This version of the form is not currently in use and is provided for reference only. Download this version of

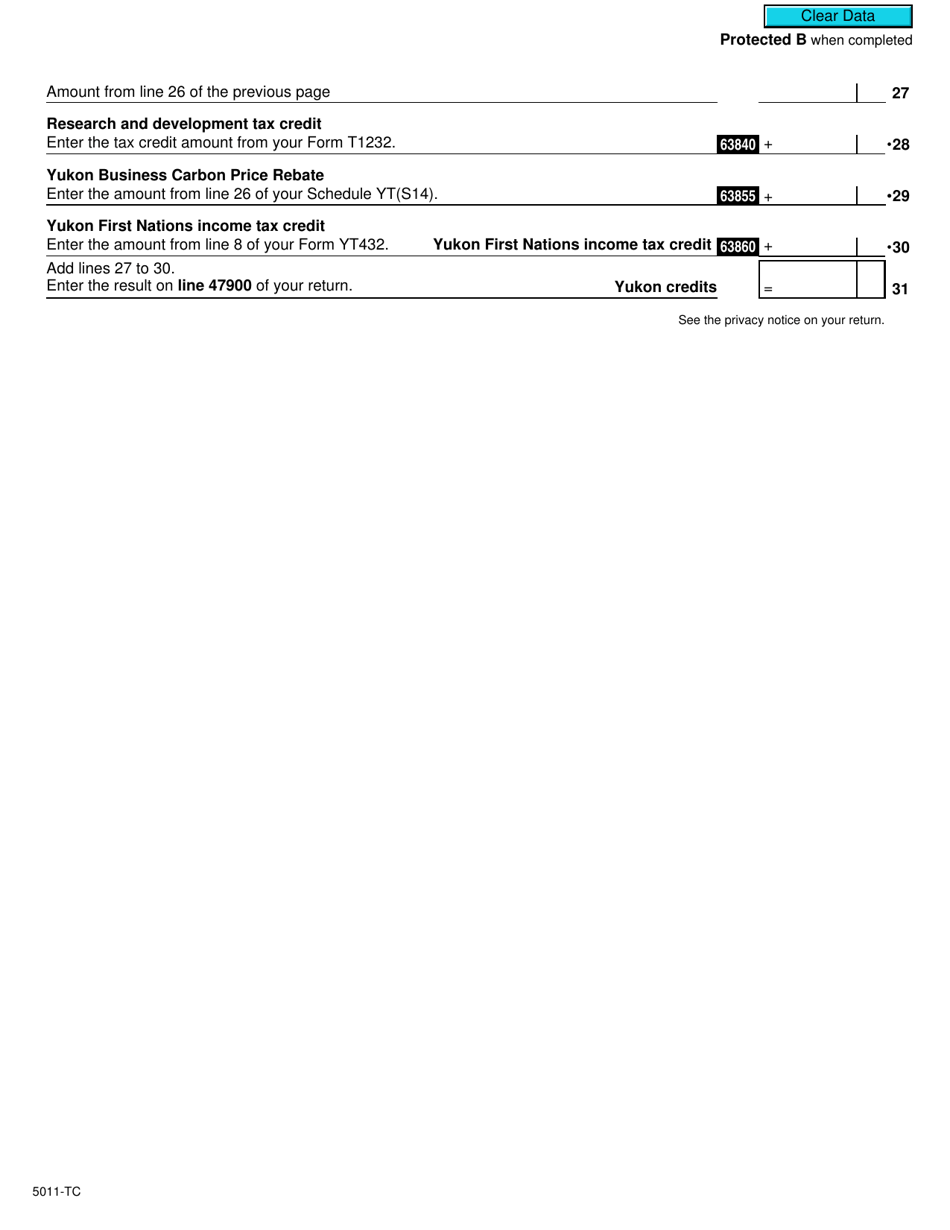

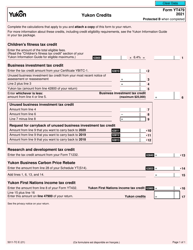

Form 5011-TC (YT479)

for the current year.

