This version of the form is not currently in use and is provided for reference only. Download this version of

Form TD1

for the current year.

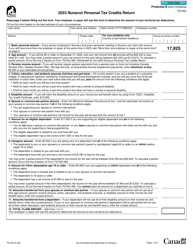

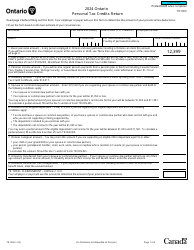

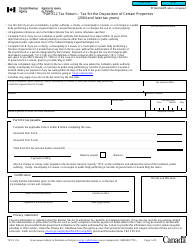

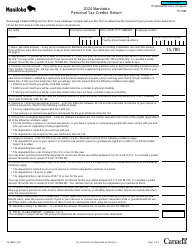

Form TD1 Personal Tax Credits Return - Canada

What Is Form TD1?

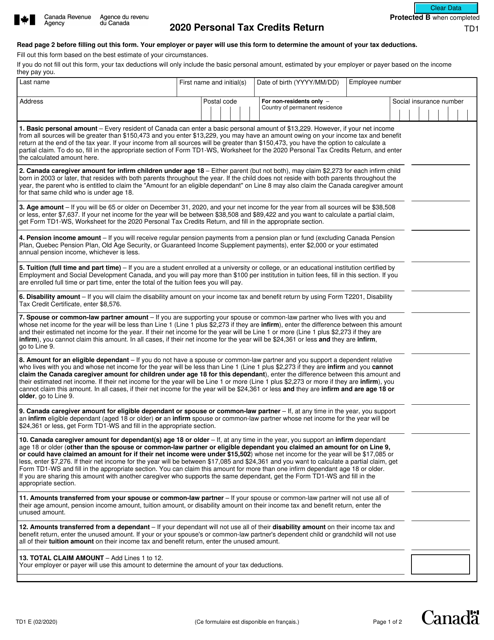

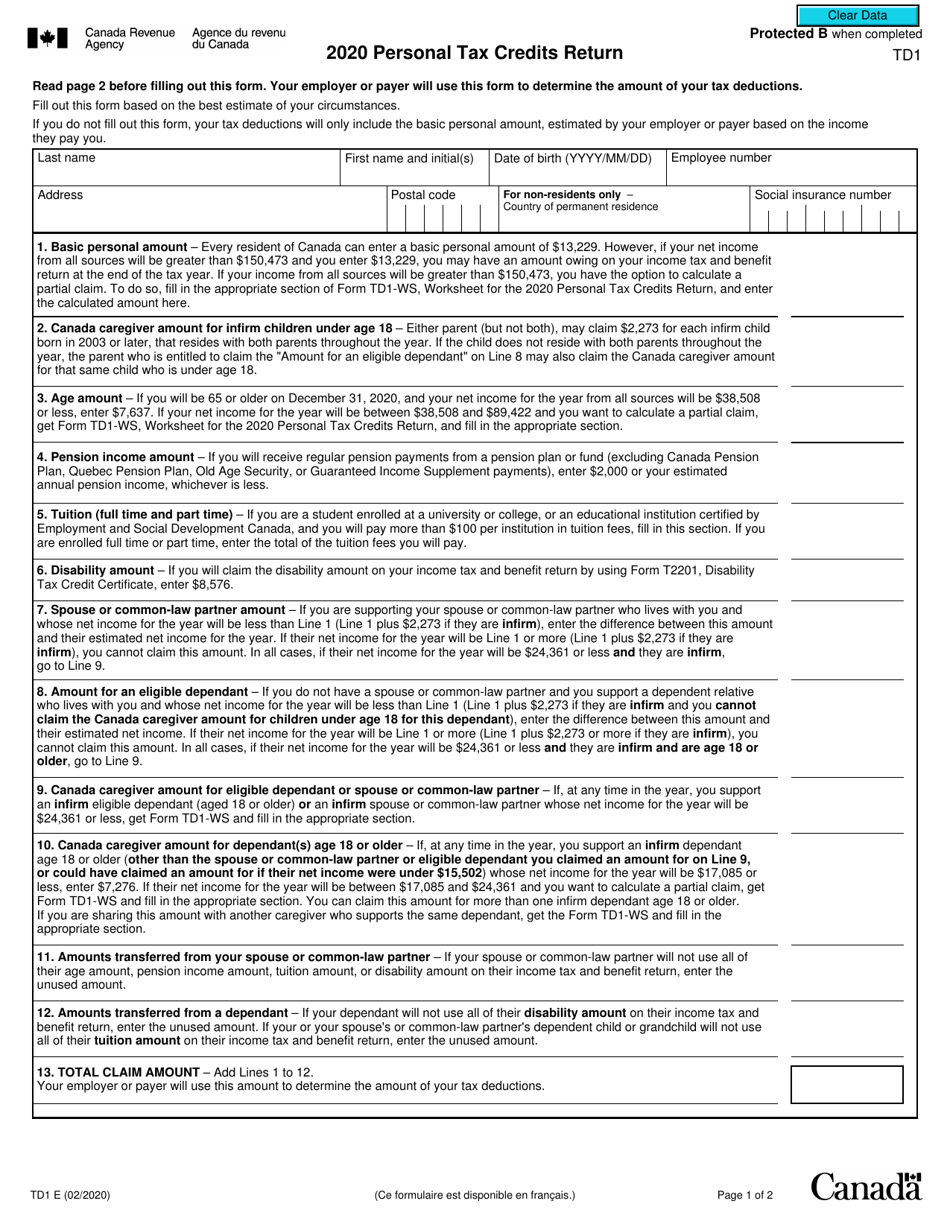

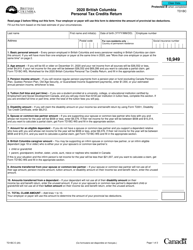

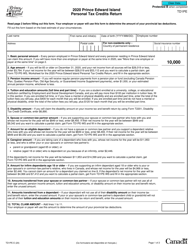

Form TD1, Personal Tax Credits Return , is a document that taxpayers can use when they want to claim the deductions they are entitled to, or change them. This form was issued by the Canadian Revenue Agency (CRA) and was last revised in 2020 . A fillable TD1 Tax Form is available for download below.

Alternate Name:

- TD1 Tax Form.

The purpose of Form TD1 is to provide the taxpayer's employer with all the necessary information so that they will be able to determine the number of tax deductions for the taxpayer. The form can be used by taxpayers in the following circumstances:

- The taxpayer has a new employer and is entitled to receive a salary, commissions, pension, or other remuneration.

