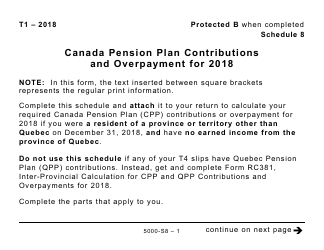

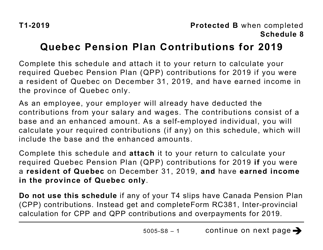

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5005-S8 Schedule 8

for the current year.

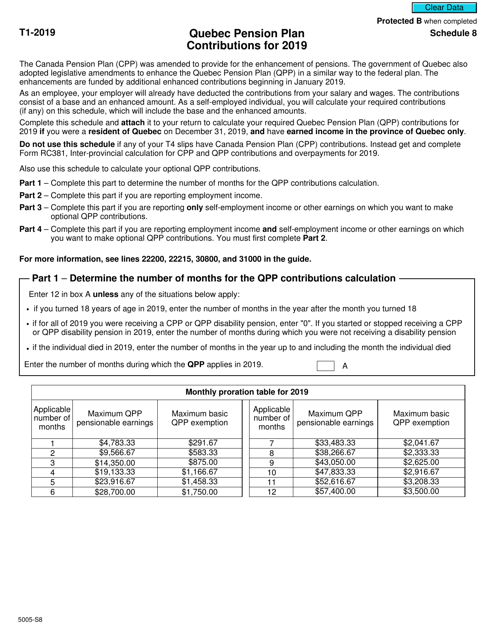

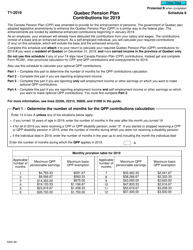

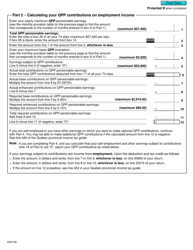

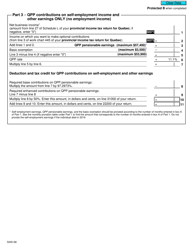

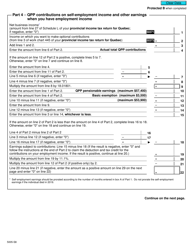

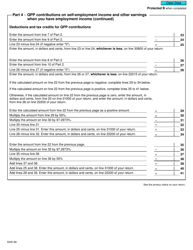

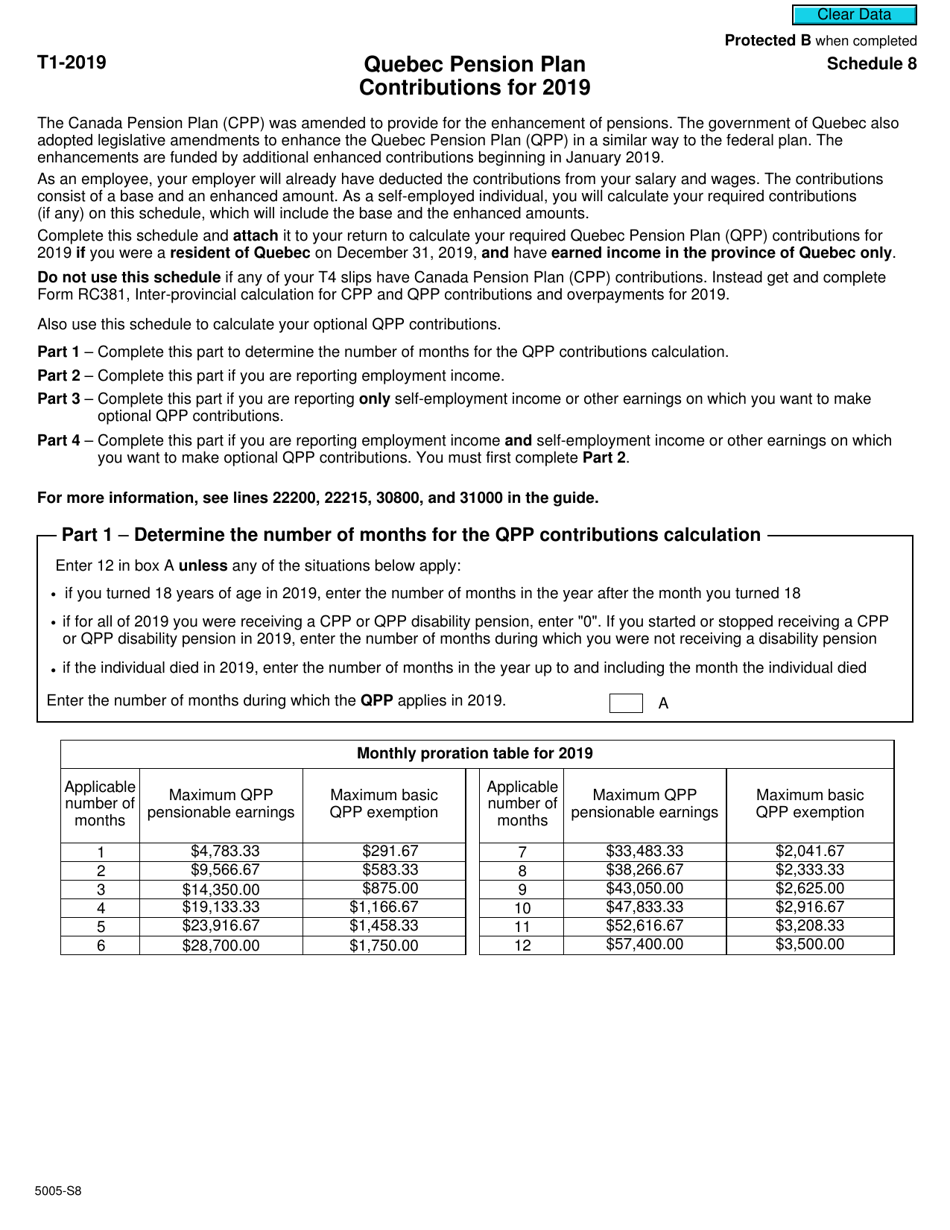

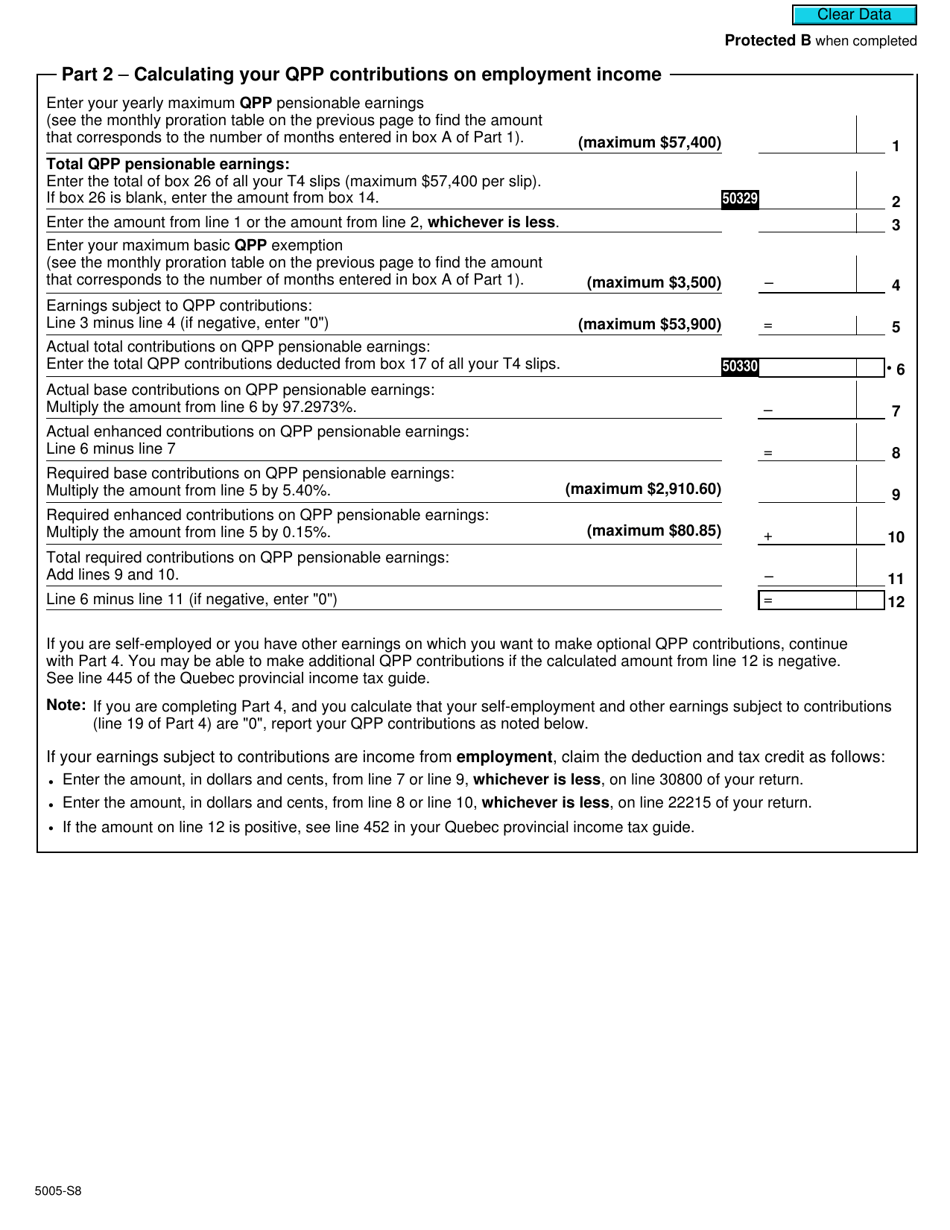

