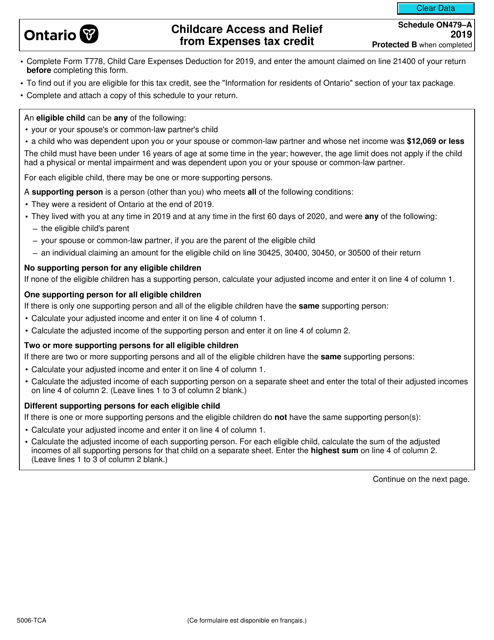

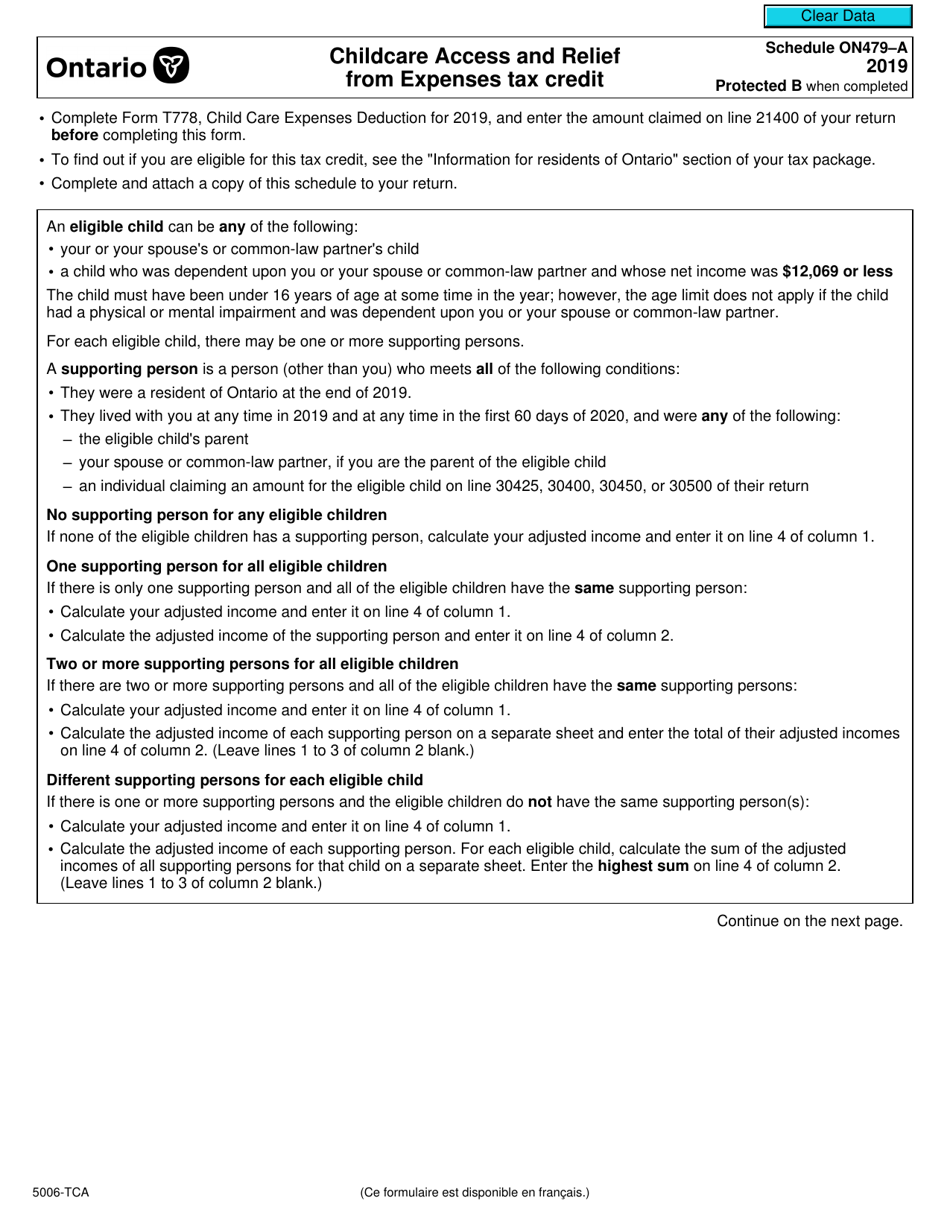

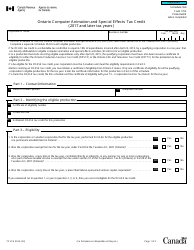

Form 5006-TCA Schedule ON479-A Childcare Access and Relief From Expenses Tax Credit - Canada

Form 5006-TCA Schedule ON479-A is a tax form used in Canada to claim the Childcare Access and Relief From Expenses (CARE) Tax Credit. This credit helps families with the cost of child care expenses.

