This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5011-S11 Schedule YT(S11)

for the current year.

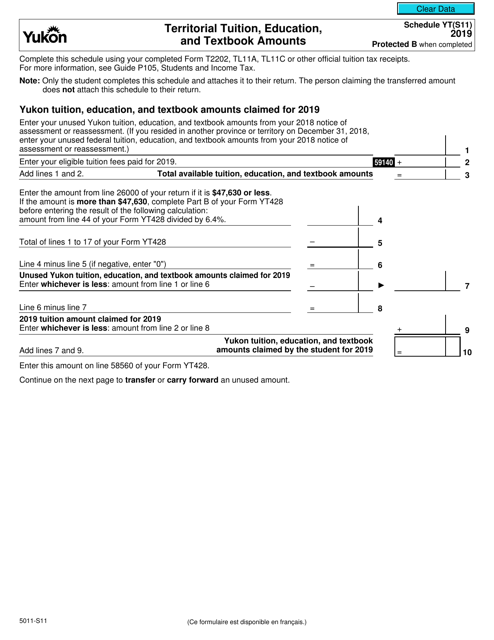

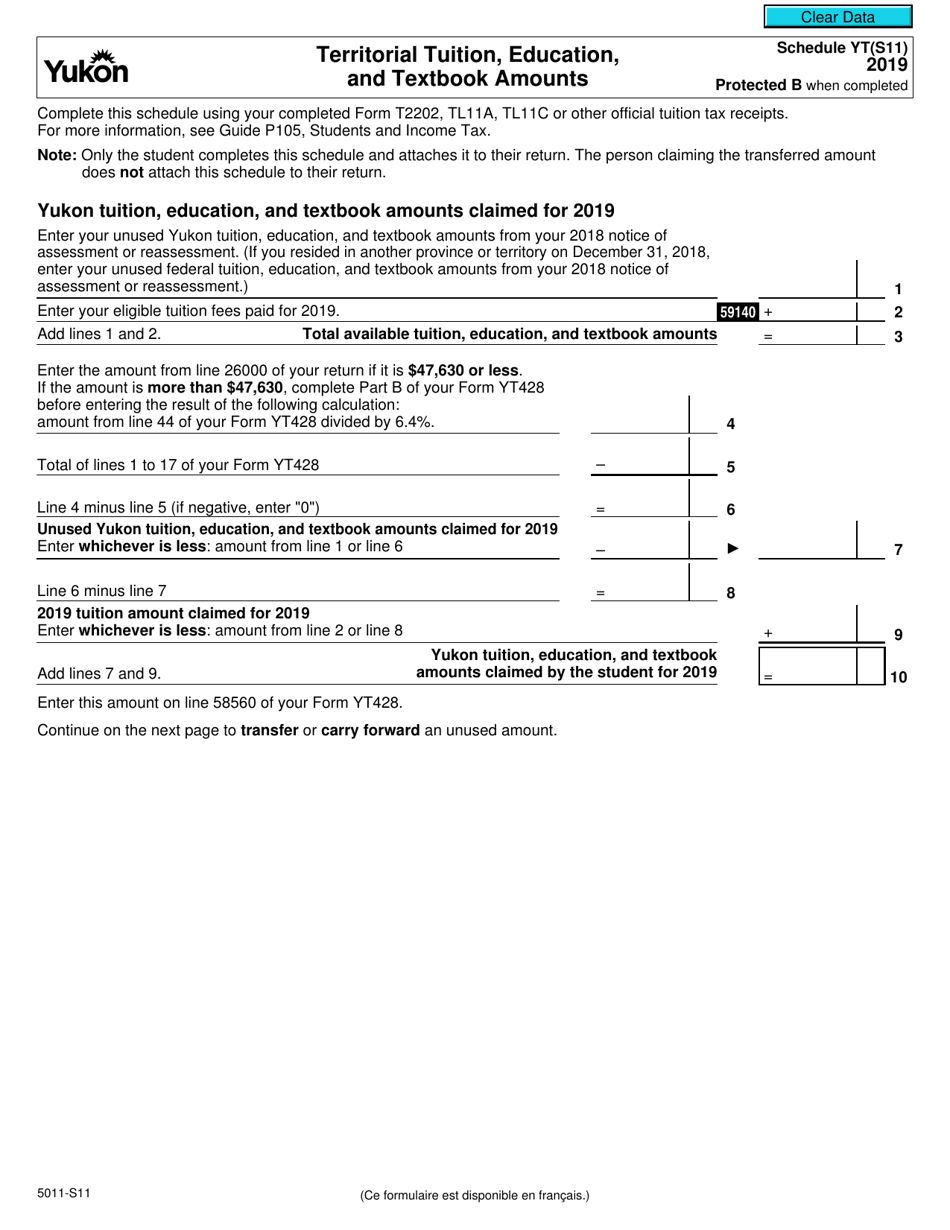

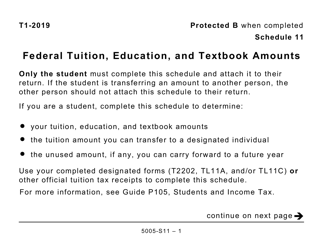

Form 5011-S11 Schedule YT(S11) Territorial Tuition, Education, and Textbook Amounts - Canada

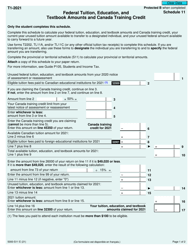

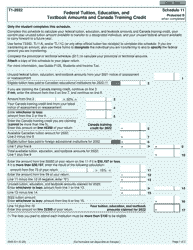

Form 5011-S11 Schedule YT(S11) is used in Canada to claim territorial tuition, education, and textbook amounts. It allows residents of the Yukon Territory to report and claim tax credits for eligible education expenses incurred during the tax year.

The Form 5011-S11 Schedule YT(S11) for Territorial Tuition, Education, and Textbook Amounts in Canada is typically filed by Canadian residents who reside in the Yukon Territory.

FAQ

Q: What is Form 5011-S11?

A: Form 5011-S11 is a tax form in Canada that is used to claim territorial tuition, education, and textbook amounts.

Q: What is Schedule YT(S11)?

A: Schedule YT(S11) is a specific schedule of Form 5011-S11 that is used by residents of the Yukon Territory in Canada.

Q: What is territorial tuition, education, and textbook amounts?

A: Territorial tuition, education, and textbook amounts are tax credits that residents of certain territories in Canada can claim to reduce their tax liability.

Q: Who is eligible to claim territorial tuition, education, and textbook amounts?

A: Residents of the Yukon Territory in Canada are eligible to claim territorial tuition, education, and textbook amounts.

Q: How do I claim territorial tuition, education, and textbook amounts?

A: To claim territorial tuition, education, and textbook amounts, you need to fill out Form 5011-S11 and include Schedule YT(S11) if you are a resident of the Yukon Territory in Canada.

Q: Are territorial tuition, education, and textbook amounts refundable?

A: No, territorial tuition, education, and textbook amounts are non-refundable tax credits that can only be used to reduce your tax liability.

