This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5014-S2 Schedule NU(S2)

for the current year.

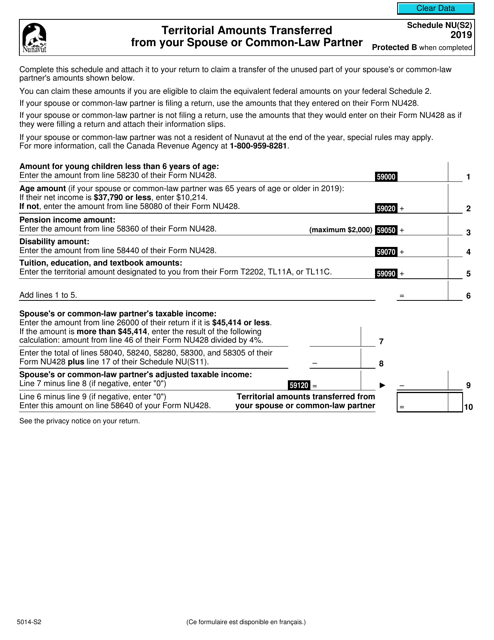

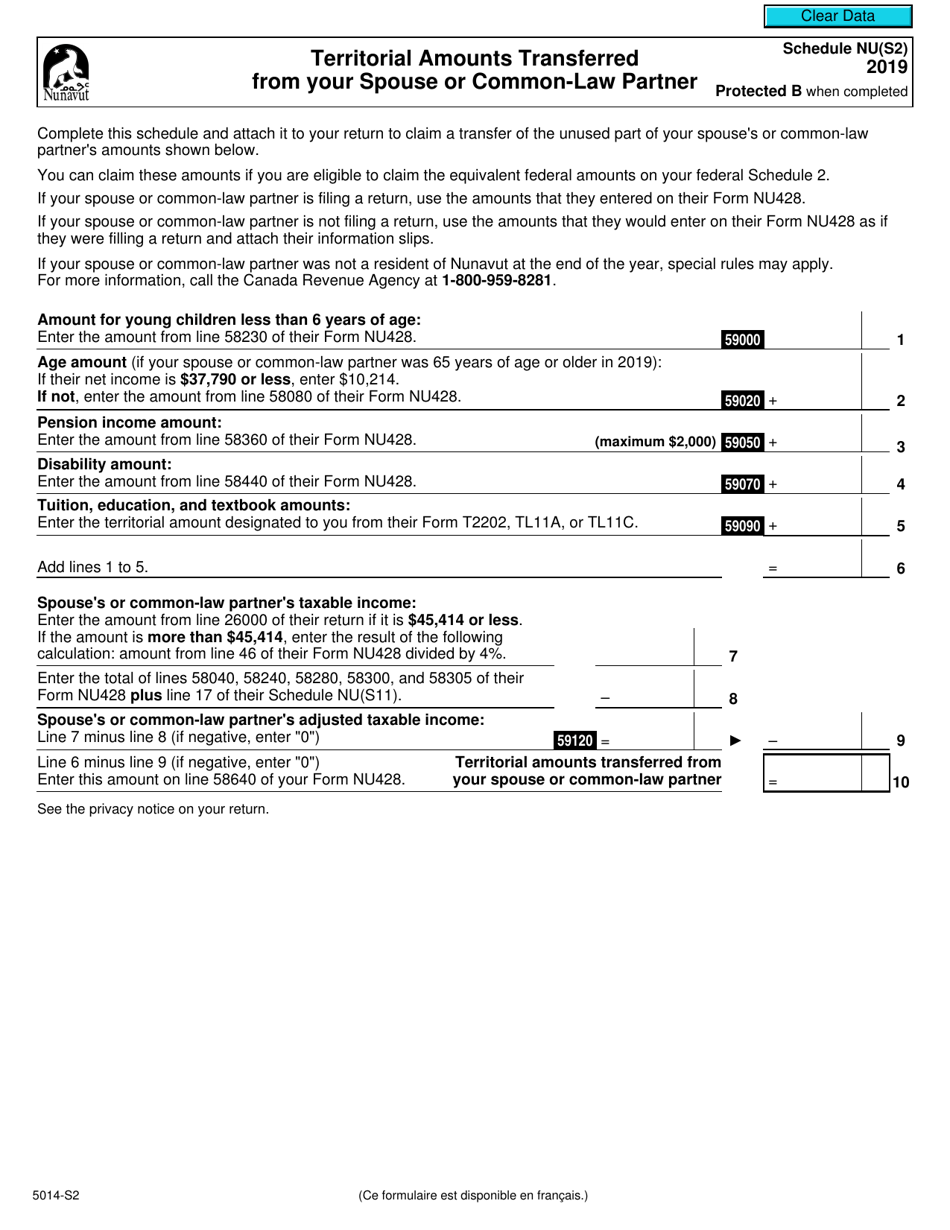

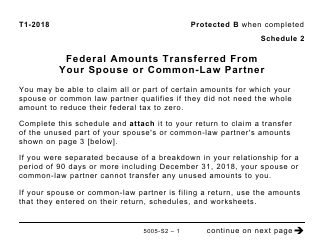

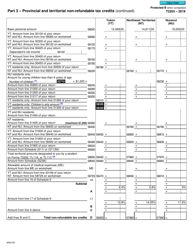

Form 5014-S2 Schedule NU(S2) Territorial Amounts Transferred From Your Spouse or Common-Law Partner - Nunavut - Canada

Form 5014-S2 Schedule NU(S2) is used for reporting territorial amounts transferred from your spouse or common-law partner specifically for Nunavut in Canada.

FAQ

Q: What is Form 5014-S2?

A: Form 5014-S2 is Schedule NU(S2) used to report territorial amounts transferred from your spouse or common-law partner in Nunavut, Canada.

Q: What is Schedule NU(S2)?

A: Schedule NU(S2) is a form used to report territorial amounts transferred from your spouse or common-law partner in Nunavut, Canada.

Q: What are territorial amounts?

A: Territorial amounts refer to deductions or credits available for residents of Nunavut.

Q: Who is eligible to use Form 5014-S2?

A: Residents of Nunavut who have transferred territorial amounts from their spouse or common-law partner are eligible to use Form 5014-S2.

Q: Why would someone transfer territorial amounts from their spouse or common-law partner?

A: Transferring territorial amounts from a spouse or common-law partner can help reduce the overall tax burden for the couple.

Q: Is Form 5014-S2 specific to Nunavut?

A: Yes, Form 5014-S2 is specific to residents of Nunavut.

Q: Are there any deadlines for submitting Form 5014-S2?

A: The deadline for submitting Form 5014-S2 is usually April 30th of the following year, but it's always a good idea to check with the CRA for any updates or changes.

Q: Can I claim territorial amounts transferred from my spouse or common-law partner if they live outside of Nunavut?

A: No, territorial amounts can only be claimed if both the transferee and transferor are residents of Nunavut.