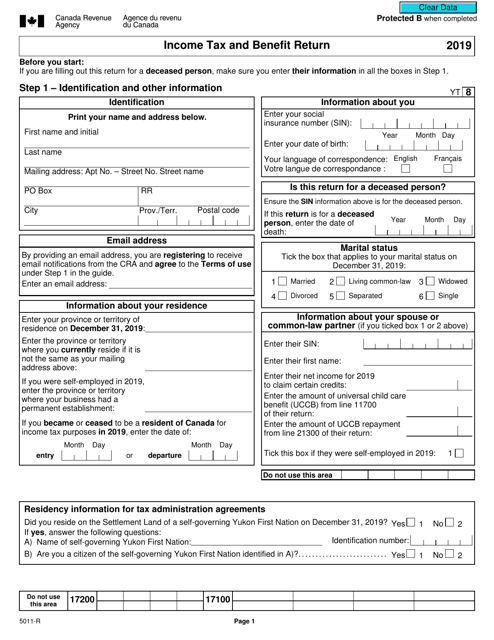

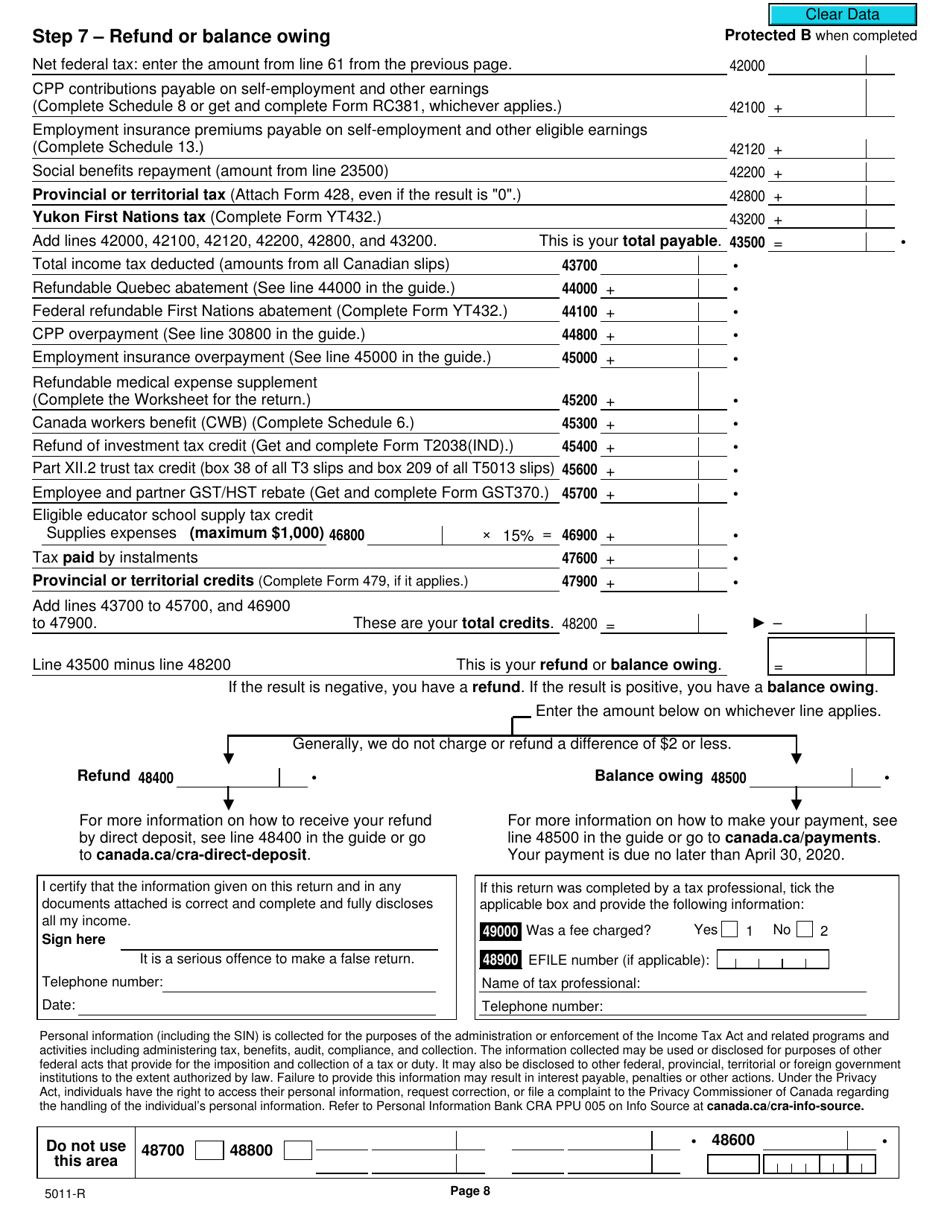

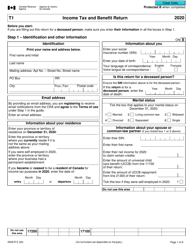

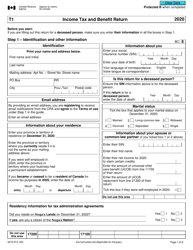

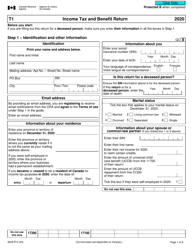

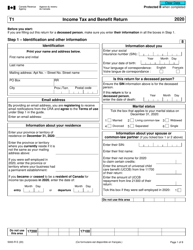

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5011-R

for the current year.