The Form 5006-TCA Schedule ON479-A is filed by individual taxpayers in Canada who are claiming the Childcare Access and Relief From Expenses Tax Credit.

FAQ

Q: What is Form 5006-TCA?

A: Form 5006-TCA is a form used in Canada for applying for the Childcare Access and Relief From Expenses Tax Credit.

Q: What is Schedule ON479-A?

A: Schedule ON479-A is a specific schedule that is part of Form 5006-TCA, used to claim the Childcare Access and Relief From Expenses Tax Credit in Ontario, Canada.

Q: What is the Childcare Access and Relief From Expenses Tax Credit?

A: The Childcare Access and Relief From Expenses Tax Credit is a tax credit in Canada that provides financial relief to families for childcare expenses.

Q: How do I apply for the Childcare Access and Relief From Expenses Tax Credit?

A: To apply for the Childcare Access and Relief From Expenses Tax Credit, you need to complete Form 5006-TCA and include the necessary information and supporting documents.

Q: Is the Childcare Access and Relief From Expenses Tax Credit available nationwide?

A: No, the Childcare Access and Relief From Expenses Tax Credit is currently available only in Ontario, Canada.

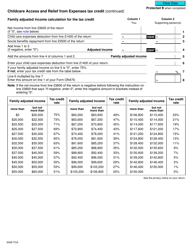

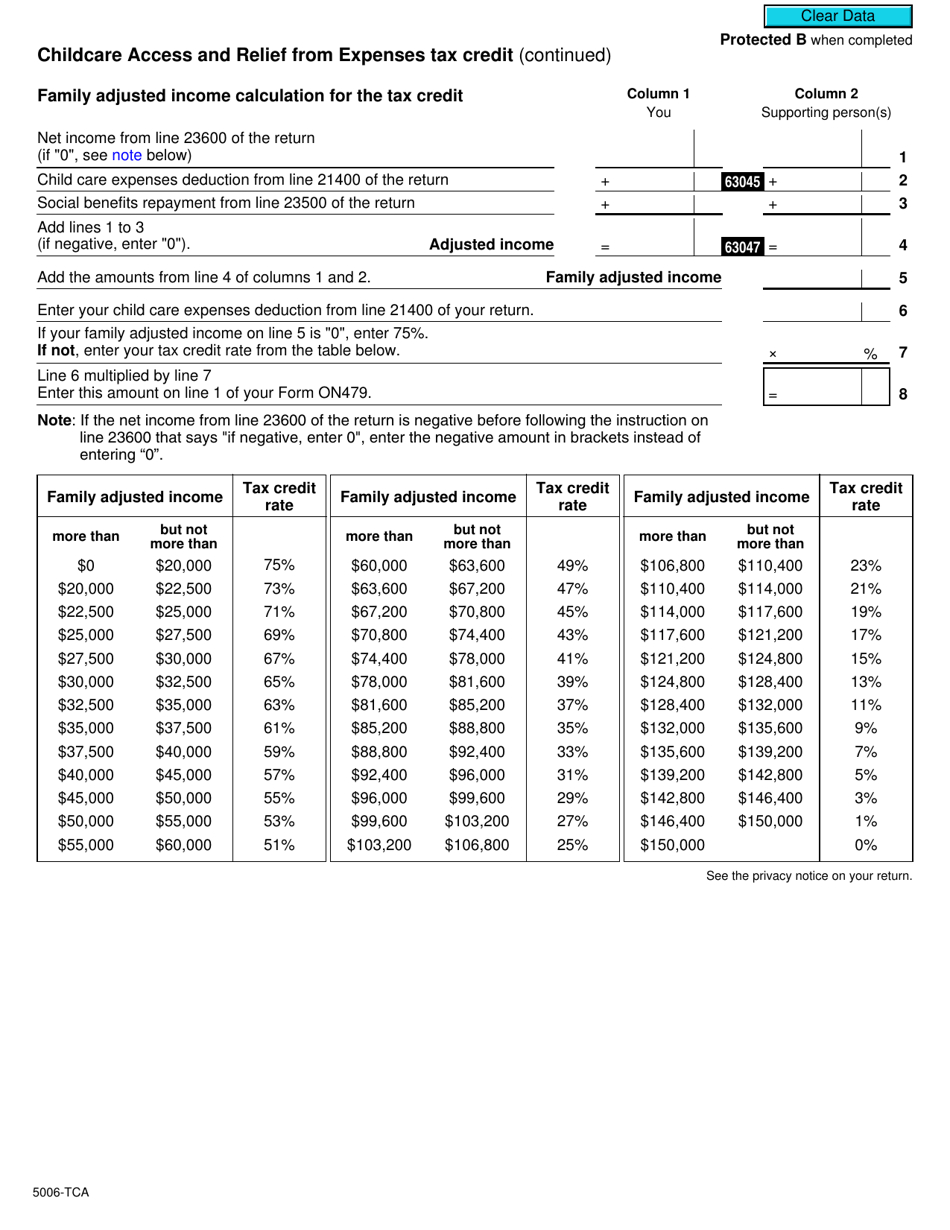

Q: What expenses can be claimed with the Childcare Access and Relief From Expenses Tax Credit?

A: Expenses that can be claimed with the Childcare Access and Relief From Expenses Tax Credit include childcare fees, expenses for boarding schools or camps, and certain other eligible expenses.