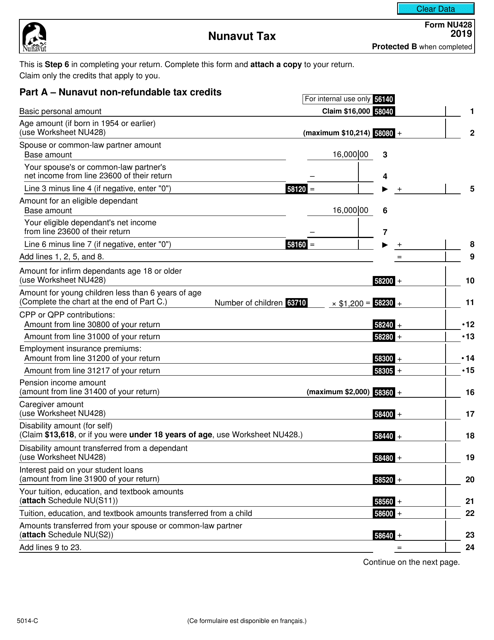

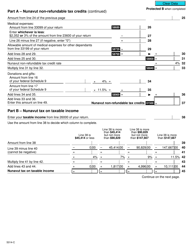

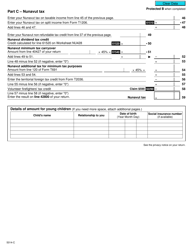

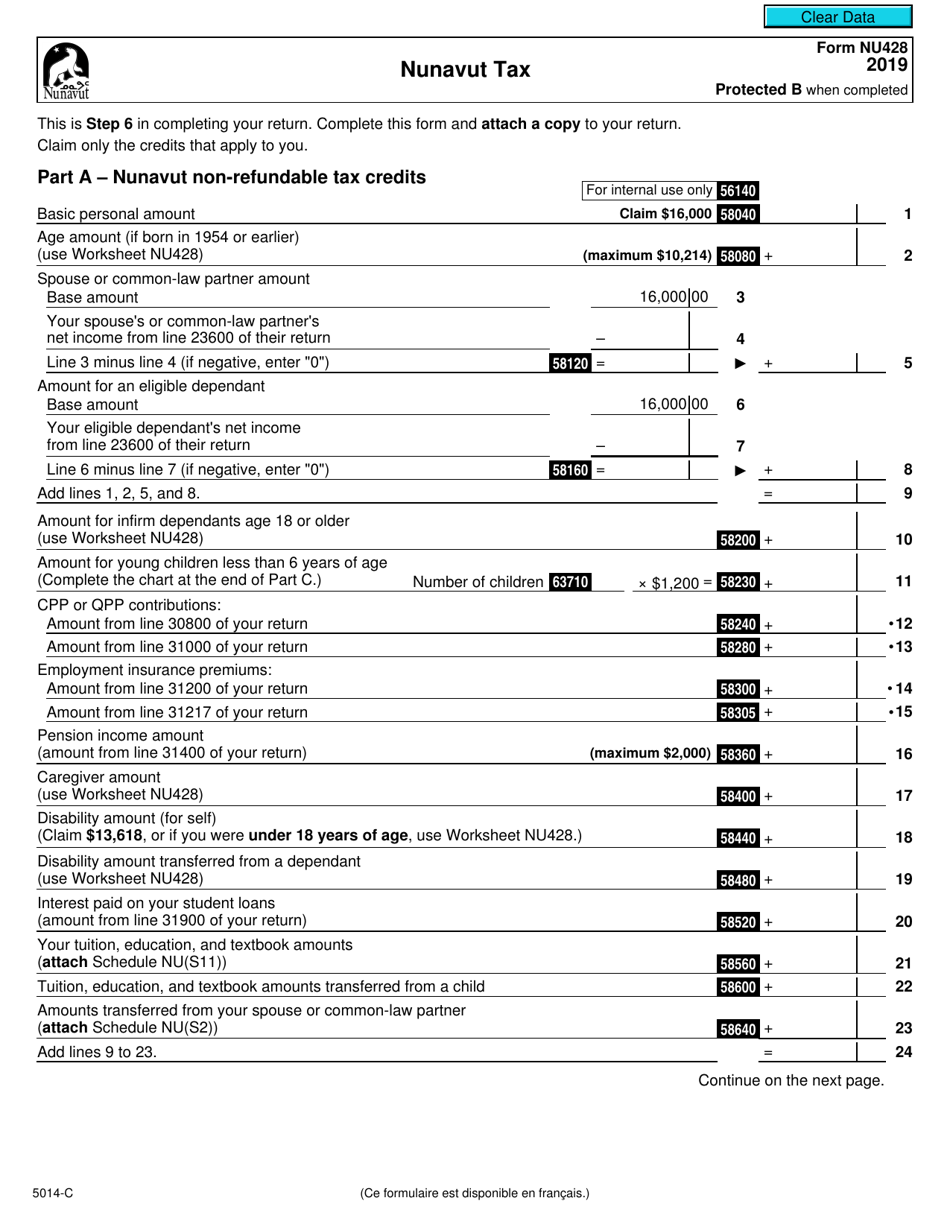

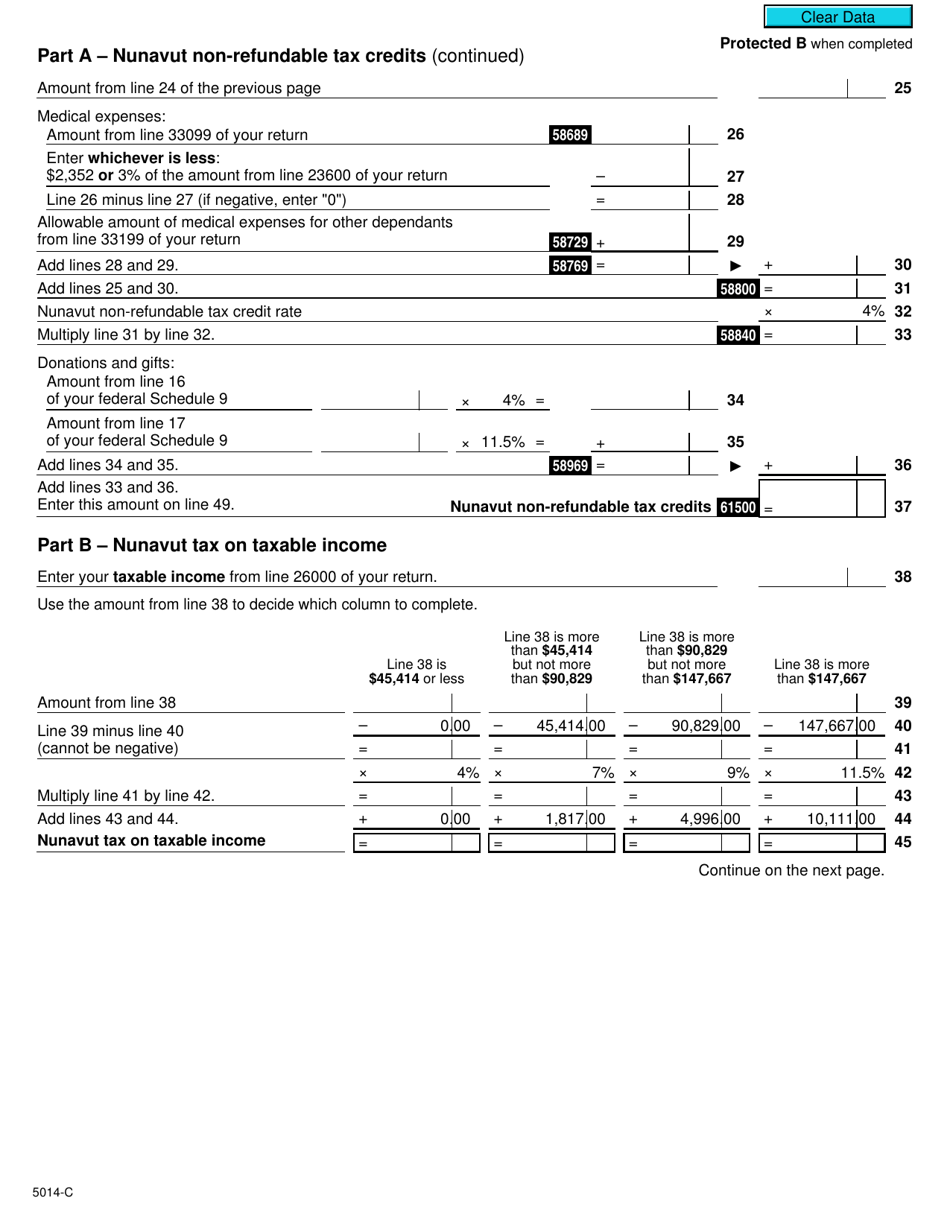

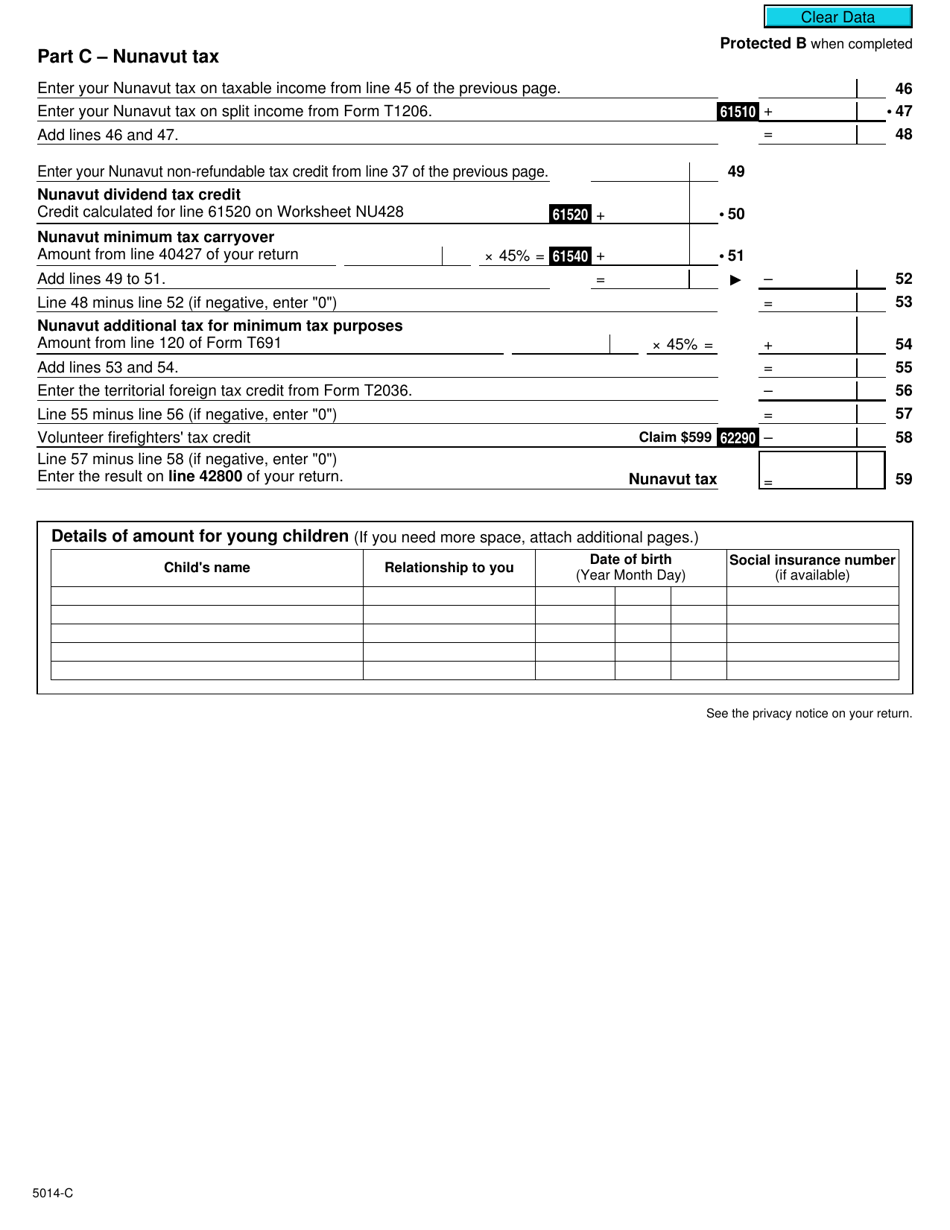

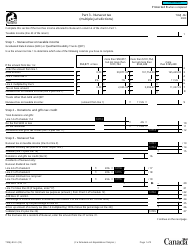

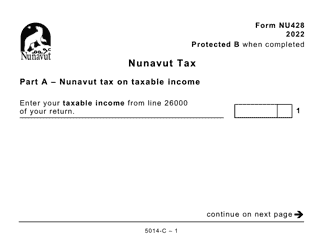

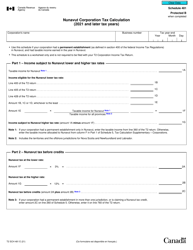

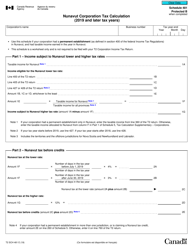

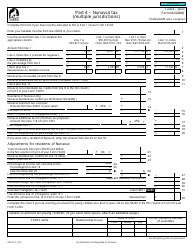

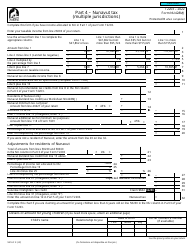

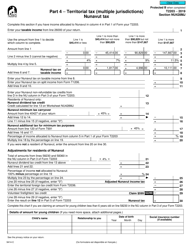

