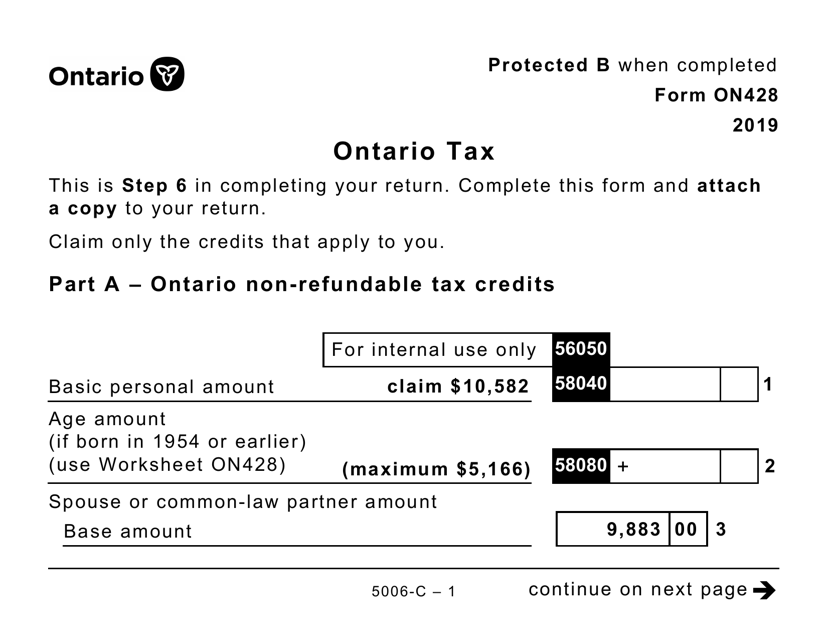

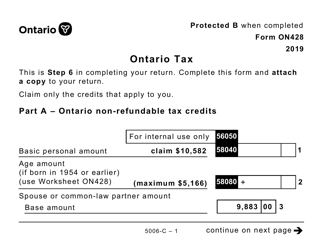

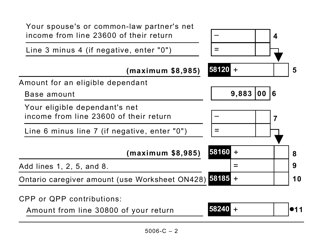

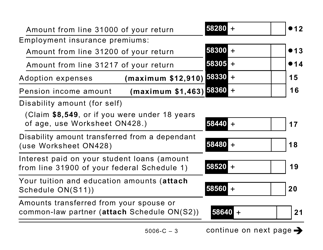

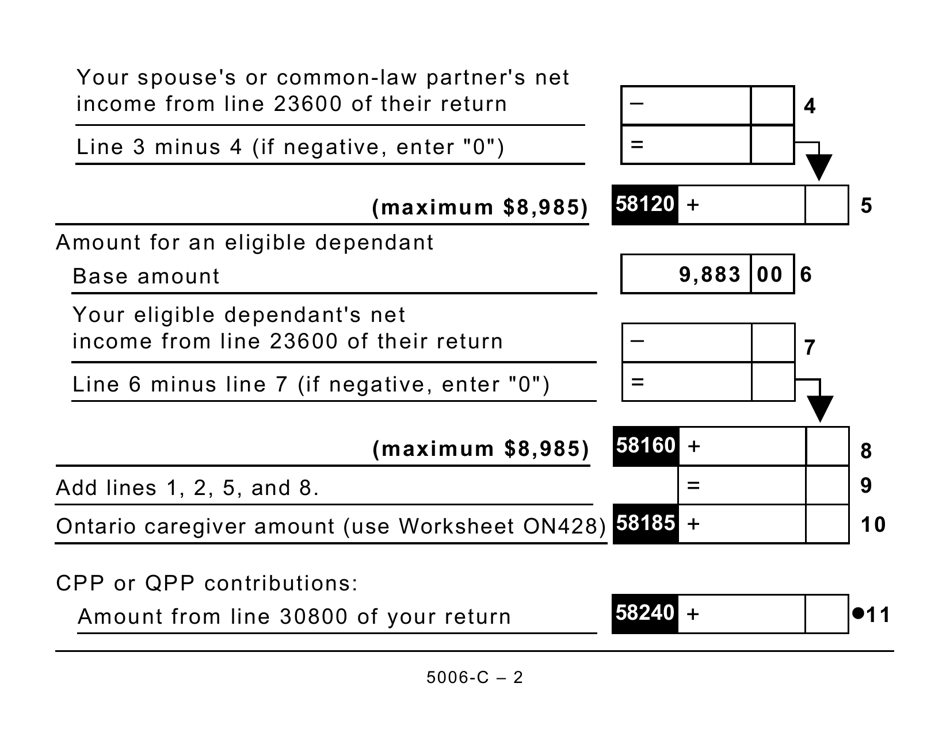

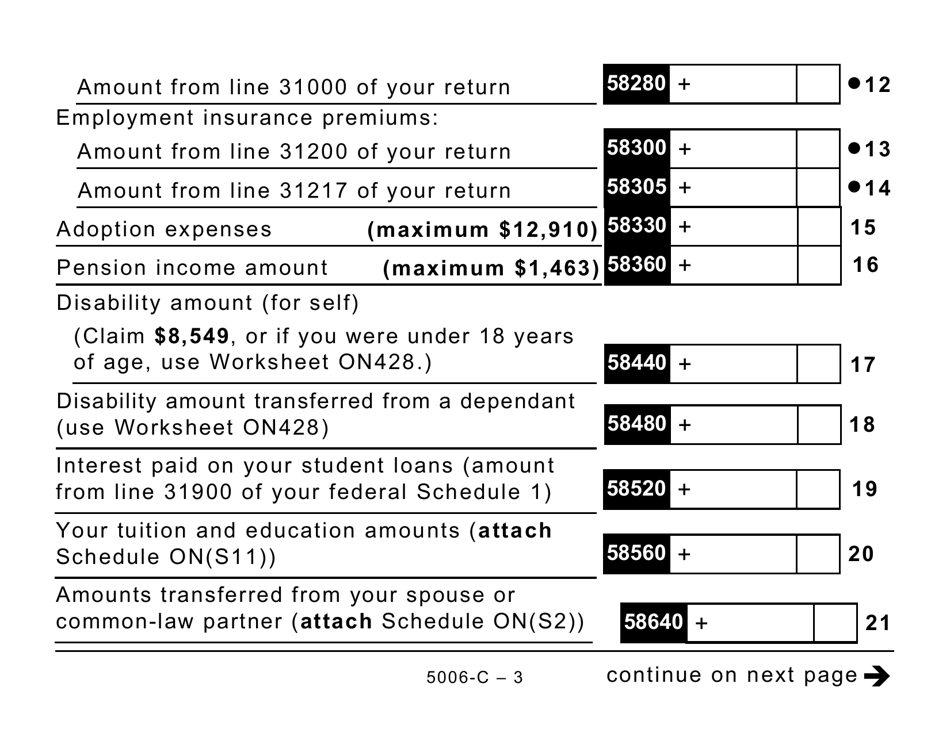

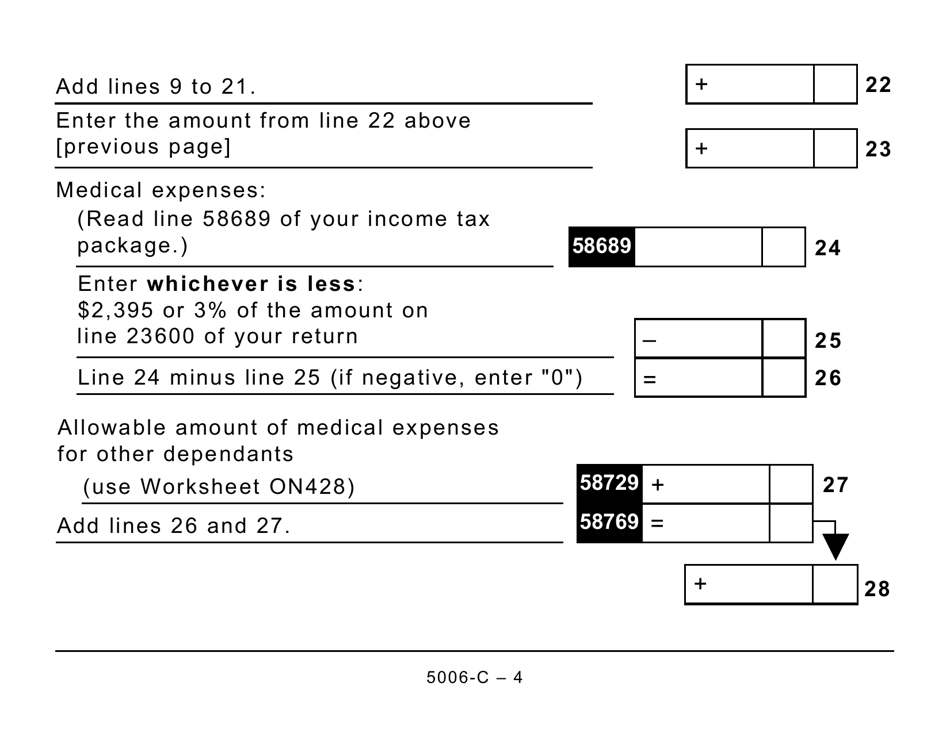

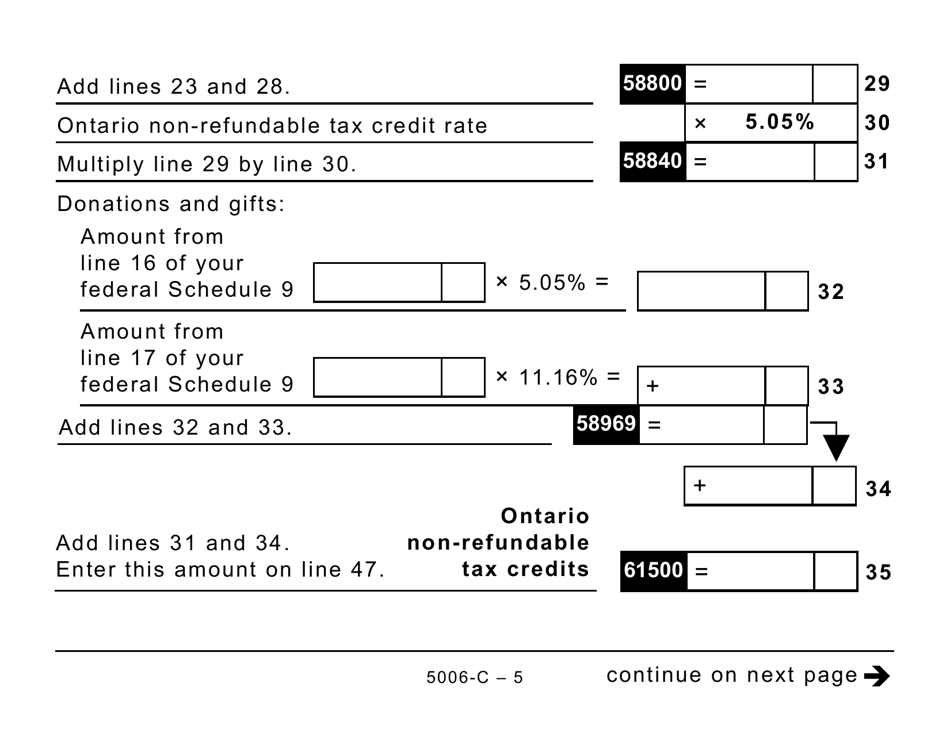

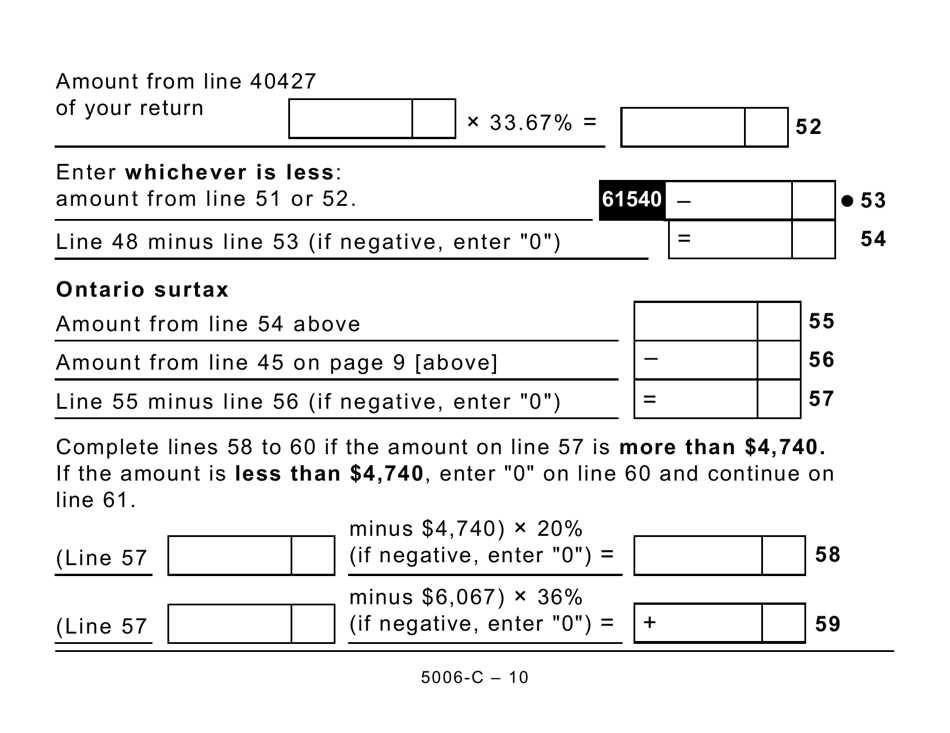