- The taxpayer wishes to change the deduction amount they claimed before due to the changes that took place in their life.

- The taxpayer would like to claim the deduction for living in a prescribed zone.

- The taxpayer wants to increase the amount of tax deducted at the source.

How to Fill Out TD1 Form?

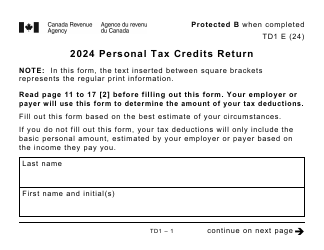

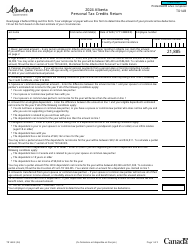

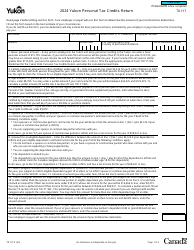

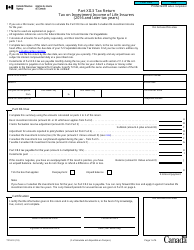

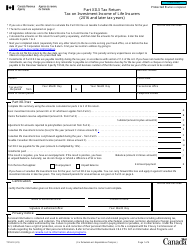

Form TD1 is presented on two pages and is divided into the following parts:

- Information About the Taxpayer. In the first part of the form, the taxpayer can designate their name, date of birth, employee number, address (including the postal code), and social insurance number. If the taxpayer is a non-resident of Canada, then in addition to everything mentioned above that must also designate the country of their permanent residence.

- Amounts. This section of the document consists of 13 parts in which the taxpayer is supposed to designate different amounts they paid or received. Here, the taxpayer can state their estimated annual pension income, tuition payments, disability amounts, etc.

