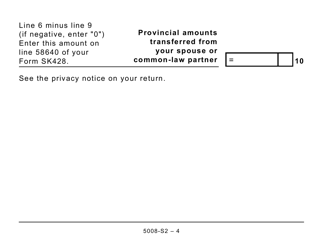

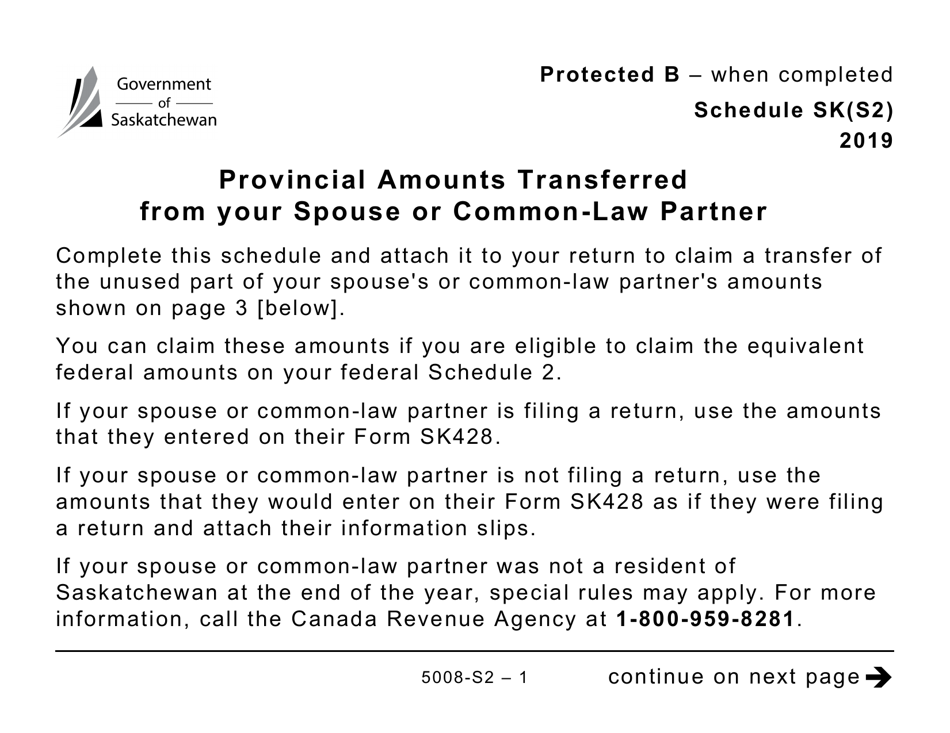

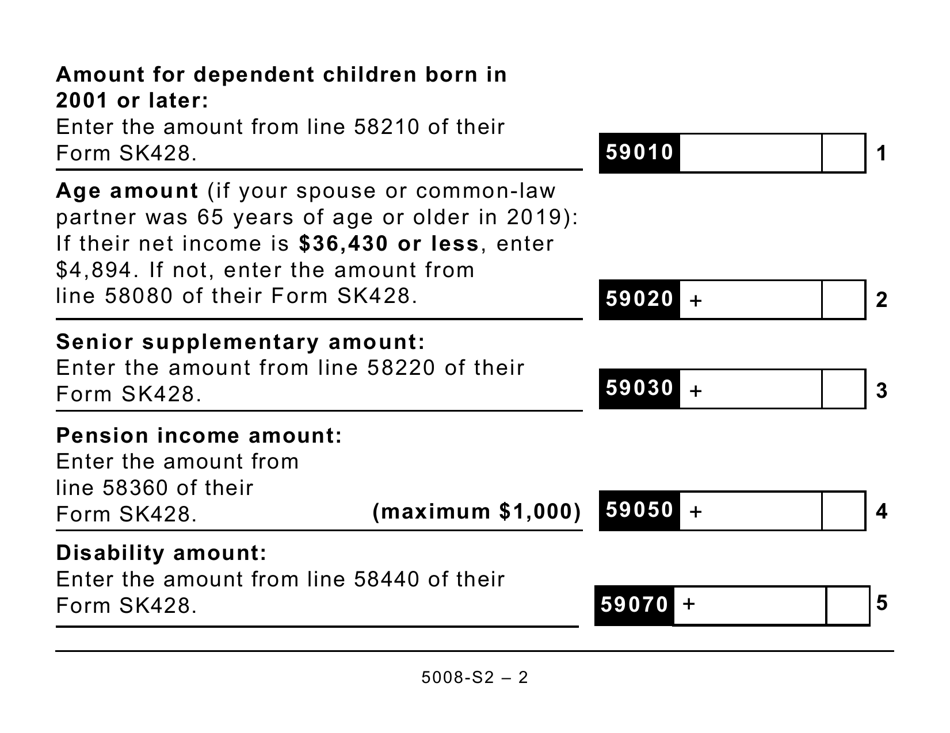

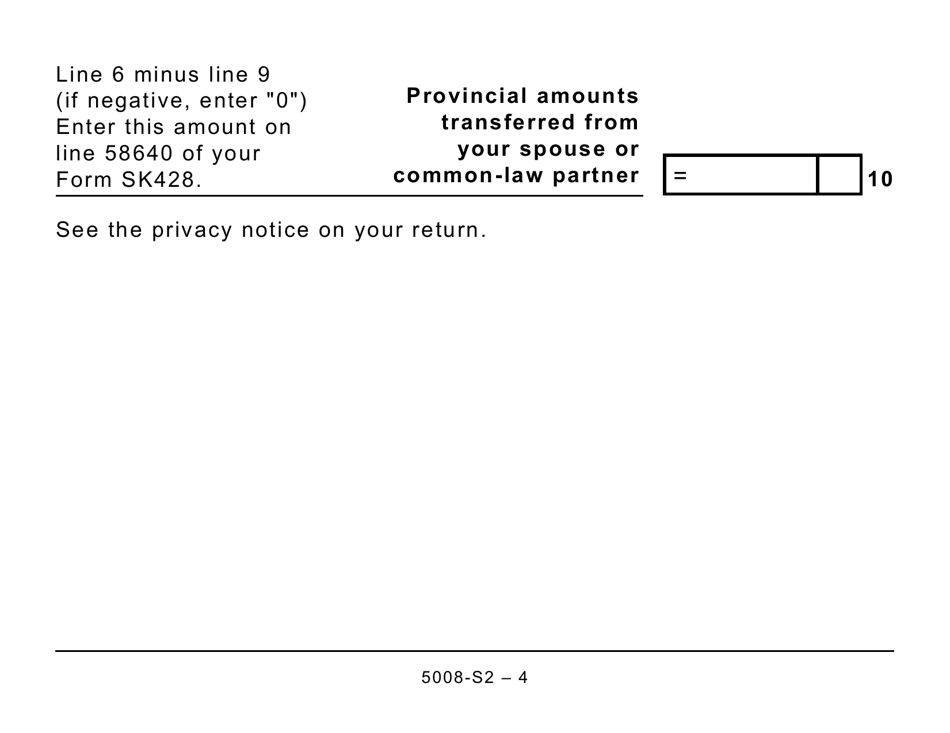

Form 5008-S2 Schedule SK(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner (Large Print) - Canada

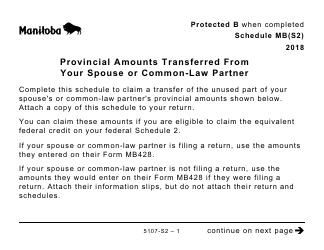

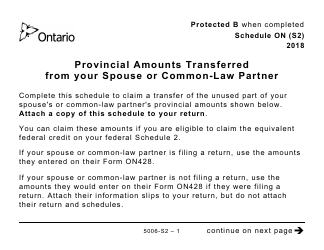

Form 5008-S2 Schedule SK(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner (Large Print) in Canada is used to report the amounts transferred from your spouse or common-law partner for provincial tax purposes. It is specifically designed for individuals with visual impairments as it is in large print format.

The individual who files the Form 5008-S2 Schedule SK(S2) is responsible for reporting the provincial amounts transferred from their spouse or common-law partner in Canada.

FAQ

Q: What is Form 5008-S2?

A: Form 5008-S2 is a schedule used in Canada for reporting provincial amounts transferred from your spouse or common-law partner.

Q: What is Schedule SK(S2)?

A: Schedule SK(S2) is a specific version of Form 5008-S2 used for reporting provincial amounts transferred from your spouse or common-law partner in a large print format.

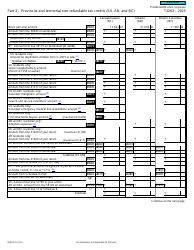

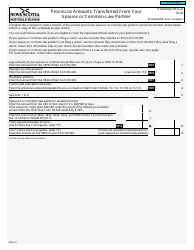

Q: What does Form 5008-S2/Schedule SK(S2) cover?

A: Form 5008-S2/Schedule SK(S2) covers the reporting of provincial amounts transferred from your spouse or common-law partner.

