This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2125

for the current year.

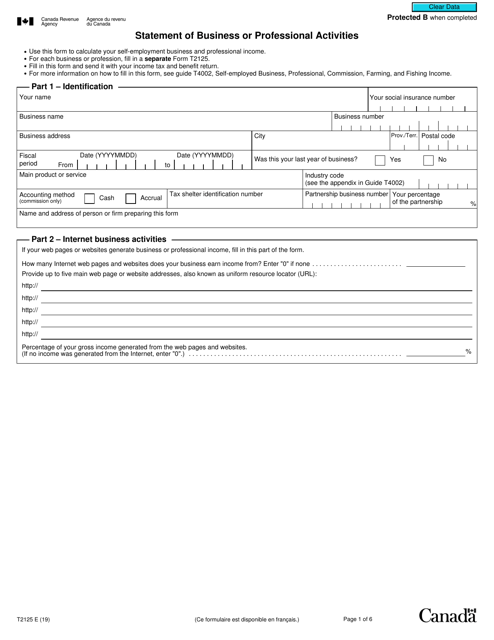

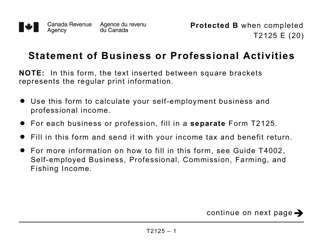

Form T2125 Statement of Business or Professional Activities - Canada

What Is Form T2125?

