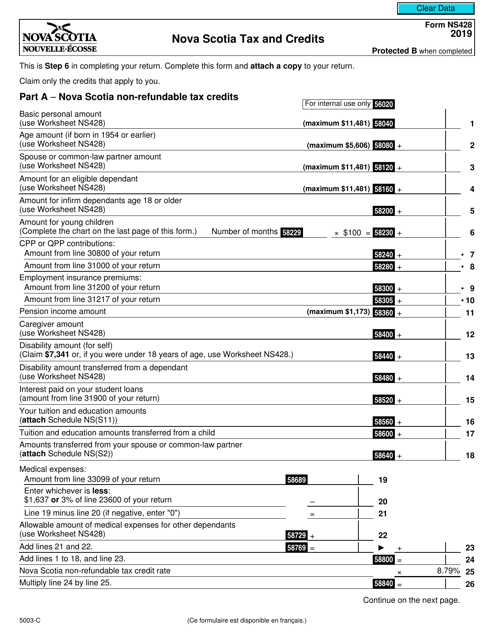

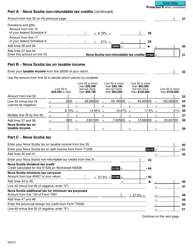

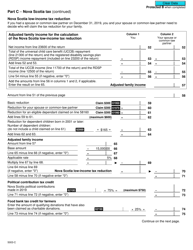

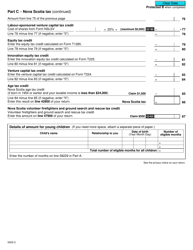

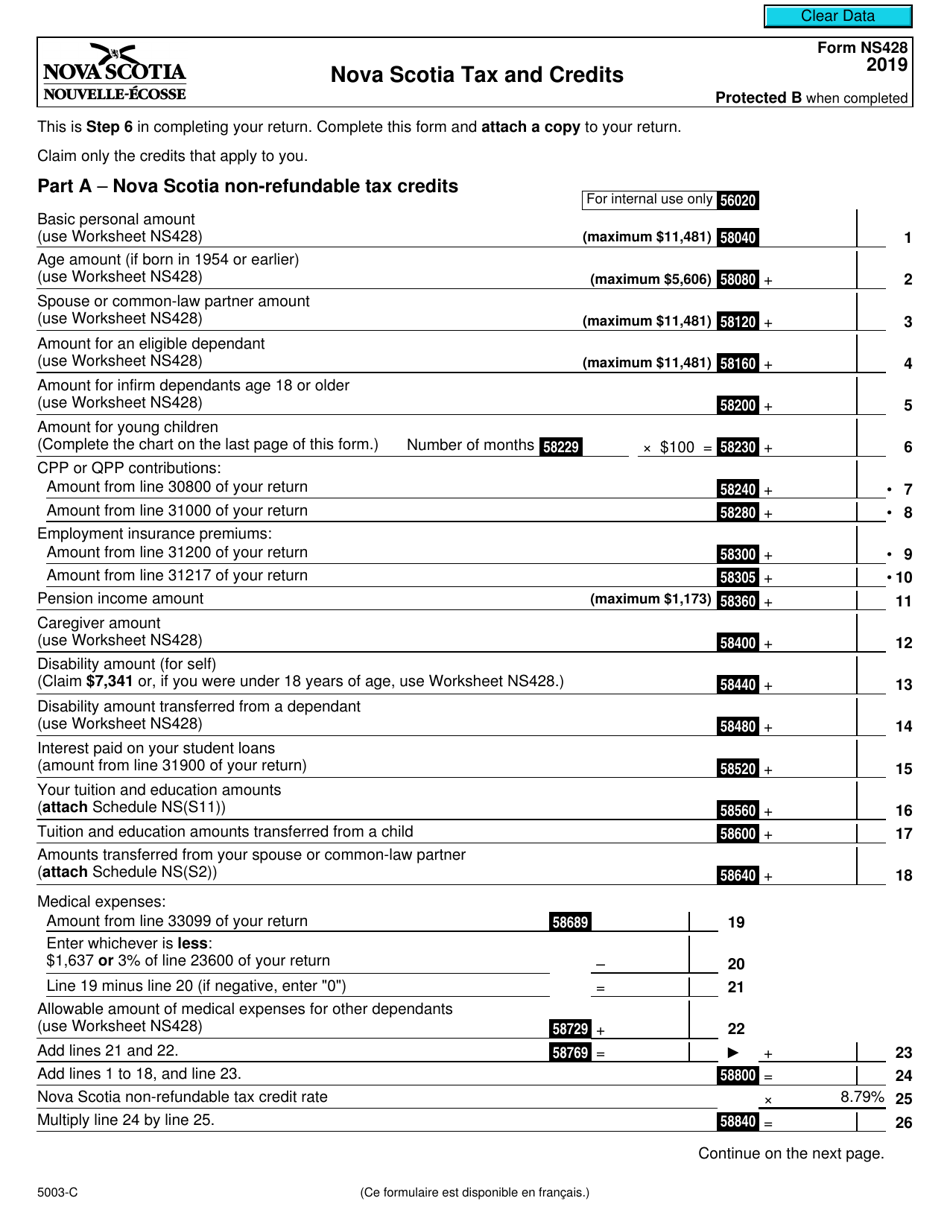

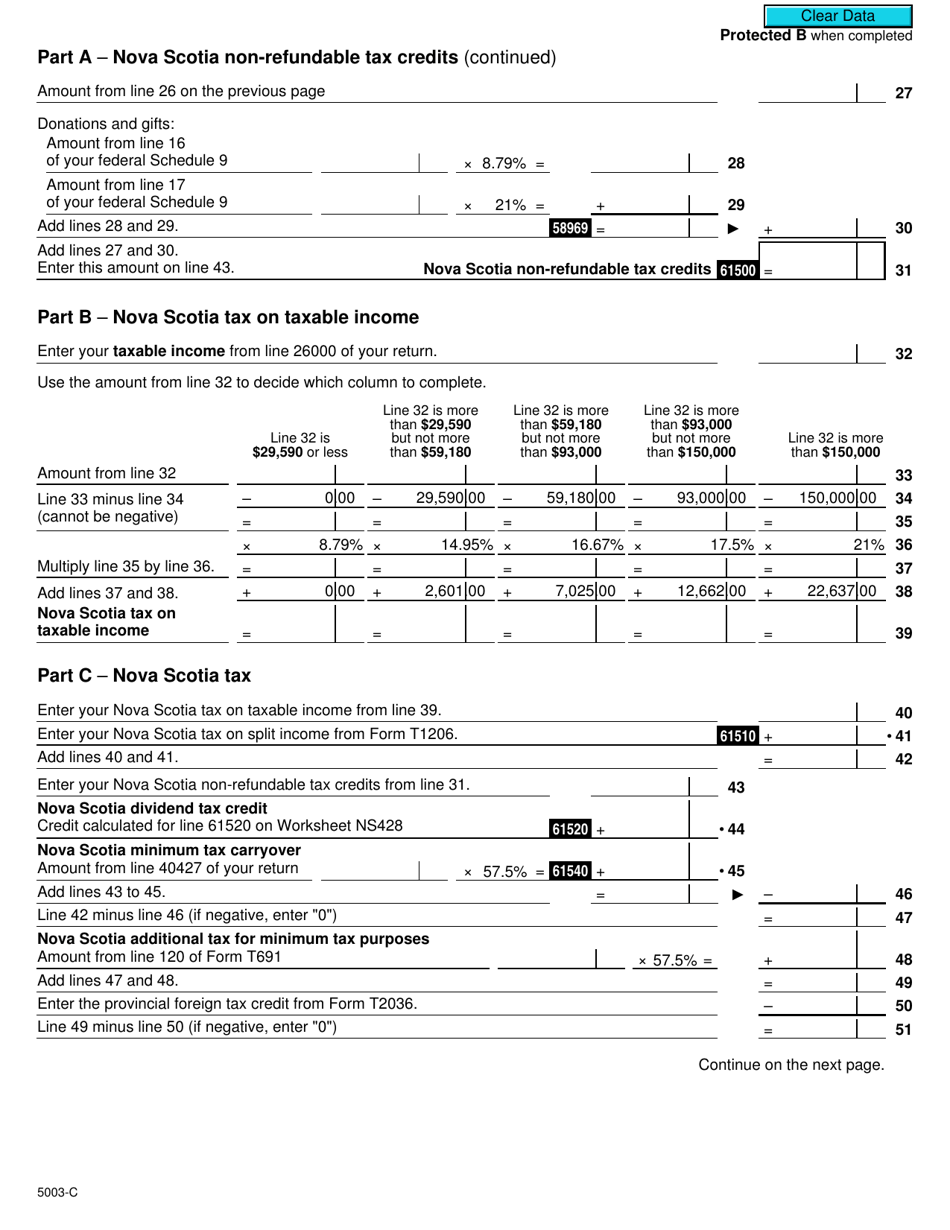

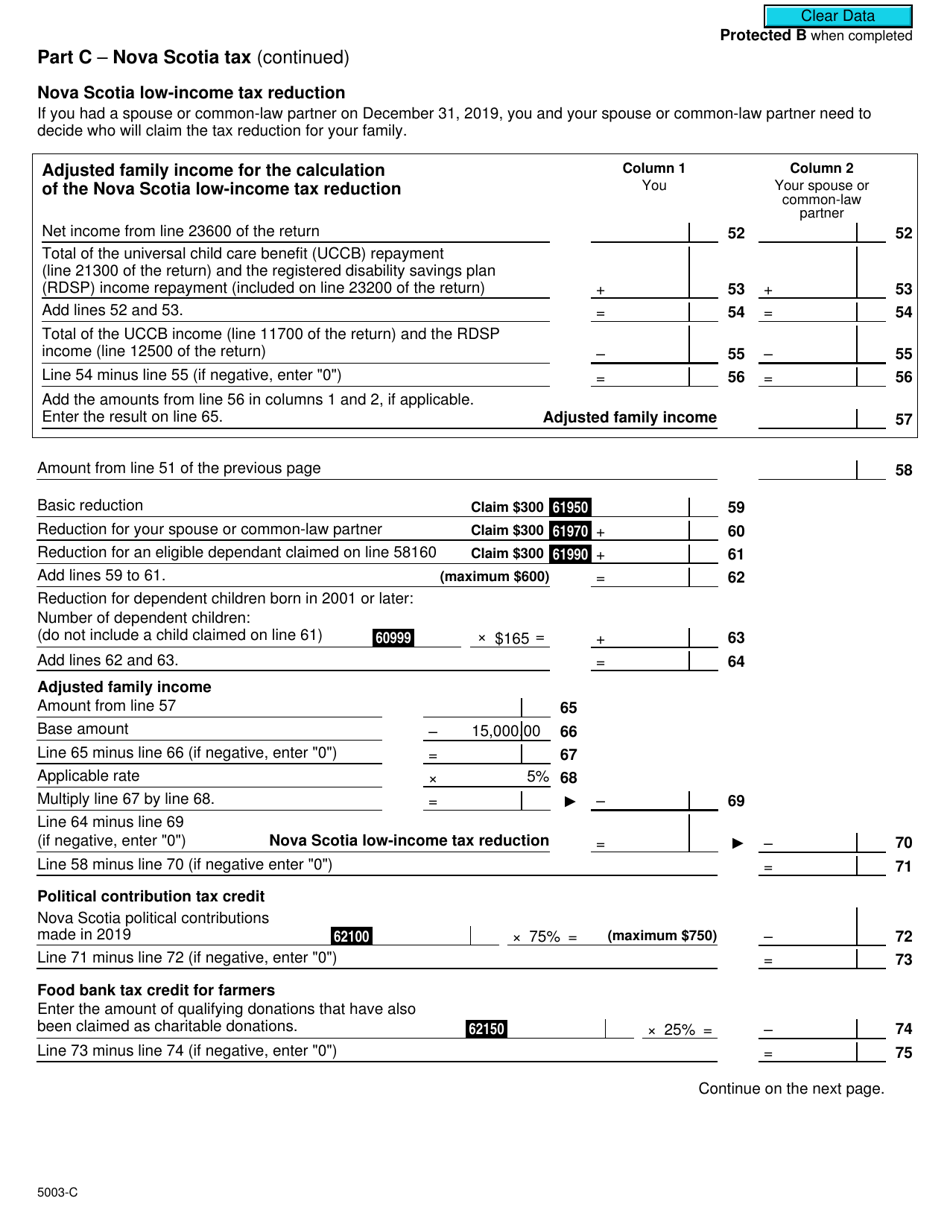

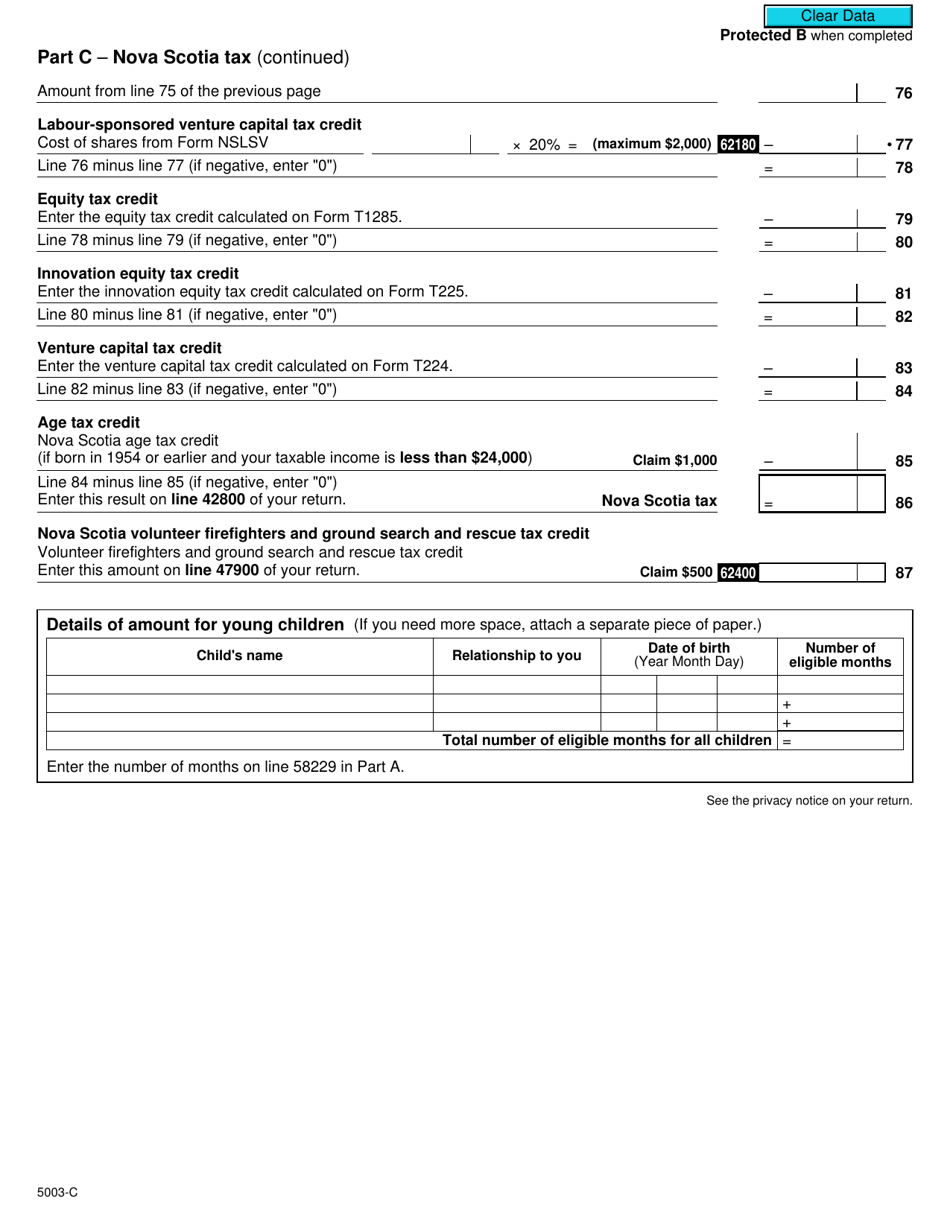

Form NS428 (5003-C) Nova Scotia Tax and Credits - Canada

Form NS428 (5003-C) is the tax form used by residents of Nova Scotia, Canada, to