This version of the form is not currently in use and is provided for reference only. Download this version of

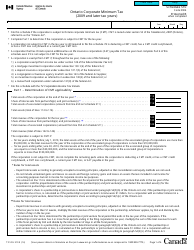

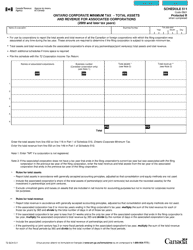

Form T691

for the current year.

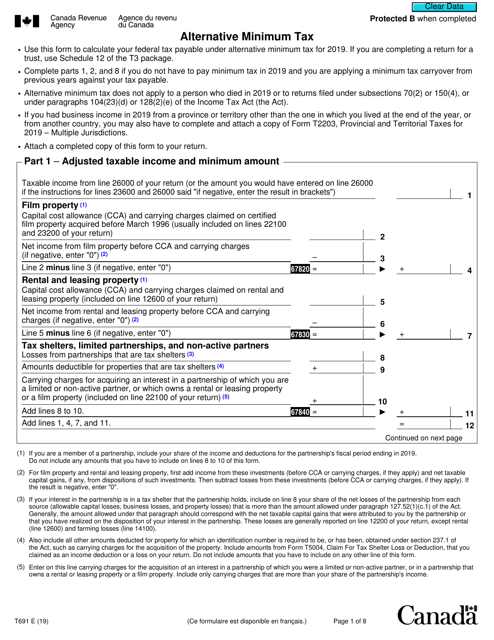

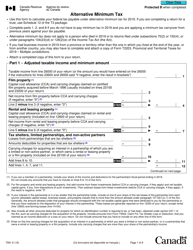

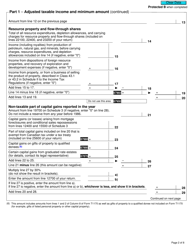

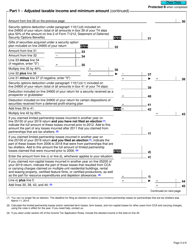

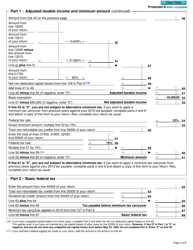