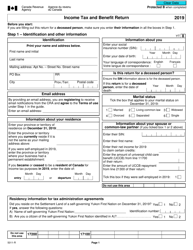

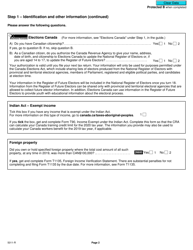

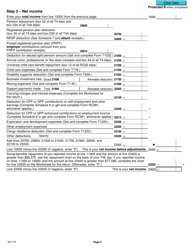

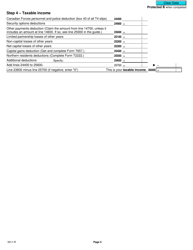

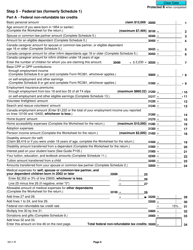

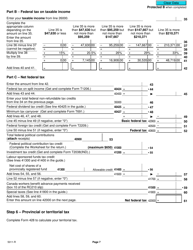

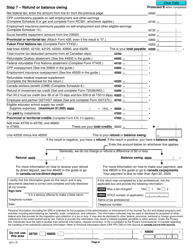

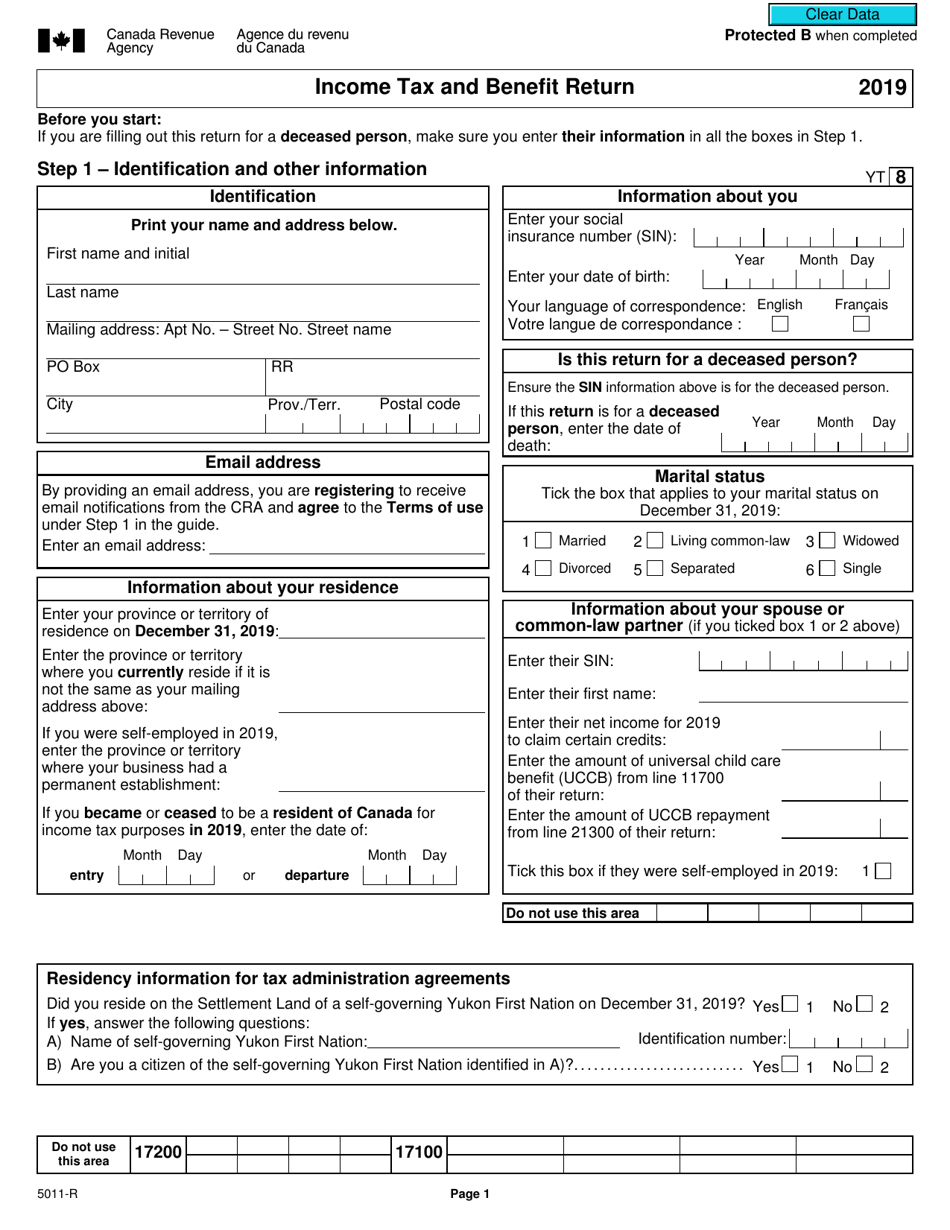