Q: Who needs to use Form 5008-S2/Schedule SK(S2)?

A: Individuals in Canada who have provincial amounts transferred from their spouse or common-law partner need to use Form 5008-S2/Schedule SK(S2).

Q: Is Form 5008-S2/Schedule SK(S2) only for large print?

A: Yes, Schedule SK(S2) is a specific version of Form 5008-S2 that is available in a large print format.

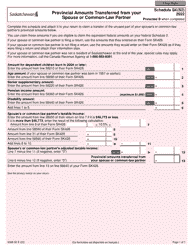

Q: How do I fill out Form 5008-S2/Schedule SK(S2)?

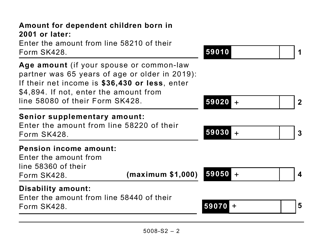

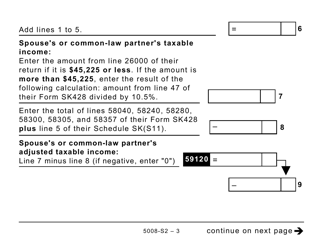

A: You need to provide the required information regarding the provincial amounts transferred from your spouse or common-law partner as instructed on the form.

Q: When is the deadline to file Form 5008-S2/Schedule SK(S2)?

A: The deadline to file Form 5008-S2/Schedule SK(S2) is usually the same as the deadline for filing your income tax return in Canada.

Q: What happens if I don't file Form 5008-S2/Schedule SK(S2)?

A: Failing to file Form 5008-S2/Schedule SK(S2) correctly or on time may result in penalties or delays in processing your tax return.

Q: Can I file Form 5008-S2/Schedule SK(S2) electronically?

A: No, at the moment, Form 5008-S2/Schedule SK(S2) cannot be filed electronically and must be filed by mail.

Q: Can I get assistance in filling out Form 5008-S2/Schedule SK(S2)?

A: Yes, you can seek assistance from a tax professional or contact the Canada Revenue Agency (CRA) helpline for guidance in filling out Form 5008-S2/Schedule SK(S2).