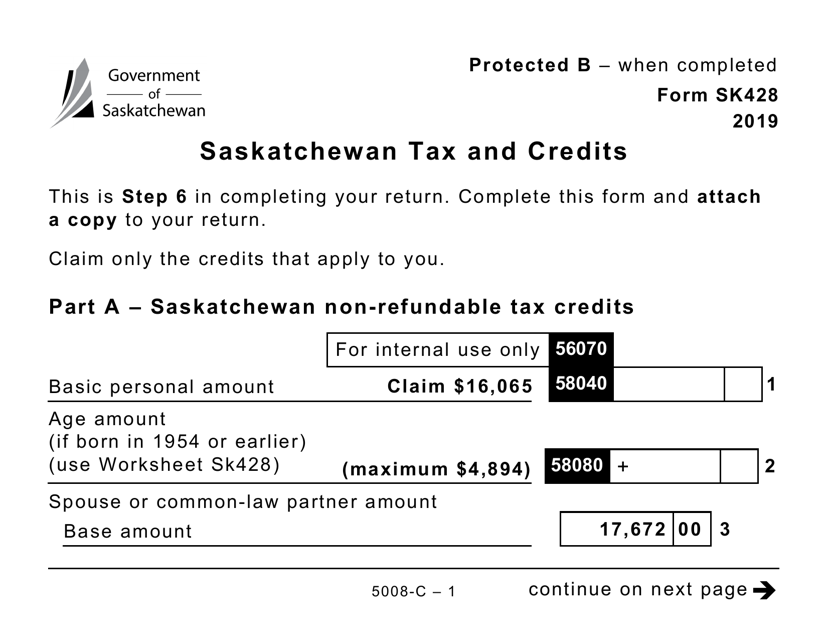

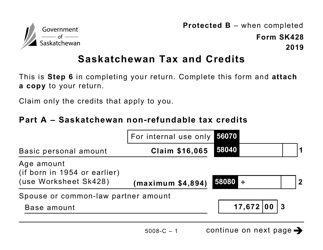

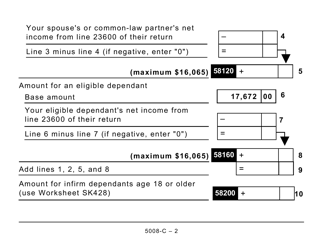

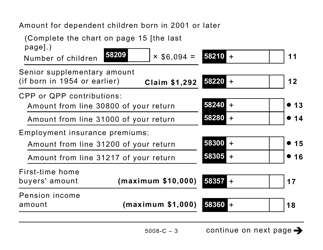

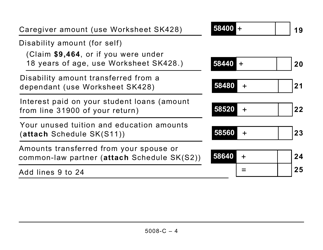

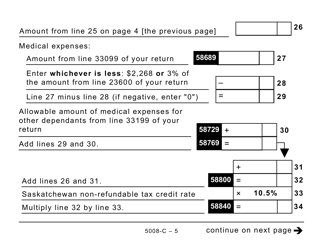

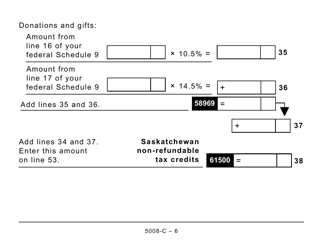

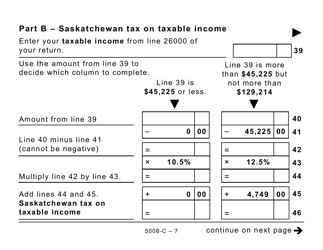

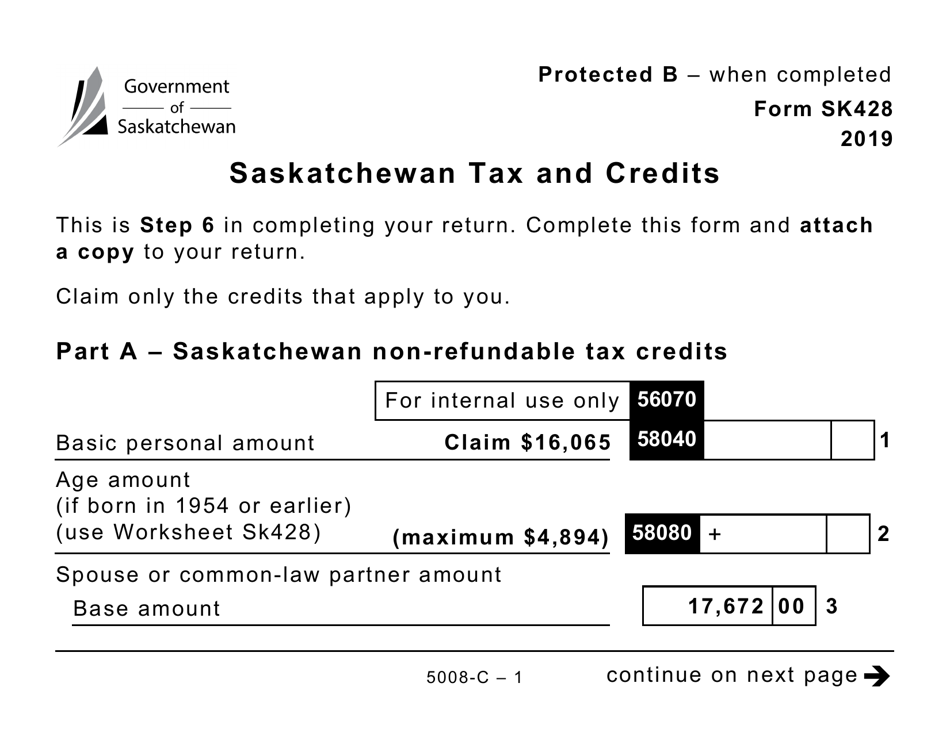

