This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5011-S2 Schedule YT(S2)

for the current year.

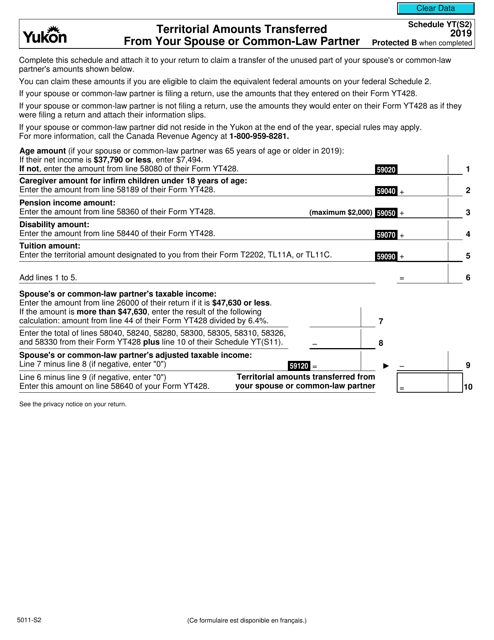

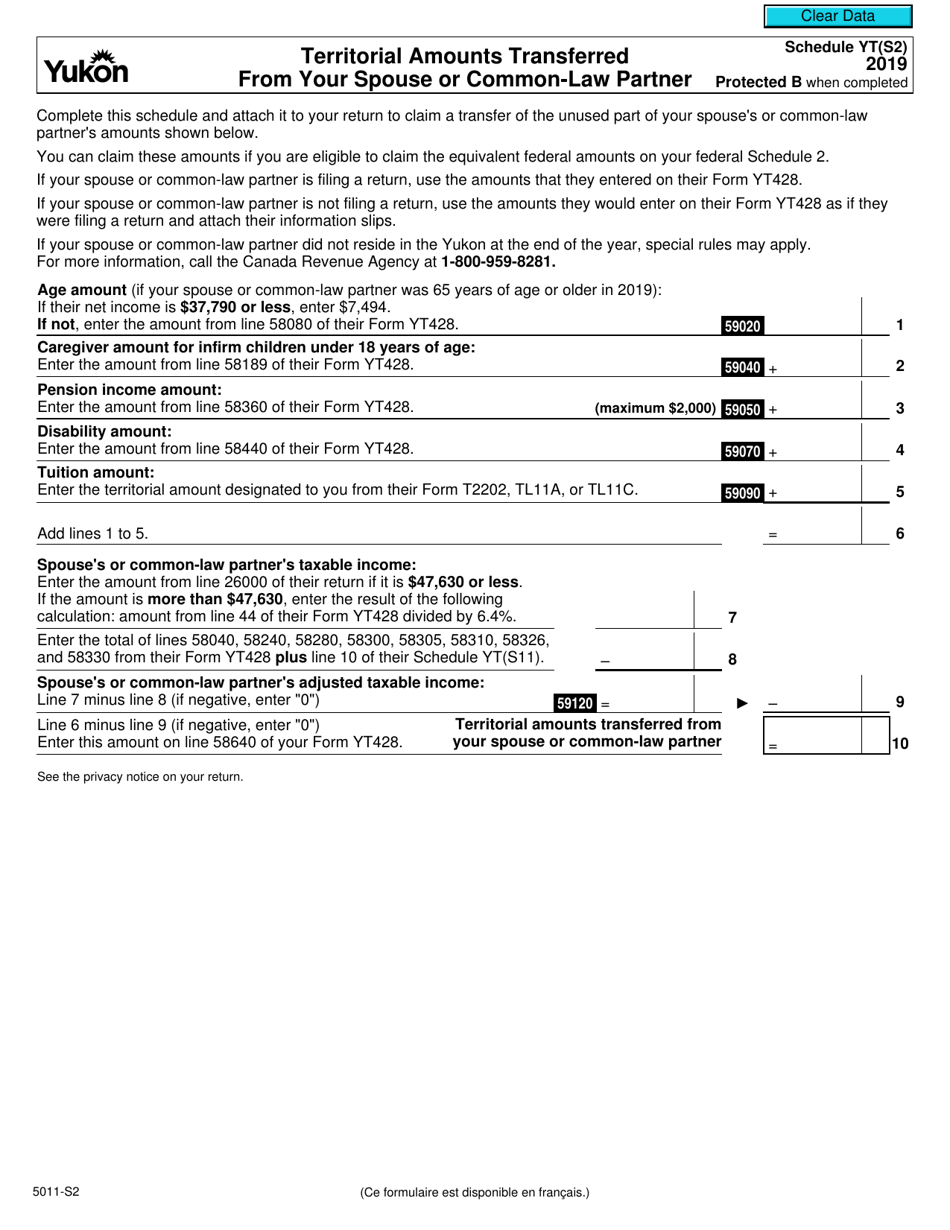

Form 5011-S2 Schedule YT(S2) Territorial Amounts Transferred From Your Spouse or Common-Law Partner - Canada

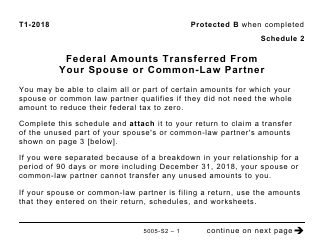

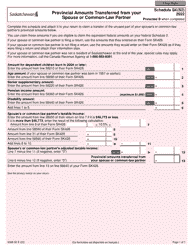

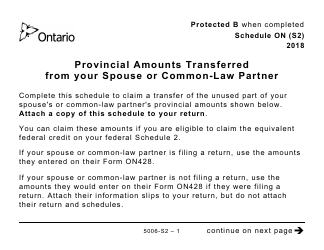

According to the Canada Revenue Agency (CRA), individuals who want to claim a territorial amount transferred from their spouse or common-law partner would need to file Form 5011-S2 Schedule YT(S2).

FAQ

Q: What is Form 5011-S2 Schedule YT(S2)?

A: Form 5011-S2 Schedule YT(S2) is a form used in Canada for reporting territorial amounts transferred from your spouse or common-law partner.

Q: Why would I need to use Form 5011-S2 Schedule YT(S2)?

A: You would need to use Form 5011-S2 Schedule YT(S2) if you want to claim territorial amounts transferred from your spouse or common-law partner for tax purposes.

Q: What are territorial amounts?

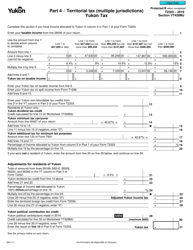

A: Territorial amounts are certain tax credits and deductions that are specific to the Canadian territories of Yukon, Northwest Territories, and Nunavut.

Q: Can I transfer territorial amounts from my spouse or common-law partner?

A: Yes, you can transfer territorial amounts from your spouse or common-law partner if you meet the eligibility criteria.

Q: How do I fill out Form 5011-S2 Schedule YT(S2)?

A: To fill out Form 5011-S2 Schedule YT(S2), you will need to provide information about yourself, your spouse or common-law partner, and the territorial amounts being transferred.

Q: When is the deadline to file Form 5011-S2 Schedule YT(S2)?

A: The deadline to file Form 5011-S2 Schedule YT(S2) is usually the same as the deadline for filing your income tax return, which is April 30th of the following year.

Q: Do I need to file Form 5011-S2 Schedule YT(S2) every year?

A: No, you only need to file Form 5011-S2 Schedule YT(S2) if you want to claim territorial amounts transferred from your spouse or common-law partner for that specific tax year.