Form 5008-S14 Schedule 14 Climate Action Incentive - Saskatchewan (Large Print) - Canada

Form 5008-S14 Schedule 14 Climate Action Incentive - Saskatchewan (Large Print) is a document used in Canada for reporting and claiming the Climate Action Incentive. It specifically applies to residents of Saskatchewan and provides information on the incentives and benefits available for taking climate action.

The form 5008-S14 Schedule 14 Climate Action Incentive - Saskatchewan (Large Print) in Canada is typically filed by individuals or businesses who are eligible for the Climate Action Incentive in Saskatchewan.

FAQ

Q: What is Form 5008-S14?

A: Form 5008-S14 is a tax form used in Canada.

Q: What is Schedule 14?

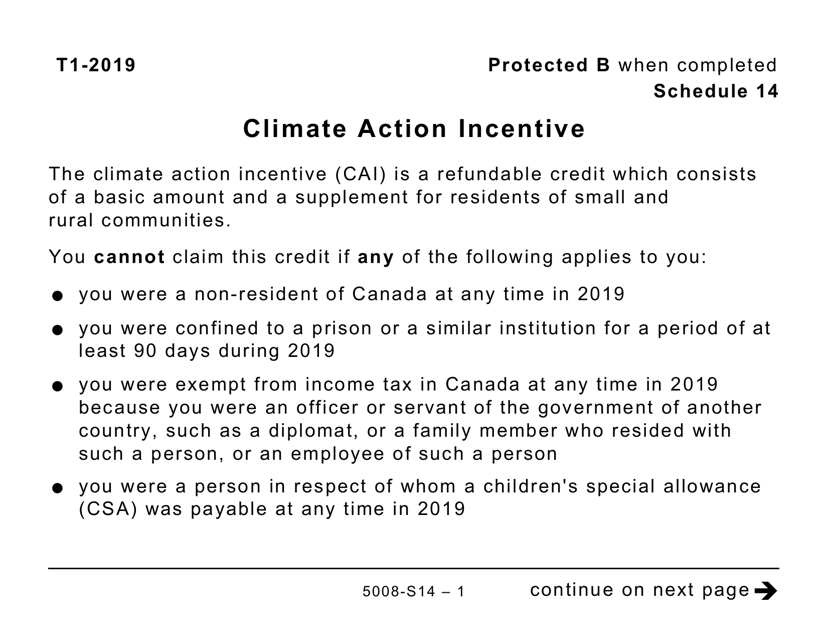

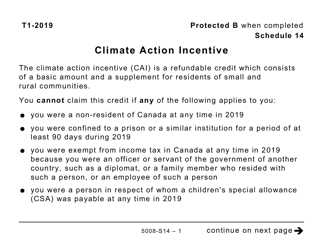

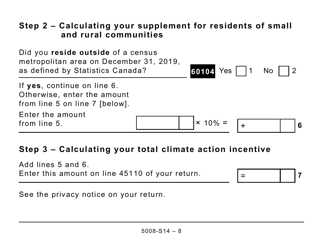

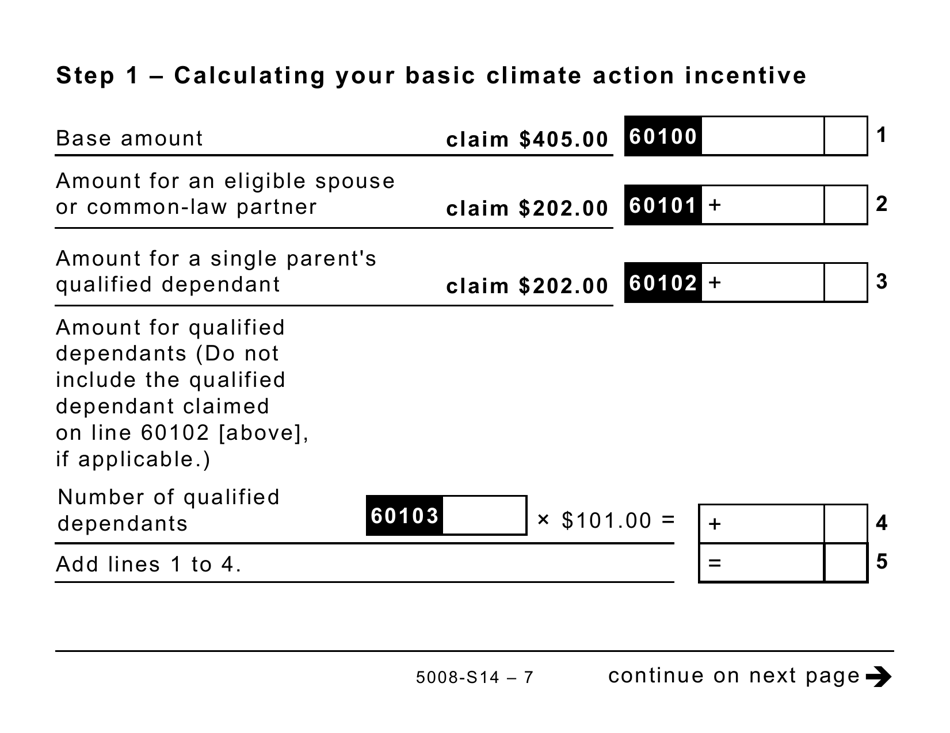

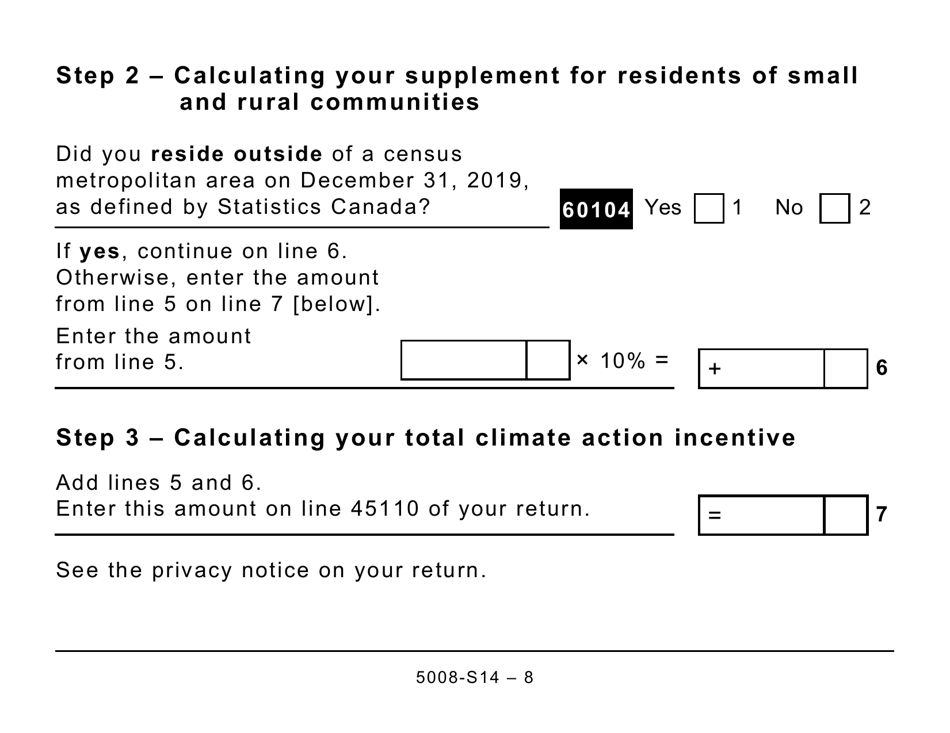

A: Schedule 14 is a form used to claim the Climate Action Incentive in Saskatchewan.

