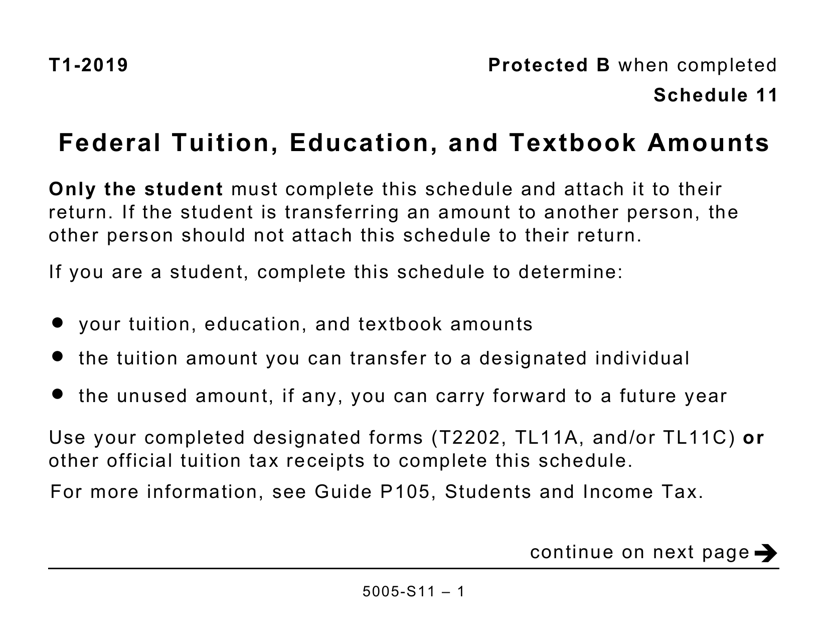

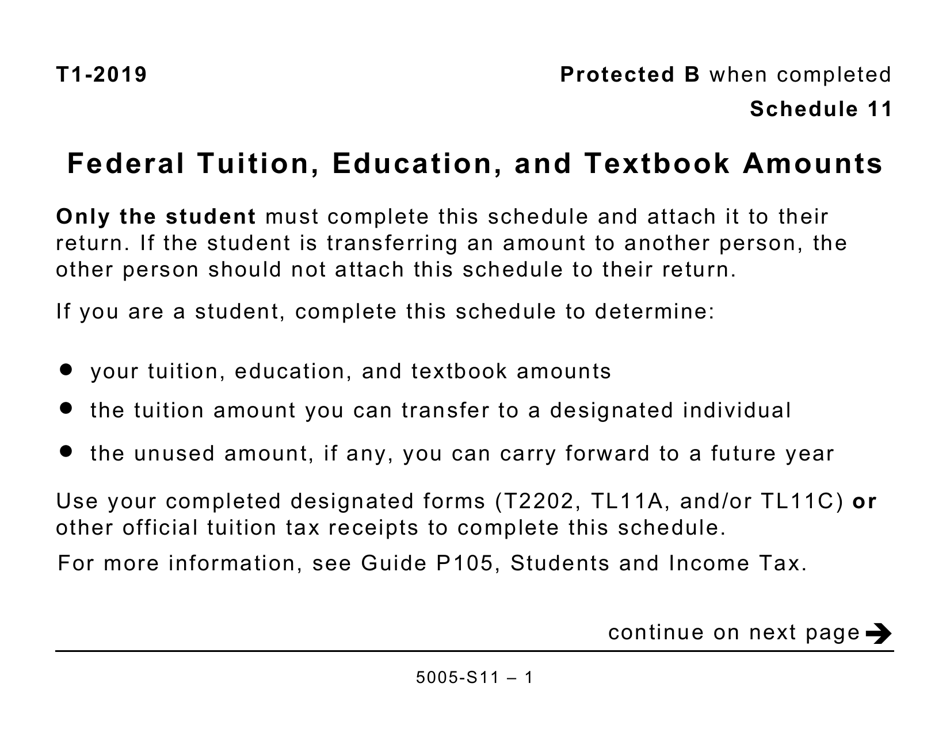

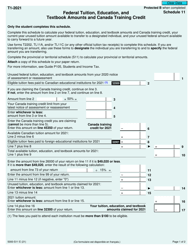

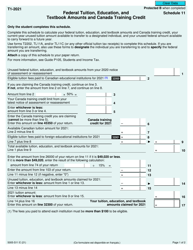

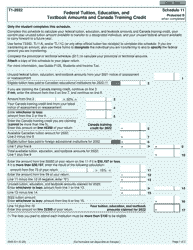

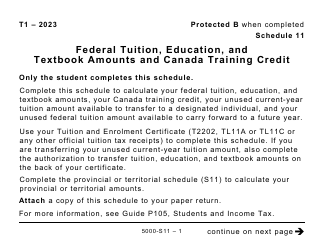

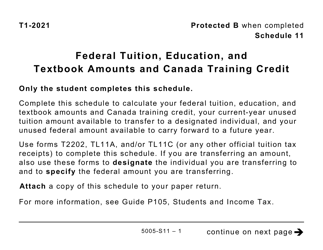

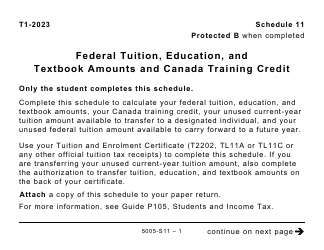

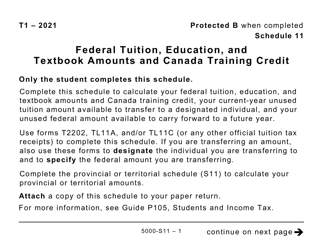

Form 5005-S11 Schedule 11 Federal Tuition, Education, and Textbook Amounts (Large Print) - Canada