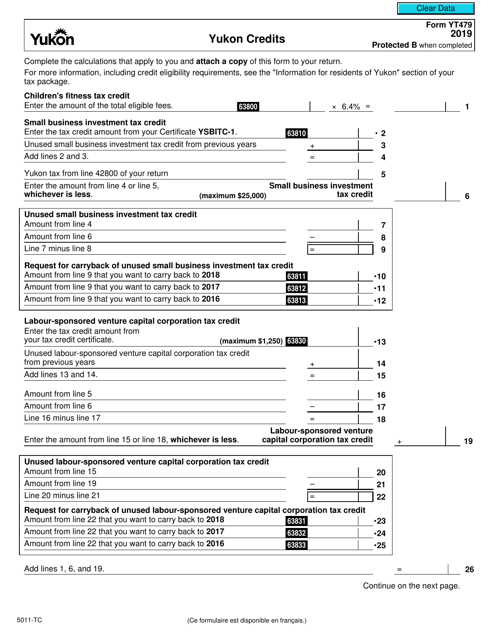

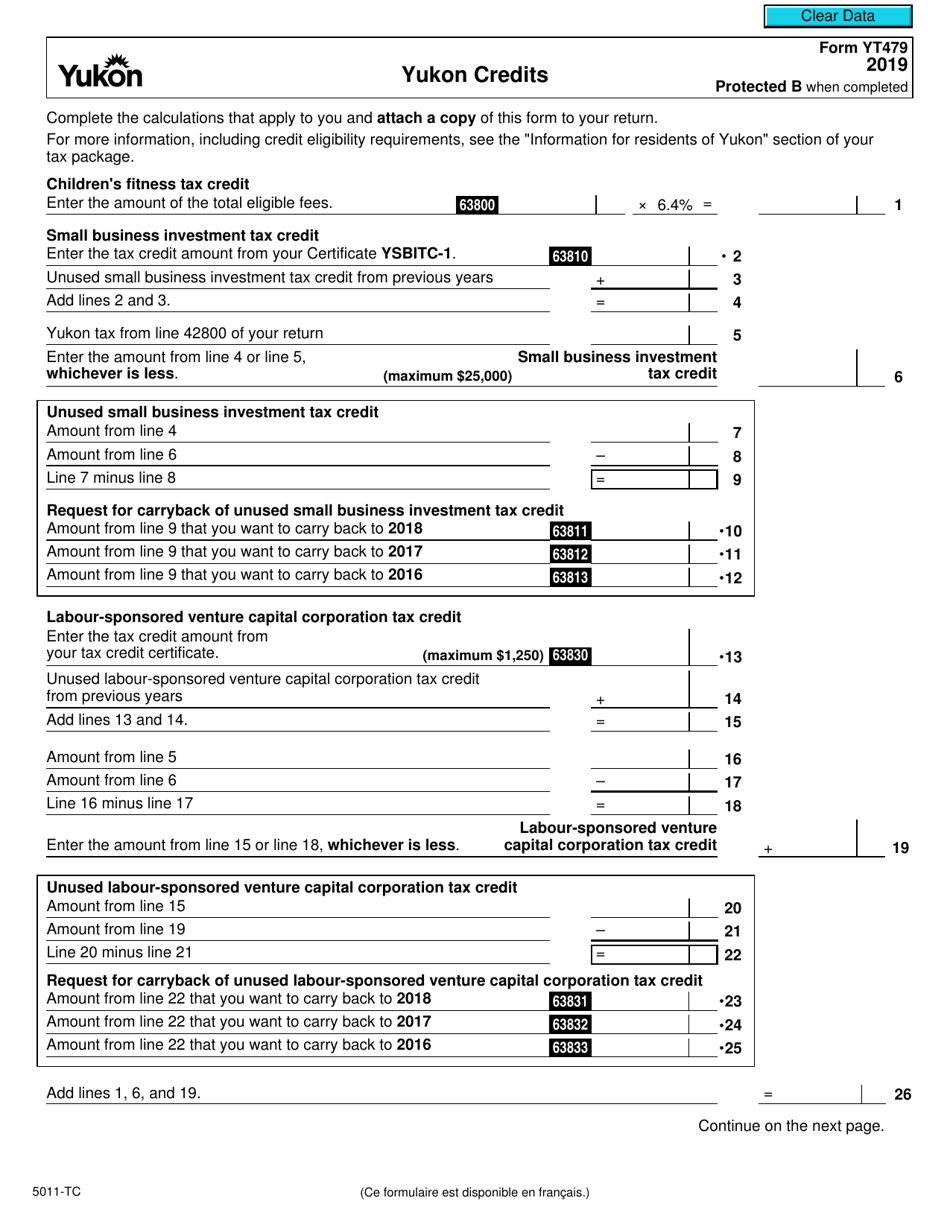

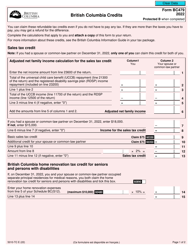

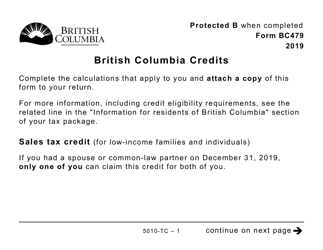

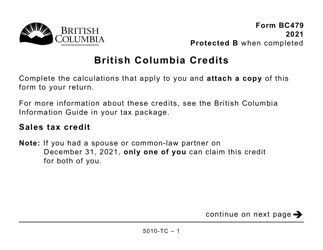

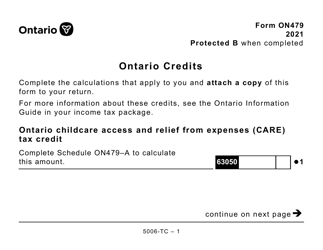

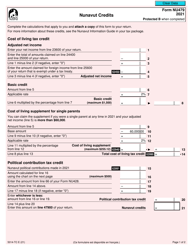

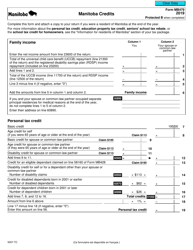

Form 5011-TC (YT479) Yukon Credits - Canada

Form 5011-TC (YT479) is used to claim tax credits specifically for individuals who are residents of the Yukon territory in Canada. It allows residents to reduce their federal tax liability by claiming credits for certain expenses incurred in the Yukon.

The Form 5011-TC (YT479) for Yukon Credits in Canada is filed by individual taxpayers who are residents of Yukon.

FAQ

Q: What is Form 5011-TC?

A: Form 5011-TC is a tax form used in the Yukon territory of Canada.

Q: What are Yukon Credits?

A: Yukon Credits are tax credits specific to the Yukon territory.

Q: Who is eligible for Yukon Credits?

A: Residents of the Yukon territory who meet certain criteria are eligible for Yukon Credits.

Q: What is the purpose of Form 5011-TC?

A: Form 5011-TC is used to claim Yukon Credits on your tax return.

Q: When is Form 5011-TC due?

A: Form 5011-TC is typically due by April 30th of each year, along with your tax return.

Q: What should I do if I have questions about Form 5011-TC?

A: If you have questions about Form 5011-TC or Yukon Credits, you can contact the Canada Revenue Agency (CRA) or consult a tax professional.