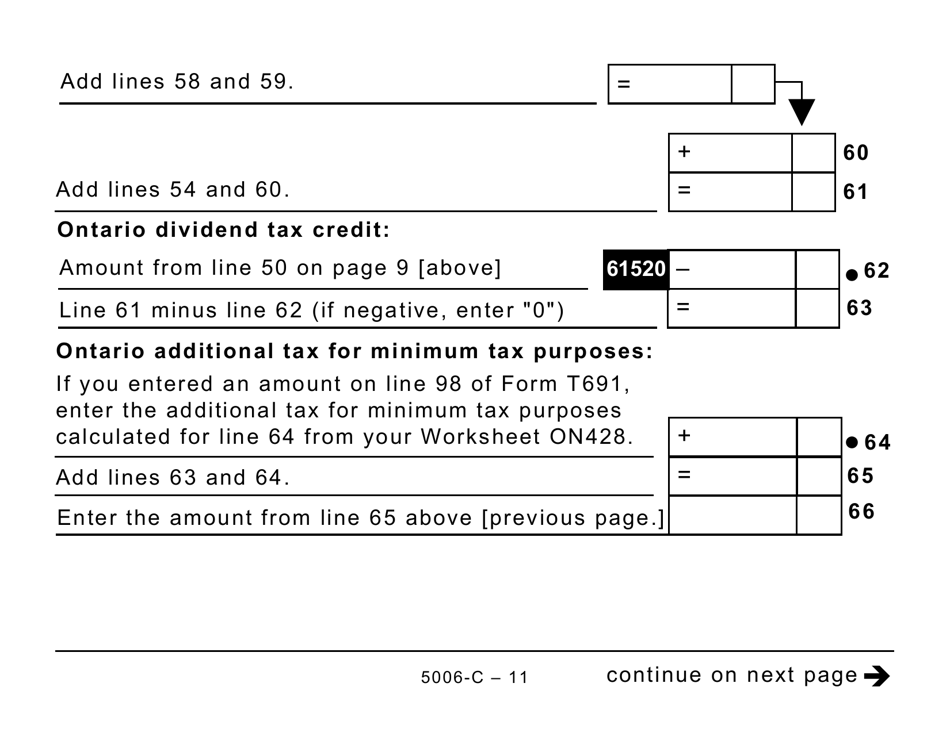

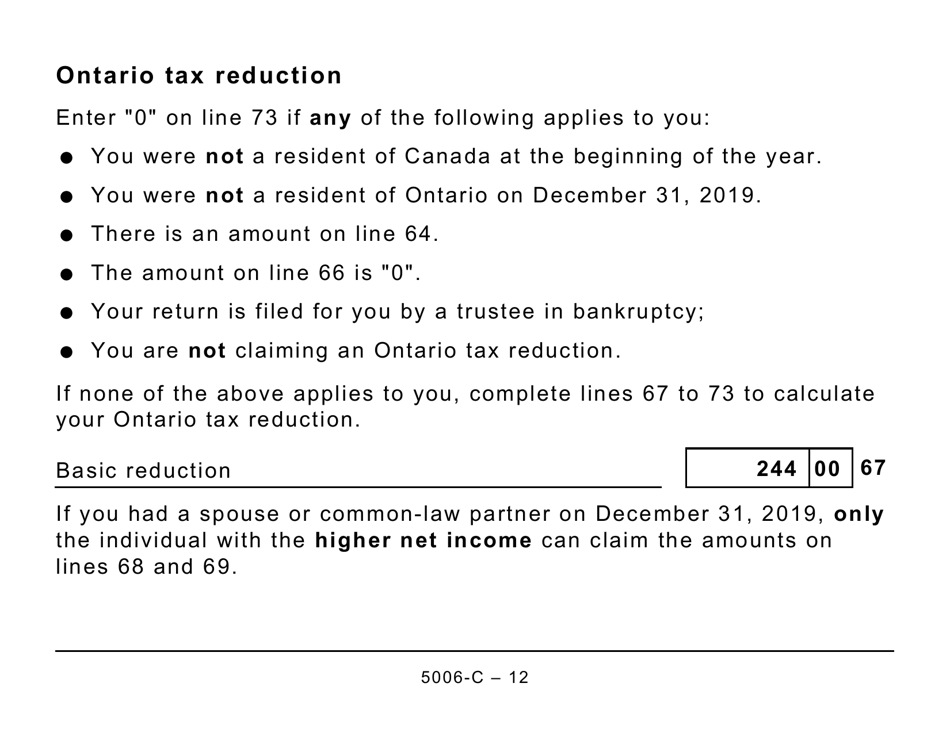

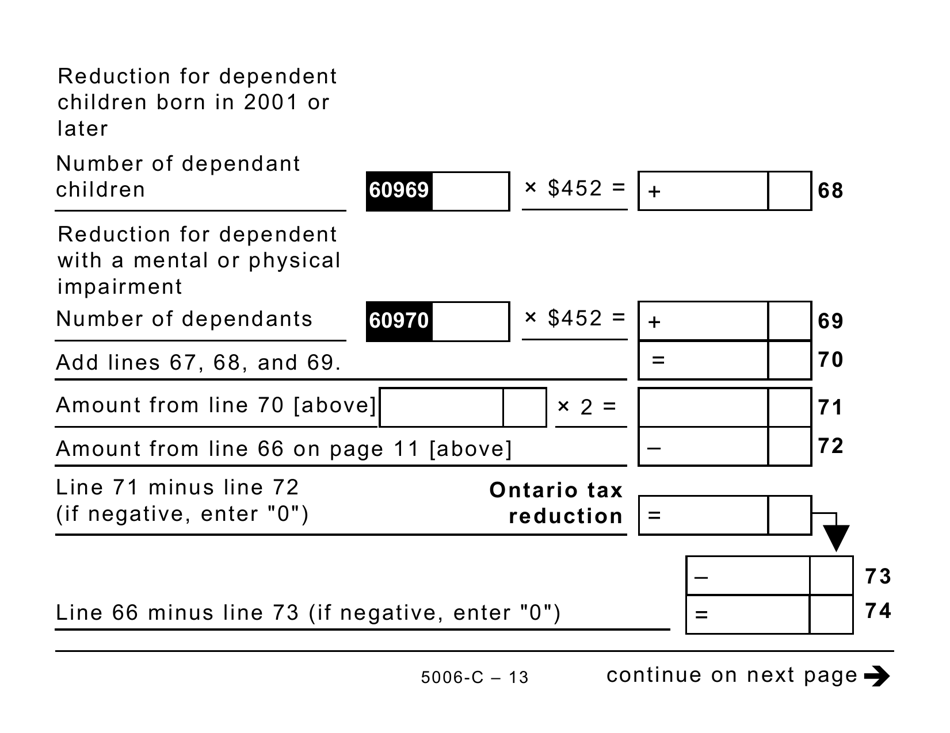

Form ON428 (5006-C) Ontario Tax (Large Print) - Canada

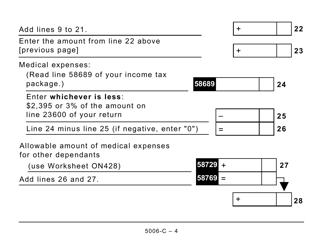

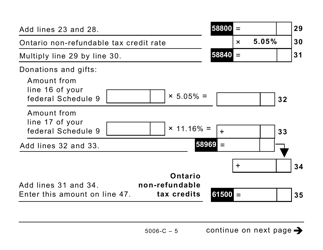

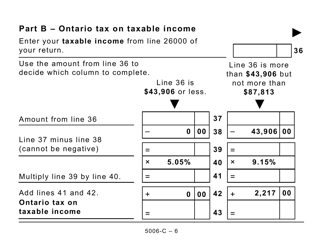

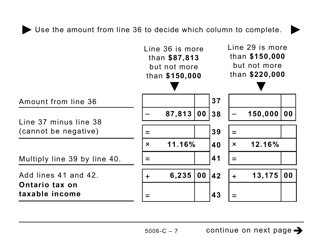

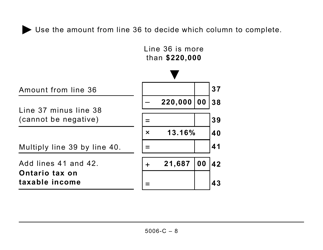

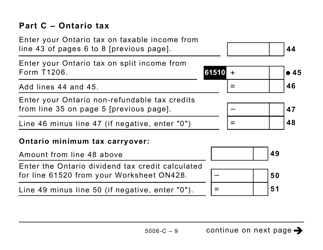