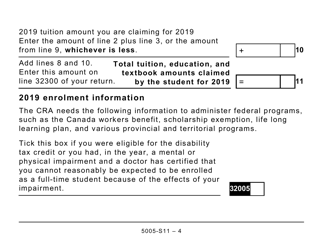

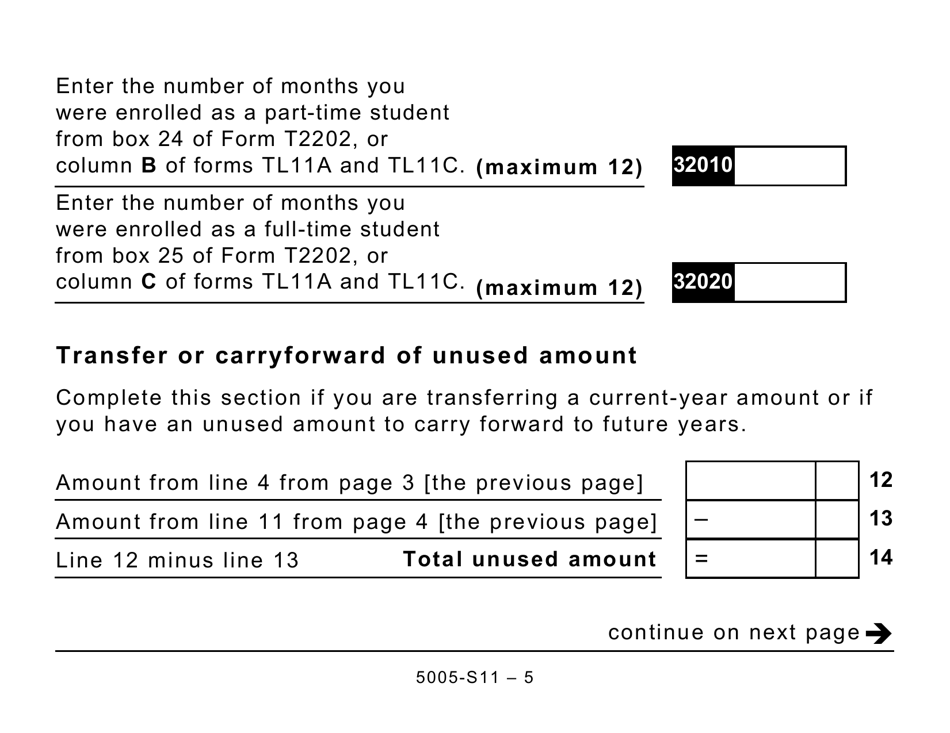

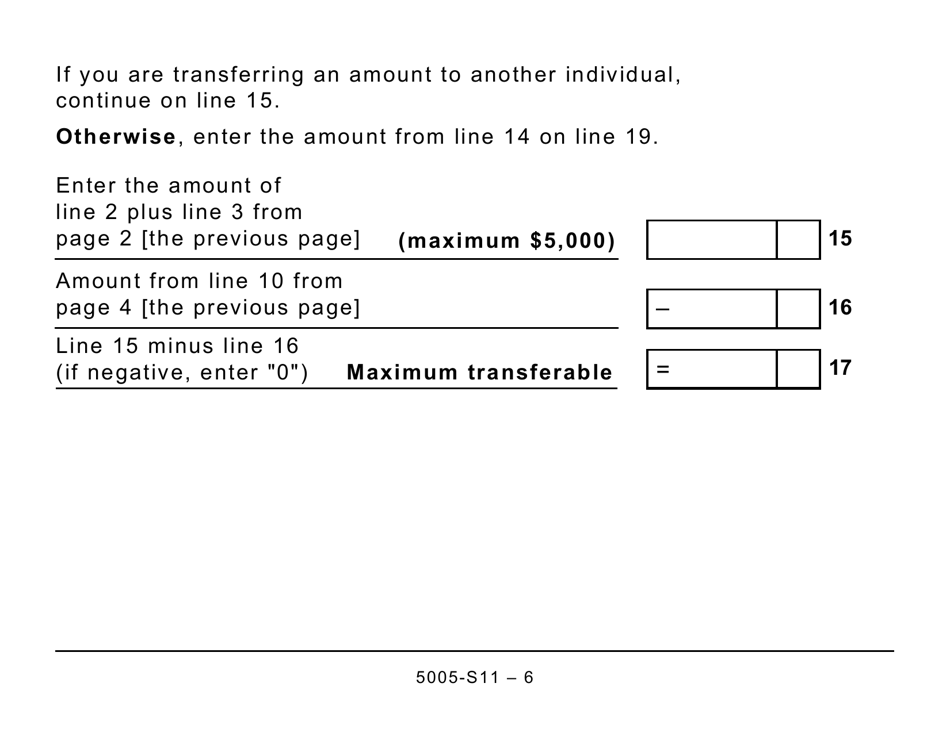

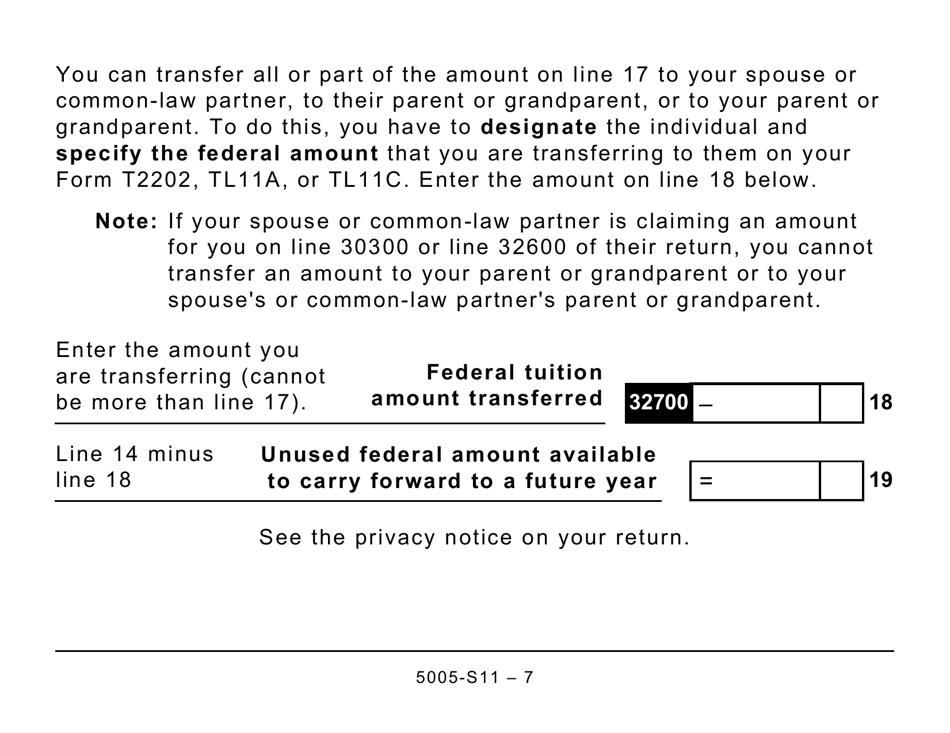

Form 5005-S11 Schedule 11 Federal Tuition, Education, and Textbook Amounts (Large Print) in Canada is used for claiming federal tax credits related to tuition, education, and textbook expenses.

FAQ

Q: What is Form 5005-S11?

A: Form 5005-S11 is a schedule used in Canada to claim federal tuition, education, and textbook amounts.

Q: What does Schedule 11 refer to?

A: Schedule 11 refers to the federal tuition, education, and textbook amounts.

Q: Who can use Form 5005-S11?

A: Canadian residents who have eligible tuition, education, and textbook amounts can use Form 5005-S11.