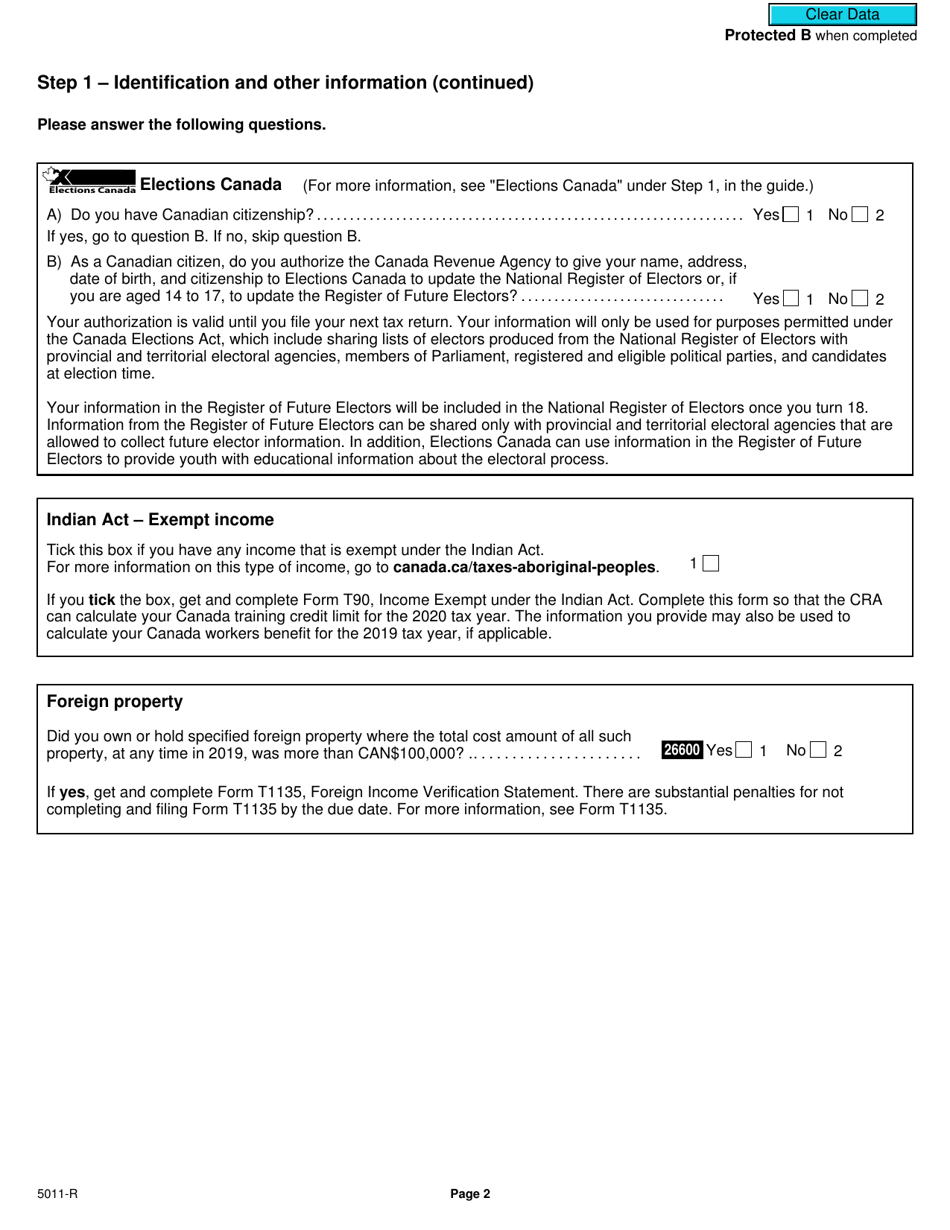

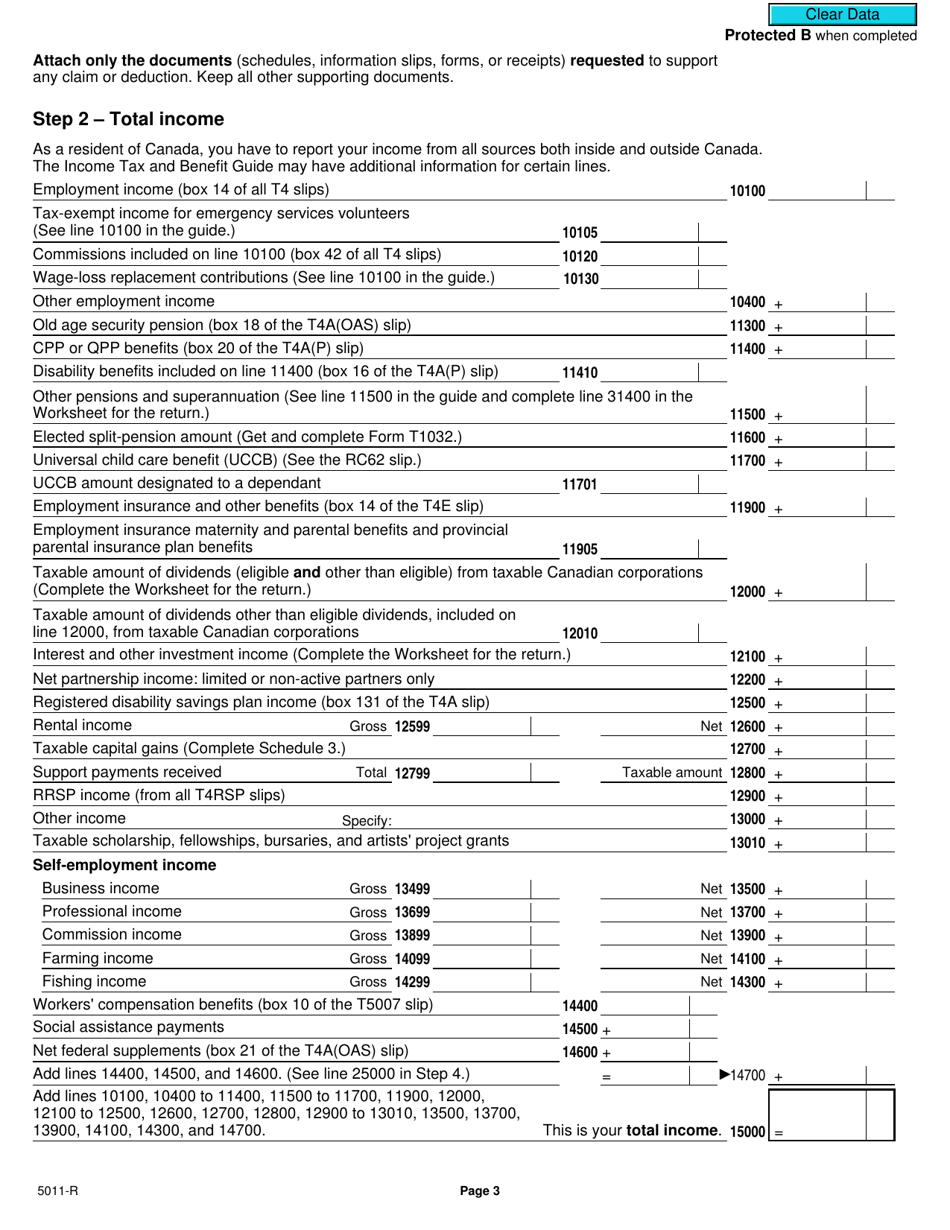

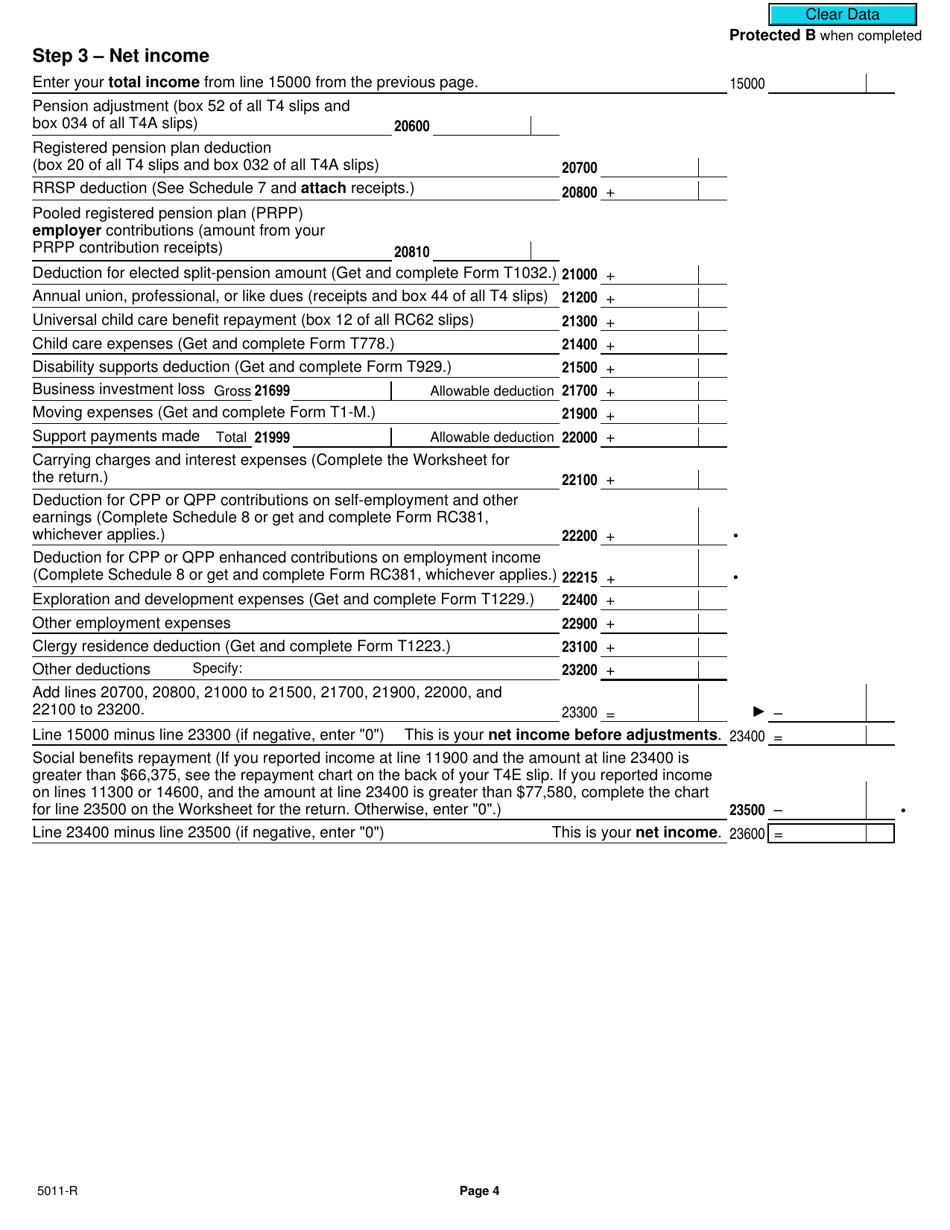

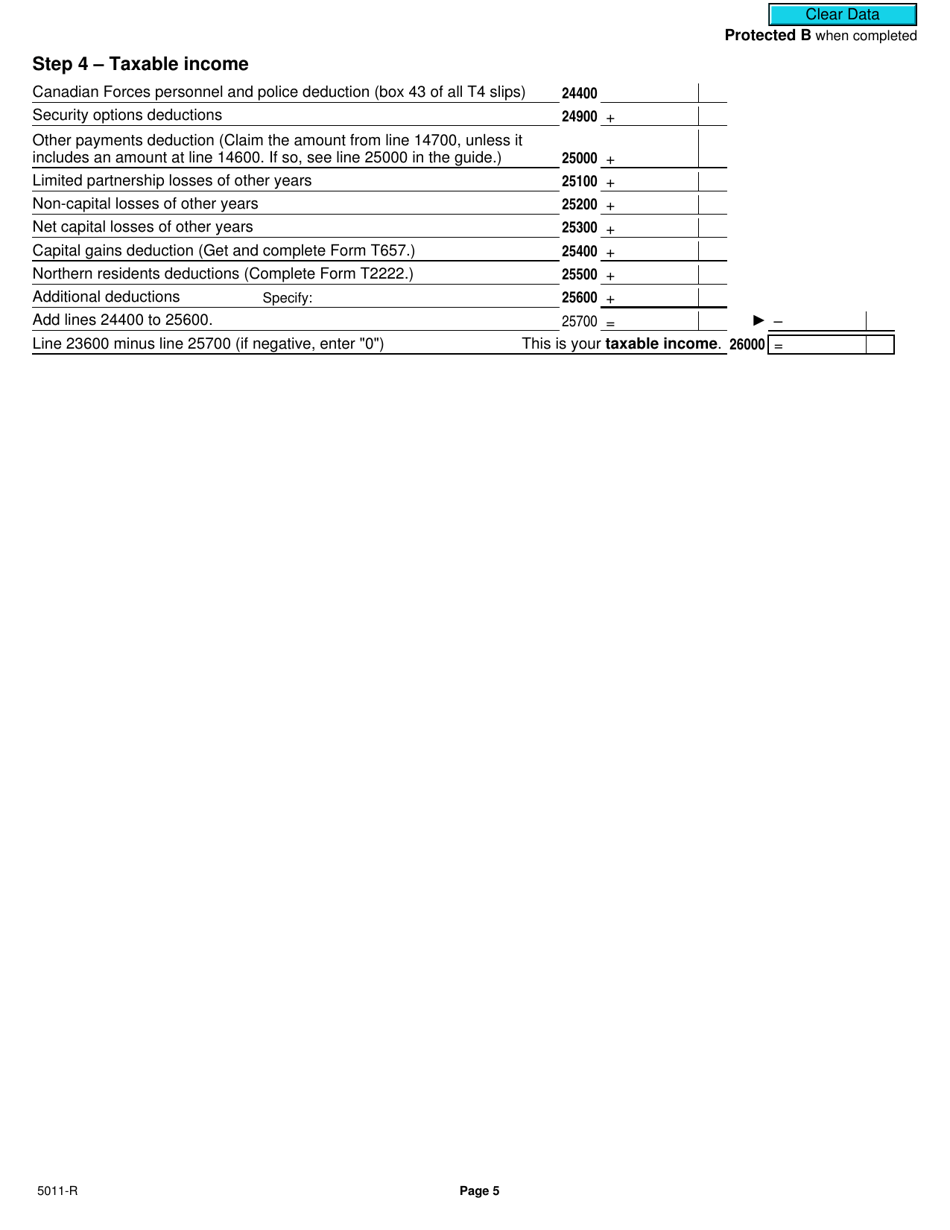

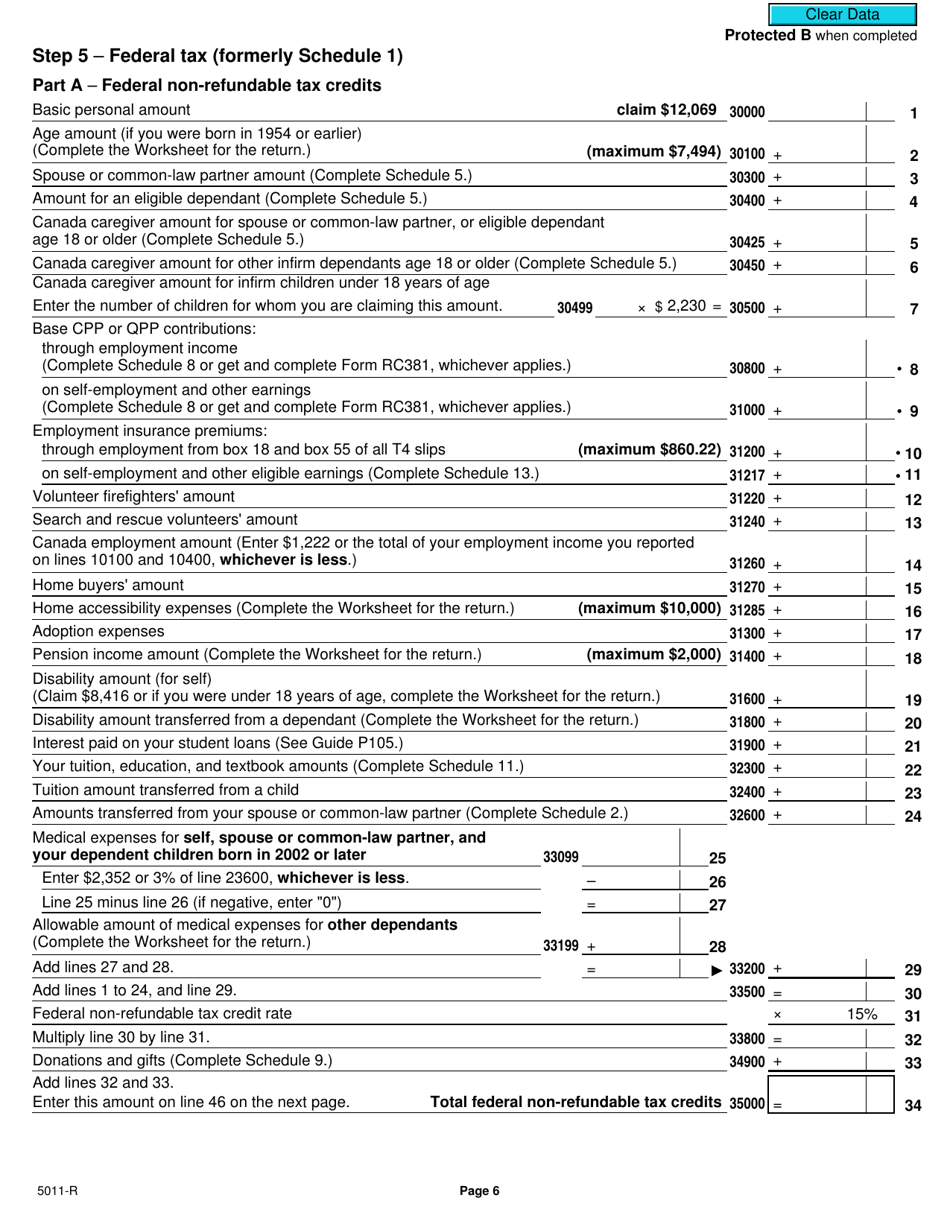

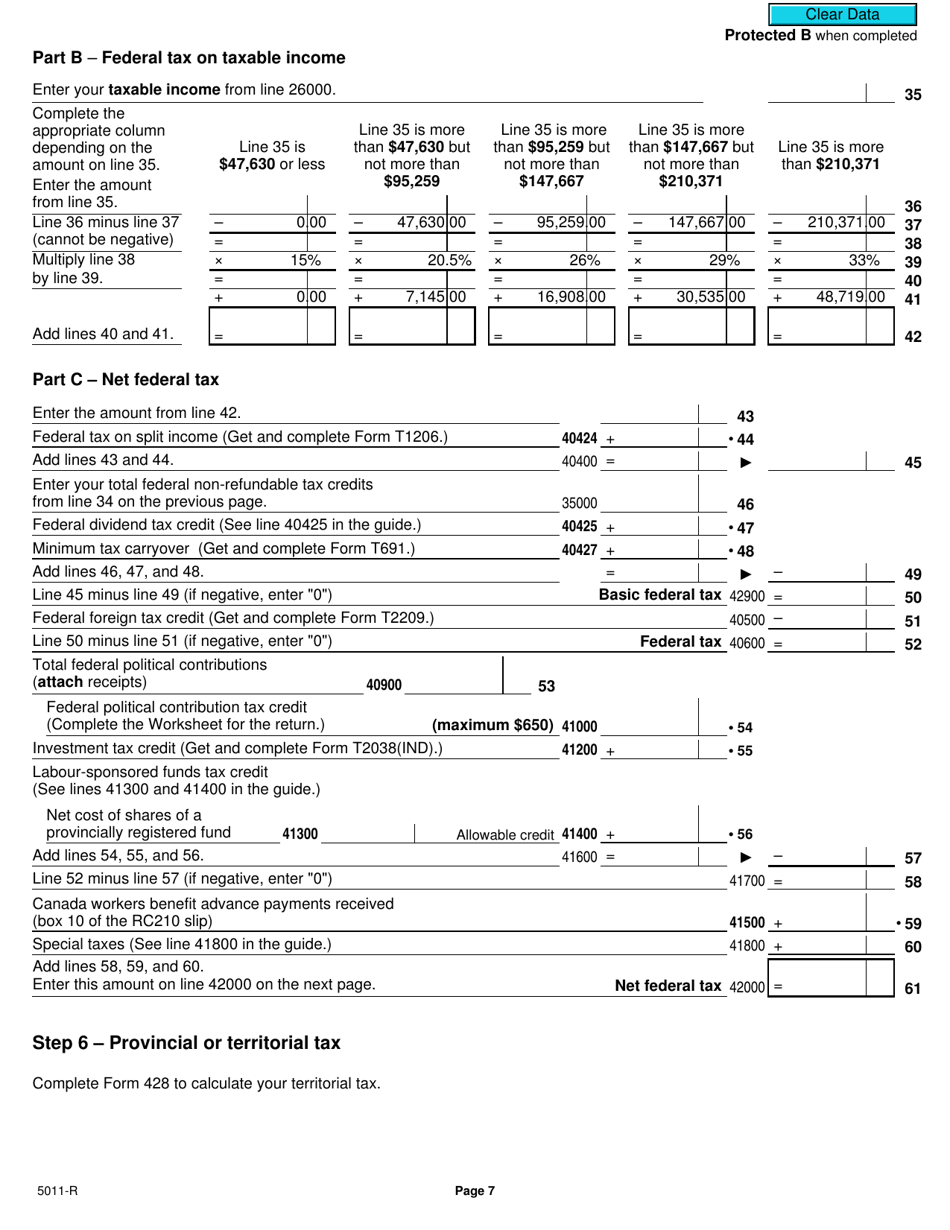

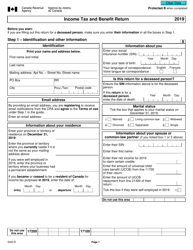

Form 5011-R Income Tax and Benefit Return - Canada

