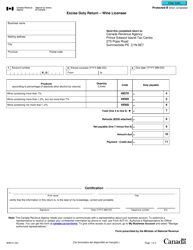

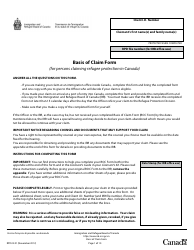

This version of the form is not currently in use and is provided for reference only. Download this version of

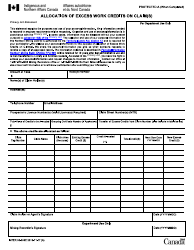

Form RC634

for the current year.

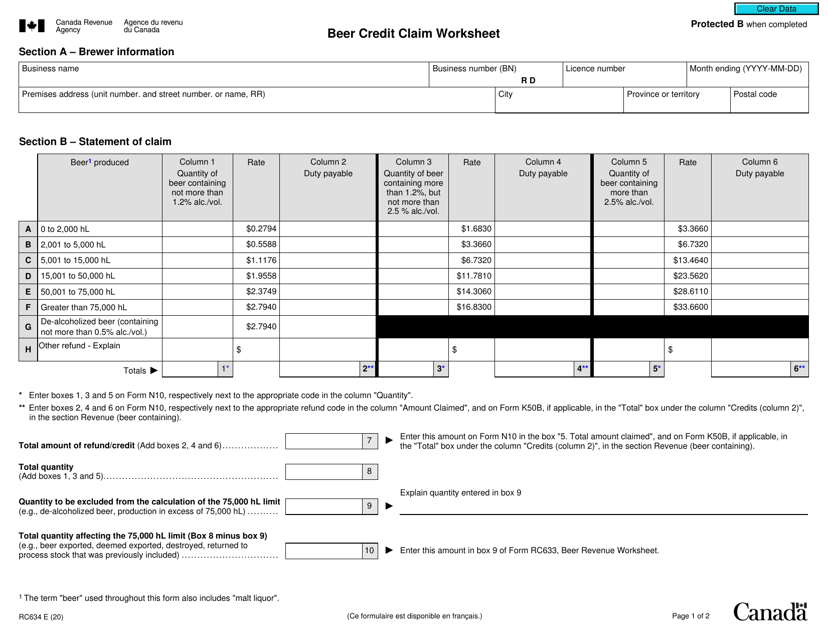

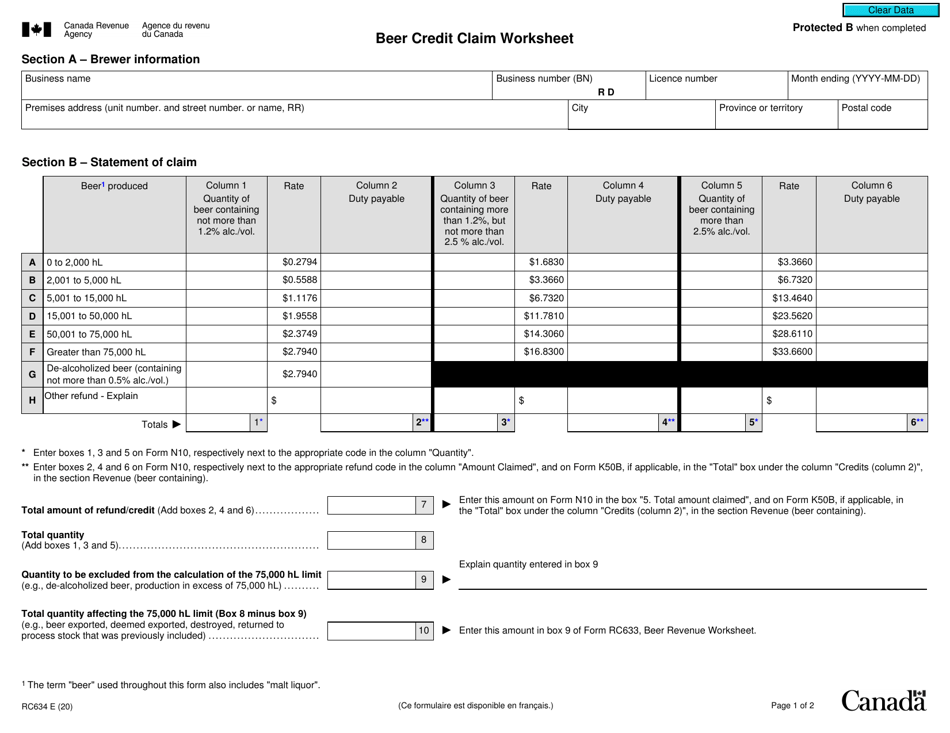

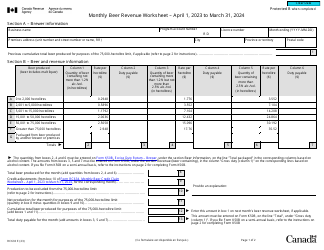

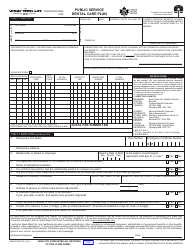

Form RC634 Beer Credit Claim Worksheet - Canada

Form RC634 Beer Credit Claim Worksheet in Canada is used to claim a credit for the federal excise tax paid on beer by licensed brewers. It helps the brewers calculate the amount of credit they are eligible to claim.