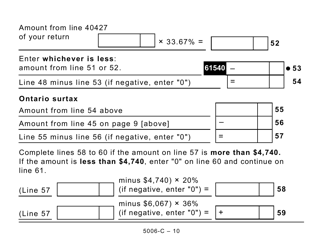

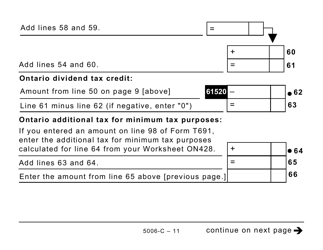

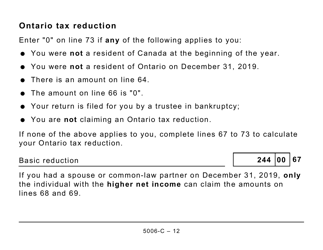

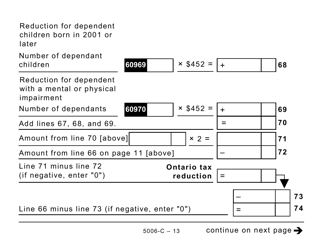

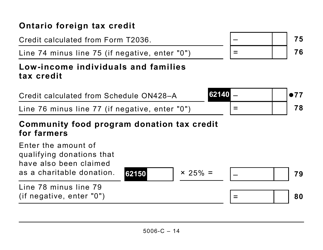

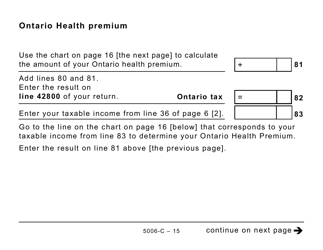

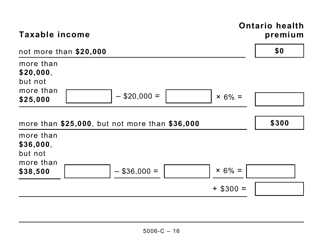

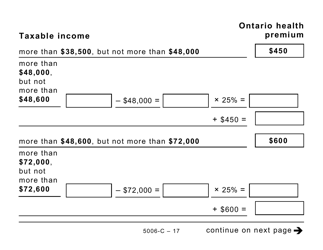

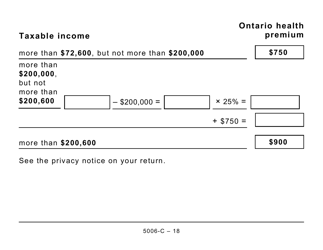

