This version of the form is not currently in use and is provided for reference only. Download this version of

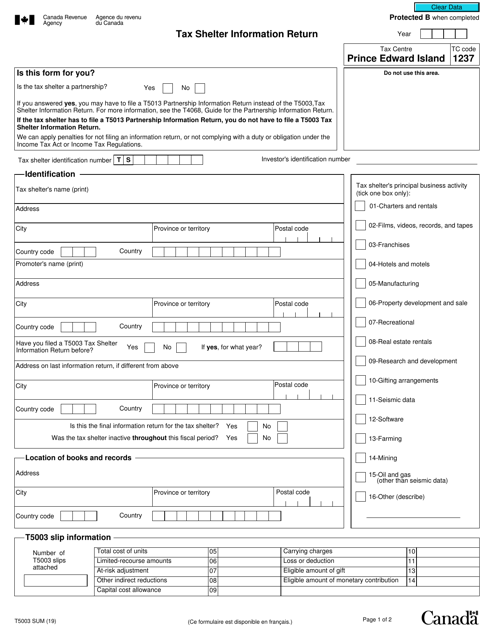

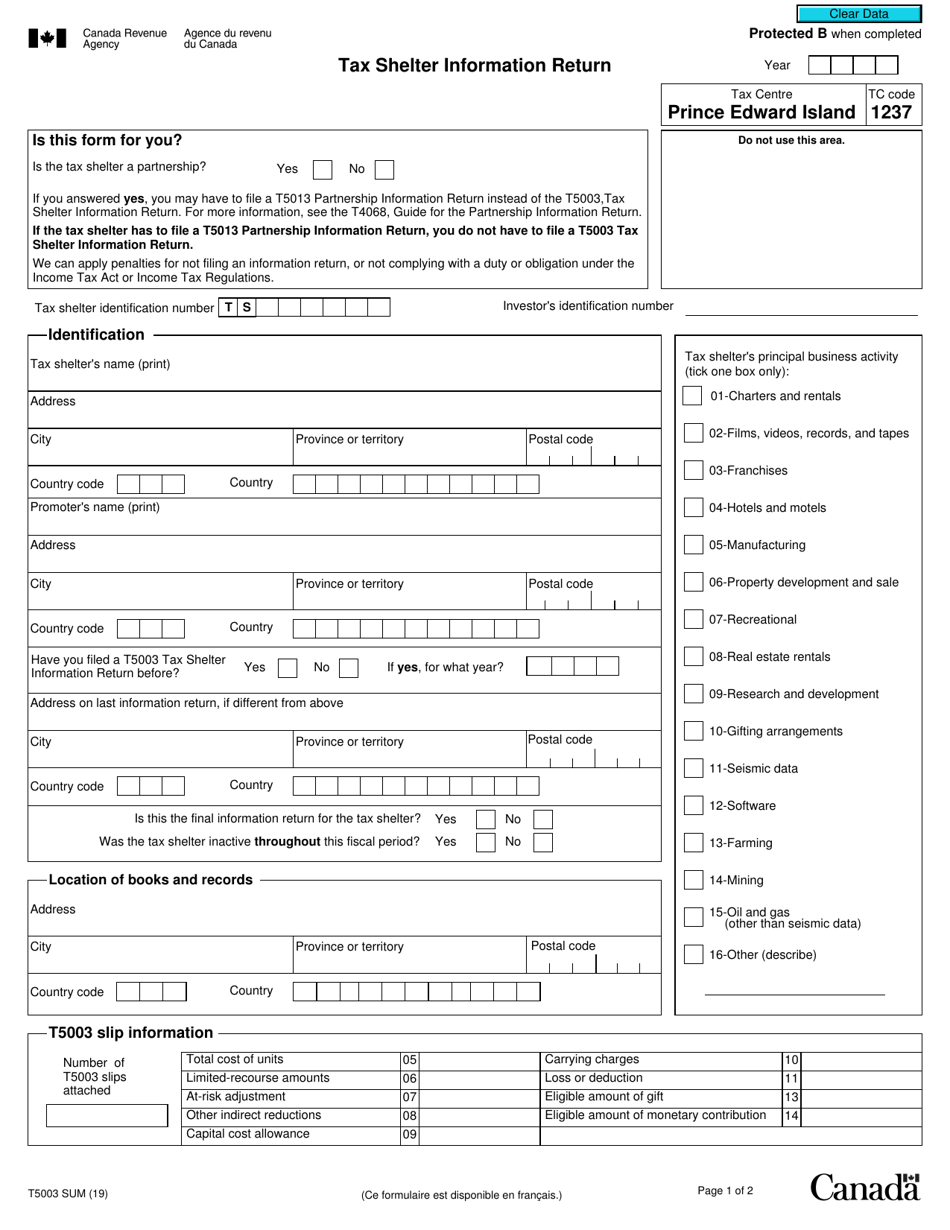

Form T5003 SUM

for the current year.