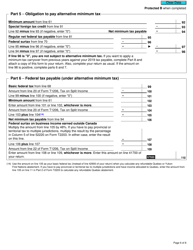

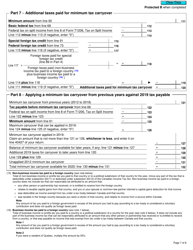

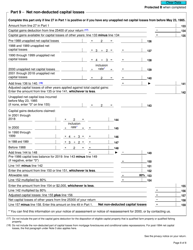

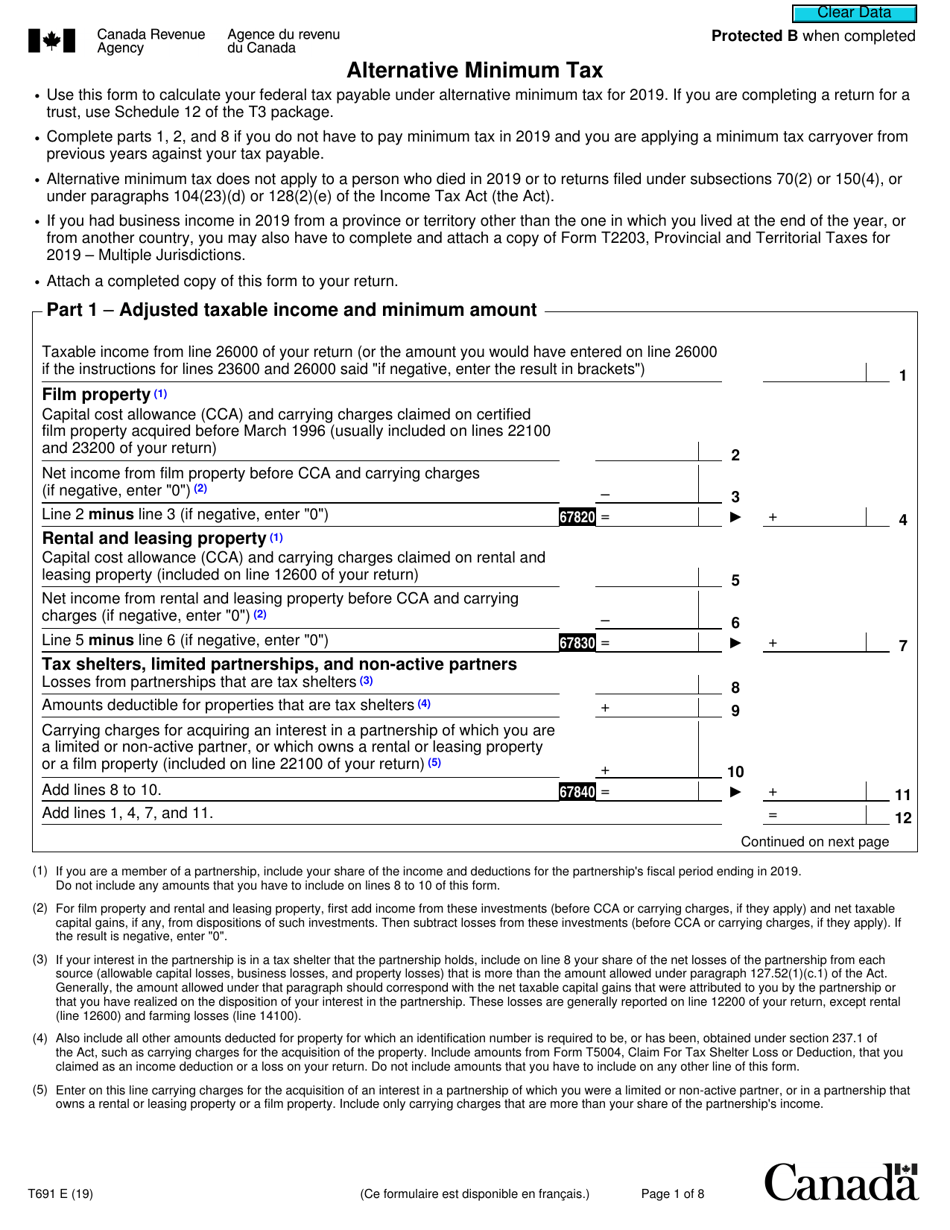

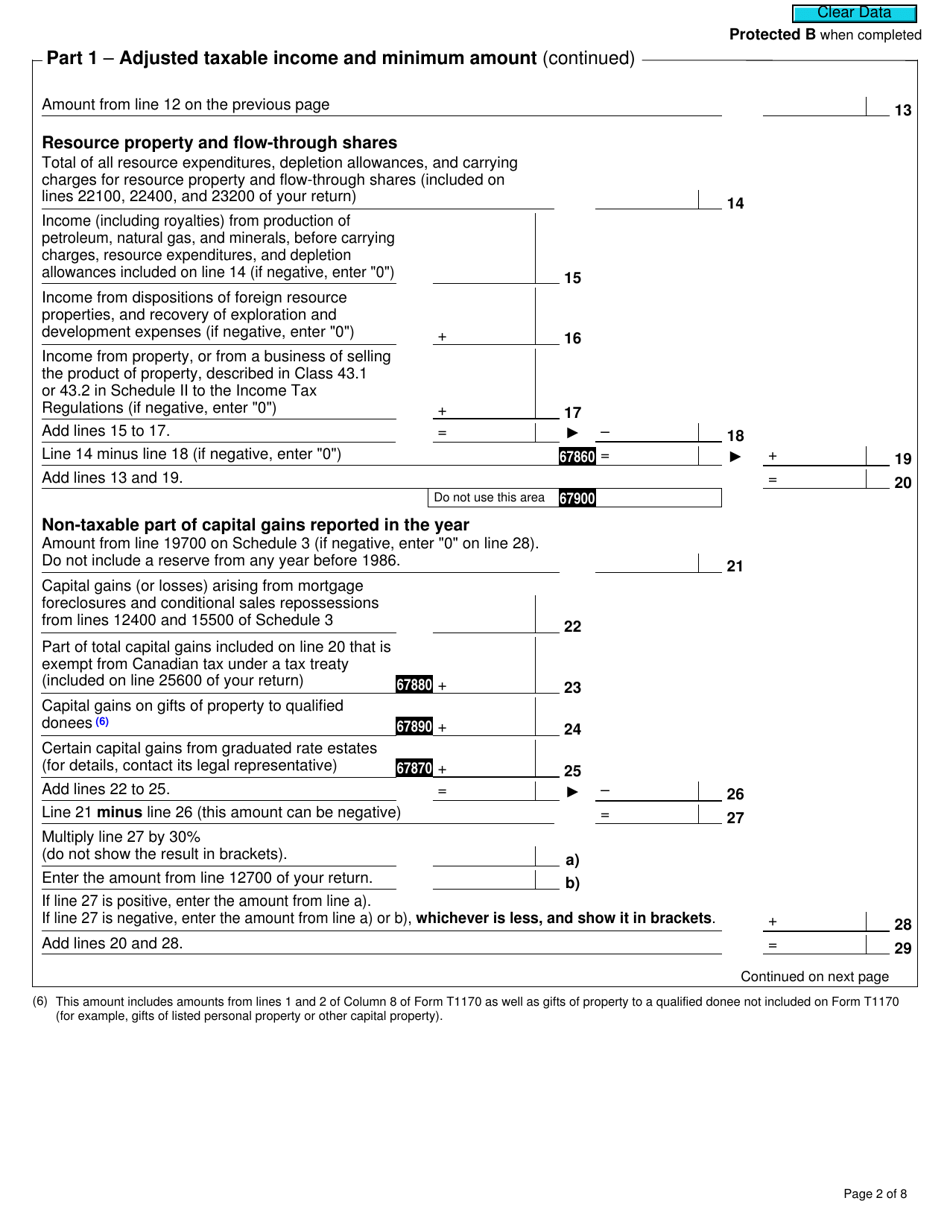

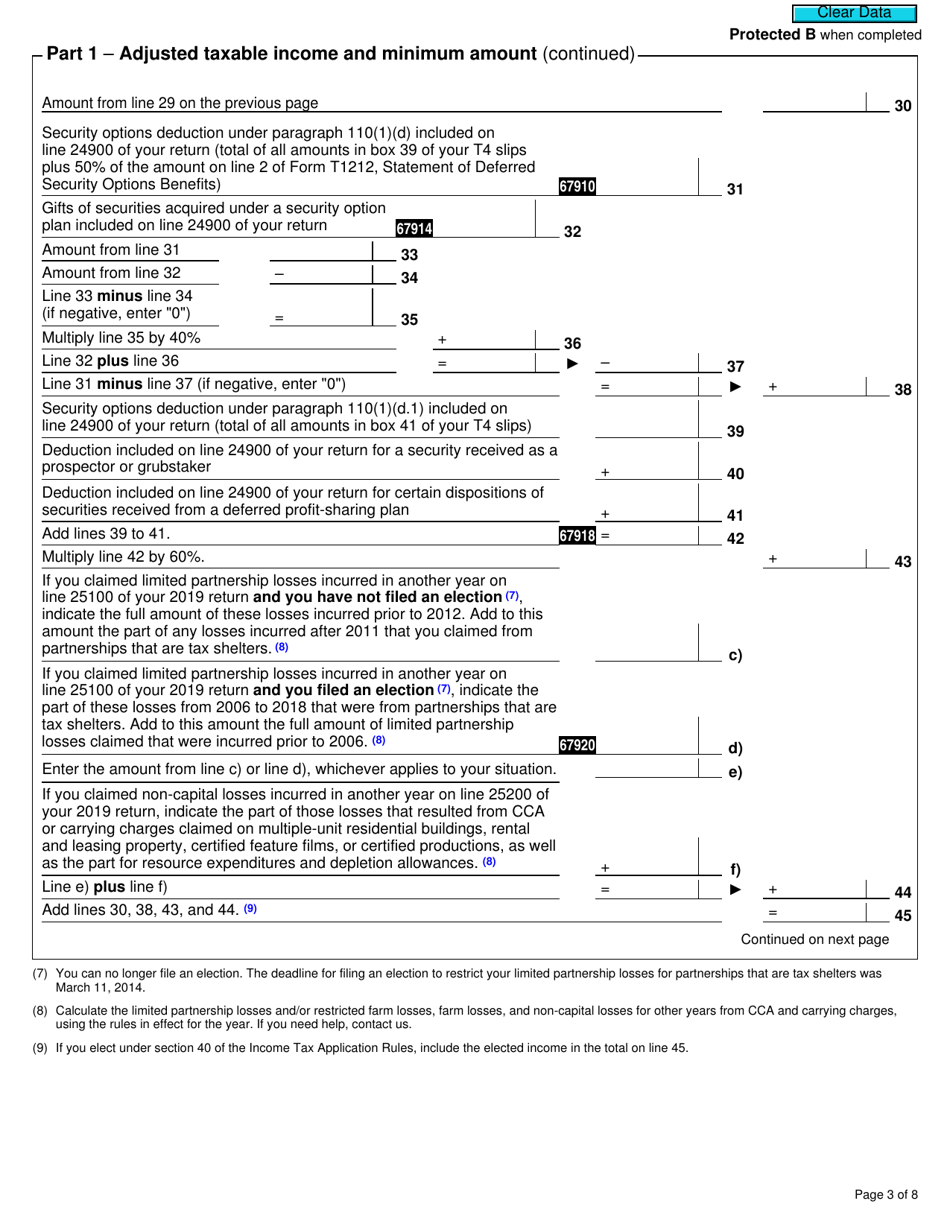

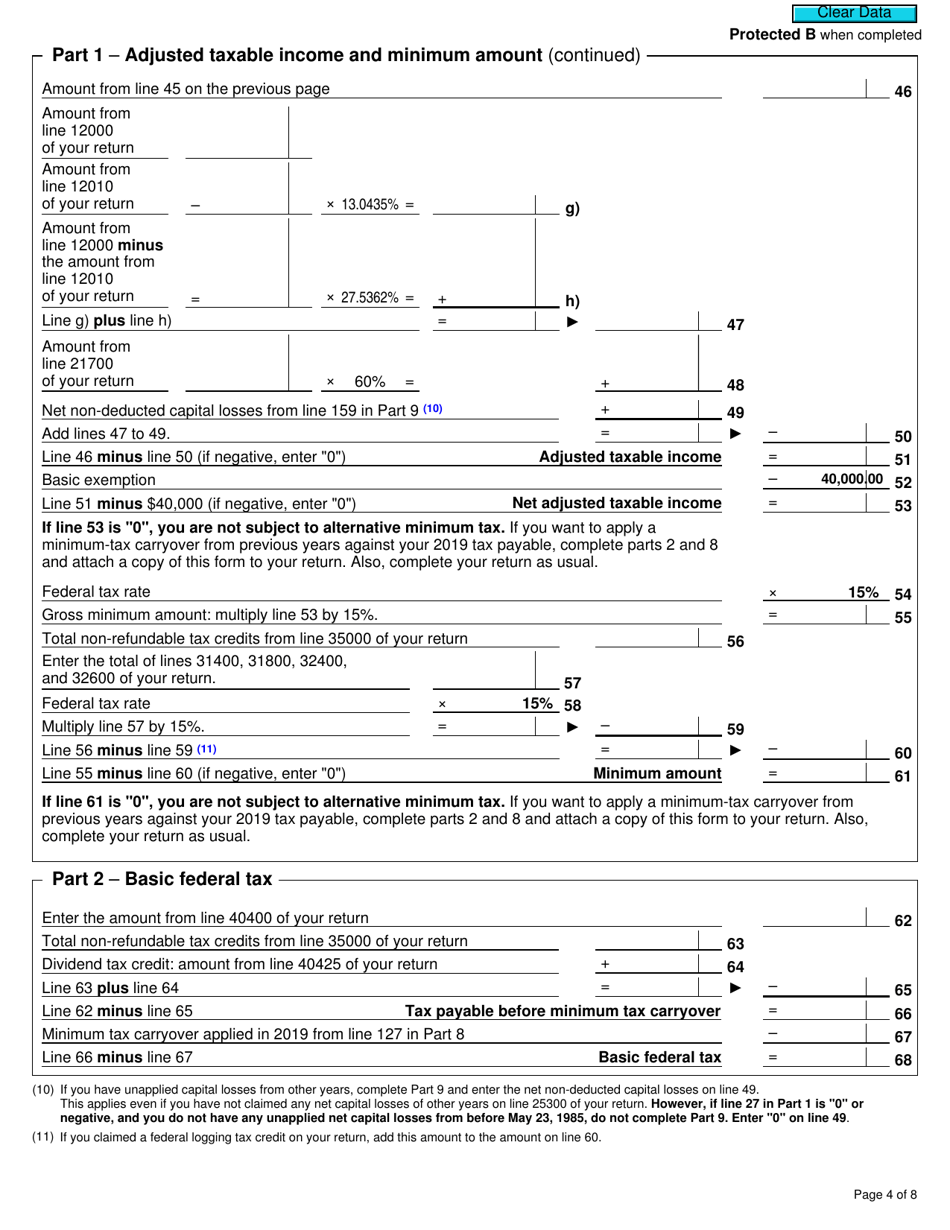

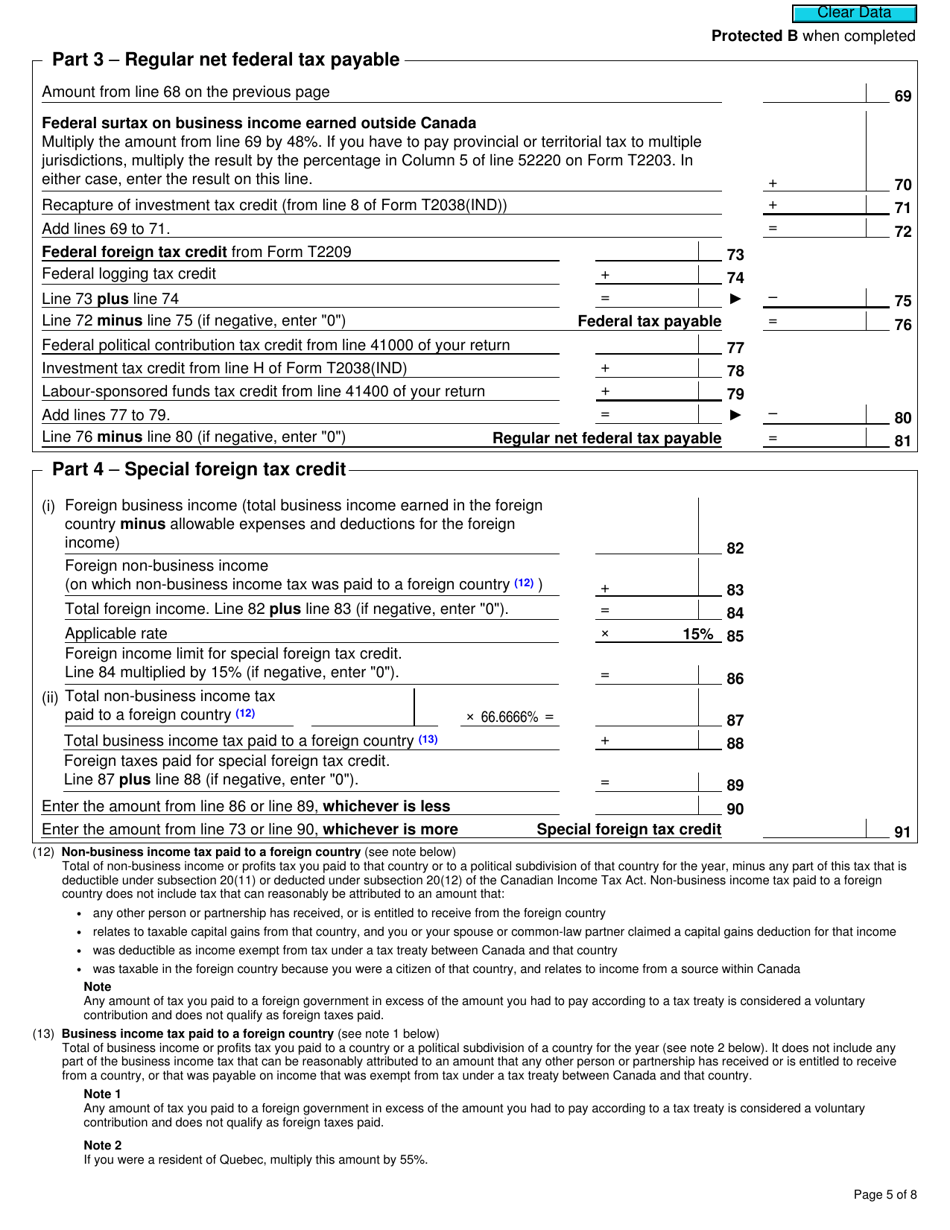

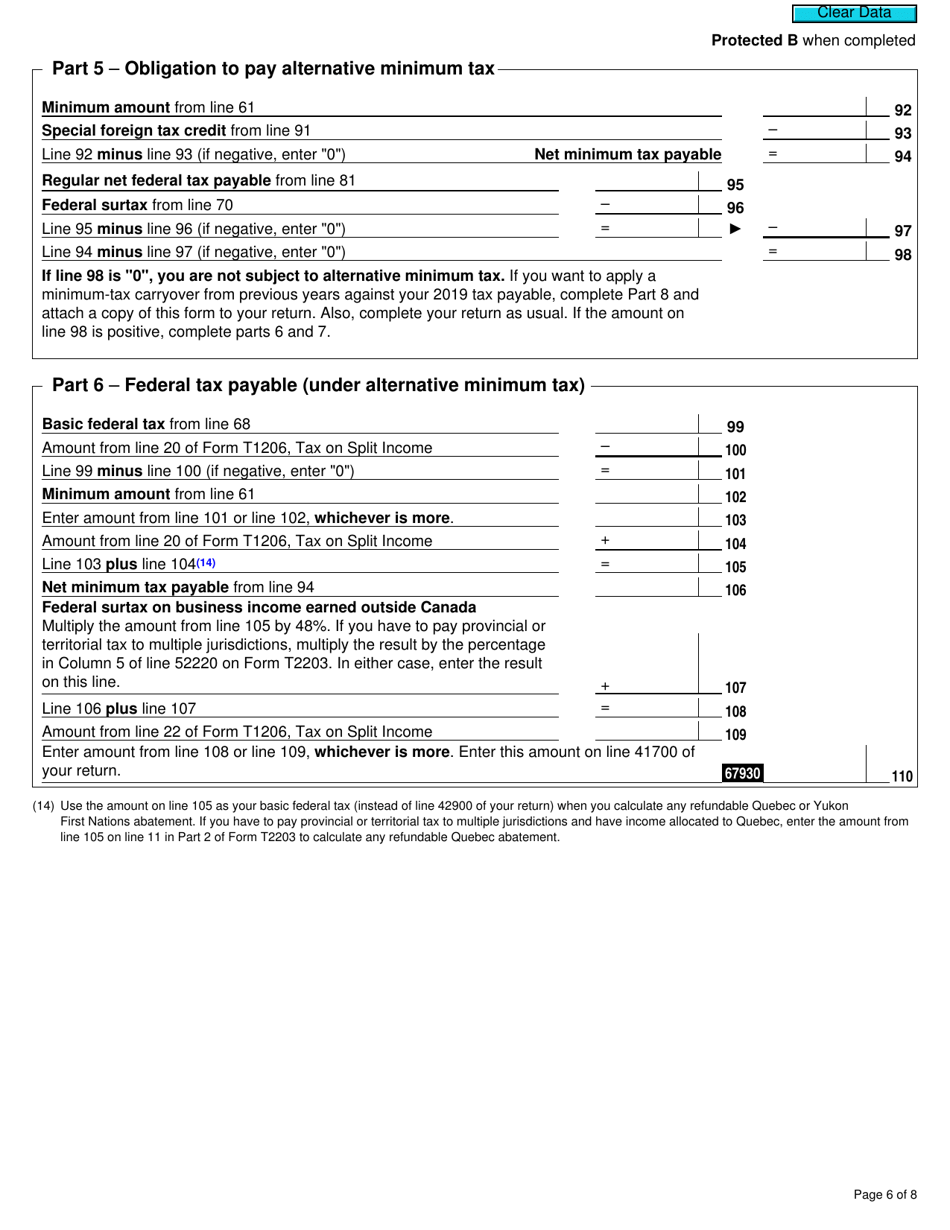

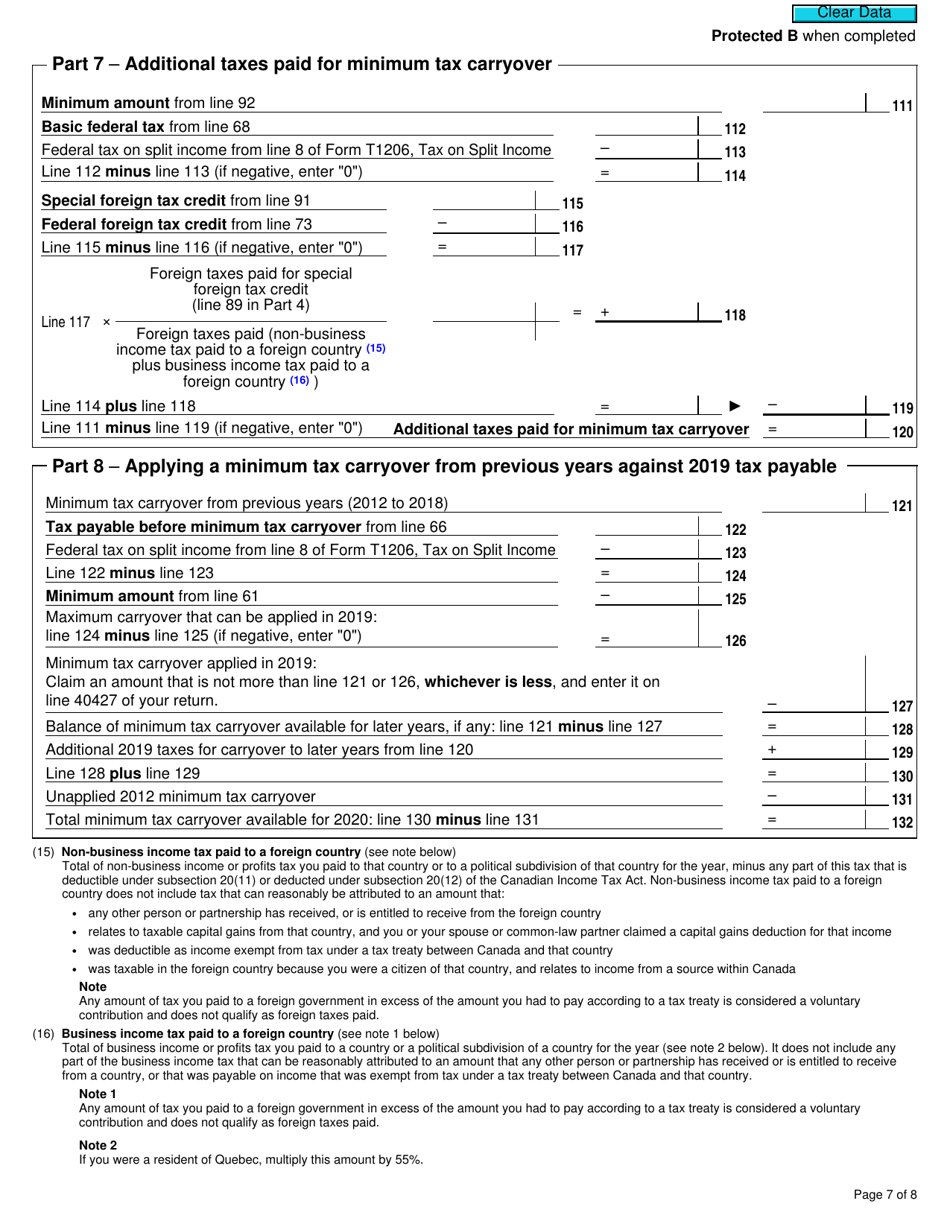