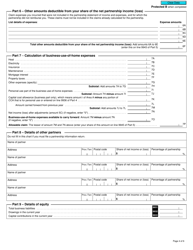

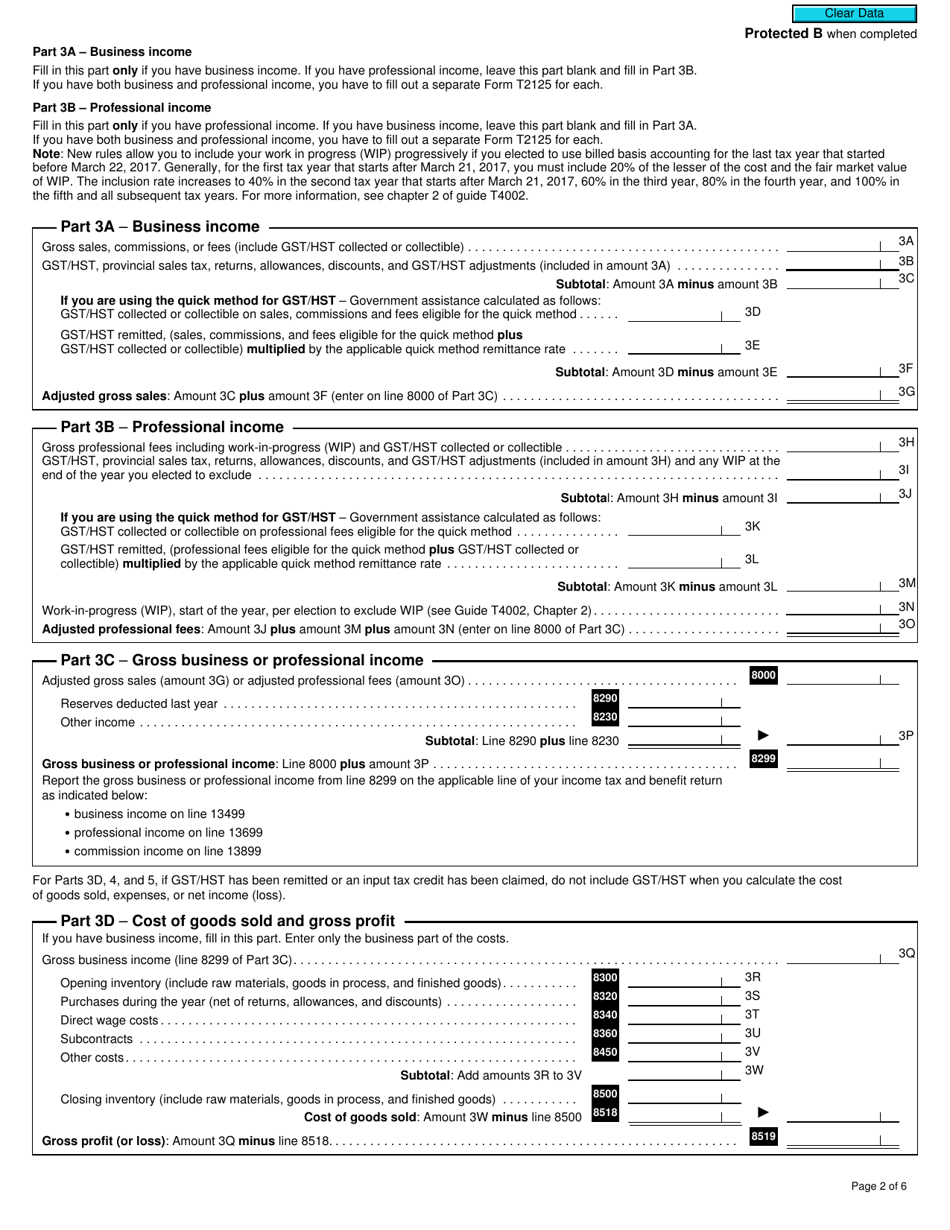

Form T2125, Statement of Business or Professional Activitie s, is a legal document that taxpayers can use when they want to report their income. This form was specifically developed for those taxpayers who receive self-employment business or professional income. If the taxpayer receives business and professional income at the same time, they must complete a separate tax form for reporting each of them.

Alternate Name:

- T2125 Tax Form.

This form was issued by the Canadian Revenue Agency (CRA) and was last revised on . The document is supposed to be filed with a taxpayer's income tax and benefit return. A fillable T2125 Form is available for download below. The taxpayer is required to report all of their income to the CRA, failing to do so or reporting invalid information can make the taxpayer liable for penalties. In order to support the information they present to the CRA, the taxpayer is required to keep records of all their transactions.

How to Fill Out Form T2125?