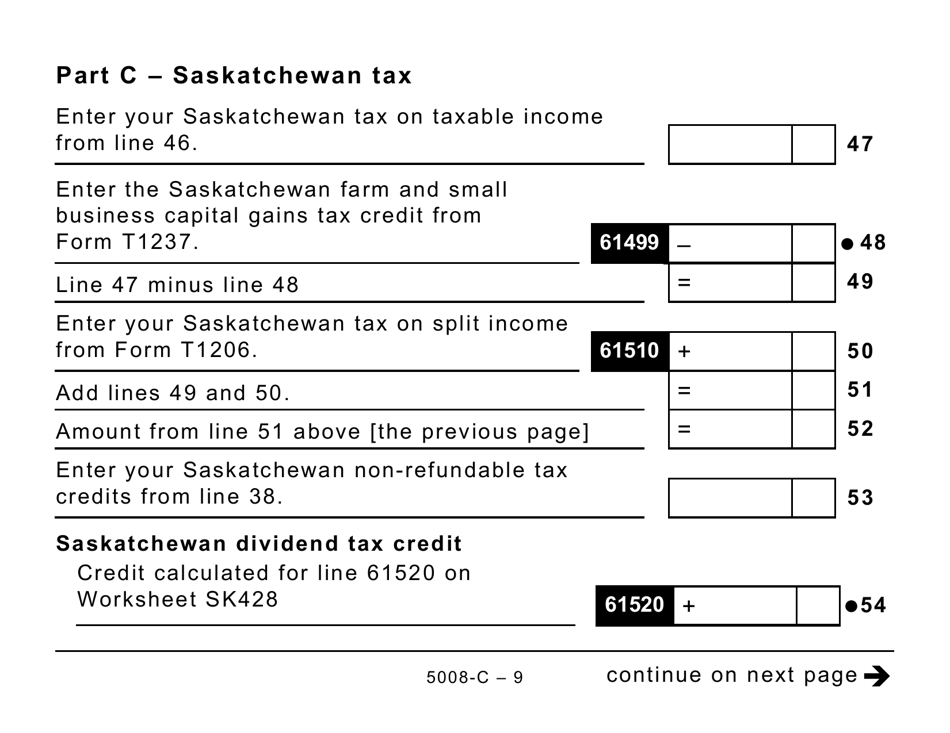

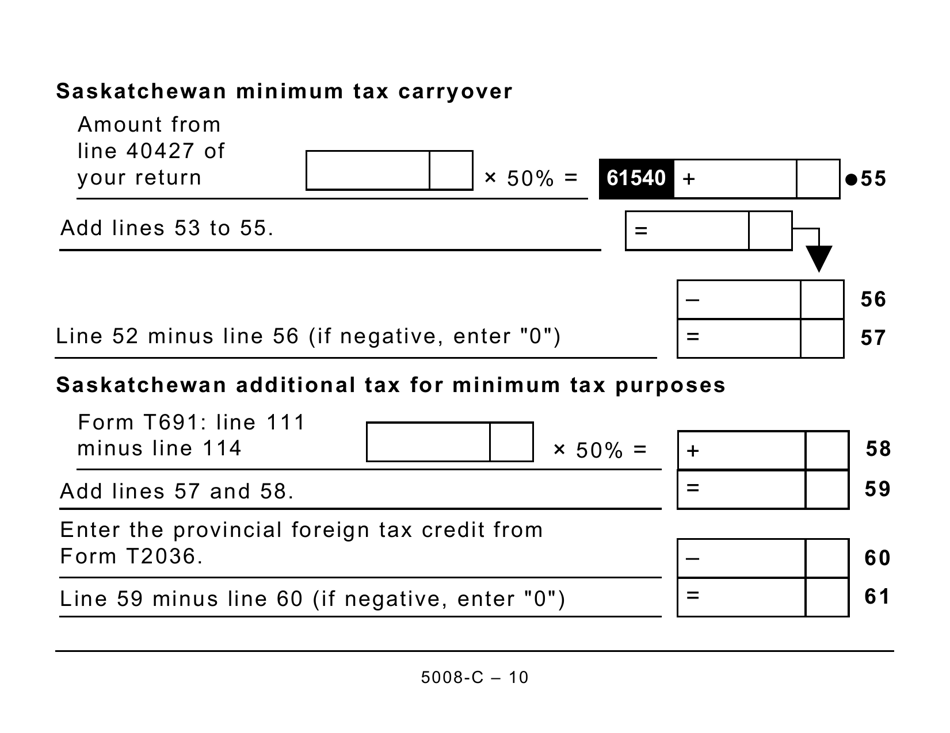

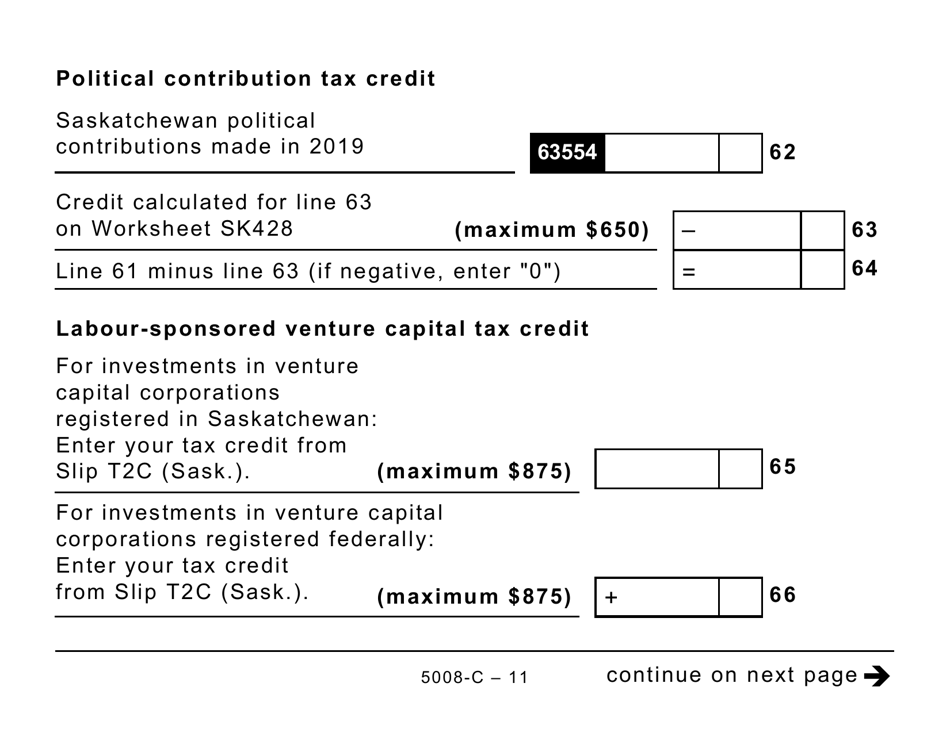

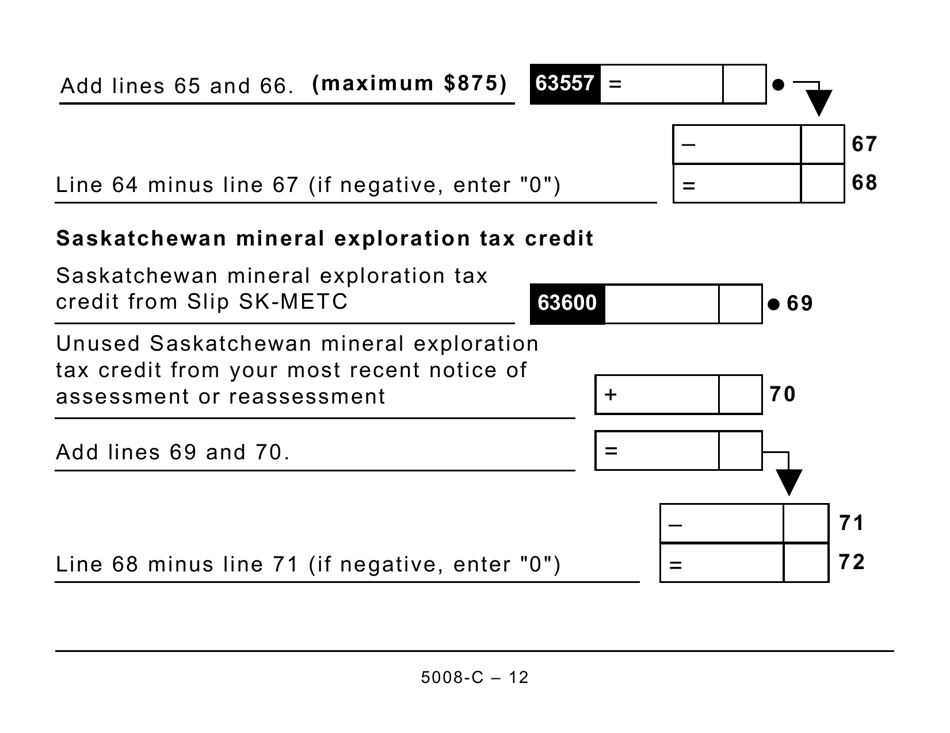

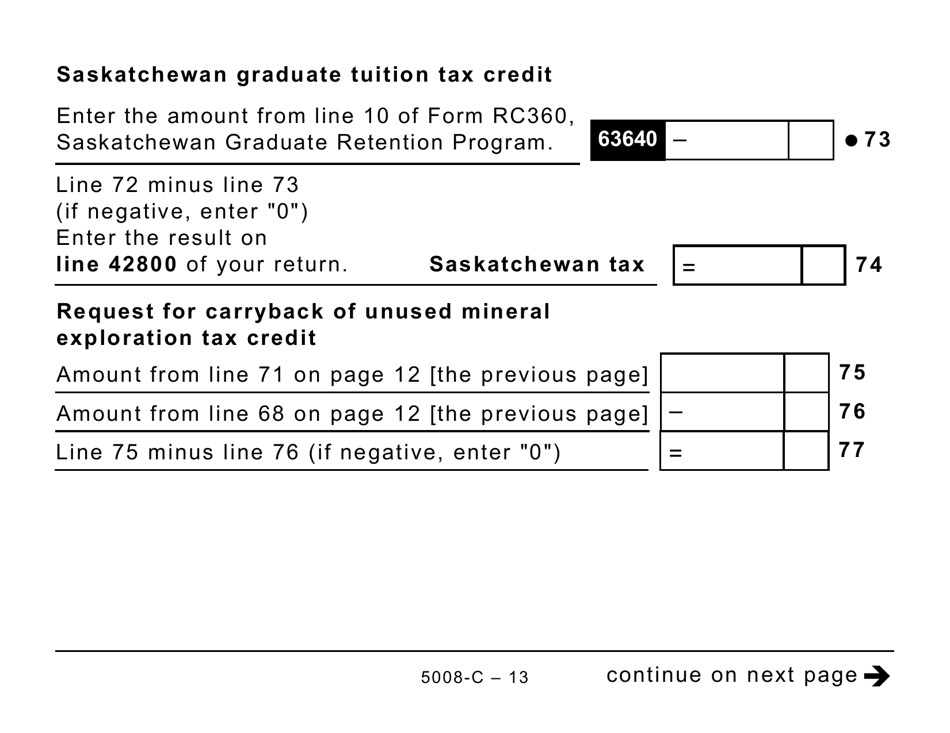

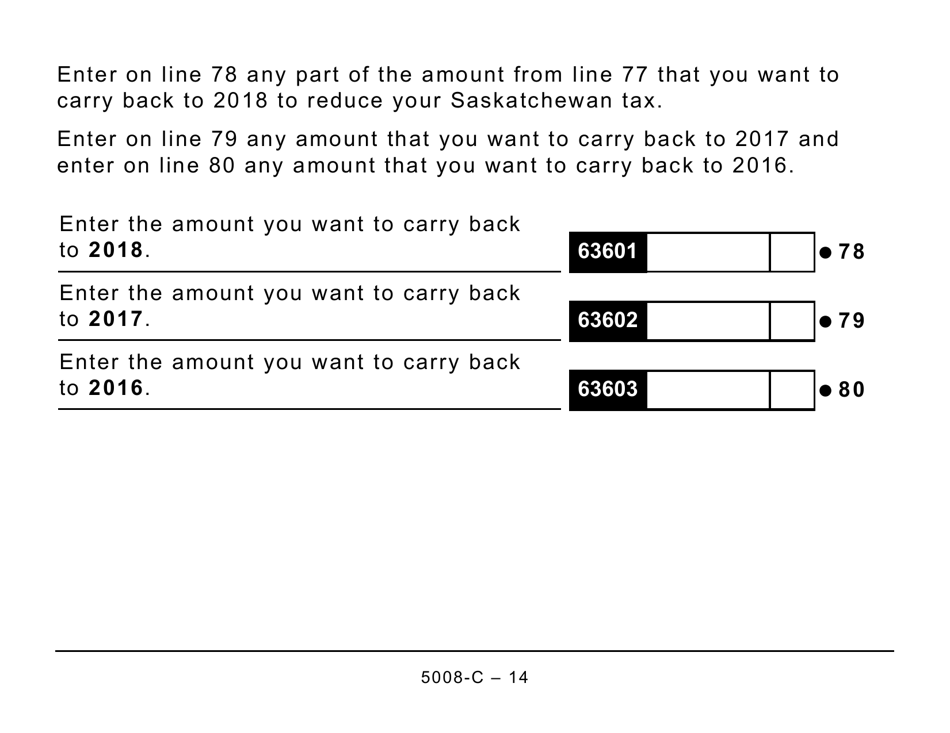

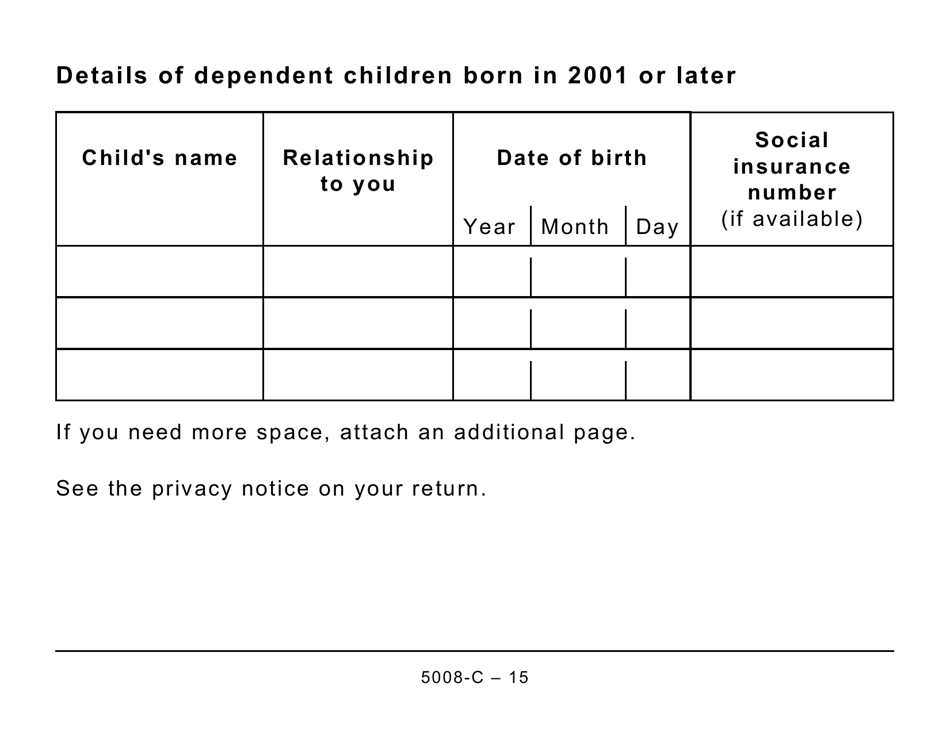

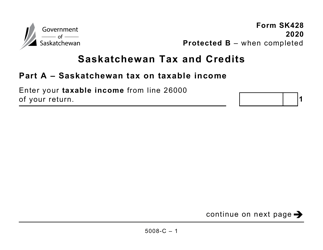

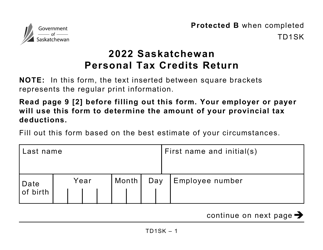

Form 5008-C (SK428) Saskatchewan Tax and Credits - Large Print - Canada

Form 5008-C (SK428) is a large print version of the Saskatchewan Tax and Credits form in Canada. It is specifically designed to make it easier for individuals with visual impairments to complete their tax return in Saskatchewan.

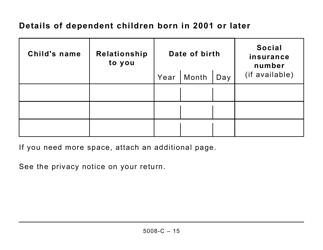

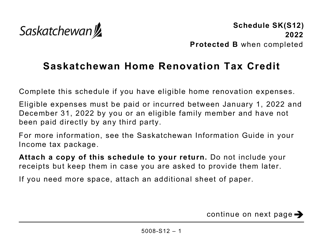

The Form 5008-C (SK428) is filed by individuals in Saskatchewan, Canada who are seeking tax benefits and credits.

FAQ

Q: What is Form 5008-C?

A: Form 5008-C is a tax form used in Saskatchewan, Canada.

Q: What is SK428?

A: SK428 is the code used for the Saskatchewan Tax and Credits form.

Q: What is the purpose of Form 5008-C?

