Form 5006-S11 Schedule ON(S11) Provincial Tuition and Education Amounts - Ontario (Large Print) - Canada

Form 5006-S11 Schedule ON(S11) is used in Canada for reporting provincial tuition and education amounts specific to the province of Ontario. It is designed for individuals who require a large print format.

The Form 5006-S11 Schedule ON(S11) Provincial Tuition and Education Amounts - Ontario (Large Print) in Canada is generally filed by individual taxpayers who are residents of Ontario and want to claim their provincial tuition and education amounts.

FAQ

Q: What is Form 5006-S11?

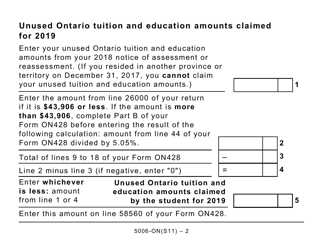

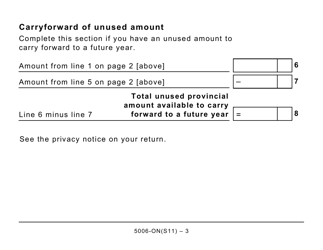

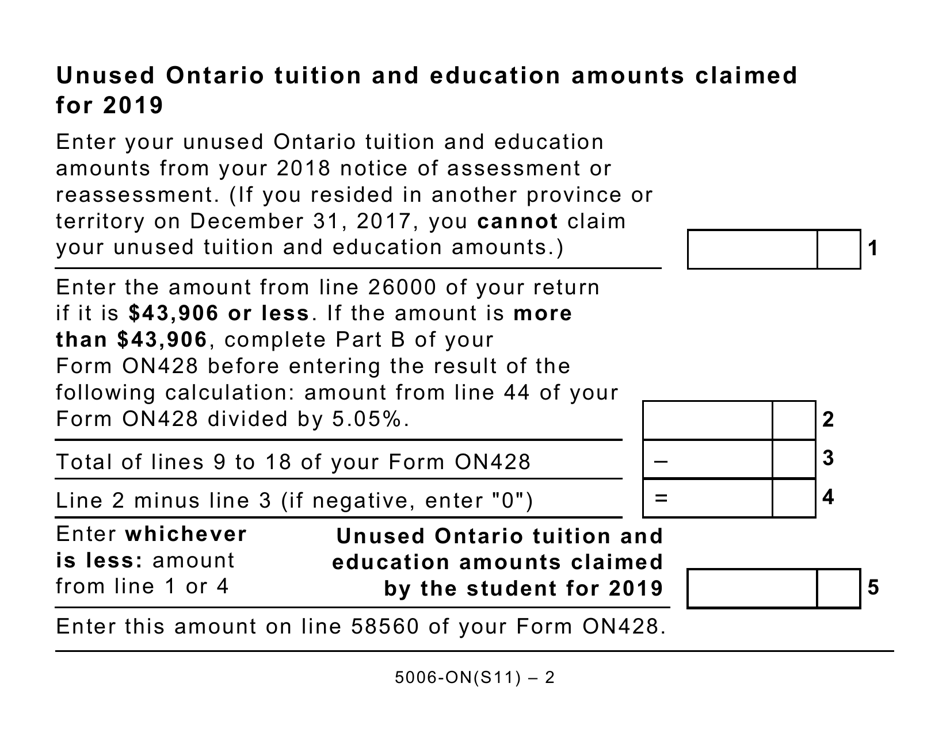

A: Form 5006-S11 is a schedule used to claim provincial tuition and education amounts for residents of Ontario in Canada.

Q: What is a provincial tuition and education amount?

A: A provincial tuition and education amount is a tax credit or deduction that can be claimed by residents of Ontario to reduce their taxable income.

Q: Who is eligible to claim the provincial tuition and education amount in Ontario?

A: Residents of Ontario who attended a qualifying educational institution and paid tuition fees can claim the provincial tuition and education amount.

Q: What is the purpose of Schedule ON(S11)?

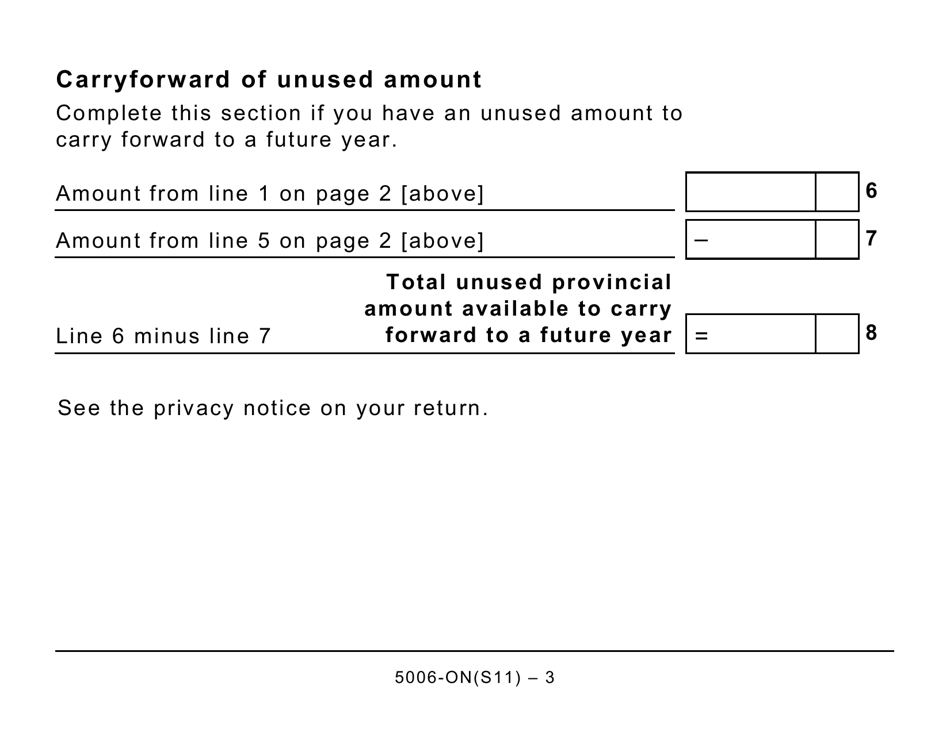

A: Schedule ON(S11) is used to calculate and report the provincial tuition and education amounts that can be claimed by residents of Ontario on their tax return.

Q: Is Schedule ON(S11) specific to Ontario?

A: Yes, Schedule ON(S11) is specific to residents of Ontario in Canada.

Q: Is the schedule available in large print format?

A: Yes, the schedule is available in a large print format for individuals who require a larger font size.