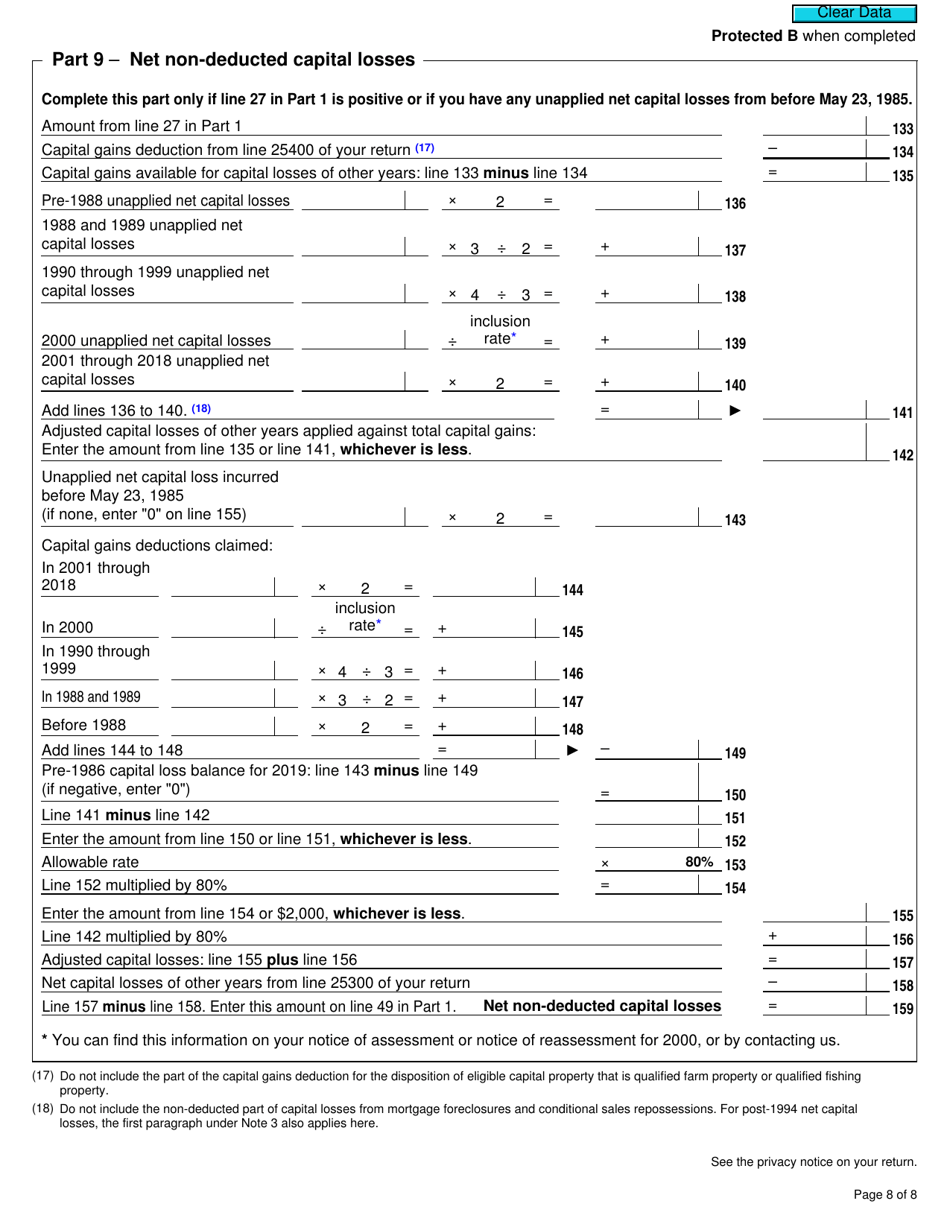

Form T691 Alternative Minimum Tax - Canada

Form T691 is used to calculate and report the Alternative Minimum Tax (AMT) in Canada. The AMT is an additional tax calculated based on a different set of rules than regular income tax. It helps ensure that individuals and corporations with high incomes or significant tax benefits still pay a minimum amount of tax, even if they have deductions or