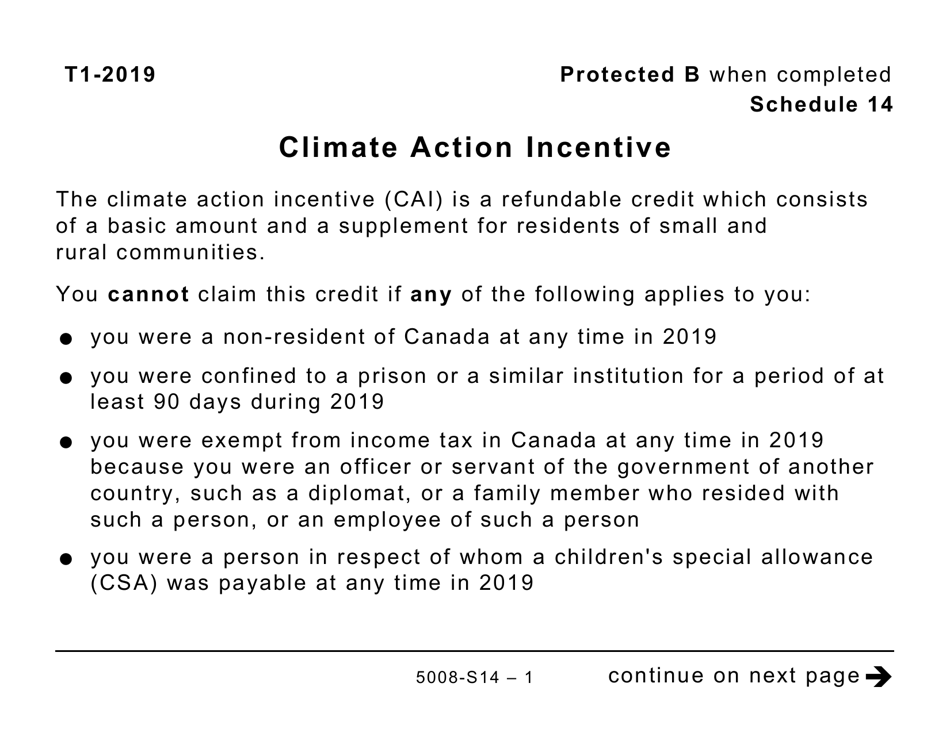

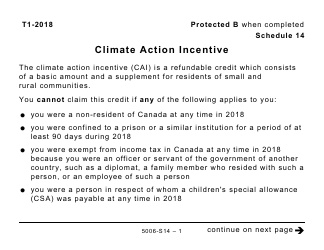

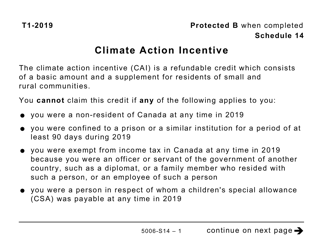

Q: What is the Climate Action Incentive?

