This version of the form is not currently in use and is provided for reference only. Download this version of

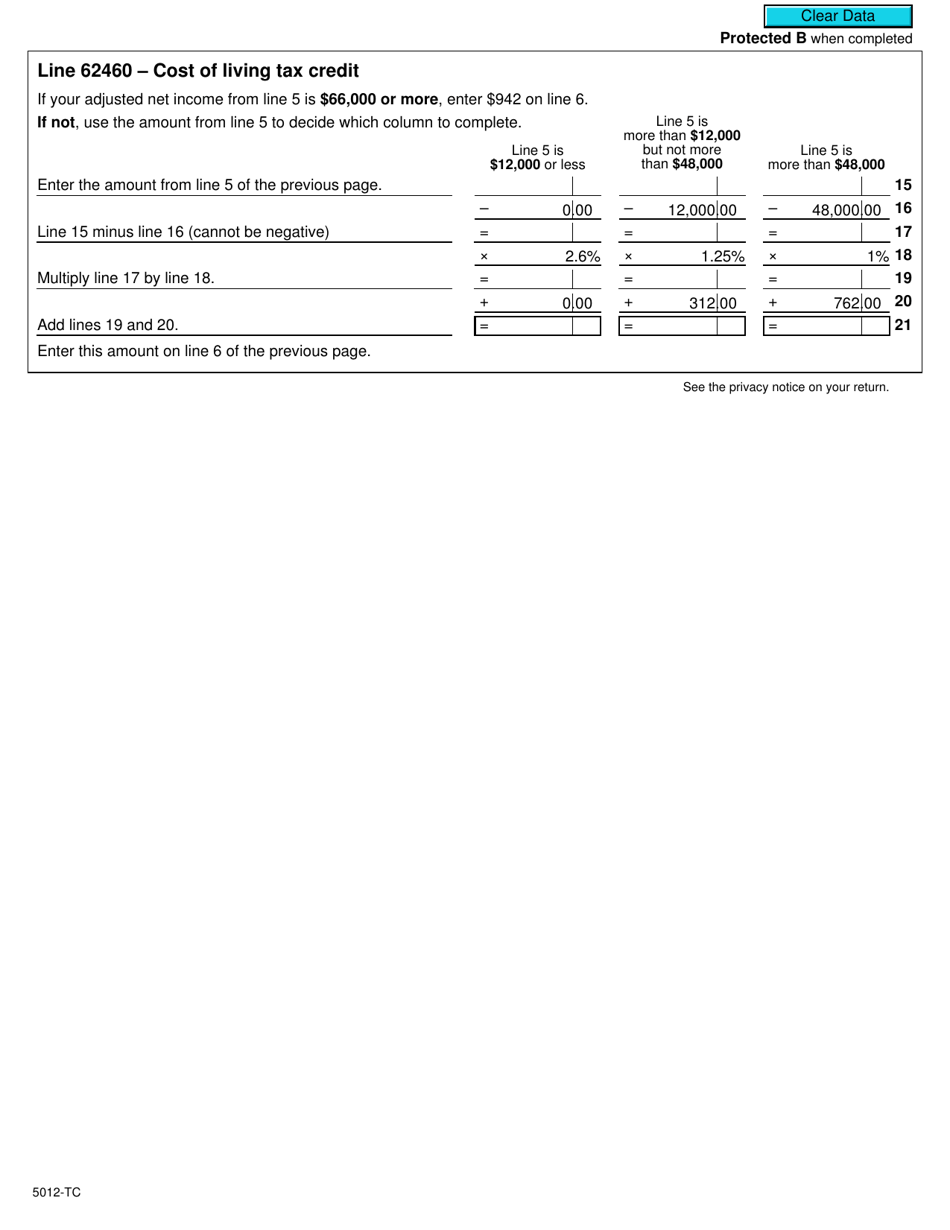

Form NT479 (5012-TC)

for the current year.

