This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5006-S14 Schedule 14

for the current year.

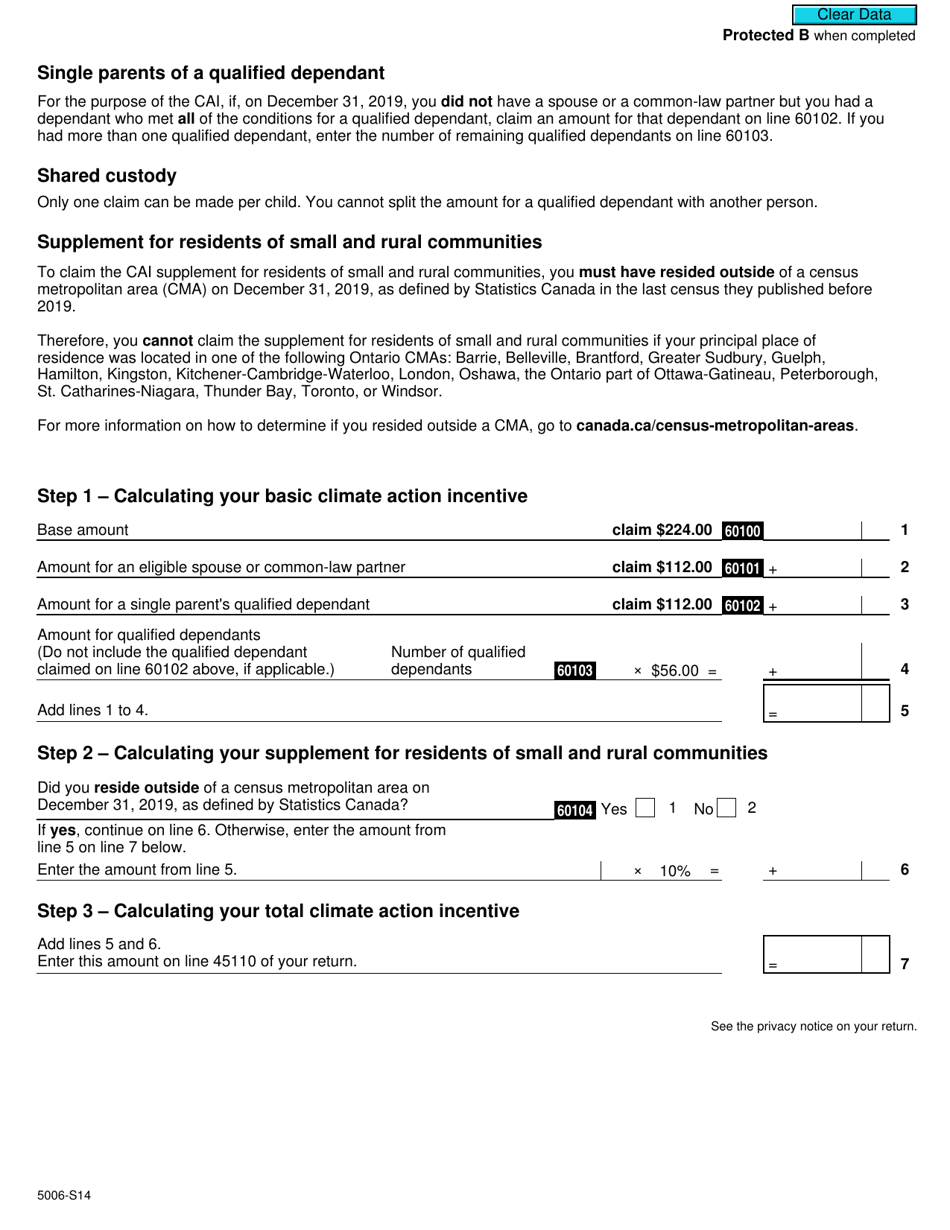

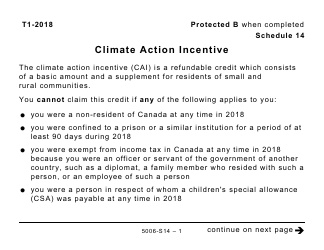

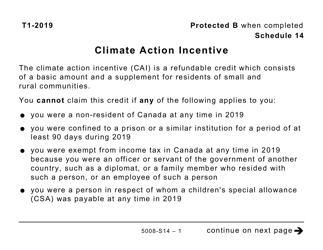

Form 5006-S14 Schedule 14 Climate Action Incentive - Ontario - Canada

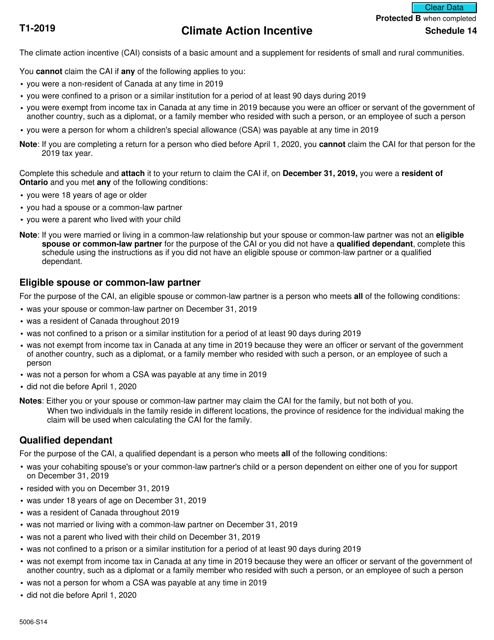

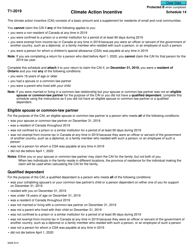

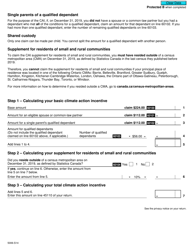

Form 5006-S14 Schedule 14 Climate Action Incentive - Ontario - Canada is a tax form used to claim the Climate Action Incentive for residents of Ontario, Canada. This incentive encourages individuals and families to take action to reduce greenhouse gas emissions and support climate protection efforts.

Individuals who reside in Ontario, Canada can file the Form 5006-S14 Schedule 14 Climate Action Incentive.

FAQ

Q: What is Form 5006-S14 Schedule 14?

A: Form 5006-S14 Schedule 14 is a specific tax form related to climate action incentives in Ontario, Canada.

Q: What is a climate action incentive?

A: A climate action incentive is a measure or program designed to encourage individuals and businesses to take actions that reduce greenhouse gas emissions and mitigate climate change.

Q: What is the purpose of Form 5006-S14 Schedule 14?

A: The purpose of Form 5006-S14 Schedule 14 is to claim the climate action incentive available to residents of Ontario, Canada.

Q: Who can claim the climate action incentive in Ontario?

A: Residents of Ontario who meet certain eligibility criteria can claim the climate action incentive.

Q: How much is the climate action incentive in Ontario?

A: The amount of the climate action incentive varies and is determined based on factors such as household size and residency status.

Q: How do I fill out Form 5006-S14 Schedule 14?

A: To fill out Form 5006-S14 Schedule 14, you will need to provide accurate information about your residency status, household size, and other relevant details as specified on the form.

Q: When is the deadline to submit Form 5006-S14 Schedule 14?

A: The deadline to submit Form 5006-S14 Schedule 14 usually aligns with the deadline for filing your annual income tax return, which is typically April 30th of each year.

Q: Are there any other climate action incentives available in Canada?

A: Yes, different provinces and territories in Canada may have their own specific climate action incentives, in addition to the nationwide incentives provided by the federal government.

Q: Can I claim the climate action incentive if I live in a province other than Ontario?

A: No, Form 5006-S14 Schedule 14 specifically applies to residents of Ontario. Residents of other provinces or territories should refer to their respective tax forms and guidelines for claiming any available climate action incentives.