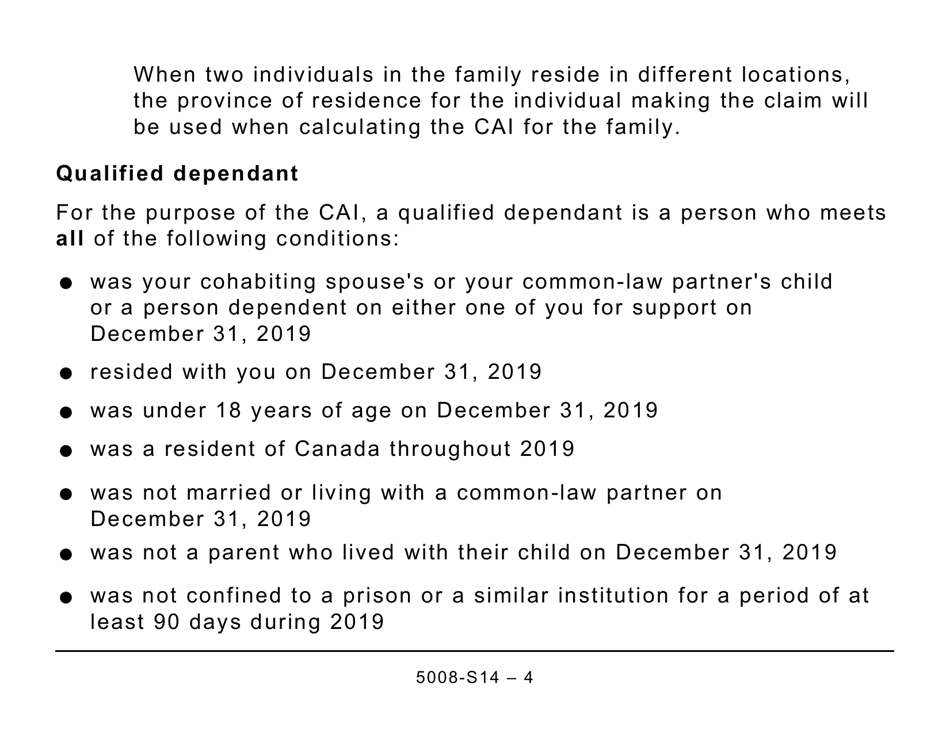

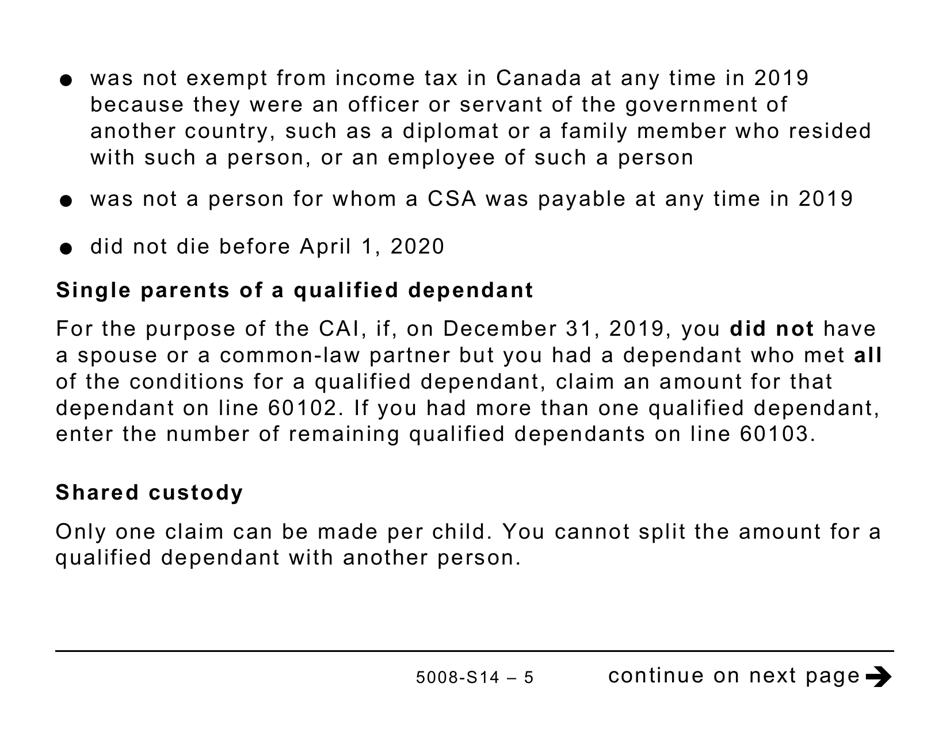

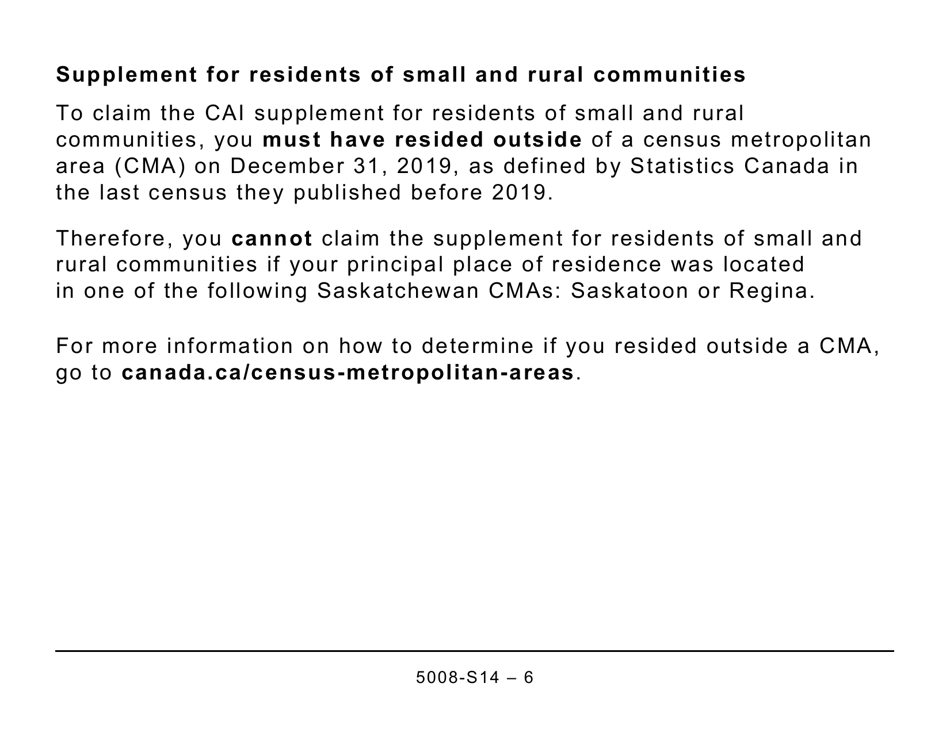

A: The Climate Action Incentive is a tax credit available to residents of Saskatchewan.

