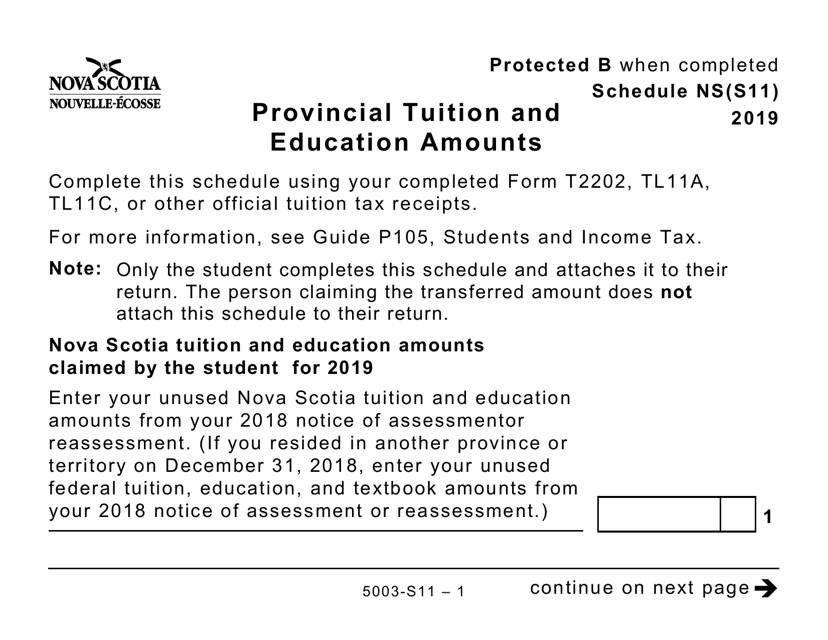

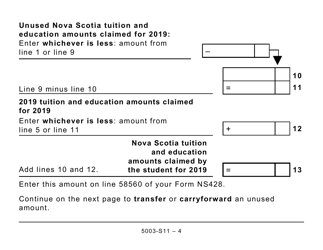

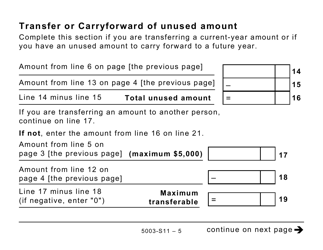

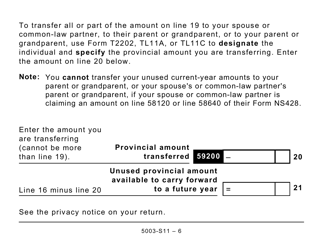

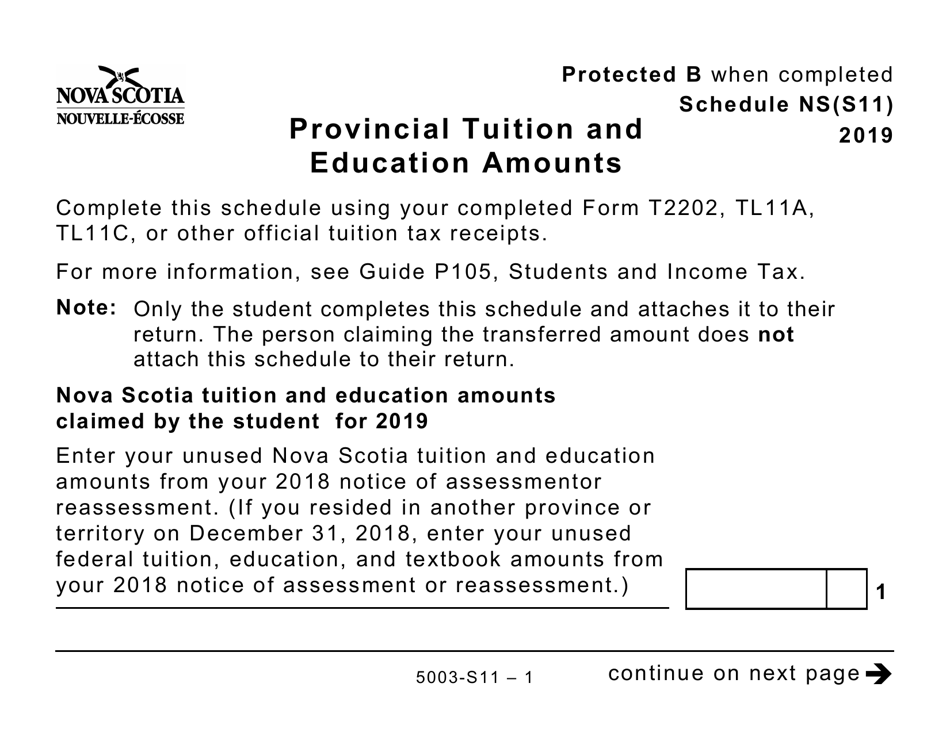

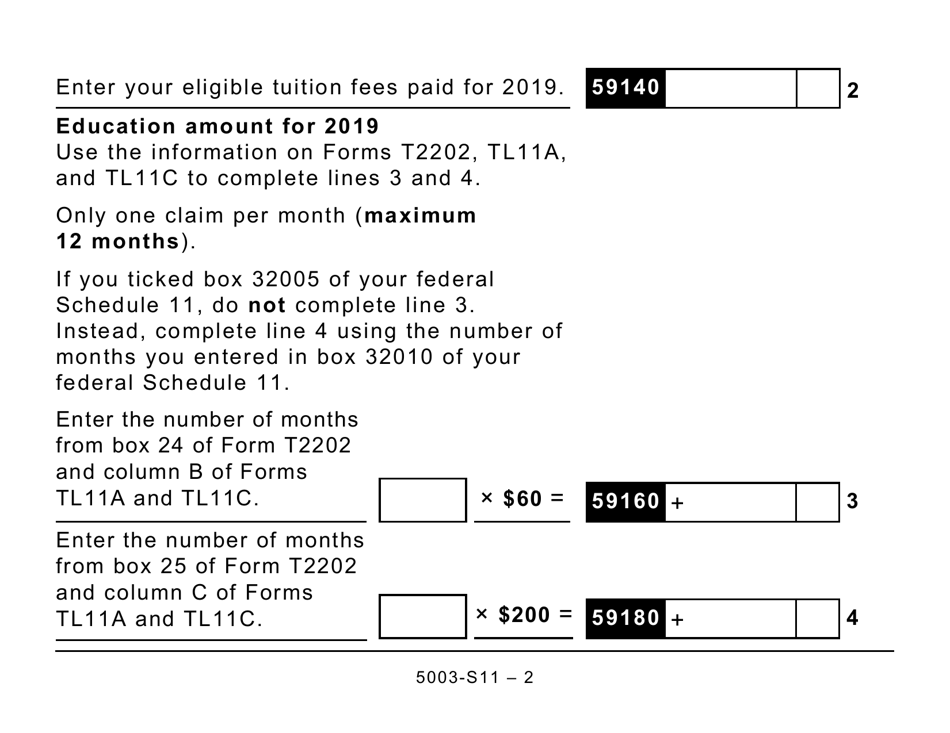

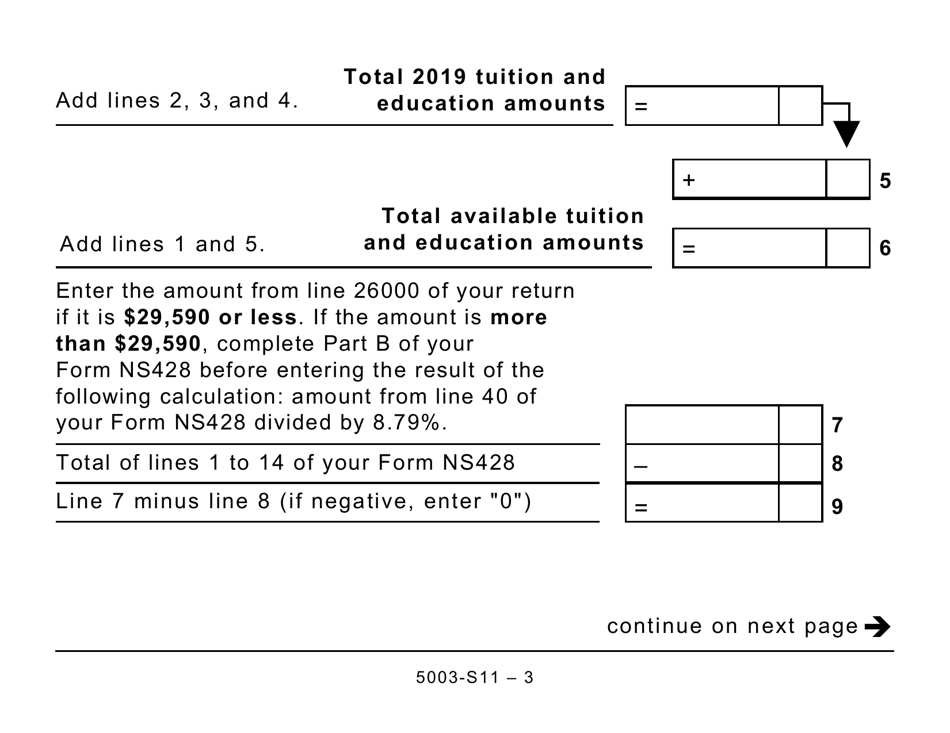

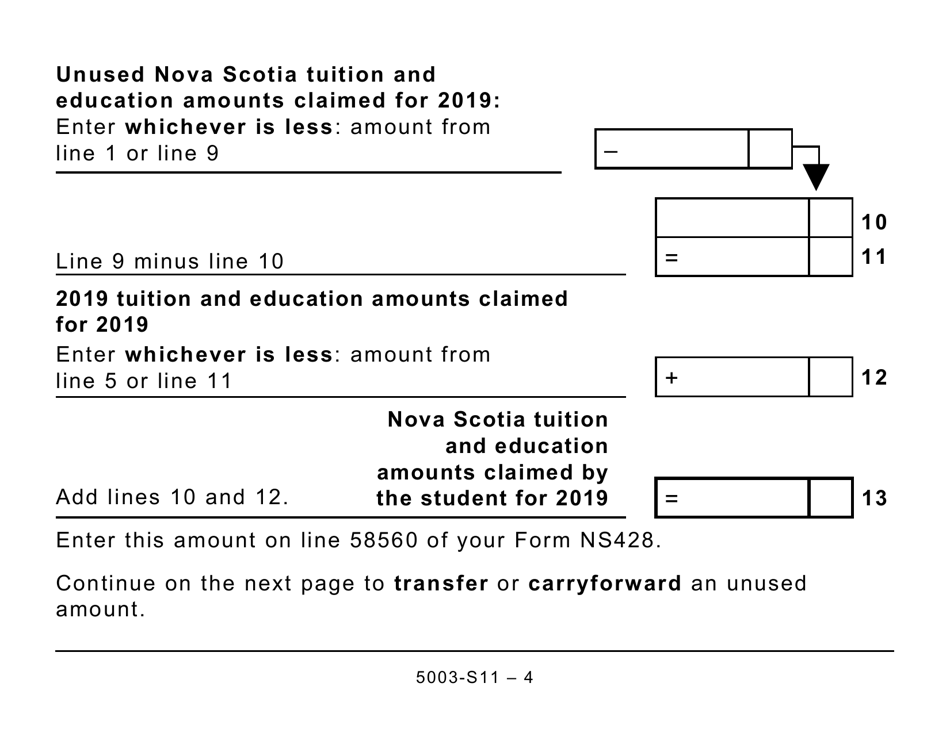

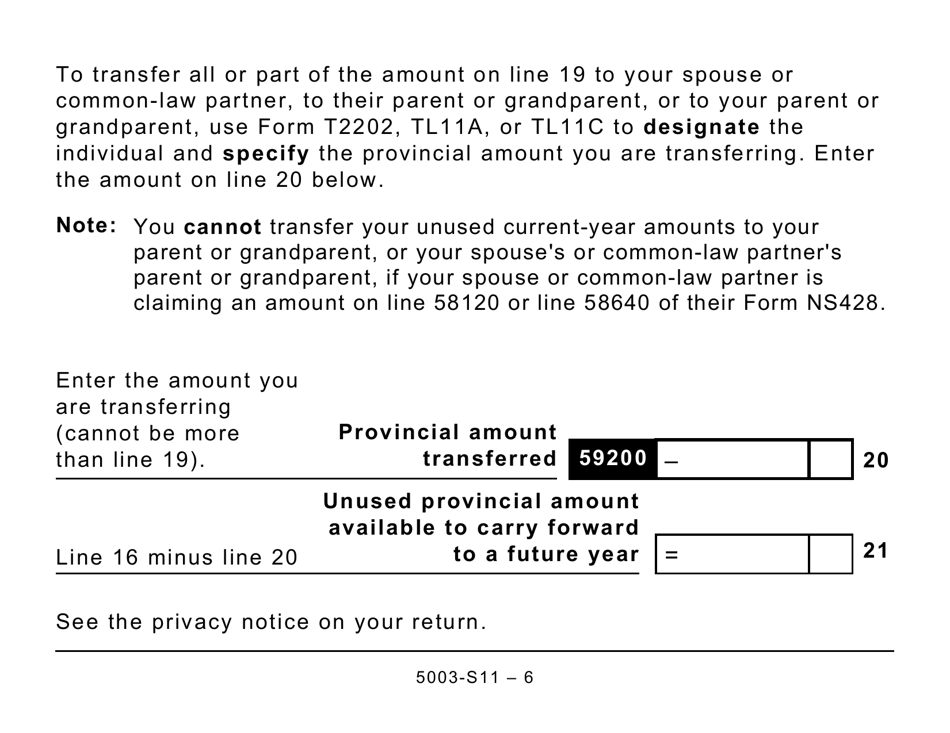

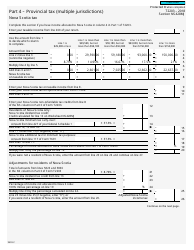

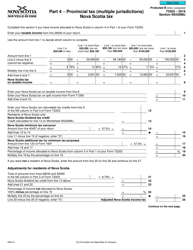

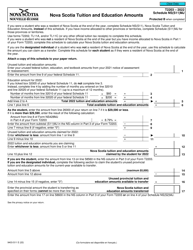

Form 5003-S11 Schedule NS(S11) Provincial Tuition and Education Amounts - Nova Scotia (Large Print) - Canada

