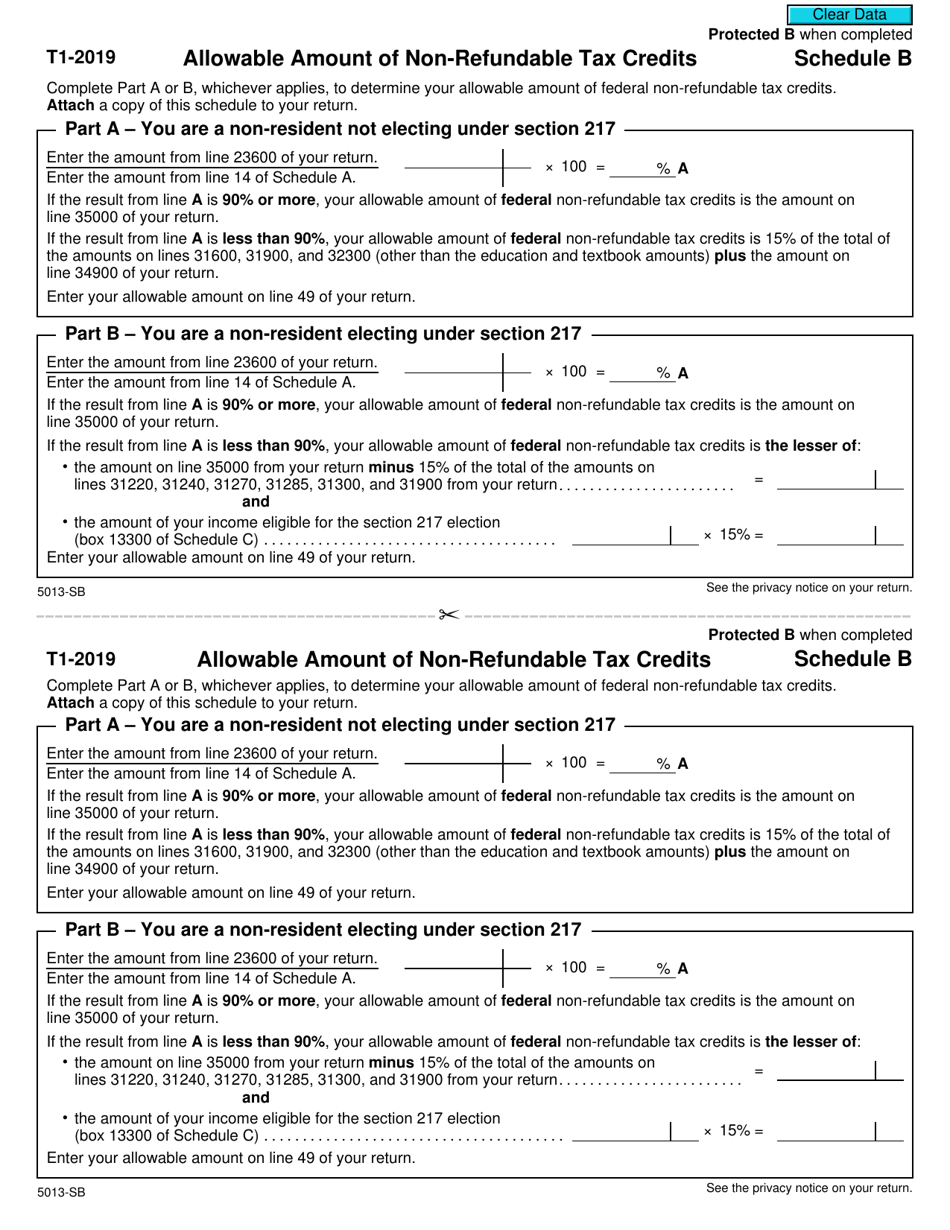

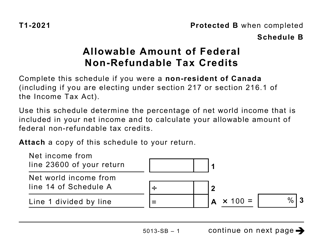

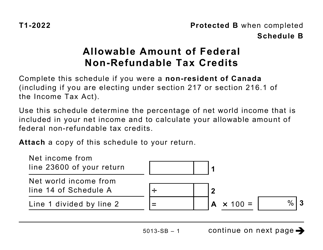

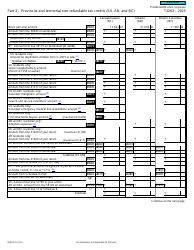

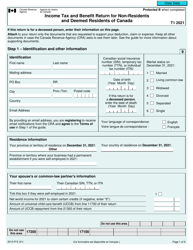

Form 5013-SB Schedule B Allowable Amount of Non-refundable Tax Credits - Non-residents of Canada - Canada

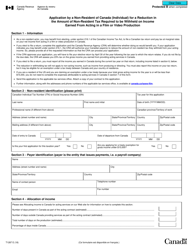

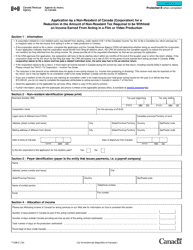

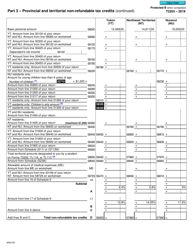

Form 5013-SB Schedule B Allowable Amount of Non-refundable Tax Credits - Non-residents of Canada - Canada is a form used to calculate the amount of non-refundable tax credits that can be claimed by non-residents of Canada. This form helps determine the tax credits that can be applied against their Canadian tax liability.

FAQ

Q: What is Form 5013-SB Schedule B?

A: Form 5013-SB Schedule B is a tax form used by non-residents of Canada to determine their allowable amount of non-refundable tax credits.

Q: Who uses Form 5013-SB Schedule B?

A: Non-residents of Canada use Form 5013-SB Schedule B.

Q: What is the purpose of Form 5013-SB Schedule B?

A: The purpose of Form 5013-SB Schedule B is to calculate the amount of non-refundable tax credits that can be claimed by non-residents of Canada.

Q: What are non-refundable tax credits?

A: Non-refundable tax credits are credits that can be used to reduce the amount of tax owed, but any excess credits cannot be refunded.

Q: Who qualifies as a non-resident of Canada?

A: A non-resident of Canada is someone who does not have significant residential ties to the country and is not considered a resident for tax purposes.

Q: What is an allowable amount of non-refundable tax credits?

A: The allowable amount of non-refundable tax credits is the maximum amount that non-residents of Canada can claim on their tax return.

Q: How do I fill out Form 5013-SB Schedule B?

A: To fill out Form 5013-SB Schedule B, you will need to report your income, calculate your non-refundable tax credits, and provide any additional required information.

Q: Can non-residents of Canada claim all non-refundable tax credits?

A: No, non-residents of Canada can only claim certain non-refundable tax credits that are available to them based on their specific circumstances.

Q: Do non-refundable tax credits reduce the amount of tax I owe?

A: Yes, non-refundable tax credits can be used to reduce the amount of tax owed by non-residents of Canada.