This version of the form is not currently in use and is provided for reference only. Download this version of

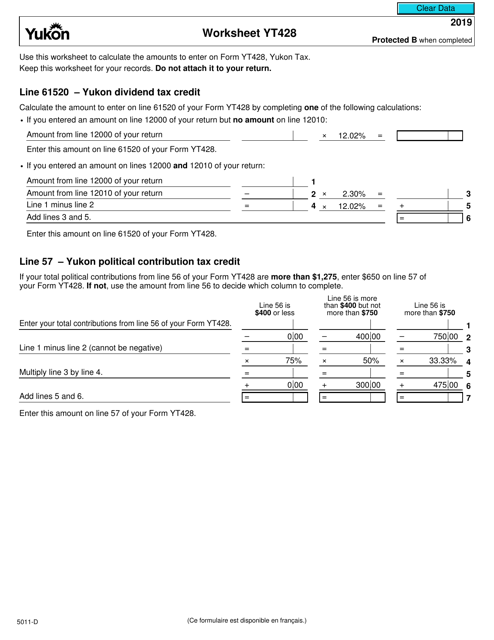

Form 5011-D Worksheet YT428

for the current year.

Form 5011-D Worksheet YT428 - Canada

According to available information, the Form 5011-D Worksheet YT428 in Canada is typically filed by individuals who are claiming the Yukon mineral explorationtax credit.

FAQ

Q: What is Form 5011-D Worksheet YT428?

A: Form 5011-D Worksheet YT428 is a tax form used in Canada.

Q: Who needs to fill out Form 5011-D Worksheet YT428?

A: Individuals in Canada who have specific tax situations may need to fill out this form.

Q: What is the purpose of Form 5011-D Worksheet YT428?

A: The purpose of this form is to help individuals calculate their income tax liability and determine any credits or deductions they may be eligible for.

Q: Is Form 5011-D Worksheet YT428 mandatory to file taxes?

A: It depends on your specific tax situation. Some individuals may be required to fill out this form as part of their tax return.

Q: What should I do if I have questions about Form 5011-D Worksheet YT428?

A: If you have questions or need assistance with this form, you can contact the Canada Revenue Agency (CRA) or consult a tax professional.

Q: Are there any deadlines for submitting Form 5011-D Worksheet YT428?

A: The deadline for filing this form is typically the same as the deadline for submitting your annual tax return, which is usually April 30th (or June 15th for self-employed individuals). However, it is recommended to check with the CRA for any specific deadlines or extensions.

Q: What happens if I make a mistake on Form 5011-D Worksheet YT428?

A: If you make a mistake on this form, you should correct it as soon as possible. Depending on the error, you may need to file an amended tax return or contact the CRA for further instructions.

Q: Can I save a copy of Form 5011-D Worksheet YT428 for future reference?

A: Yes, it is advisable to keep a copy of this form and all supporting documents for future reference or in case of any audit or review by the CRA.