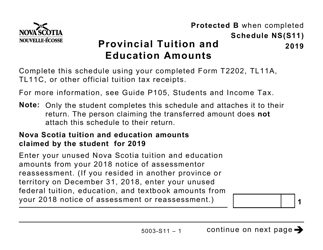

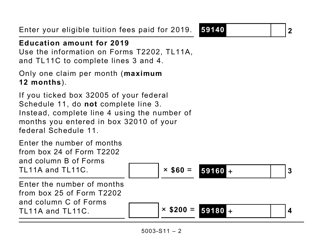

Form 5003-S11 Schedule NS(S11) is used in Canada for claiming tuition and education amounts specific to the province of Nova Scotia. It is designed for individuals who are eligible for the provincial credits related to tuition and education expenses.

The individual who wants to claim the provincial tuition and education amounts in Nova Scotia would file the Form 5003-S11 Schedule NS(S11).

FAQ

Q: What is Form 5003-S11?

A: Form 5003-S11 is a schedule to report provincial tuition and education amounts for Nova Scotia in Canada.

Q: What is Schedule NS(S11)?

A: Schedule NS(S11) is a specific schedule for reporting provincial tuition and education amounts for Nova Scotia.

Q: Who can use Form 5003-S11?

A: Residents of Nova Scotia in Canada can use Form 5003-S11 to report their provincial tuition and education amounts.

Q: What is the purpose of Form 5003-S11?

A: The purpose of Form 5003-S11 is to claim tax credits for tuition and education expenses incurred by residents of Nova Scotia.

Q: Is Form 5003-S11 for individuals or businesses?

A: Form 5003-S11 is for individuals, specifically residents of Nova Scotia.

Q: Do I need to attach supporting documents with Form 5003-S11?

A: Yes, you may need to attach relevant supporting documents such as tuition fee receipts with Form 5003-S11.

Q: What is the due date for filing Form 5003-S11?

A: The due date for filing Form 5003-S11 is the same as the due date for your annual income tax return, which is usually April 30th.

Q: Is Form 5003-S11 specific to Nova Scotia?

A: Yes, Form 5003-S11 is specific to residents of Nova Scotia and their provincial tuition and education amounts.