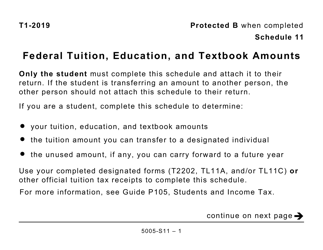

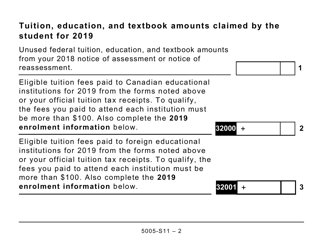

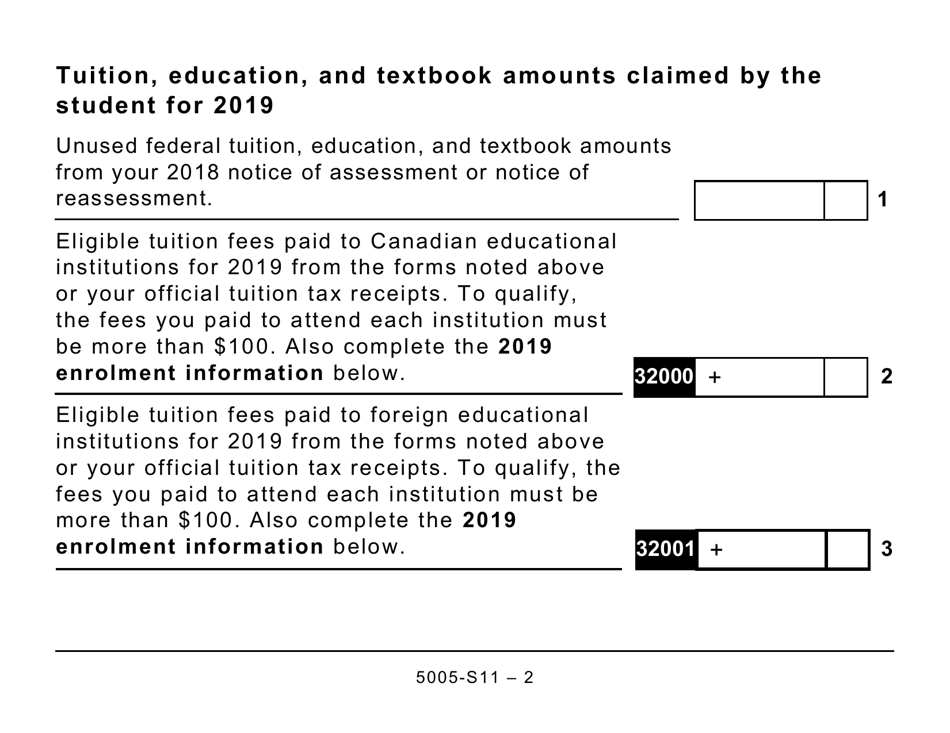

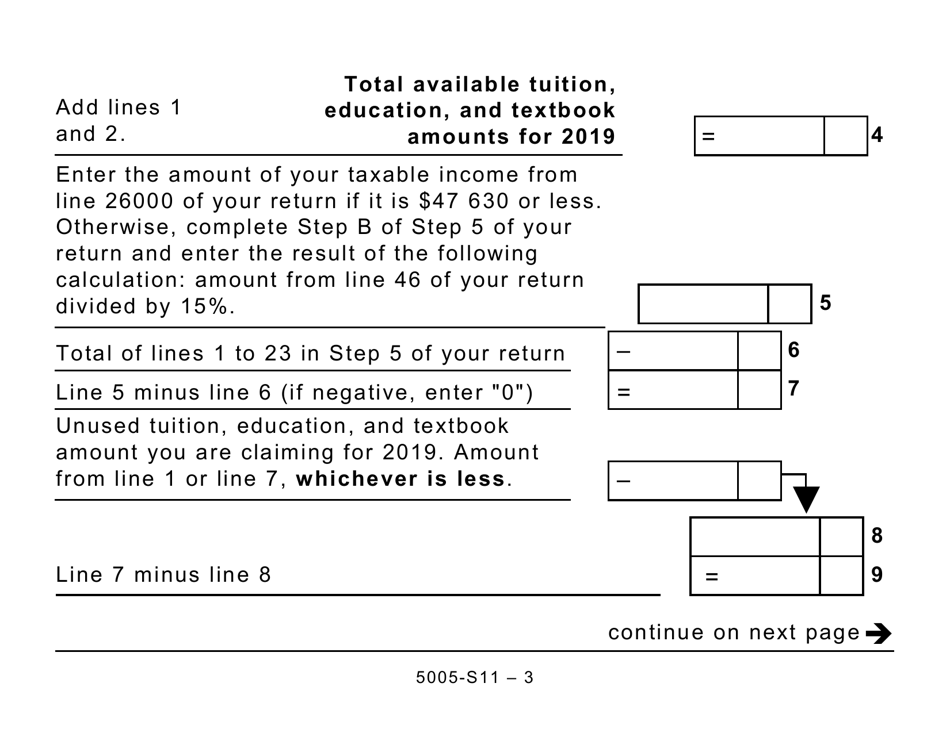

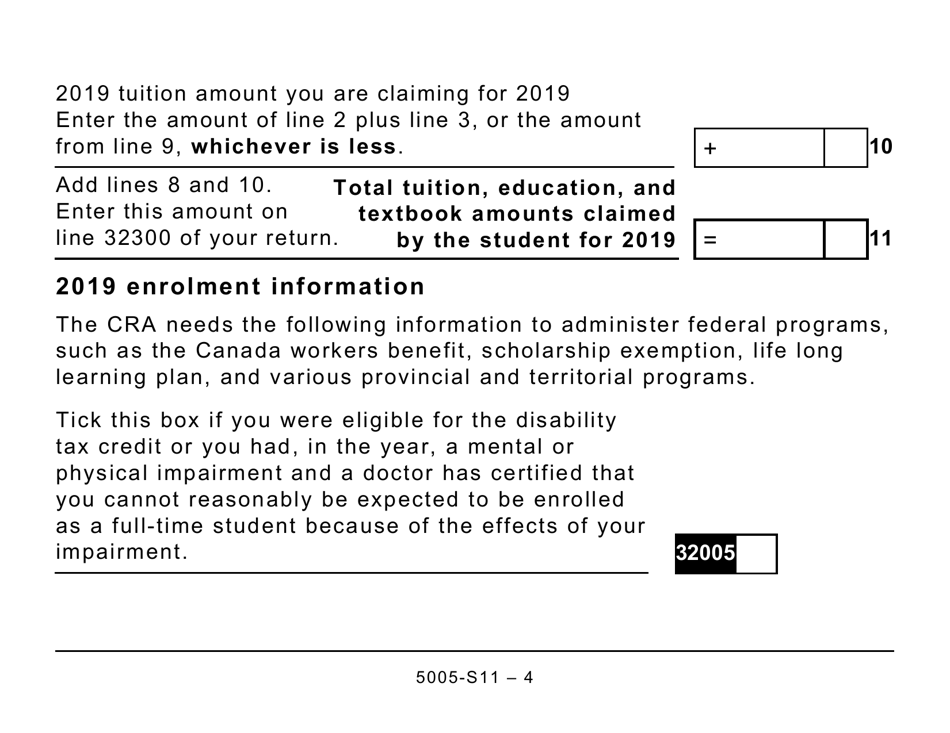

Q: What can be claimed on Schedule 11?

A: On Schedule 11, you can claim tuition fees, education amounts, and textbook amounts.

Q: Why is Schedule 11 important?

A: Schedule 11 allows you to claim tax credits for tuition, education, and textbooks, which can help reduce your taxes owed.

Q: When should I file Form 5005-S11?

A: Form 5005-S11 should be filed along with your Canadian income tax return for the applicable tax year.

Q: Are there any eligibility criteria to use Schedule 11?

