This version of the form is not currently in use and is provided for reference only. Download this version of

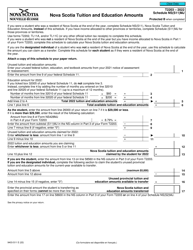

Form 5003-S11 Schedule NS(S11)

for the current year.

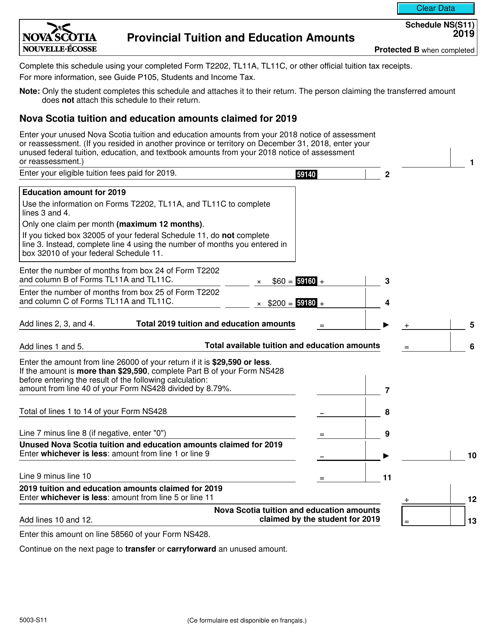

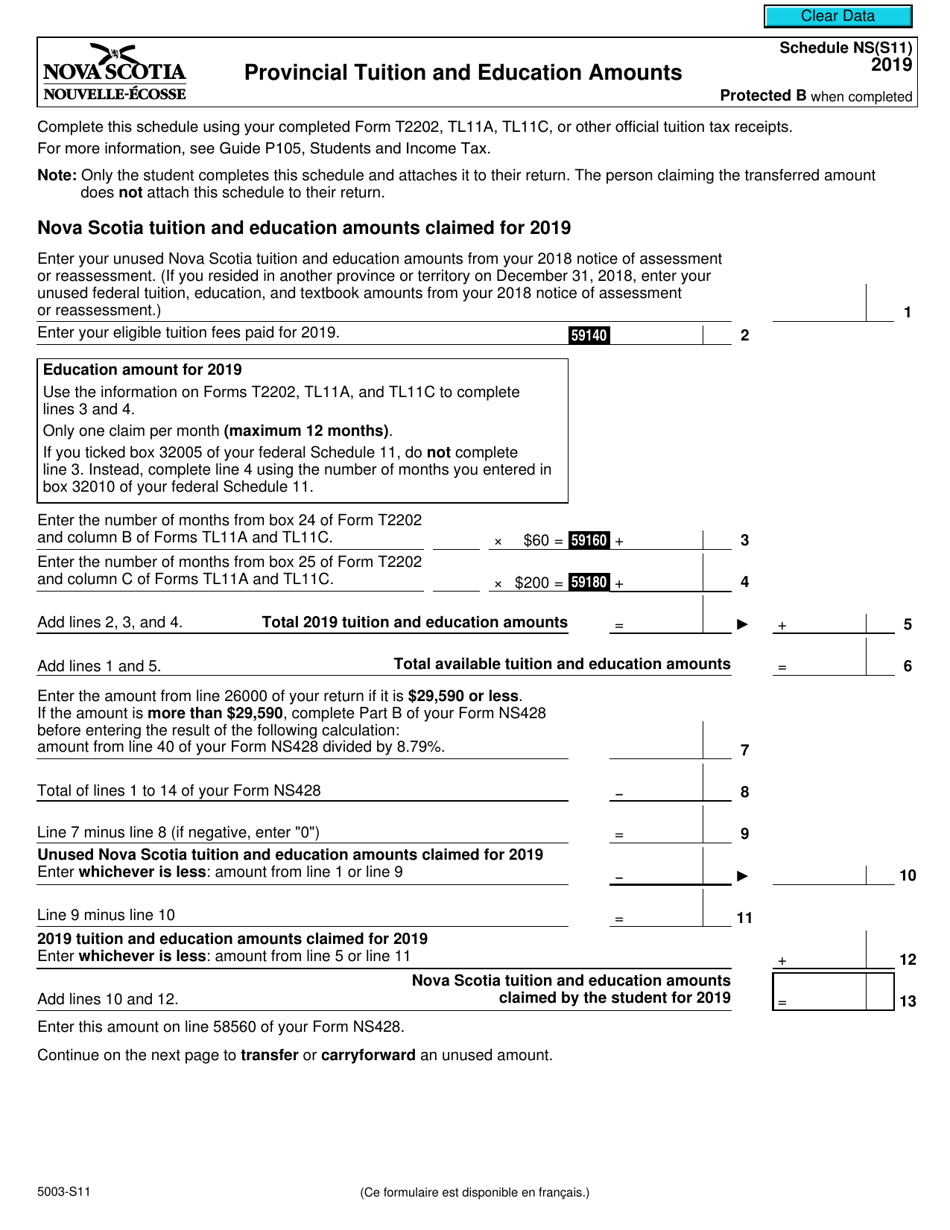

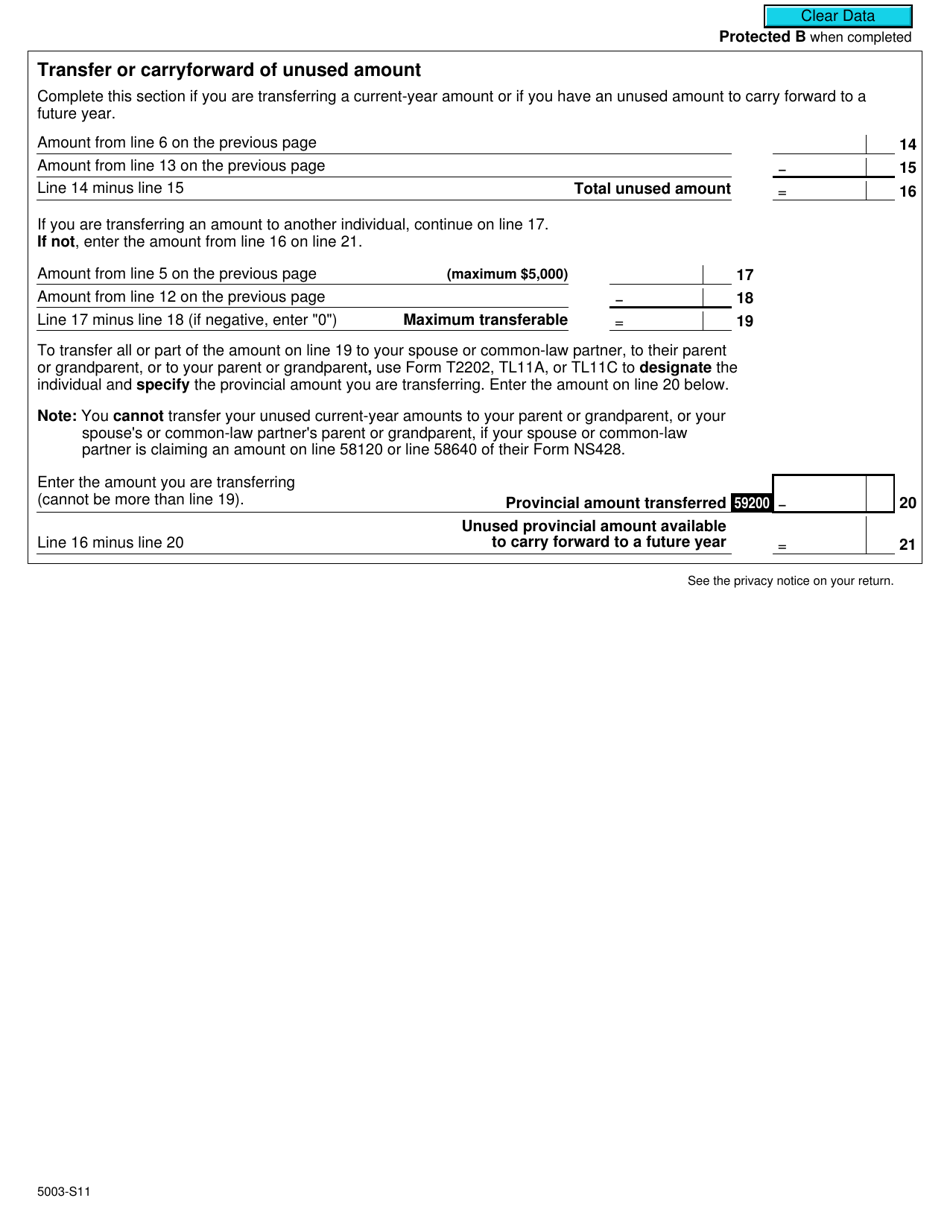

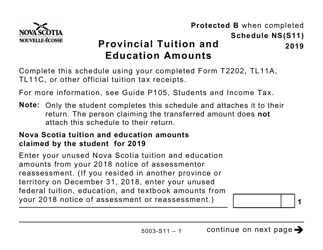

Form 5003-S11 Schedule NS(S11) Provincial Tuition and Education Amounts - Nova Scotia - Canada

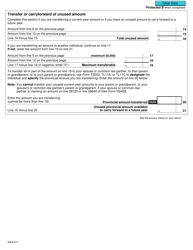

Form 5003-S11, Schedule NS(S11) Provincial Tuition and Education Amounts, is used for claiming tuition and education amounts specifically for residents of Nova Scotia, Canada.

Students who reside in Nova Scotia and are eligible for the provincial tuition and education amounts can file the Form 5003-S11 Schedule NS(S11).

FAQ

Q: What is Form 5003-S11 Schedule NS(S11)?

A: Form 5003-S11 Schedule NS(S11) is a tax form used in Canada to claim provincial tuition and education amounts for residents of Nova Scotia.