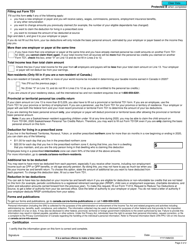

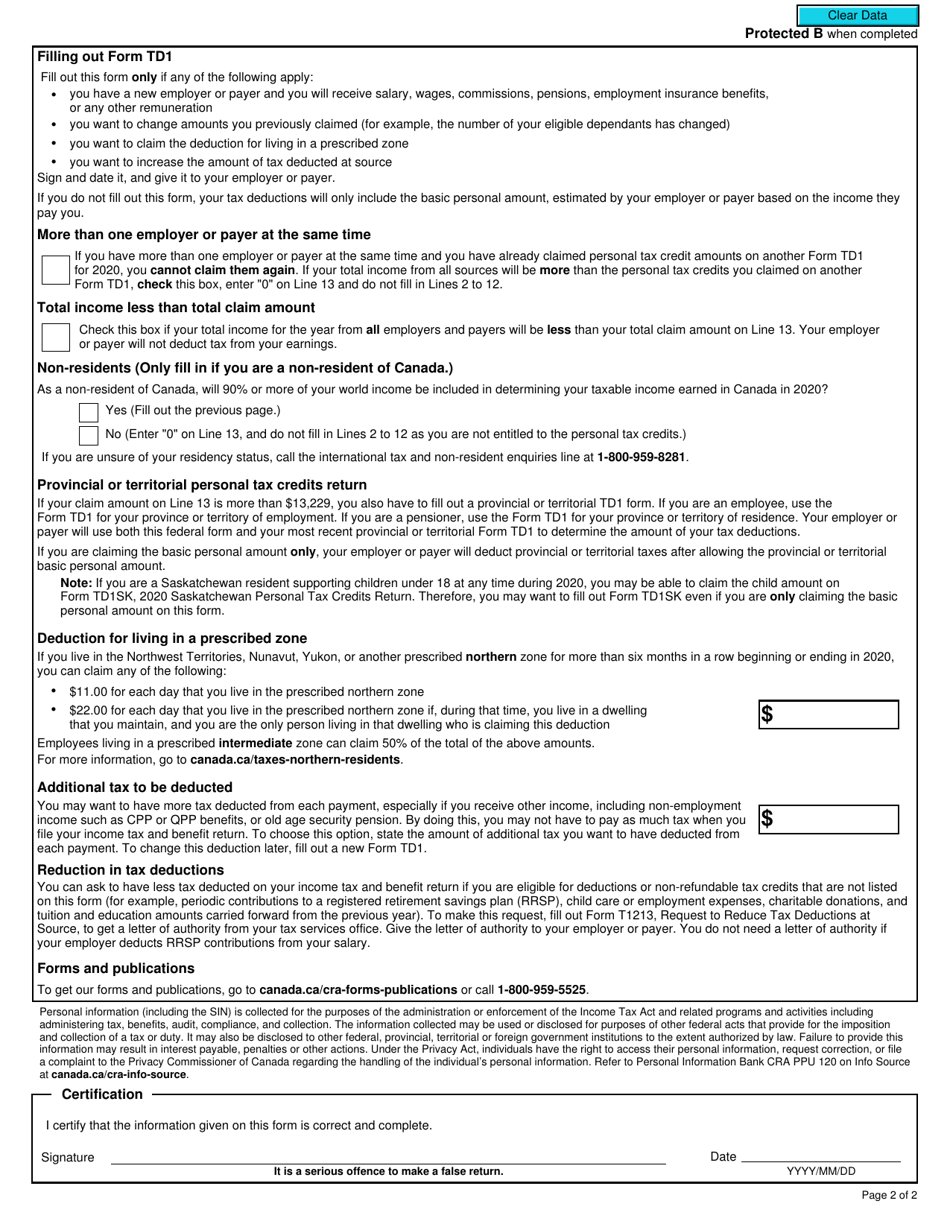

- Filing Requirements. If the taxpayer does not know whether they can use this document or not, they can check out the section with instructions. Here, they can find the filing requirements for the form, where to file it, and the consequences of not filing it.

- Tax Information. This part of the form consists of boxes that the taxpayer is supposed to check if the circumstances described there matching their situation. For example, they can check the appropriate box if they are a non-resident of Canada, if their total income amount is smaller than the total claim amount, or if they have more than one employer. In addition, in this part taxpayers can find information about prescribed zones and claim deductions for living in them.

- Information Disclosure. Here, taxpayers can find out why this information is collected and how it is going to be used. They can also read about who this information can be disclosed to and what to do if they do not like the way how their personal information is handled.

- Signature. At the end of the document, the taxpayer must certify that information they presented in the form is true and correct. To make the form valid the taxpayer must sign and date it.