Form NU428 (5014-C) Nunavut Tax - Canada

Form NU428 (5014-C), also known as the Nunavut Tax, is used for individuals who are residents of Nunavut, Canada, to calculate and report their provincial tax liabilities. This form helps determine the amount of tax owed or any refund due to the taxpayer in Nunavut.

The Form NU428 (5014-C) for Nunavut Tax in Canada is filed by individual taxpayers who reside in the province of Nunavut.

FAQ

Q: What is Form NU428?

A: Form NU428 is the tax form used in Nunavut, Canada for filing personal income tax.

Q: Who needs to fill out Form NU428?

A: Residents of Nunavut, Canada with taxable income need to fill out Form NU428.

Q: What information is required on Form NU428?

A: Form NU428 requires information such as personal details, employment income, deductions, and tax credits.

Q: When is the deadline to submit Form NU428?

A: The deadline to submit Form NU428 is usually April 30th, but it may vary depending on the tax year.

Q: Are there penalties for late submission of Form NU428?

A: Yes, there may be penalties for late submission of Form NU428, including interest charges on any outstanding taxes.

Q: What if I need help with filling out Form NU428?

A: If you need help with filling out Form NU428, you can seek assistance from a tax professional or contact the CRA for guidance.

Q: Is Form NU428 only for residents of Nunavut?

A: Yes, Form NU428 is specifically for residents of Nunavut, Canada.

Q: Do I need to include supporting documents with Form NU428?

A: In most cases, you do not need to include supporting documents with Form NU428, but it's recommended to keep them for reference in case of an audit.