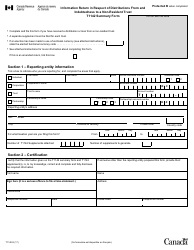

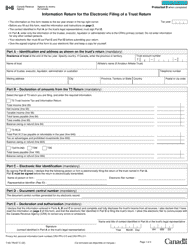

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3F

for the current year.

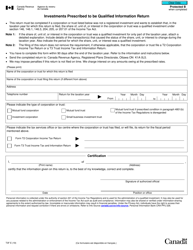

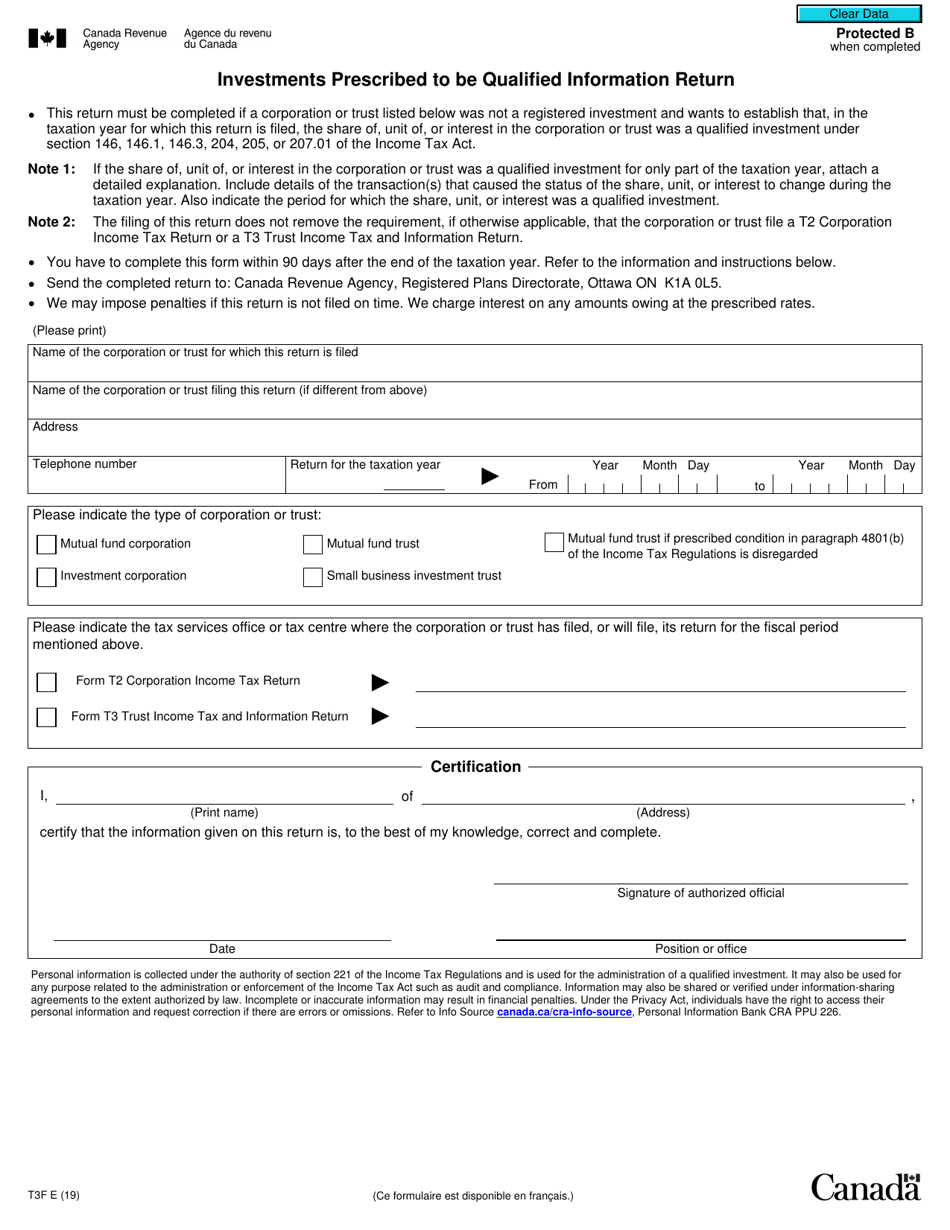

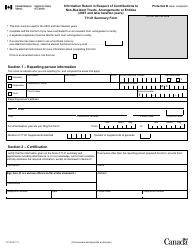

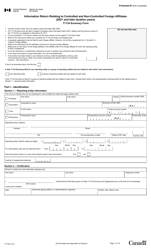

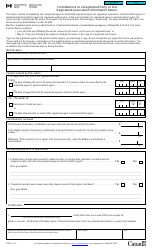

Form T3F Investments Prescribed to Be Qualified Information Return - Canada

Form T3F Investments Prescribed to Be Qualified Information Return is used in Canada to report information about investments held in a registered trust account. It provides details on the trust's investments, income received, expenses incurred, and any distributions made to beneficiaries. The purpose of this form is to ensure the accurate reporting of income and to comply with tax regulations.

The Form T3F Investments Prescribed to Be Qualified Information Return in Canada is filed by the trustee of a mutual fund trust.

FAQ

Q: What is Form T3F?

A: Form T3F is an information return in Canada.

Q: What are prescribed investments?

A: Prescribed investments refer to certain types of investments.

Q: What does it mean for an investment to be qualified?

A: A qualified investment meets specific requirements.

Q: Why is Form T3F important?

A: Form T3F is important for reporting prescribed and qualified investments.

Q: Who needs to file Form T3F?

A: Anyone with prescribed or qualified investments in Canada needs to file Form T3F.

Q: When is the deadline for filing Form T3F?

A: The deadline for filing Form T3F is usually within 90 days after the end of the tax year.

Q: Are there any penalties for not filing Form T3F?

A: Yes, there may be penalties for not filing Form T3F, including financial penalties.

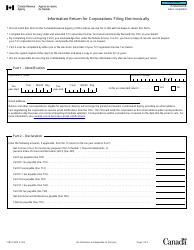

Q: Can I file Form T3F on paper?

A: Yes, Form T3F can also be filed on paper and mailed to the CRA.

Q: What other information should I include with Form T3F?

A: You should include any supporting documents or statements required by the CRA.

Q: Can I get help with filling out Form T3F?

A: Yes, you can seek assistance from a tax professional or contact the CRA for guidance.

Q: Is Form T3F applicable only to individuals?

A: No, Form T3F is applicable to both individuals and corporations with prescribed or qualified investments.

Q: What happens after I file Form T3F?

A: After you file Form T3F, the CRA will review the information and may contact you if further clarification is needed.

Q: Can I amend Form T3F if I made a mistake?

A: Yes, you can amend Form T3F by filing a new form with the corrected information.

Q: Is Form T3F the same as a tax return?

A: No, Form T3F is an information return specific to prescribed and qualified investments, while a tax return includes a broader range of income and deductions.