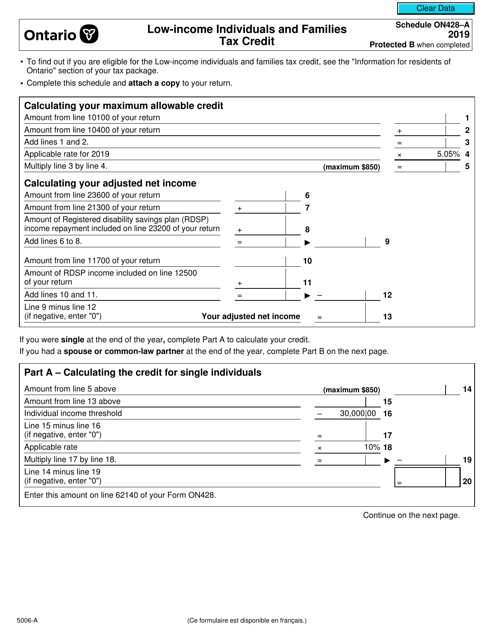

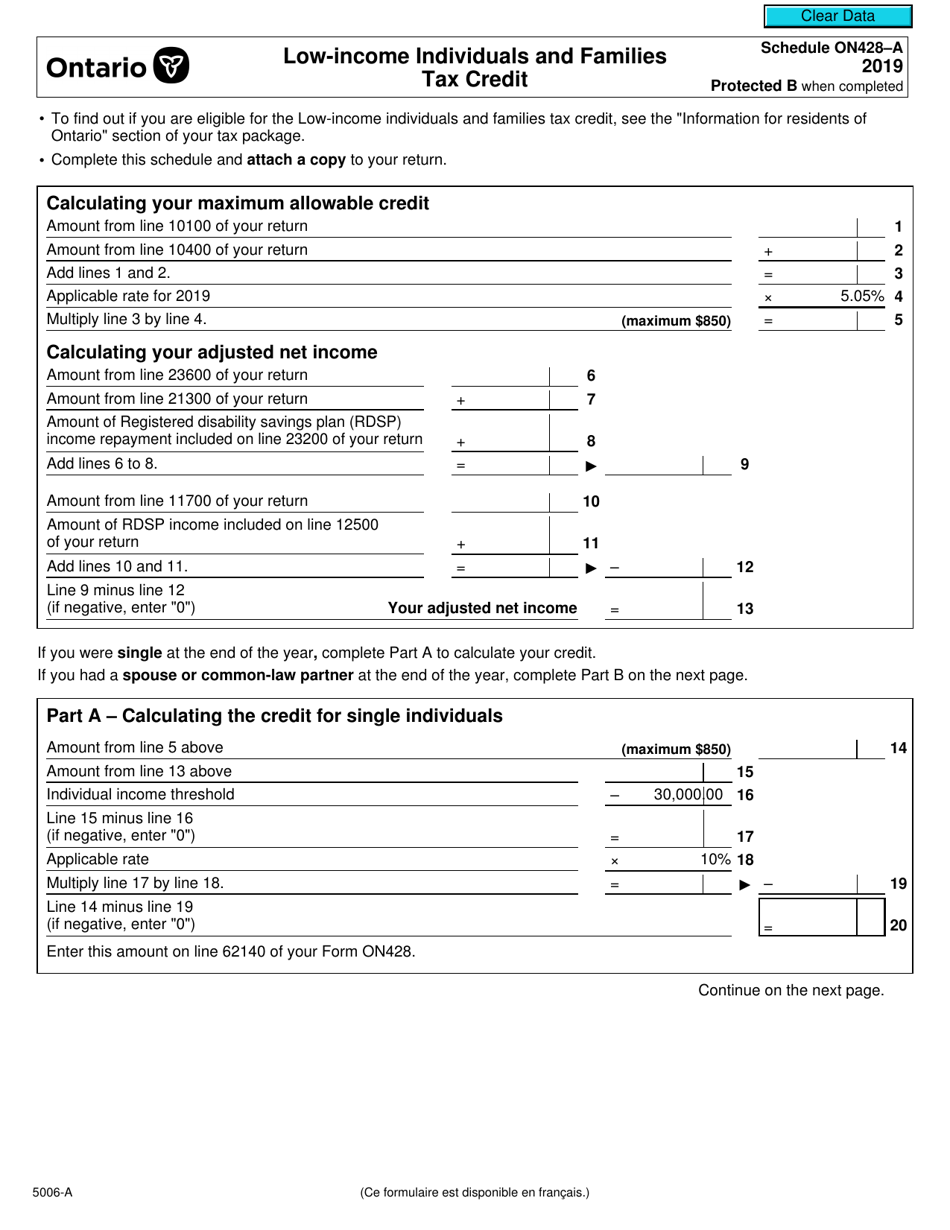

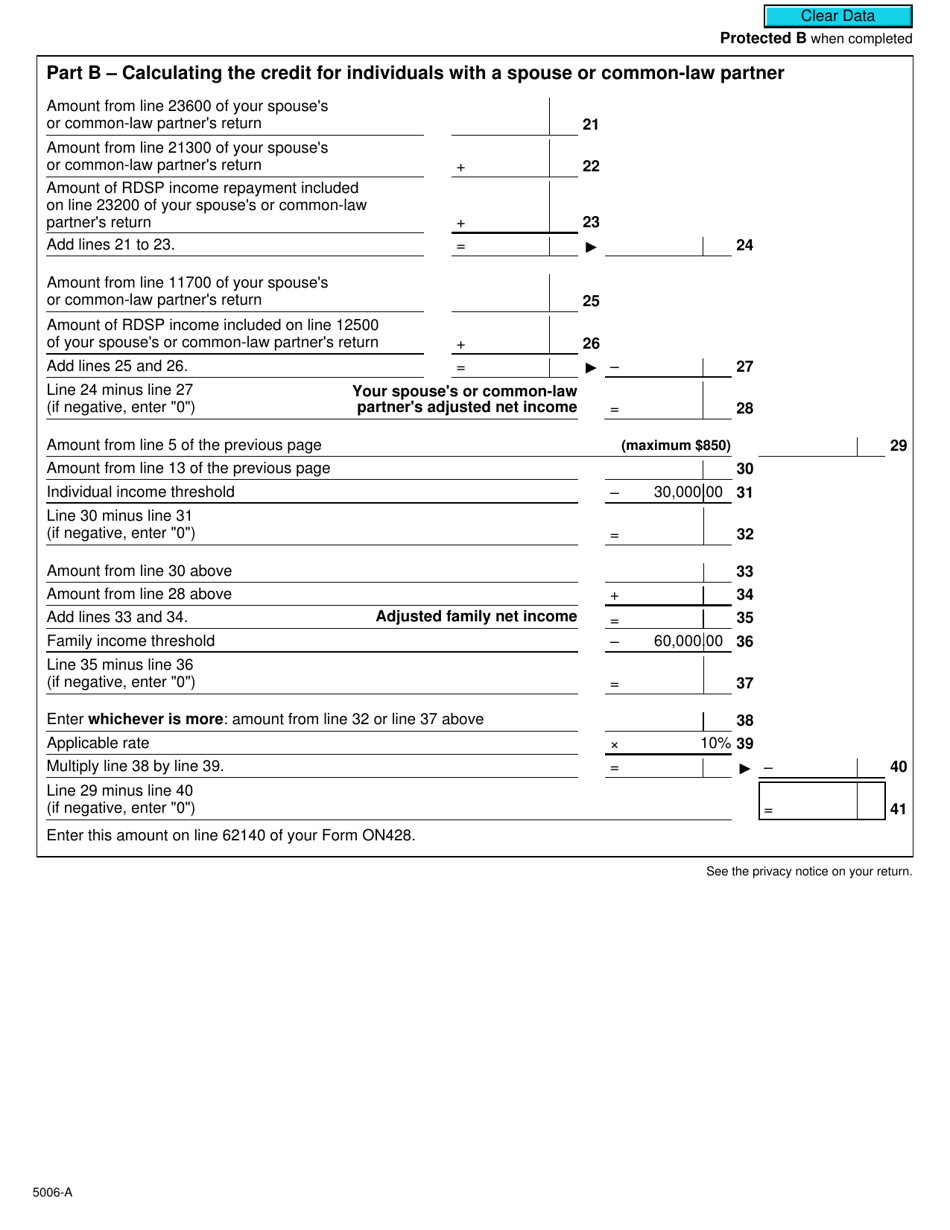

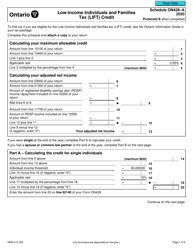

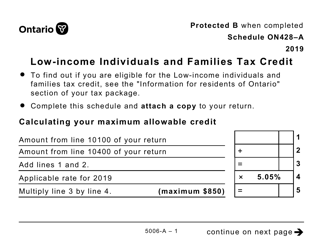

Form 5006-A Schedule ON428-A Low-Income Individuals and Families Tax Credit - Canada

Form 5006-A Schedule ON428-A is used in Canada to claim the Low-Income Individuals and Families Tax Credit. This credit is designed to provide financial assistance to low-income individuals and families by reducing their overall tax liability. It is important for eligible individuals to complete this form in order to claim the credit and potentially receive a tax refund.

The Form 5006-A Schedule ON428-A Low-Income Individuals and Families Tax Credit in Canada is typically filed by low-income individuals and families who are eligible for the tax credit.

FAQ

Q: What is Form 5006-A?

A: Form 5006-A is a form used in Canada for claiming the Low-Income Individuals and Families Tax Credit.

Q: What is the Schedule ON428-A?

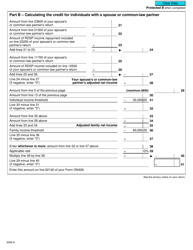

A: The Schedule ON428-A is a specific schedule that is part of the Form 5006-A and is used to calculate the Low-Income Individuals and Families Tax Credit in Ontario.

Q: Who can claim the Low-Income Individuals and Families Tax Credit?

A: Low-income individuals and families in Ontario who meet the eligibility criteria can claim this tax credit.

Q: What is the purpose of the Low-Income Individuals and Families Tax Credit?

A: The Low-Income Individuals and Families Tax Credit is designed to provide financial support to low-income individuals and families in Ontario.