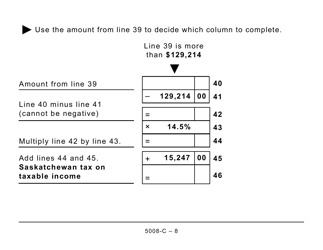

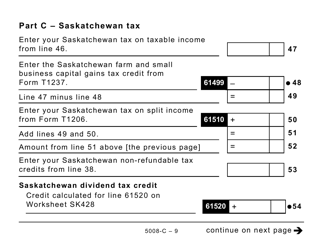

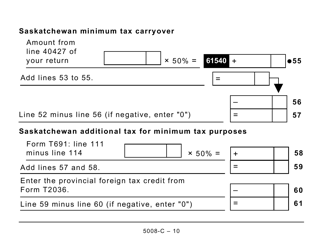

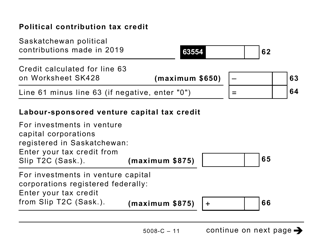

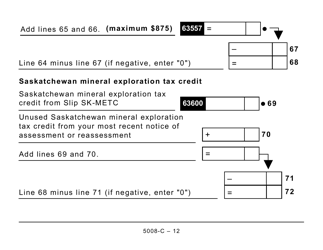

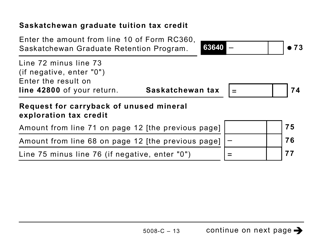

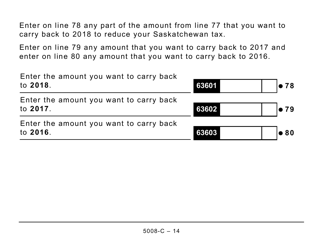

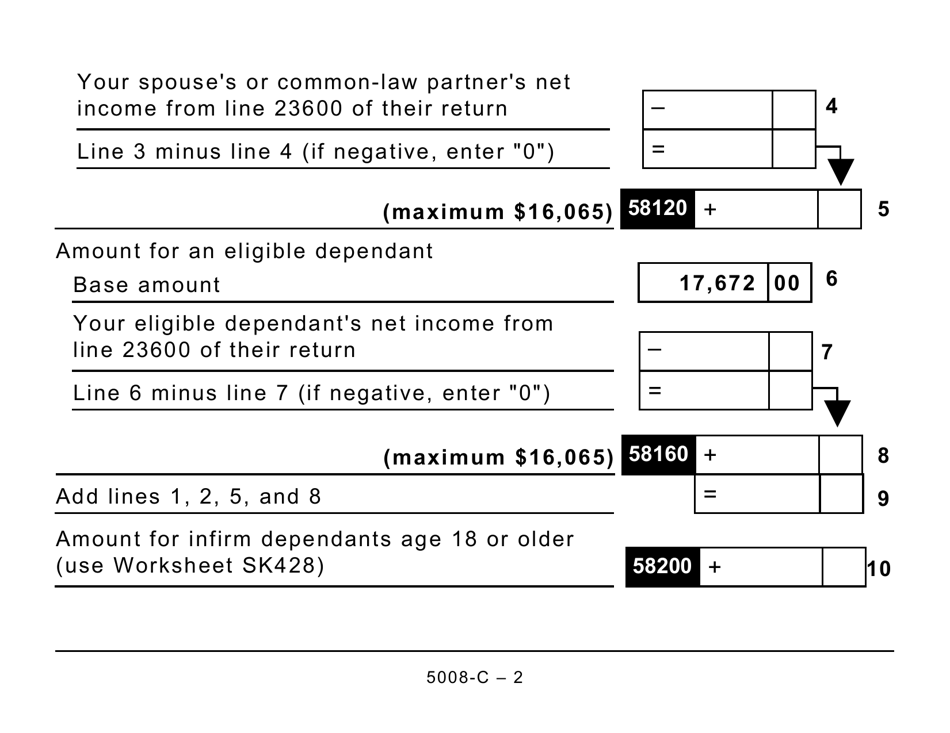

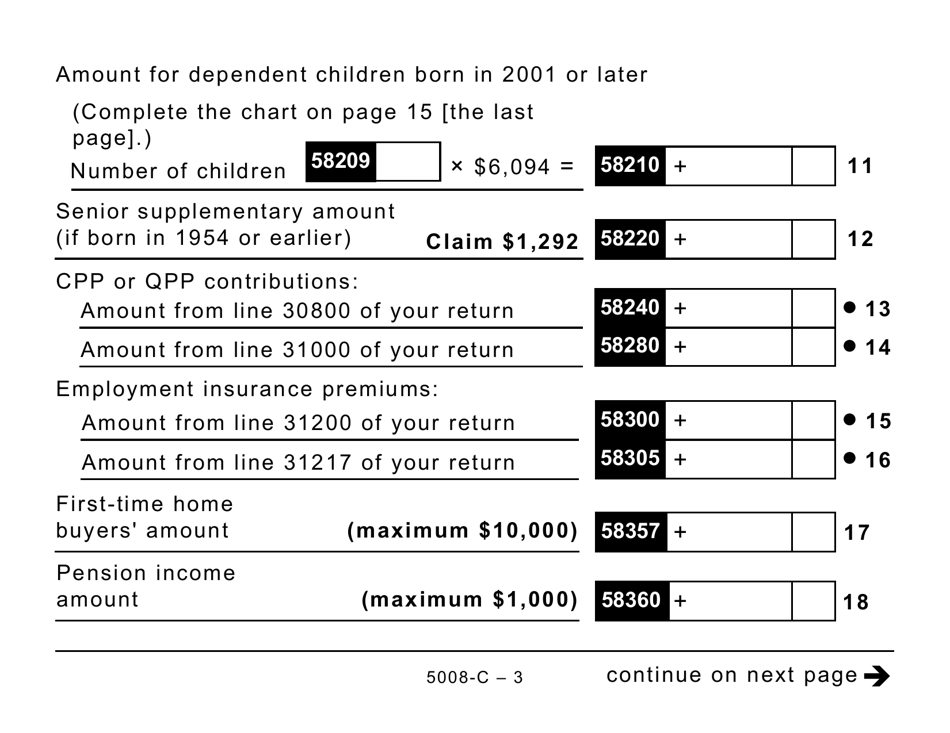