A: Yes, there are specific eligibility criteria that need to be met in order to use Schedule 11. These criteria include being enrolled in a qualifying educational program and having eligible tuition fees.

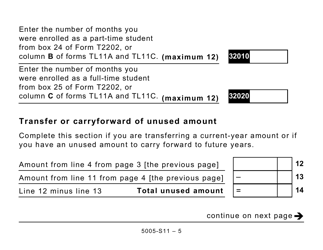

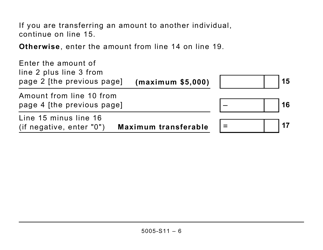

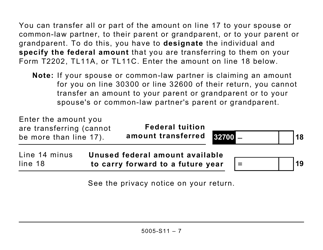

Q: Can I carry forward unused amounts from previous years?

A: Yes, unused tuition, education, and textbook amounts can be carried forward and claimed in future years.

Q: Is there a deadline to claim these amounts?

A: Generally, the deadline to claim tuition, education, and textbook amounts is within four years from the end of the tax year to which they relate.