other tax preferences. The form provides the necessary information to determine if AMT applies and the amount owed.

Individuals who are subject to the Alternative Minimum Tax (AMT) in Canada should file the Form T691.

FAQ

Q: What is Form T691?

A: Form T691 is a tax form used in Canada to calculate the Alternative Minimum Tax (AMT).

Q: What is the Alternative Minimum Tax (AMT)?

A: The Alternative Minimum Tax (AMT) is a separate tax system in Canada designed to ensure that individuals and corporations with high income and significant deductions pay a minimum amount of tax.

Q: Who needs to fill out Form T691?

A: Individuals and corporations who are subject to the Alternative Minimum Tax (AMT) in Canada need to fill out Form T691.

Q: What information is required on Form T691?

A: Form T691 requires you to provide details about your income, deductions, and adjustments that are relevant to calculating the Alternative Minimum Tax (AMT).

Q: Are there any special rules or exceptions related to Form T691?

A: Yes, there are specific rules and exceptions related to the Alternative Minimum Tax (AMT) in Canada. It is advisable to consult a tax professional or refer to the guidance provided by the Canada Revenue Agency (CRA) for more information.

Q: When is the deadline for filing Form T691?

A: The deadline for filing Form T691 is generally the same as the deadline for filing your income tax return in Canada, which is April 30th for individuals and June 15th for self-employed individuals.

Q: What happens if I don't file Form T691?

A: If you are required to file Form T691 but fail to do so, you may be subject to penalties and interest charges by the Canada Revenue Agency (CRA). It is important to meet all tax filing obligations to avoid any potential consequences.

Q: Can I e-file Form T691?

A: As of now, Form T691 cannot be e-filed. It must be filed in paper format by mail or in person at a Canada Revenue Agency (CRA) tax services office.

Q: Can I get help with filling out Form T691?

A: Yes, you can seek assistance from a tax professional or contact the Canada Revenue Agency (CRA) for guidance in filling out Form T691.