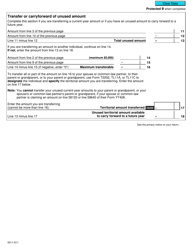

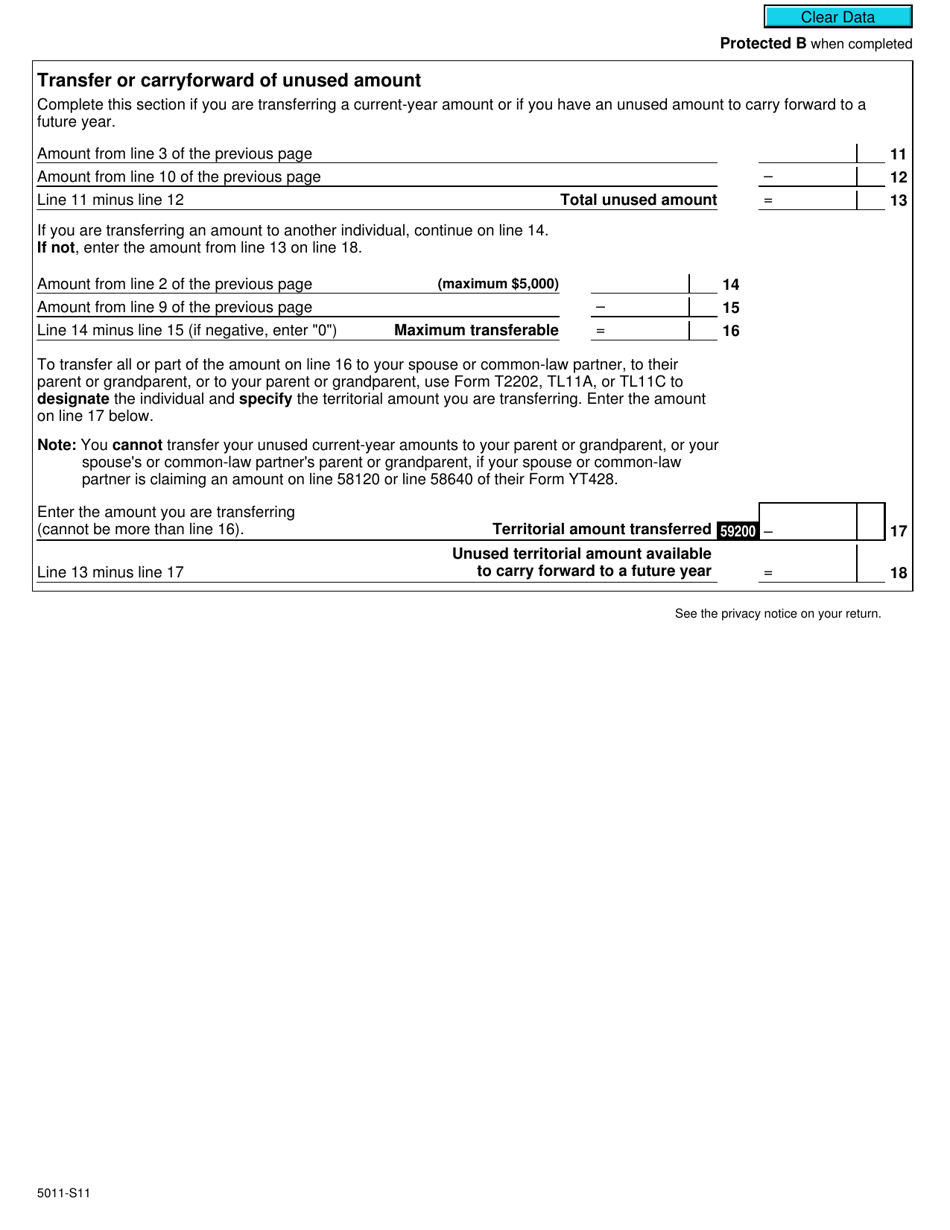

Q: Can I transfer my territorial tuition, education, and textbook amounts to someone else?

A: Yes, you may be able to transfer your territorial tuition, education, and textbook amounts to certain family members, such as your spouse or common-law partner.

Q: Do territorial tuition, education, and textbook amounts expire?

A: No, territorial tuition, education, and textbook amounts do not expire and can be carried forward to future years if you are unable to use them in the current year.

Q: Is there a limit to the amount of territorial tuition, education, and textbook amounts that I can claim?

A: Yes, there are limits to the amount of territorial tuition, education, and textbook amounts that you can claim. It is important to consult the guidelines provided by the Canada Revenue Agency for the specific limits that apply to your situation.