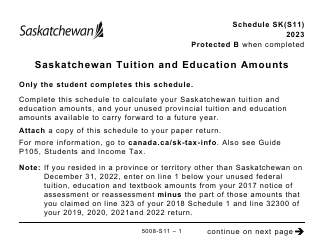

Form 5008-S11 Schedule SK(S11) Provincial Tuition and Education Amounts - Saskatchewan (Large Print) - Canada

Form 5008-S11 Schedule SK(S11) Provincial Tuition and Education Amounts - Saskatchewan (Large Print) - Canada is for claiming tuition and education amounts for the province of Saskatchewan. It is used to calculate tax credits for eligible education expenses.

In Canada, the Province of Saskatchewan offers a provincial tuition and education amount for tax purposes. The Form 5008-S11 Schedule SK(S11) is filed by residents of Saskatchewan who are eligible to claim this tax benefit.

FAQ

Q: What is Form 5008-S11?

A: Form 5008-S11 is a schedule for reporting provincial tuition and education amounts in Saskatchewan.

Q: Who needs to use Form 5008-S11?

A: Residents of Saskatchewan who want to claim tuition and education amounts on their tax return need to use this form.

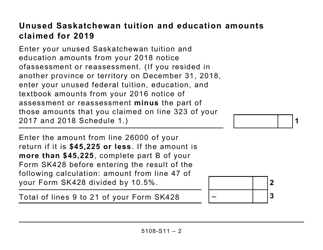

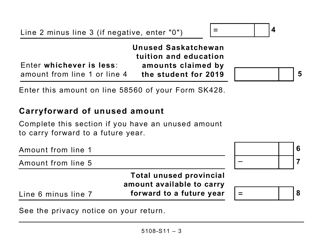

Q: What does the form include?

A: The form includes sections for reporting tuition fees, education amounts, and carryforward amounts.

Q: Is this form specific to Saskatchewan residents only?

A: Yes, this form is only applicable to residents of Saskatchewan.

Q: Is there a large print version of Form 5008-S11 available?

A: Yes, there is a large print version of the form available for individuals who have visual impairments.