Q: Who is eligible to use Form 5003-S11 Schedule NS(S11)?

A: Residents of Nova Scotia who have paid tuition and education expenses are eligible to use this form to claim provincial credits.

Q: What are provincial tuition and education amounts?

A: Provincial tuition and education amounts are credits that can be claimed on your Canadian tax return to help reduce the amount of tax you owe.

Q: How do I claim provincial tuition and education amounts in Nova Scotia?

A: To claim provincial tuition and education amounts in Nova Scotia, you will need to fill out Form 5003-S11 Schedule NS(S11) and include it with your Canadian tax return.

Q: What documents do I need to complete Form 5003-S11 Schedule NS(S11)?

A: You will need your tuition and education receipts, as well as any other supporting documentation, to complete Form 5003-S11 Schedule NS(S11).

Q: Can I claim both federal and provincial tuition and education amounts?

A: Yes, you can claim both federal and provincial tuition and education amounts on your Canadian tax return.

Q: Are there any limitations or restrictions on claiming provincial tuition and education amounts?

A: There may be limitations on the amount of provincial tuition and education amounts you can claim, so it's important to review the instructions on Form 5003-S11 Schedule NS(S11) or consult with a tax professional.

Q: When is the deadline to file Form 5003-S11 Schedule NS(S11)?

A: The deadline to file Form 5003-S11 Schedule NS(S11) is the same as the deadline for your Canadian tax return, which is generally April 30th of each year.

Q: What should I do if I have additional questions or need assistance with Form 5003-S11 Schedule NS(S11)?

A: If you have additional questions or need assistance with Form 5003-S11 Schedule NS(S11), you can contact the Canada Revenue Agency (CRA) or consult with a tax professional.