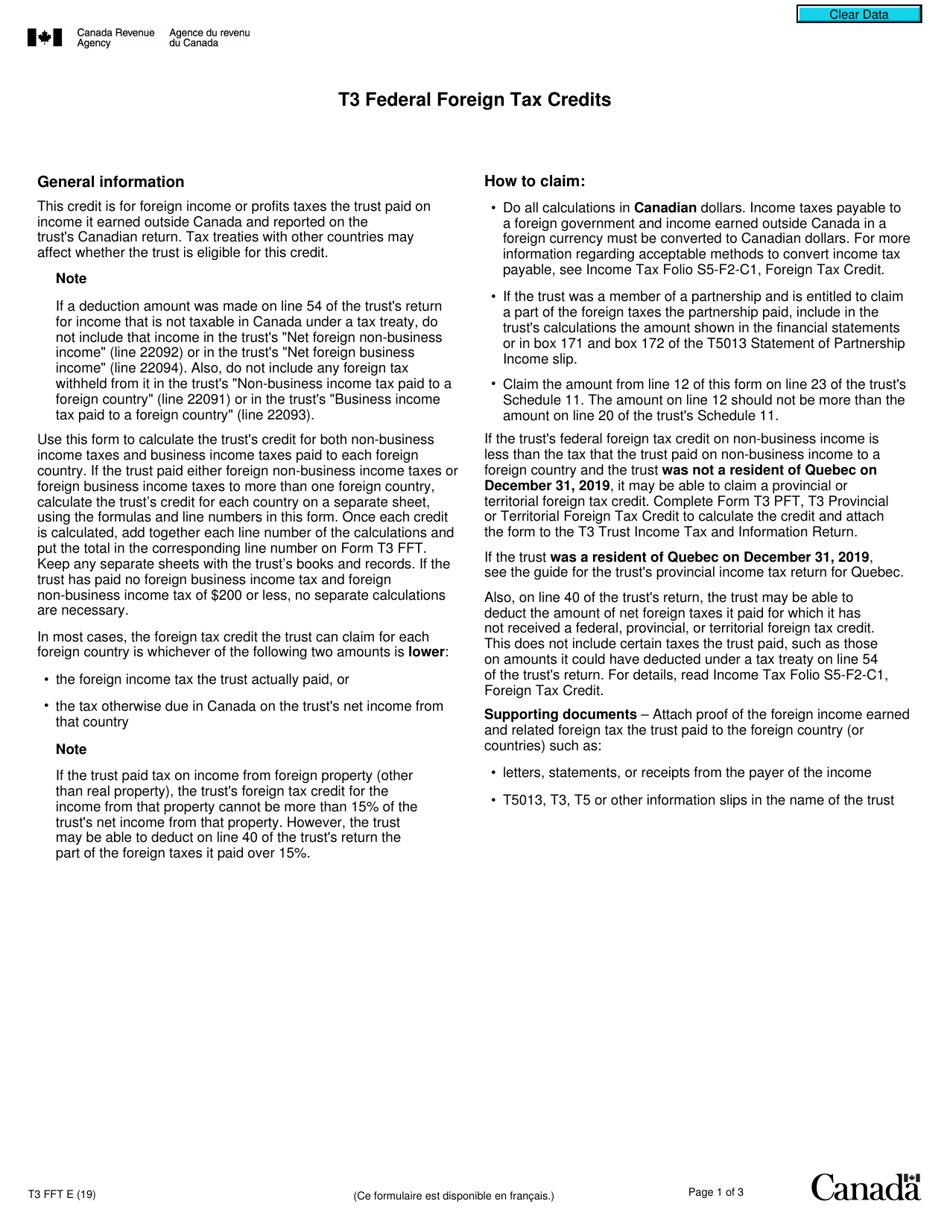

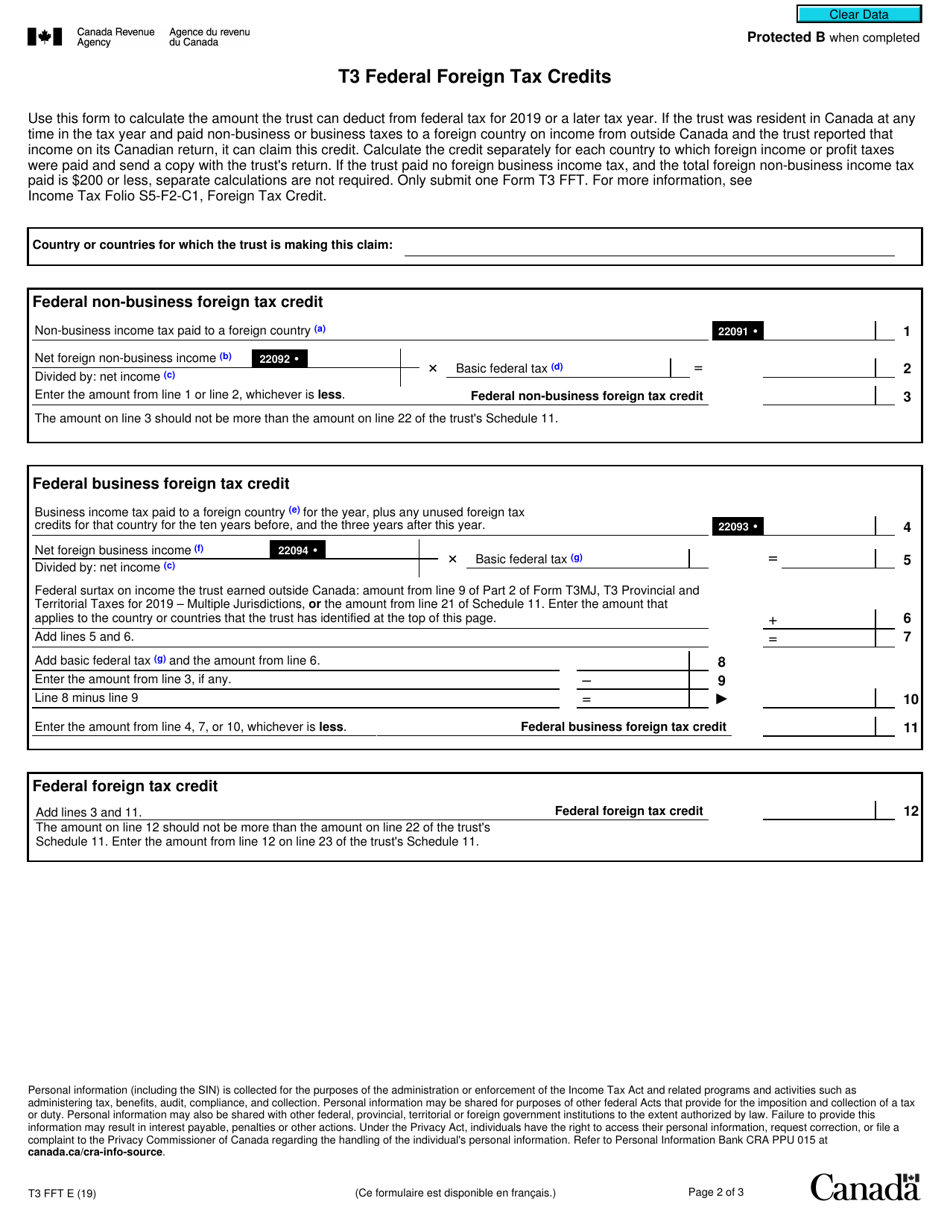

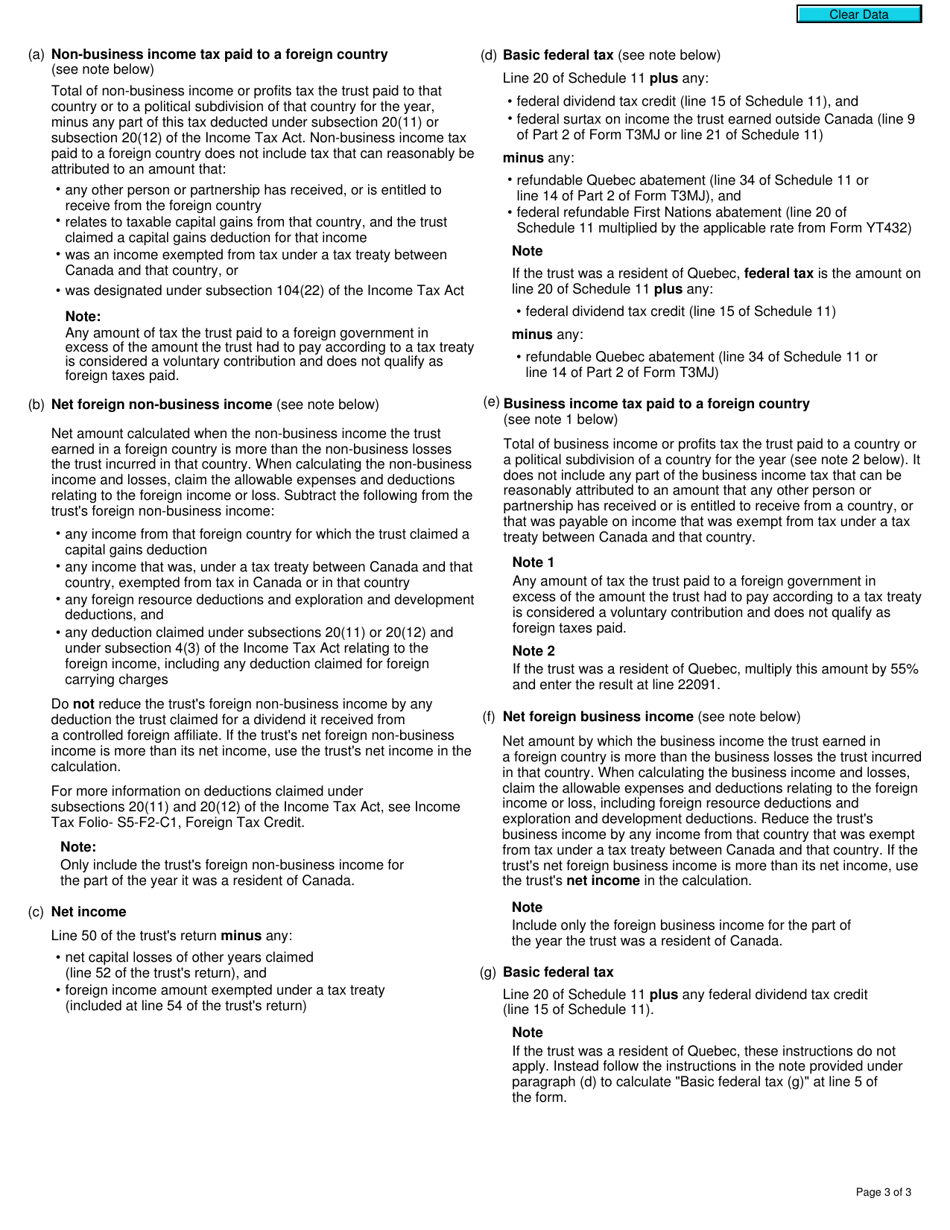

Form T3 FFT Federal Foreign Tax Credits - Canada

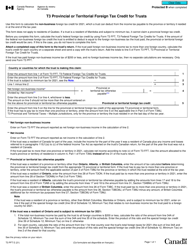

Form T3 FFT, or the Federal Foreign Tax Credits form in Canada, is used to calculate and report any foreign incometaxes paid or withheld, which can be used to offset Canadian income tax liabilities. This form allows Canadian residents to claim tax credits for foreign taxes paid on income earned in other countries.

Individuals who want to claim foreign tax credits for taxes paid to a foreign country on their Canadian income tax return file the Form T3 FFT Federal Foreign Tax Credits - Canada.

FAQ

Q: What is Form T3 FFT?

A: Form T3 FFT is a form used in Canada to calculate federal foreign tax credits.

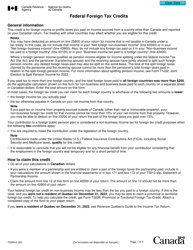