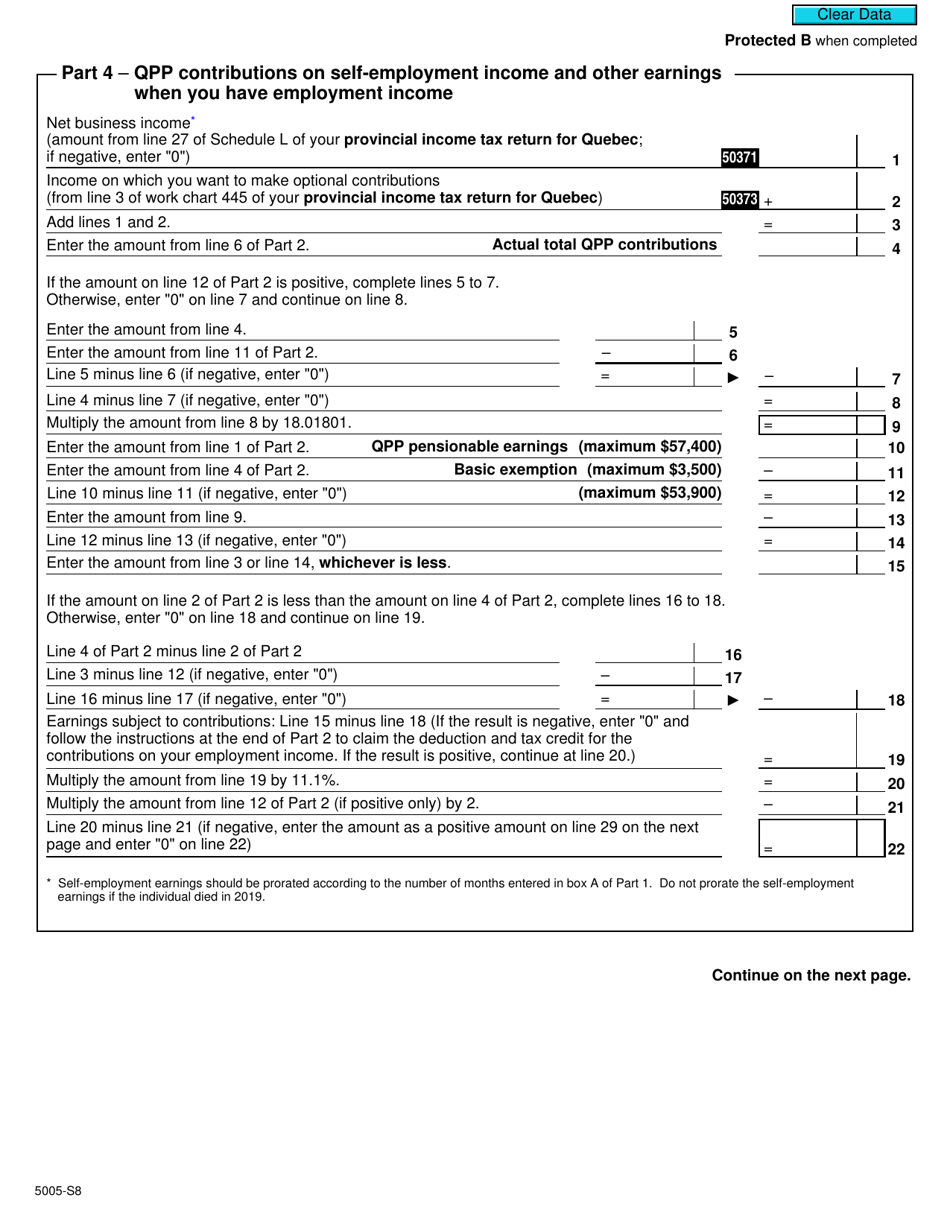

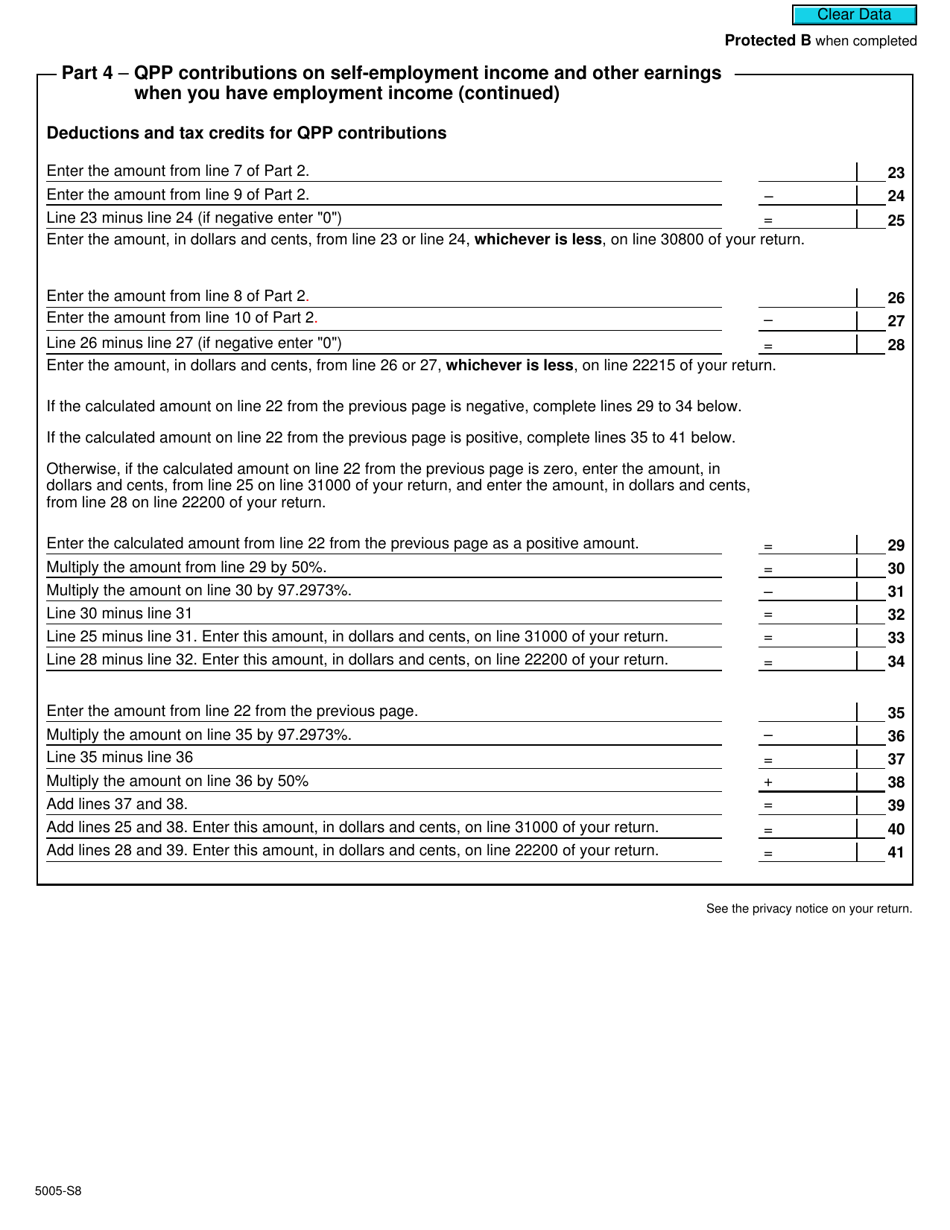

Form 5005-S8 Schedule 8 Quebec Pension Plan Contributions - Canada

Form 5005-S8 Schedule 8 Quebec Pension Plan Contributions is used in Canada to report contributions made to the Quebec Pension Plan. It is for individuals who reside in the province of Quebec and are required to make contributions to the plan.

The Form 5005-S8 Schedule 8 Quebec Pension Plan Contributions - Canada is filed