The Form RC634 Beer Credit Claim Worksheet in Canada is filed by breweries or brewpubs that are eligible to claim a beer tax credit.

FAQ

Q: What is Form RC634?

A: Form RC634 is the Beer Credit Claim Worksheet.

Q: Who is eligible to use Form RC634?

A: Brewers, brew pubs, and microbreweries in Canada are eligible to use Form RC634.

Q: What is the purpose of Form RC634?

A: The purpose of Form RC634 is to claim the beer credit for excise tax paid on beer manufactured or imported by brewers, brew pubs, and microbreweries.

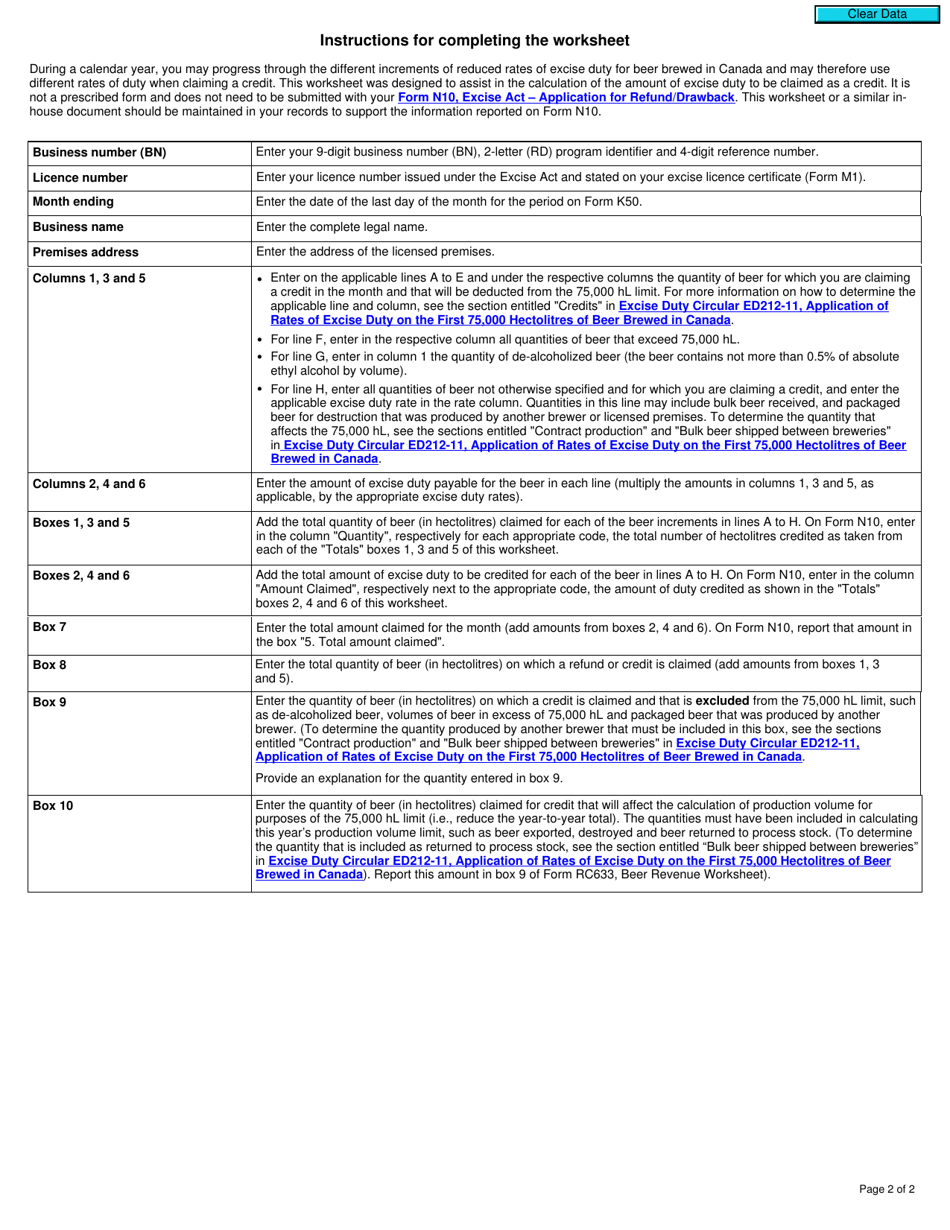

Q: How do I complete Form RC634?

A: You need to enter your business information, production information, and calculate the beer credit amount on Form RC634.

Q: When is the deadline to file Form RC634?

A: The deadline to file Form RC634 is generally within six months after the end of the reporting period.

Q: What supporting documents do I need to include with Form RC634?

A: You may need to include a summary of monthly excise tax returns and other relevant supporting documents with Form RC634.

Q: Can I file Form RC634 electronically?

A: Currently, Form RC634 cannot be filed electronically. It must be sent by mail.

Q: What should I do if I made an error on Form RC634?

A: If you made an error on Form RC634, you should correct it and submit the amended form to the CRA.

Q: Is there a fee to file Form RC634?

A: There is no fee to file Form RC634.