Q: What are federal foreign tax credits?

A: Federal foreign tax credits are credits that can be claimed by Canadian residents to offset taxes paid to foreign countries.

Q: Who is eligible to claim federal foreign tax credits?

A: Canadian residents who have paid taxes to foreign countries on income earned outside of Canada are eligible to claim federal foreign tax credits.

Q: What expenses can be claimed as federal foreign tax credits?

A: Expenses that can be claimed as federal foreign tax credits include income taxes paid to foreign countries, foreign business taxes, and foreign non-business taxes.

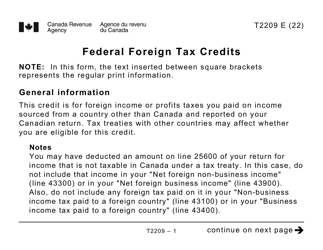

Q: How do I calculate federal foreign tax credits?

A: To calculate federal foreign tax credits, you need to determine the amount of foreign taxes paid, convert the foreign taxes to Canadian dollars, and complete Form T3 FFT.

Q: When is the deadline to file Form T3 FFT?

A: The deadline to file Form T3 FFT is the same as the deadline for filing your Canadian income tax return, which is generally April 30th of each year.

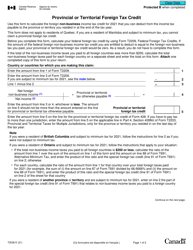

Q: Can I claim federal foreign tax credits for taxes paid to all foreign countries?

A: Yes, you can claim federal foreign tax credits for taxes paid to any foreign country, as long as you meet the eligibility criteria.

Q: Can I carry forward unused federal foreign tax credits to future years?

A: Yes, unused federal foreign tax credits can be carried forward for 10 years and applied against future taxes payable on foreign income.

Q: Do I need to include supporting documentation when filing Form T3 FFT?

A: It is recommended to keep supporting documentation, such as foreign tax returns and receipts, in case the Canada Revenue Agency requests them for verification.