calculate their provincial tax and claim any eligible tax credits. It helps determine the amount of provincial tax owed or refunded.

Individuals who are residents of Nova Scotia and have income from Nova Scotia sources file the Form NS428 (5003-C) Nova Scotia Tax and Credits in Canada.

FAQ

Q: What is Form NS428?

A: Form NS428 is a tax form used in Nova Scotia, Canada.

Q: What is the purpose of Form NS428?

A: Form NS428 is used to calculate provincial tax and credits for residents of Nova Scotia.

Q: Who needs to fill out Form NS428?

A: Residents of Nova Scotia who need to calculate their provincial tax and credits must fill out Form NS428.

Q: How do I fill out Form NS428?

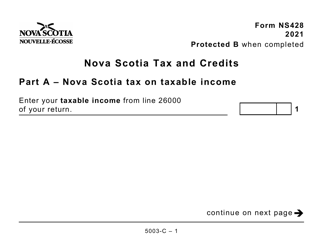

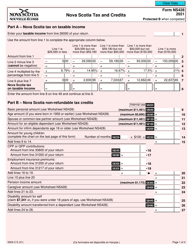

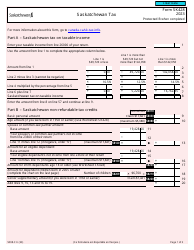

A: To fill out Form NS428, you need to provide your personal information, report your income, claim deductions and credits, and calculate your provincial tax.

Q: When is Form NS428 due?

A: Form NS428 is typically due on April 30th of the following year, along with your federal tax return.

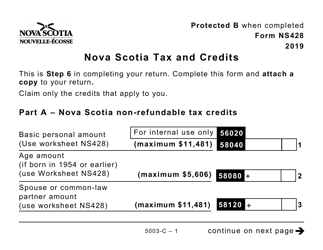

Q: What credits can I claim on Form NS428?

A: Form NS428 allows you to claim various tax credits, including the Nova Scotia Basic Personal Amount, the Age Amount, and the Nova Scotia Seniors' Home Accessibility Tax Credit, among others.

Q: Do I need to file Form NS428 if I don't owe any tax?

A: Yes, even if you don't owe any provincial tax, you still need to file Form NS428 to claim any eligible tax credits.

Q: Can I file Form NS428 electronically?

A: Yes, you can file Form NS428 electronically through the CRA's Netfile system.

Q: What should I do with Form NS428 once I have completed it?

A: Once you have completed Form NS428, you should keep a copy for your records and submit the form along with your federal tax return to the CRA.