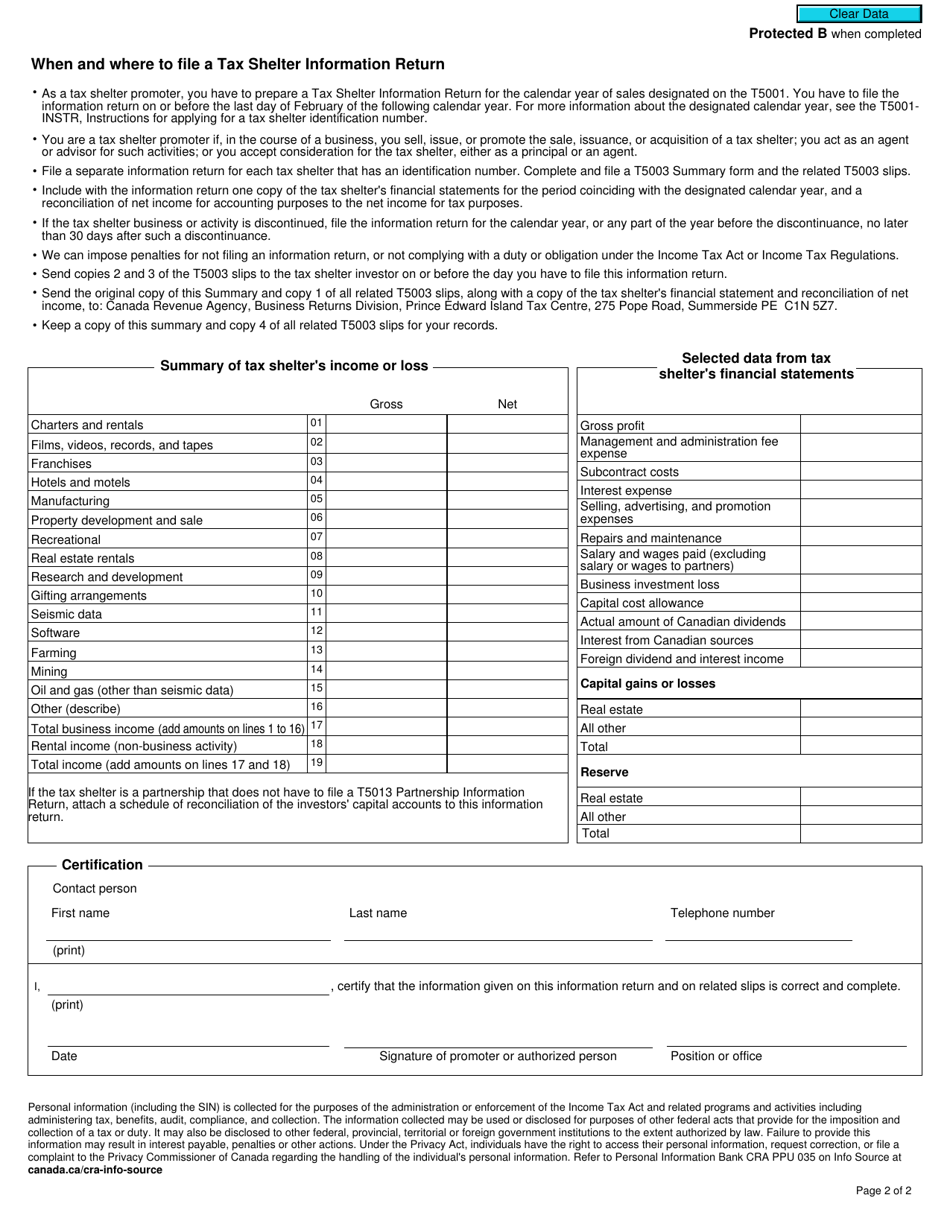

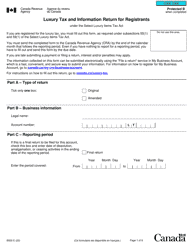

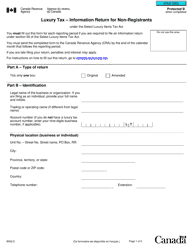

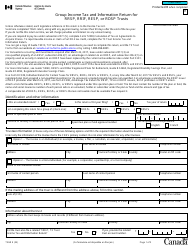

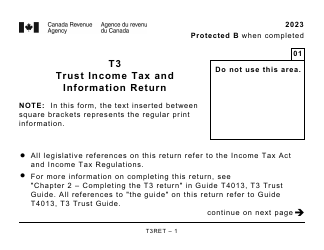

Form T5003 SUM Tax Shelter Information Return - Canada

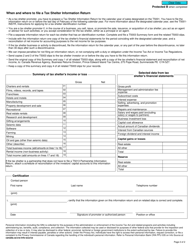

Form T5003 SUM Tax Shelter Information Return in Canada is used by tax shelter promoters to report information about tax shelter investments. It helps the Canada Revenue Agency (CRA) to track and regulate tax shelter schemes and ensure compliance with tax laws. The form provides details about the tax shelter, the investors, and any benefits or deductions claimed.

The form T5003 SUM Tax Shelter Information Return is filed by the promoters of tax shelter arrangements in Canada.

FAQ

Q: What is Form T5003?

A: Form T5003 is the SUM Tax Shelter Information Return in Canada.

Q: Who needs to fill out Form T5003?

A: Anyone who participates in a specified tax shelter must complete Form T5003.

Q: What is a specified tax shelter?

A: A specified tax shelter is an investment or arrangement that offers tax benefits which are significant in comparison to the investor’s contribution.

Q: What information is required on Form T5003?

A: Form T5003 requires details about the specified tax shelter, including the name, address, and tax shelter identification number.

Q: When is Form T5003 due?

A: Form T5003 must be filed within 90 days after the end of the tax shelter period.