Form 5011-R Income Tax and Benefit Return in Canada is used to report your income and claim benefits and deductions for the tax year. It is the form that Canadian residents use to file their personal income tax return with the Canada Revenue Agency (CRA).

Individuals who are residents of Canada and need to report their income and claim certain benefits file the Form 5011-R Income Tax and Benefit Return.

FAQ

Q: What is Form 5011-R?

A: Form 5011-R is the Income Tax and Benefit Return form used in Canada.

Q: Who needs to file Form 5011-R?

A: All Canadian residents who owe taxes or want to claim a refund must file Form 5011-R.

Q: What information is required on Form 5011-R?

A: Form 5011-R requires information about your income, deductions, credits, and personal details.

Q: When is the deadline to file Form 5011-R?

A: The deadline to file Form 5011-R is April 30th, unless you or your spouse or common-law partner are self-employed, in which case the deadline is June 15th.

Q: What happens if I don't file Form 5011-R?

A: If you don't file Form 5011-R, you may face penalties and interest charges from the Canada Revenue Agency.

Q: Can I get help in filling out Form 5011-R?

A: Yes, you can get help in filling out Form 5011-R by contacting the Canada Revenue Agency or seeking assistance from a tax professional.

Q: Can I file Form 5011-R on behalf of someone else?

A: Yes, if you have proper authorization, you can file Form 5011-R on behalf of someone else, such as a family member or a client.

Q: What should I do after filing Form 5011-R?

A: After filing Form 5011-R, make sure to keep a copy of your return and any related documents for your records.