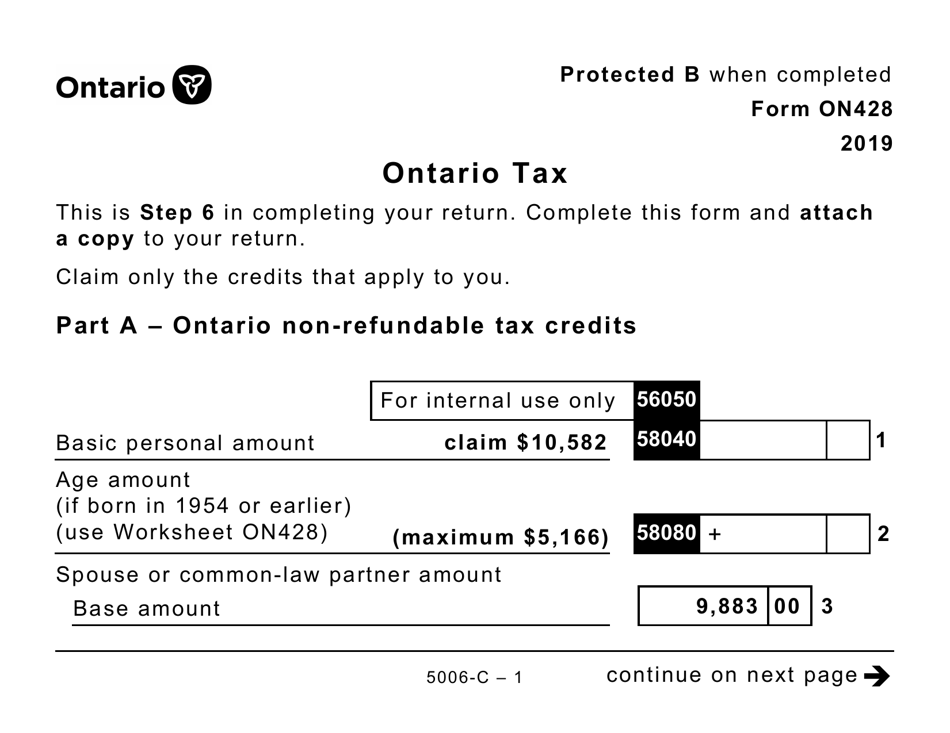

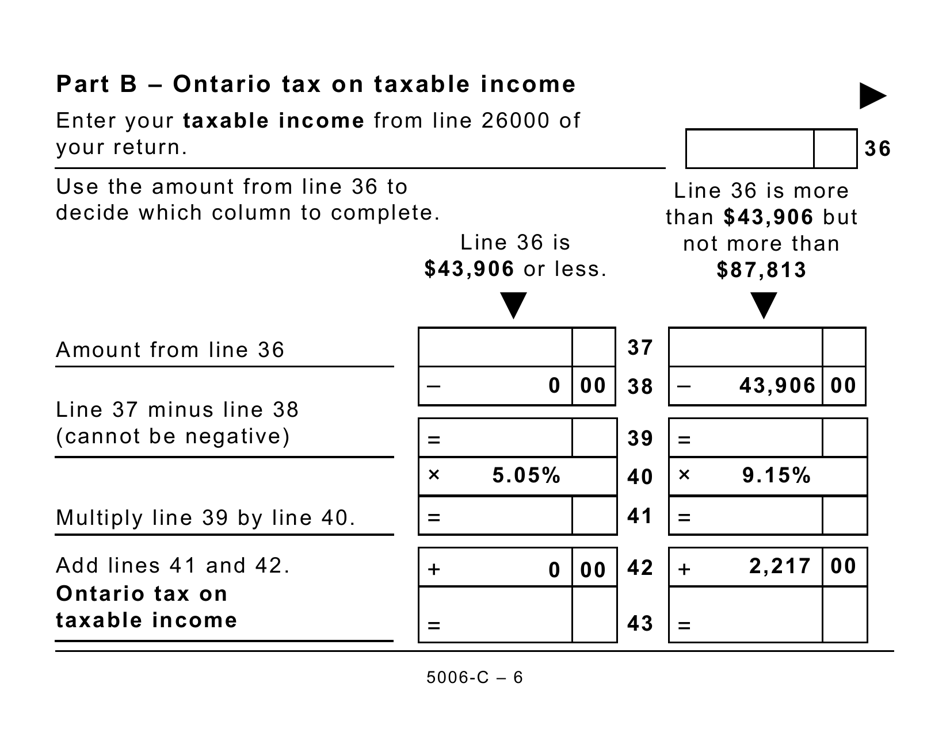

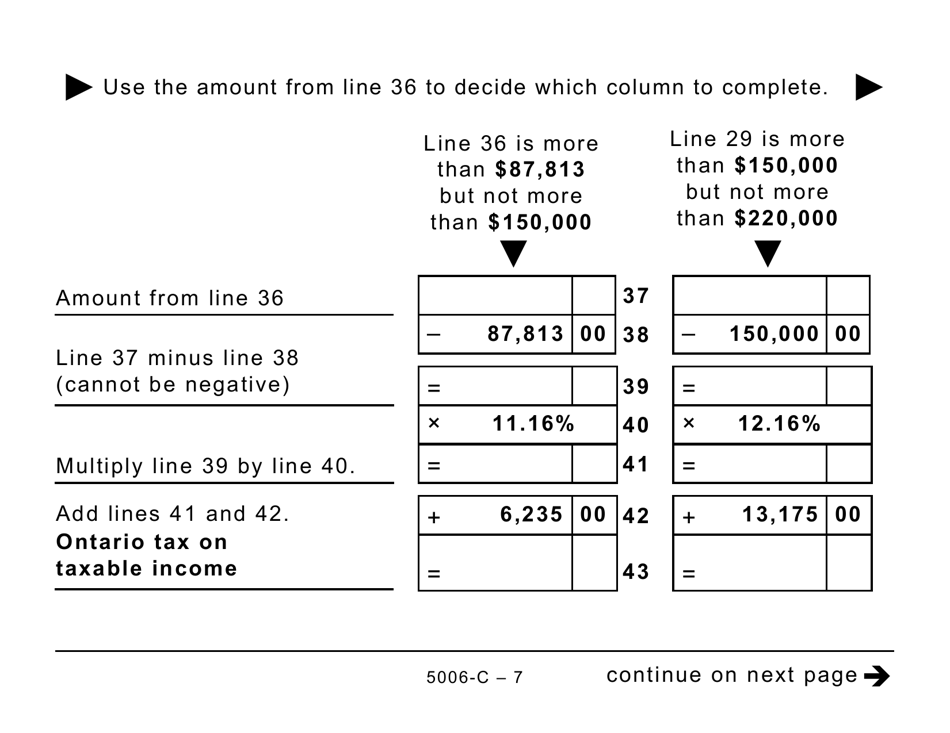

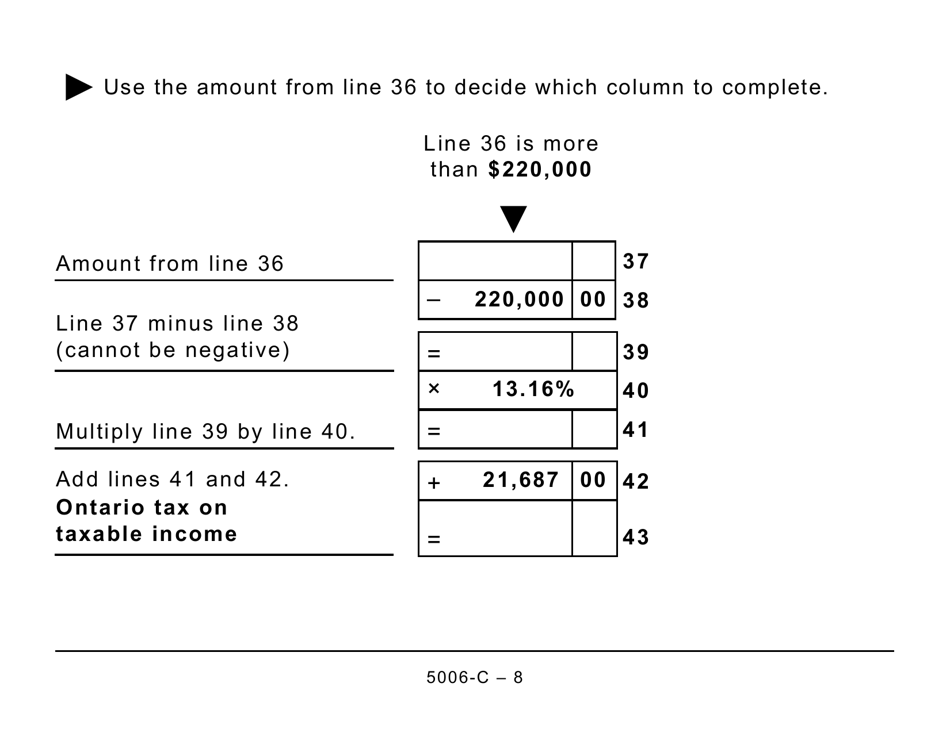

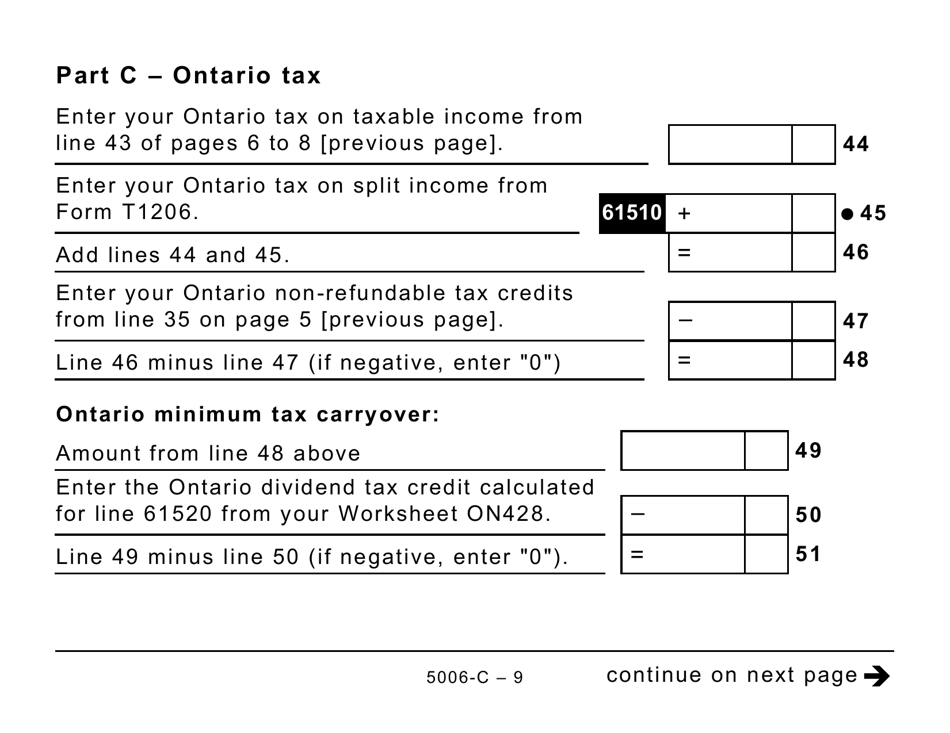

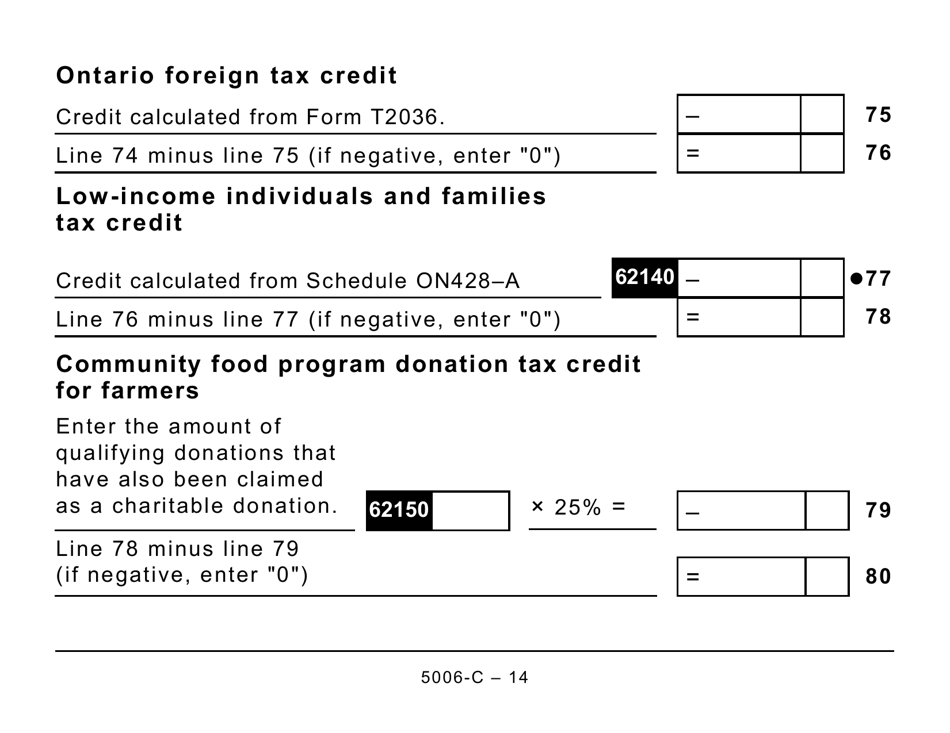

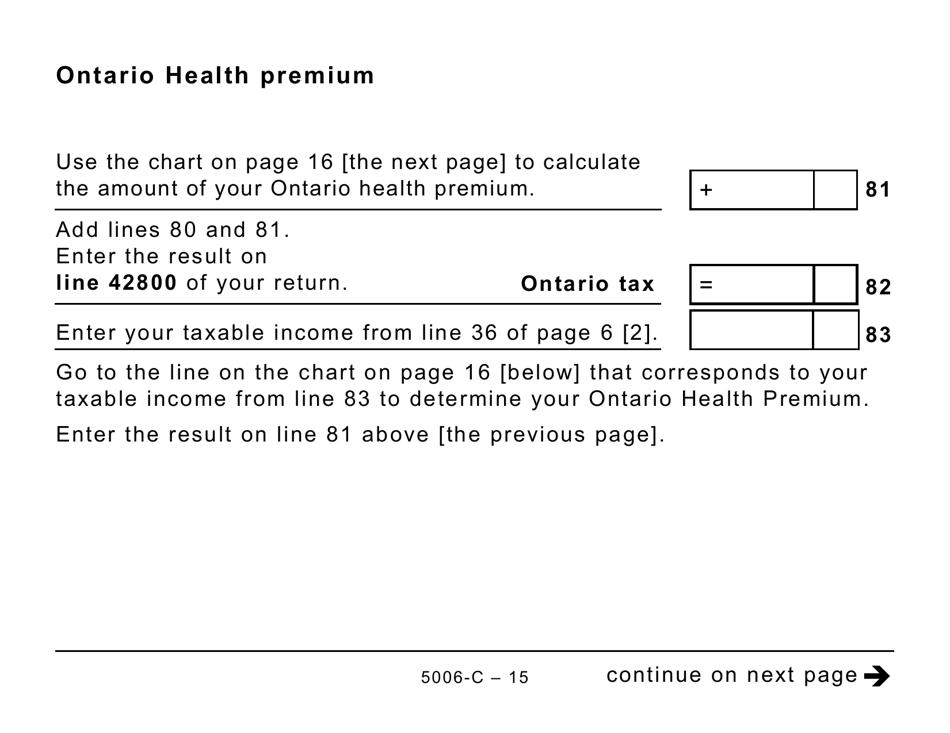

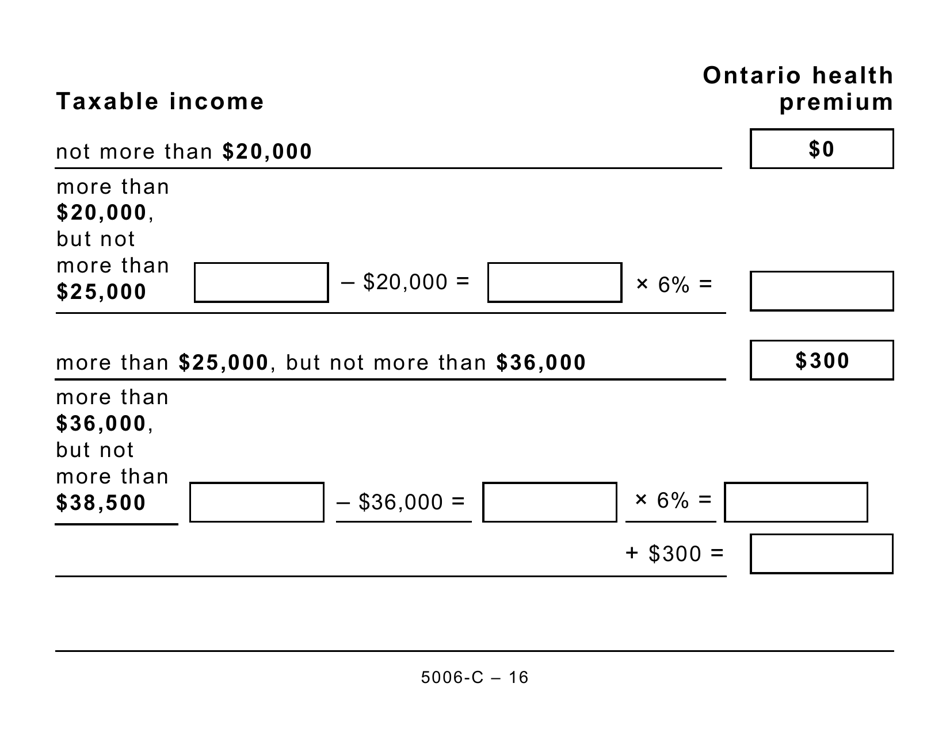

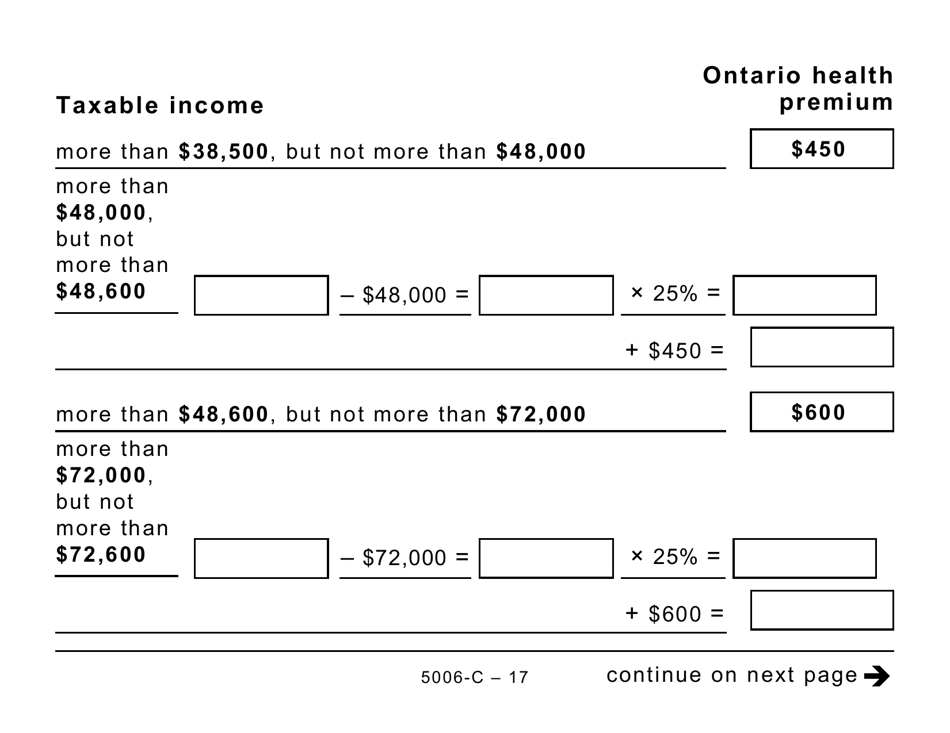

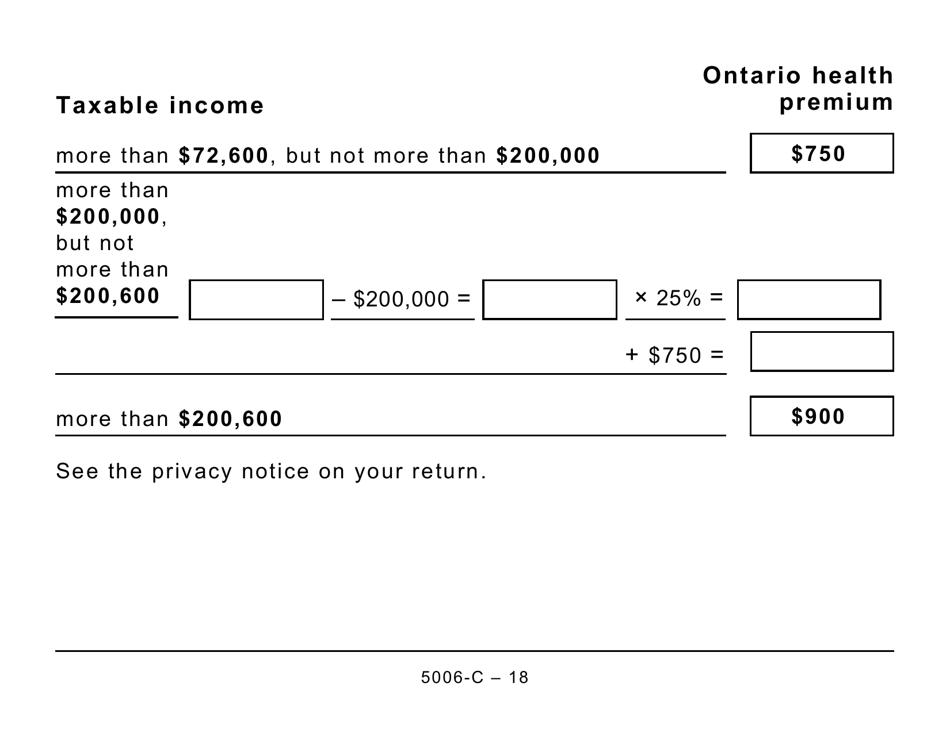