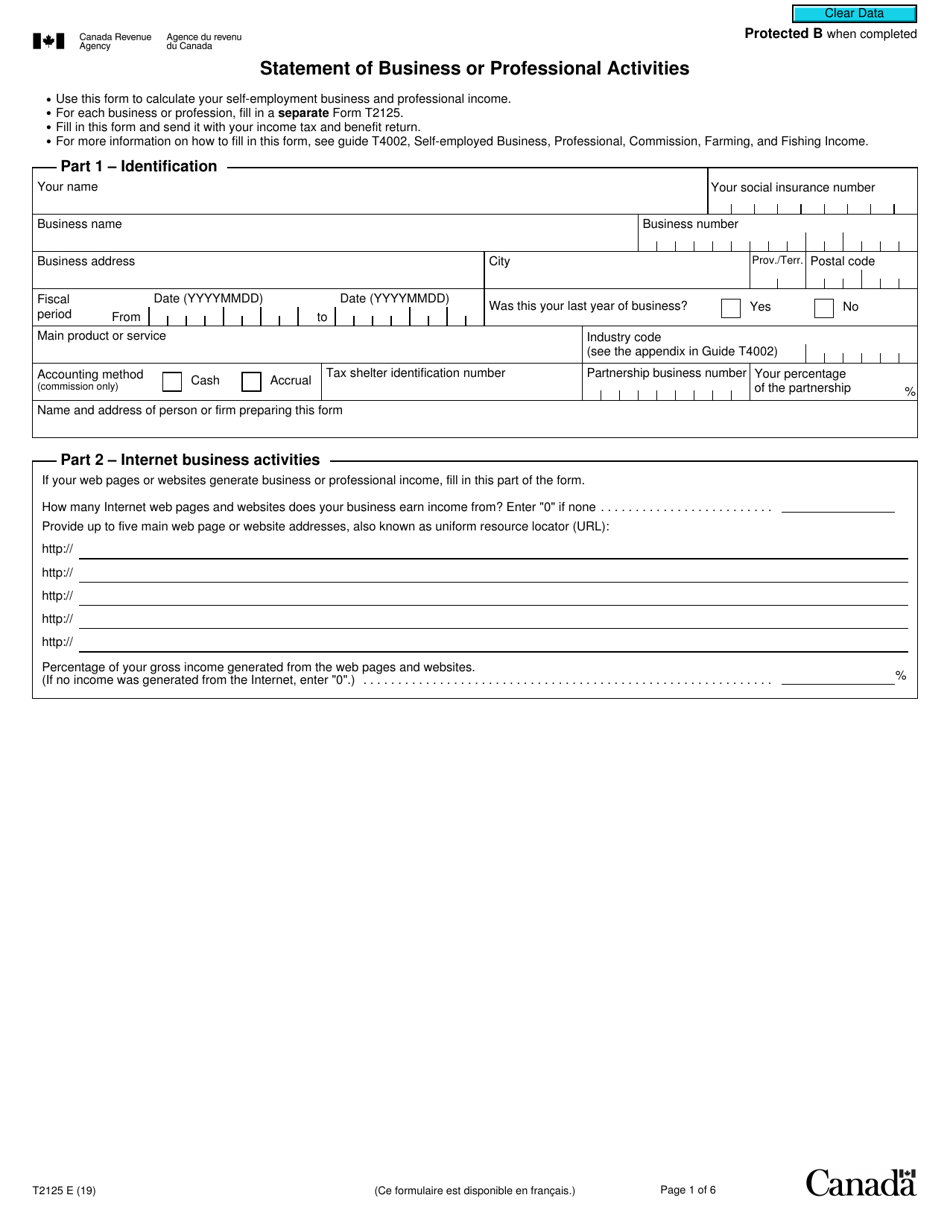

- Identification. In the first part of the document, the taxpayer must designate their full name, social insurance number, name of the business, the business address, main product (or service), fiscal period, etc. This information will help to identify the taxpayer, their business, and the reporting period.

- Internet Business Activities. If the taxpayer uses websites to produce business income, they can state its number, provide websites' uniform resource locators (URLs), and indicate the part of the income produced by them.

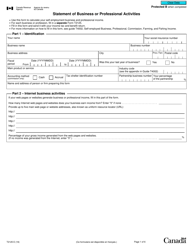

- Business Income . This section is supposed to be filled out only if the taxpayer receives business income (if they receive professional income, they should leave this part empty and move on to the next one). The taxpayer must designate the commissions (or other payments) they have received.

- Professional Income. If the taxpayer receives only professional income, they are supposed to fill in this part of the form. Here they can report gross professional fees they have received.