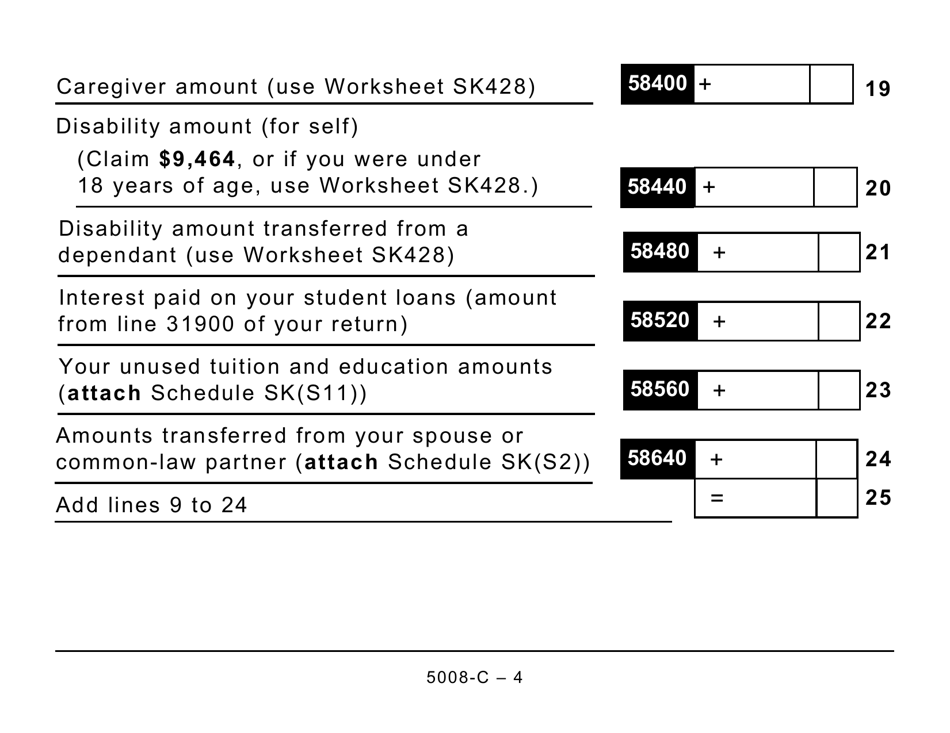

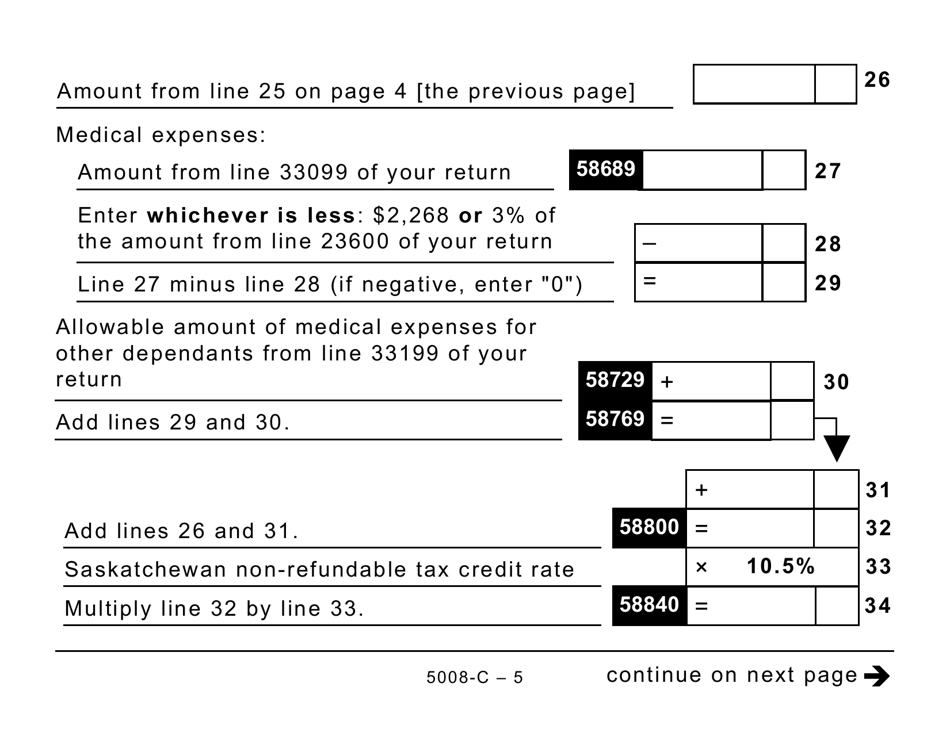

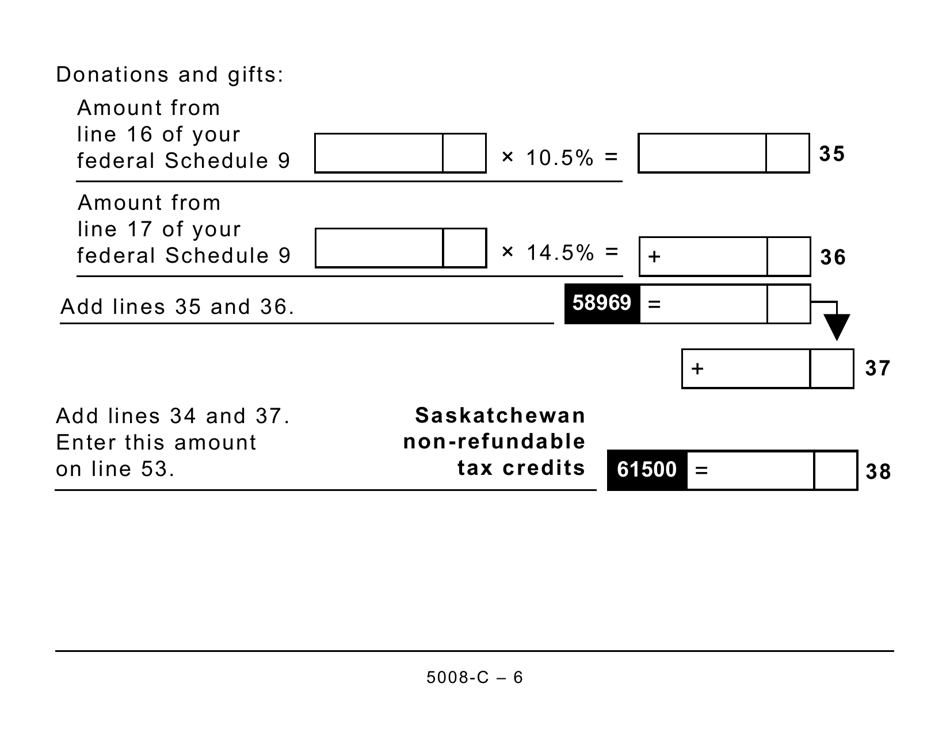

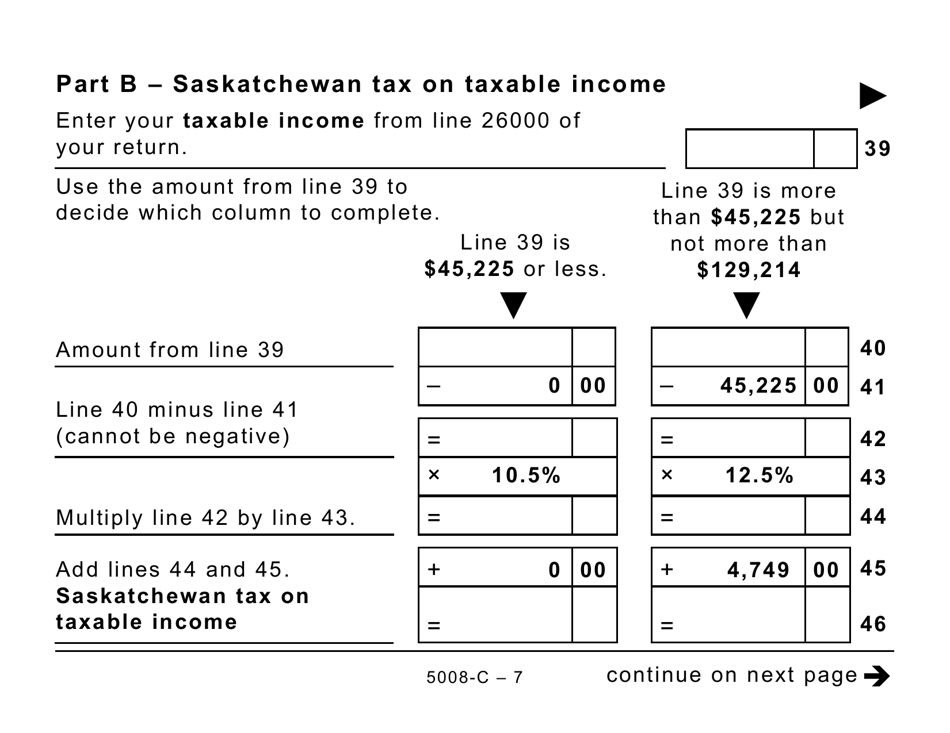

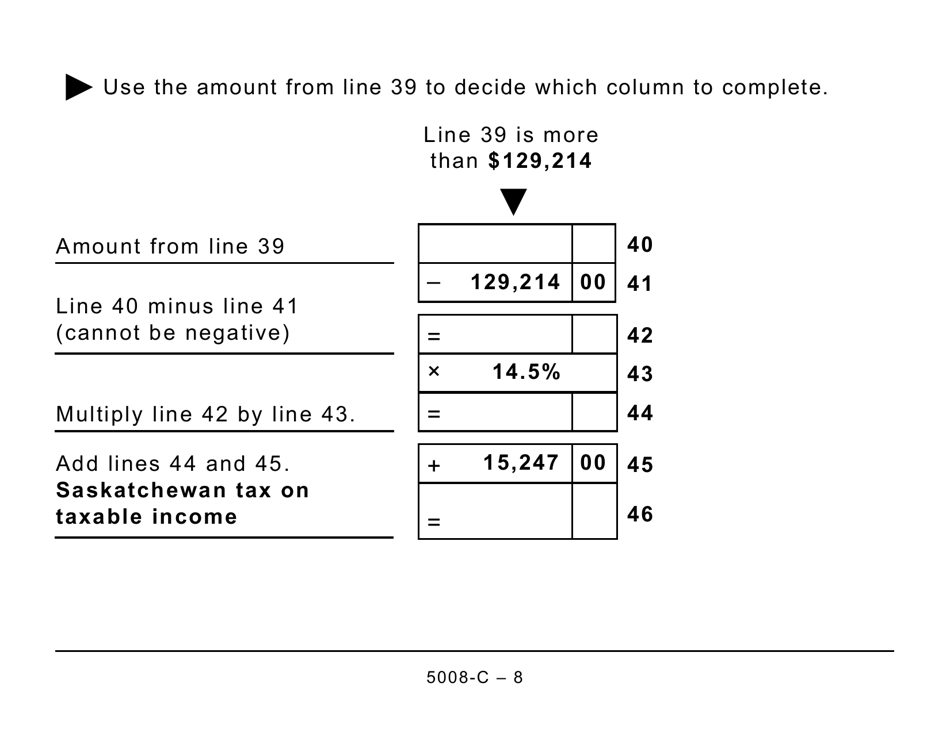

A: Form 5008-C is used to calculate and report your tax liability and claim any applicable tax credits in Saskatchewan.

Q: Is Form 5008-C specific to Saskatchewan?

A: Yes, Form 5008-C is specific to the province of Saskatchewan in Canada.

Q: What is the Large Print version of Form 5008-C?

A: The Large Print version of Form 5008-C is designed for visually impaired individuals.

Q: Can I file Form 5008-C electronically?

A: Yes, you can file Form 5008-C electronically if you have access to the appropriate software.

Q: Who is required to file Form 5008-C?

A: Residents of Saskatchewan who have income and are eligible for tax credits must file Form 5008-C.

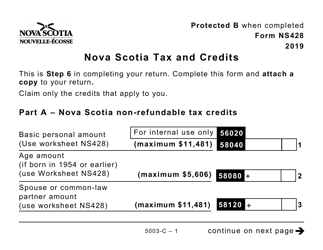

Q: What are some common tax credits available on Form 5008-C?

A: Some common tax credits available on Form 5008-C include the Basic Personal Amount, the Age Amount, and the Medical Expense Tax Credit.