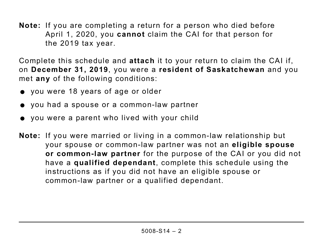

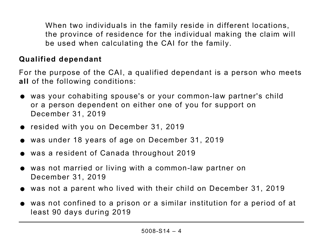

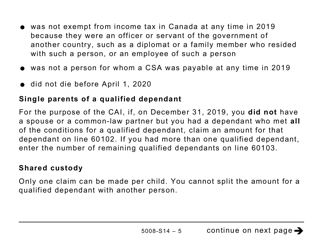

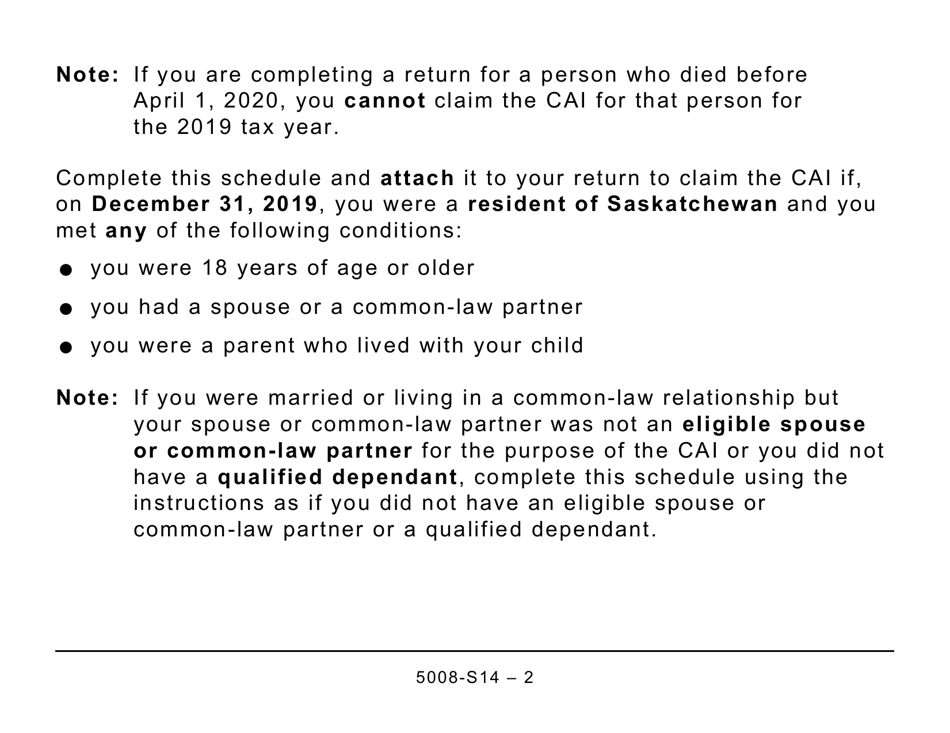

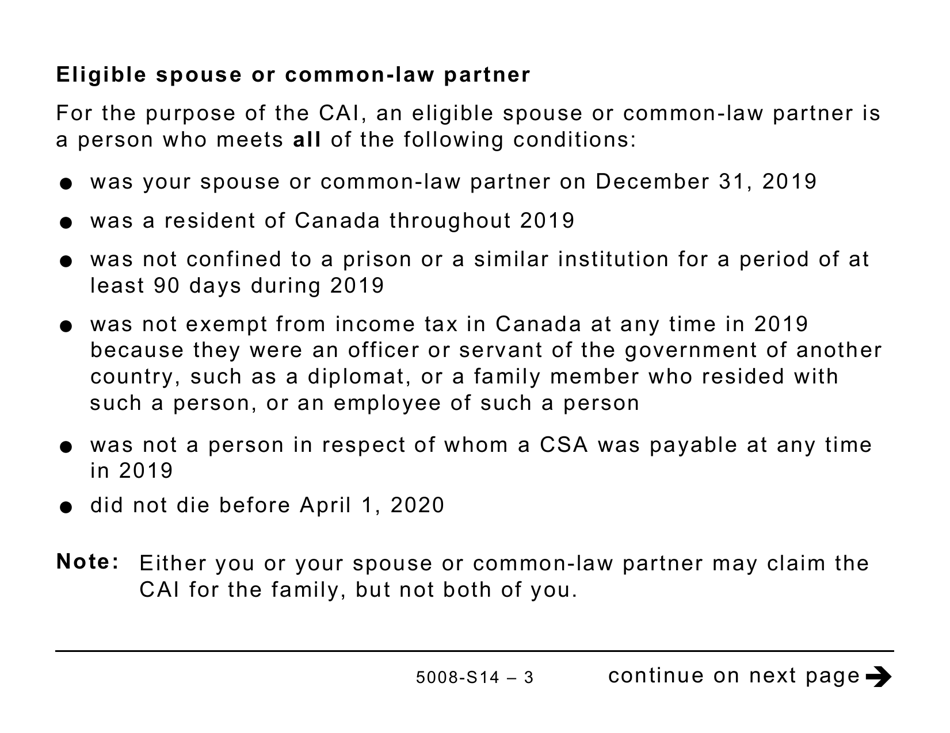

Q: Who is eligible for the Climate Action Incentive?

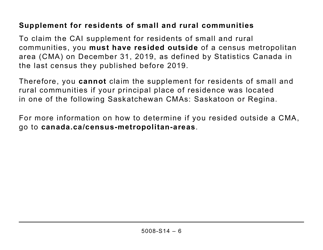

A: Residents of Saskatchewan who meet certain criteria are eligible for the Climate Action Incentive.

Q: What is the purpose of the Climate Action Incentive?

A: The purpose of the Climate Action Incentive is to encourage individuals to take actions to reduce greenhouse gas emissions and combat climate change.

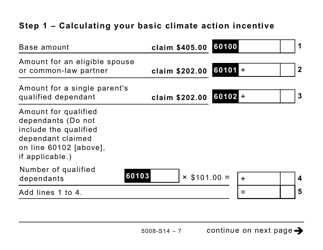

Q: How do I claim the Climate Action Incentive?

A: To claim the Climate Action Incentive, you need to complete Schedule 14 on your tax return.

Q: Is Form 5008-S14 available in large print?

A: Yes, Form 5008-S14 is available in large print for individuals who may have visual impairments.

Q: What happens if I don't claim the Climate Action Incentive?

A: If you are eligible for the Climate Action Incentive but do not claim it, you will miss out on potential tax savings.