by individuals who are residents of Quebec and have made contributions to the Quebec Pension Plan.

FAQ

Q: What is Form 5005-S8?

A: Form 5005-S8 is a tax form used in Canada to report Quebec Pension Plan (QPP) contributions.

Q: What is Schedule 8?

A: Schedule 8 is a specific section of Form 5005-S8 used to report Quebec Pension Plan (QPP) contributions.

Q: What are Quebec Pension Plan (QPP) contributions?

A: Quebec Pension Plan (QPP) contributions are payments made by individuals and employers in Quebec to fund the provincial retirement pension plan.

Q: Who needs to file Form 5005-S8?

A: Residents of Quebec who have made Quebec Pension Plan (QPP) contributions during the tax year need to file Form 5005-S8 along with their income tax return.

Q: When is the deadline to file Form 5005-S8?

A: The deadline to file Form 5005-S8 is usually April 30th of the following year, or June 15th if you or your spouse or common-law partner is self-employed.

Q: What happens if I don't file Form 5005-S8?

A: If you are required to file Form 5005-S8 and fail to do so, you may face penalties and interest charges from the Canada Revenue Agency.

Q: Can I file Form 5005-S8 electronically?

A: Yes, you can file Form 5005-S8 electronically using NETFILE or EFILE, or by using certified tax software.

Q: What should I do with Form 5005-S8 after filing?

A: After filing Form 5005-S8, you should keep a copy for your records and any supporting documentation that may be required.