Form ON428 (5006-C) Ontario Tax (Large Print) - Canada is a tax form specifically designed for residents of the province of Ontario in Canada. It is used to report and calculate provincial income tax owed by individuals.

The Form ON428 (5006-C) Ontario Tax (Large Print) in Canada is typically filed by individuals who are residents of Ontario and need to report their provincial income tax.

FAQ

Q: What is Form ON428?

A: Form ON428 is the Ontario Tax form used to calculate your provincial tax liability in Canada.

Q: Who should use Form ON428?

A: Residents of Ontario who need to report their provincial taxes should use Form ON428.

Q: What is the purpose of Form ON428?

A: The purpose of Form ON428 is to determine the amount of provincial tax you owe or the refund you are entitled to in Ontario.

Q: Are there any instructions for completing Form ON428?

A: Yes, there are instructions provided with the form that will guide you through the process of completing it.

Q: When is the deadline for filing Form ON428?

A: The deadline for filing Form ON428 is typically April 30th of the following year, or June 15th if you or your spouse/common-law partner is self-employed.

Q: What should I do if I need help filling out Form ON428?

A: If you need assistance with completing Form ON428, you can contact the Canada Revenue Agency or seek help from a tax professional.

Q: Do I need to keep a copy of Form ON428 for my records?

A: Yes, it is advisable to keep a copy of Form ON428 and any supporting documents for your records in case of future inquiries or audits.