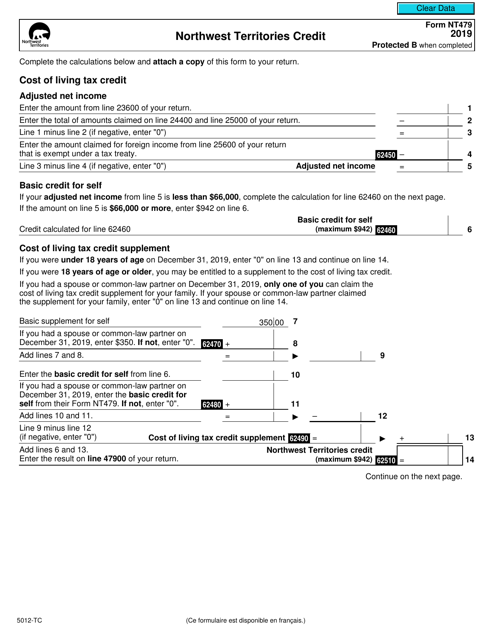

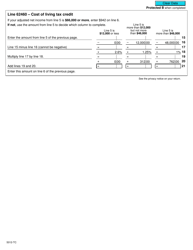

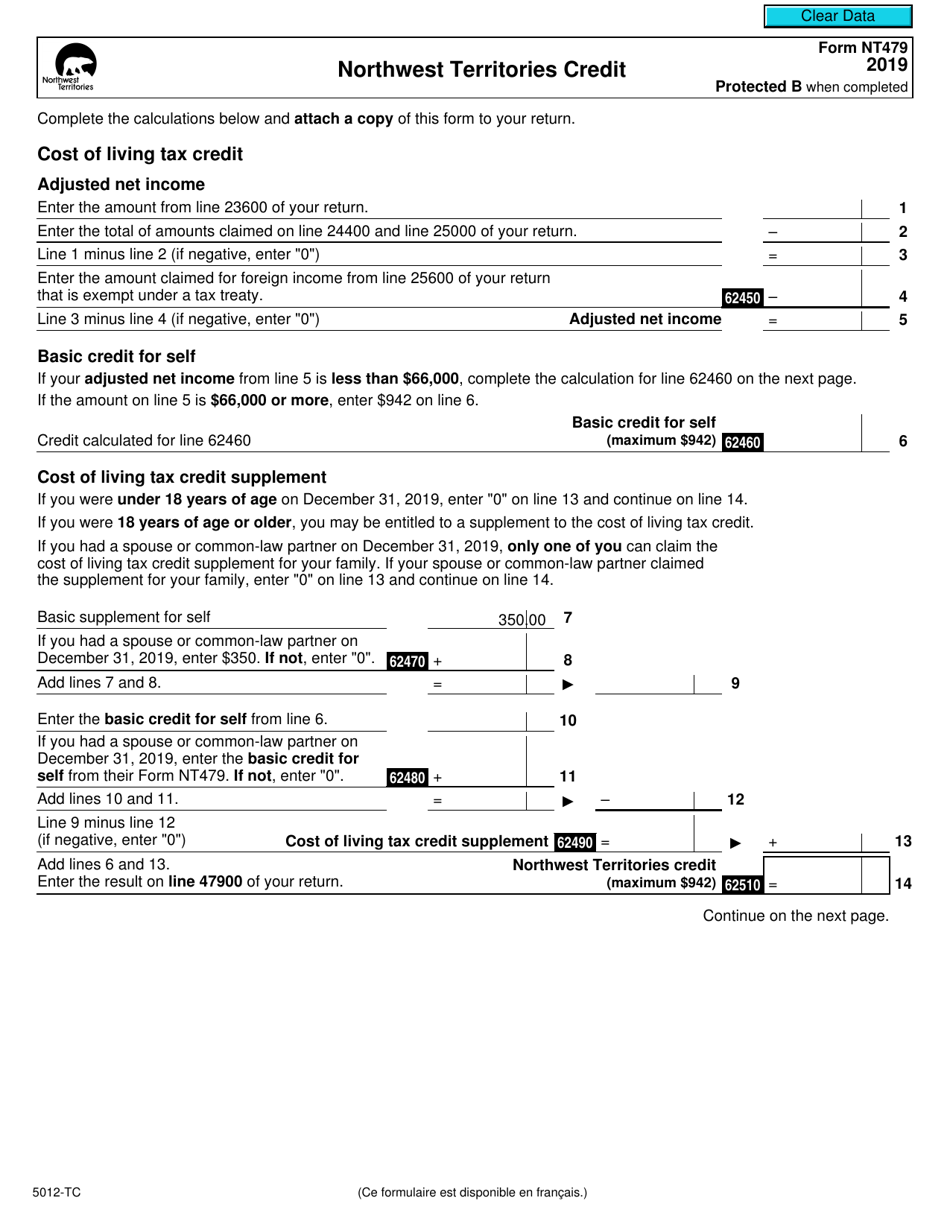

Form NT479 (5012-TC) Northwest Territories Credit - Canada

Form NT479 (5012-TC) is used in Canada to claim the Northwest Territories Credit. This credit is available to residents of the Northwest Territories and provides financial assistance to individuals and families with low to moderate incomes. The purpose of Form NT479 is to calculate and claim this credit on your income tax return.

FAQ

Q: What is Form NT479?

A: Form NT479 is the Northwest Territories Credit form in Canada.

Q: What is the purpose of Form NT479?

A: Form NT479 is used to claim the Northwest Territories Credit.

Q: Who can claim the Northwest Territories Credit?

A: Residents of the Northwest Territories in Canada can claim the credit.

Q: What is the Northwest Territories Credit?

A: The Northwest Territories Credit is a non-refundable tax credit.

Q: What expenses are eligible for the Northwest Territories Credit?

A: Eligible expenses may include rent, property tax, and school tax.

Q: How do I claim the Northwest Territories Credit?

A: You can claim the credit by filling out Form NT479 and including it with your tax return.

Q: Is the Northwest Territories Credit refundable?

A: No, the Northwest Territories Credit is non-refundable.

Q: Are there any other tax credits available in the Northwest Territories?

A: Yes, there may be other tax credits available in the Northwest Territories. You should consult the CRA or a tax professional for more information.

Q: Is the Northwest Territories Credit available in all provinces and territories of Canada?

A: No, the Northwest Territories Credit is specific to residents of the Northwest Territories only.