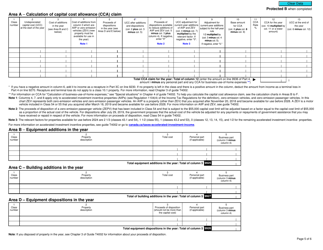

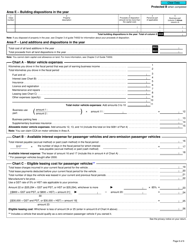

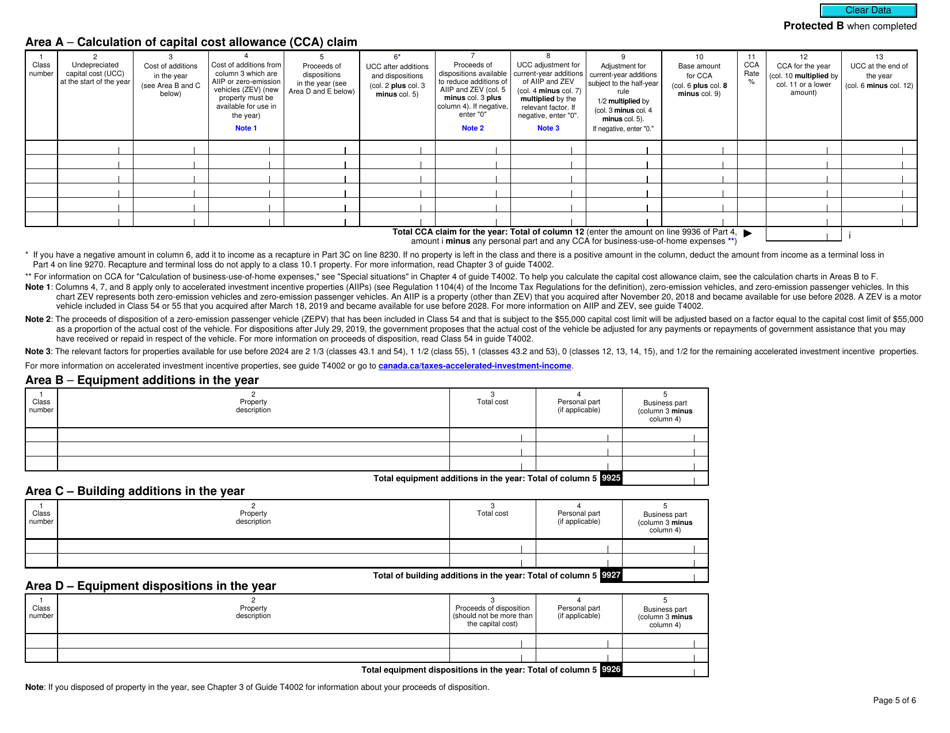

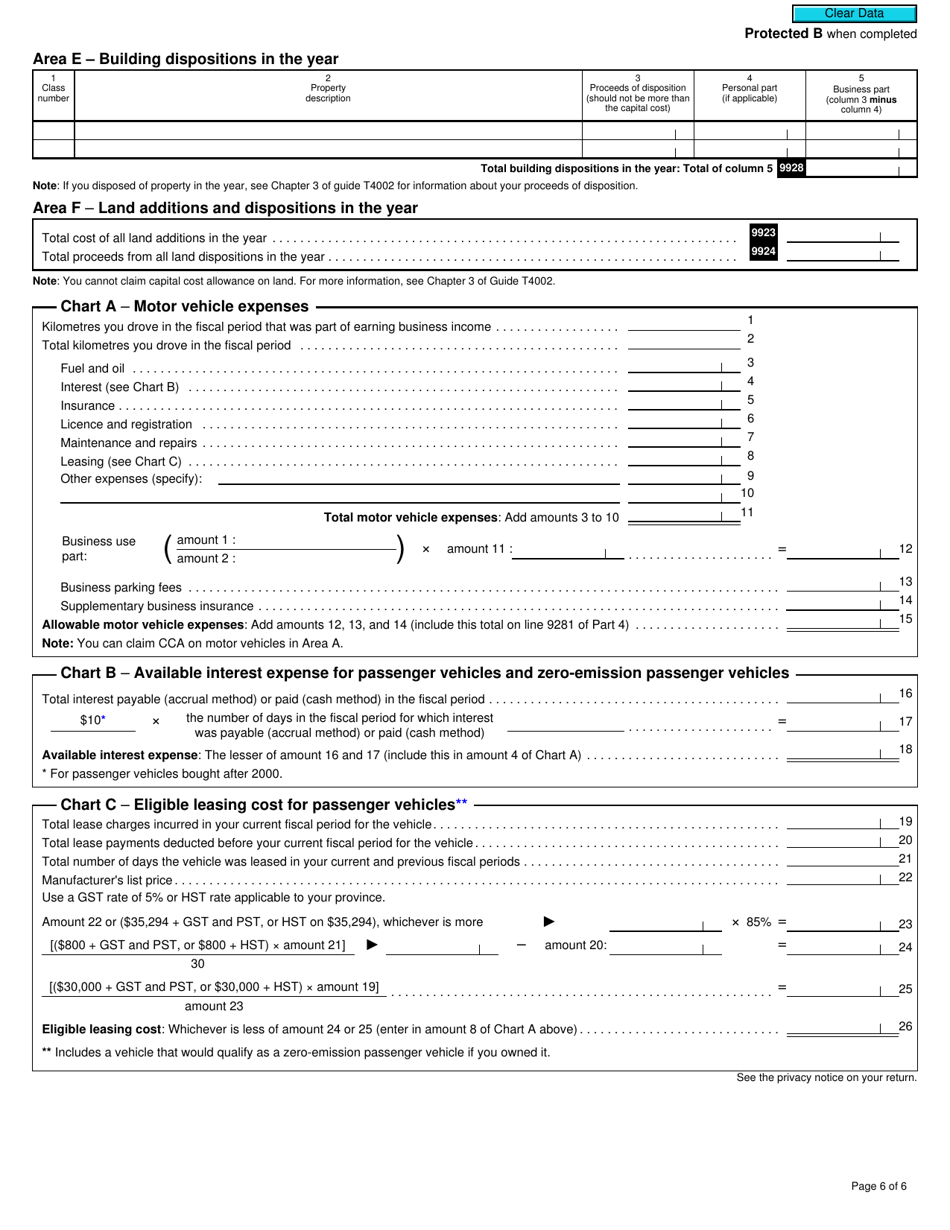

- Cost of Goods Sold and Gross Profit. Taxpayers can use this part of the document, to state certain amounts related to their business income, such as opening inventory, purchases during the year, direct wage costs, subcontracts, etc.

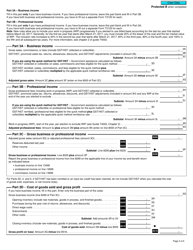

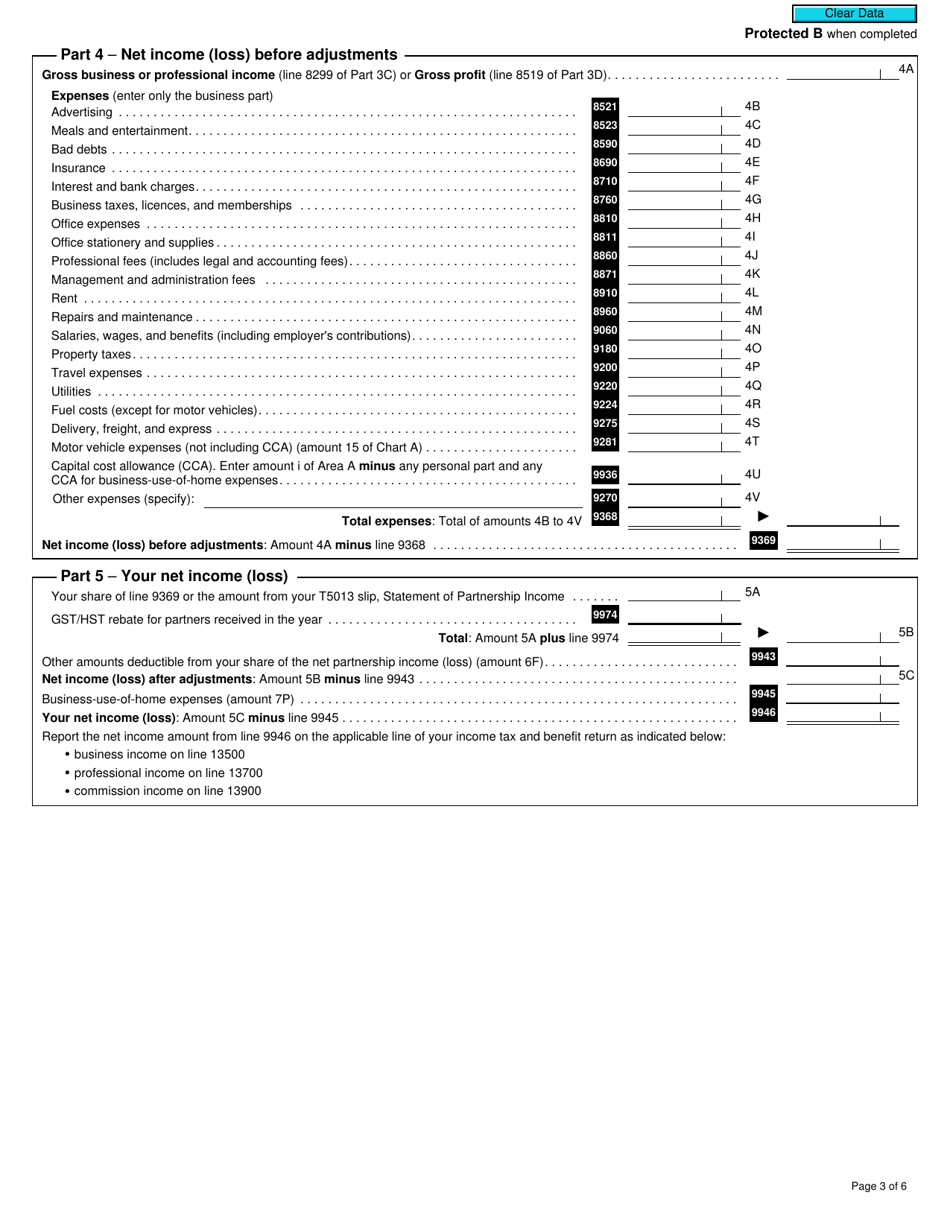

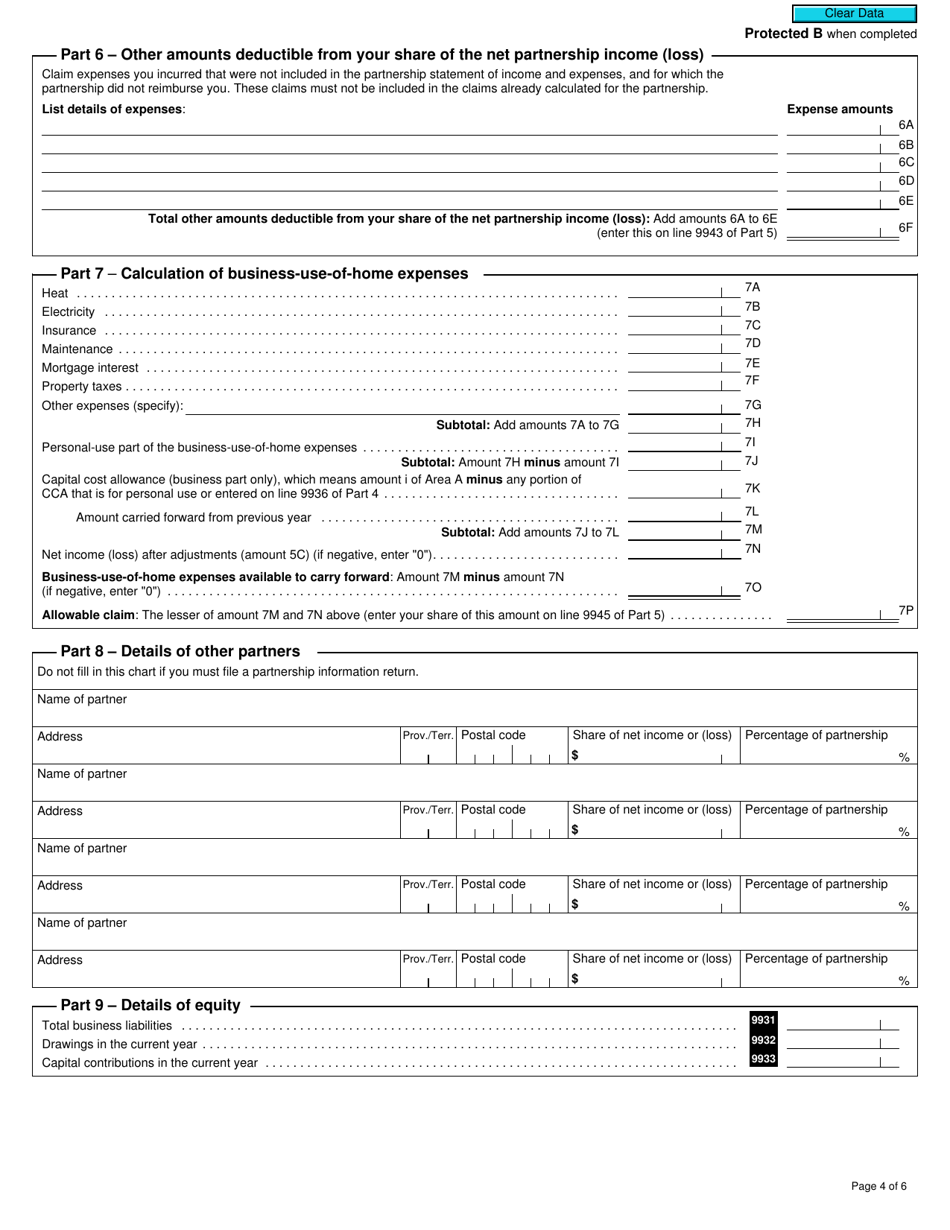

- Net Income (Loss) Before Adjustments. Here, the taxpayer can indicate some of their expenses, which include advertising expenses, insurance, professional fees, rent, travel expenses, utilities, and other payments they had to make due to their business.

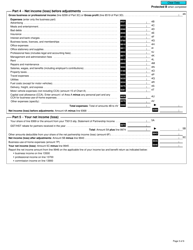

- Details of Other Partners. If the taxpayer is a partner in a partnership that does not have to file a partnership information return they must fill out this part of the document. They are supposed to provide information about each partner, such as their full name and address.

In case taxpayers are struggling with completing Form T2125, they can check out Form T4002, Self-Employed Business, Professional, Commission, Farming, and Fishing Income. This guide explains how the information return can be filled out, which amounts should be designated, how to submit the document, and provides other necessary details.