This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 6

for the current year.

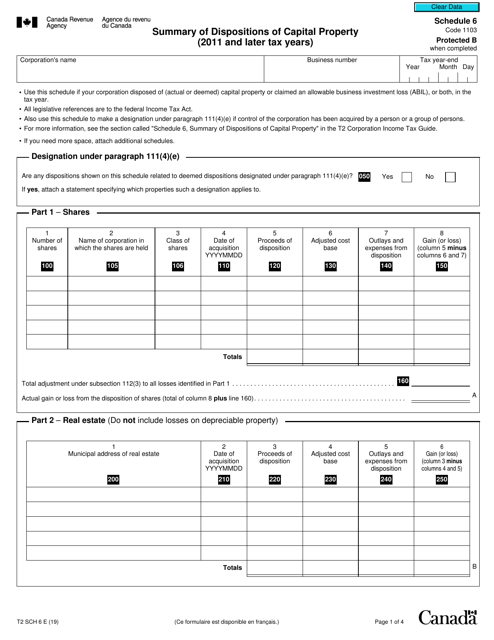

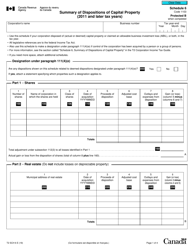

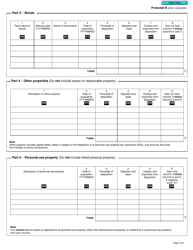

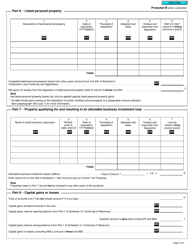

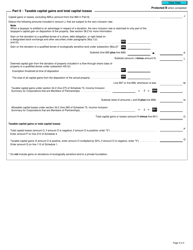

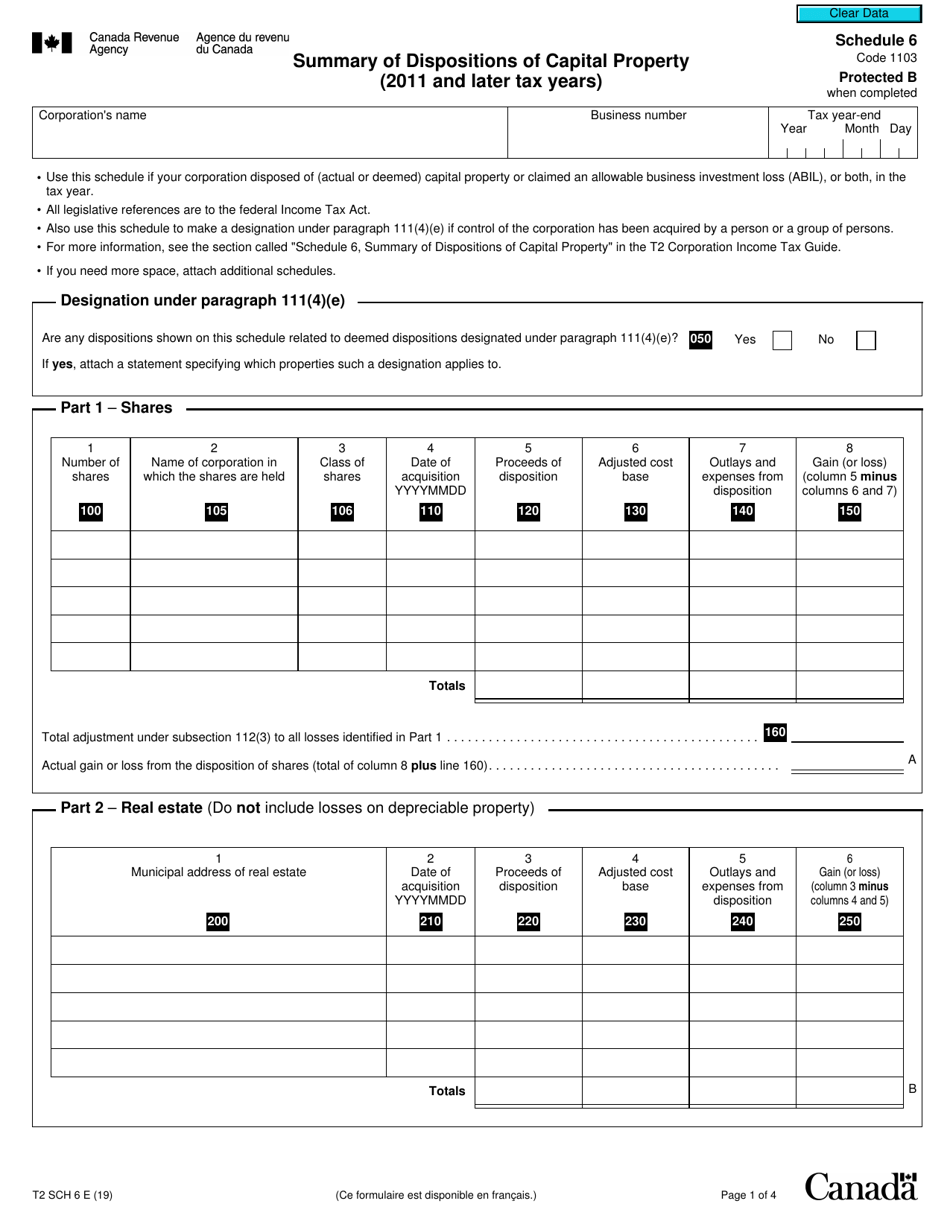

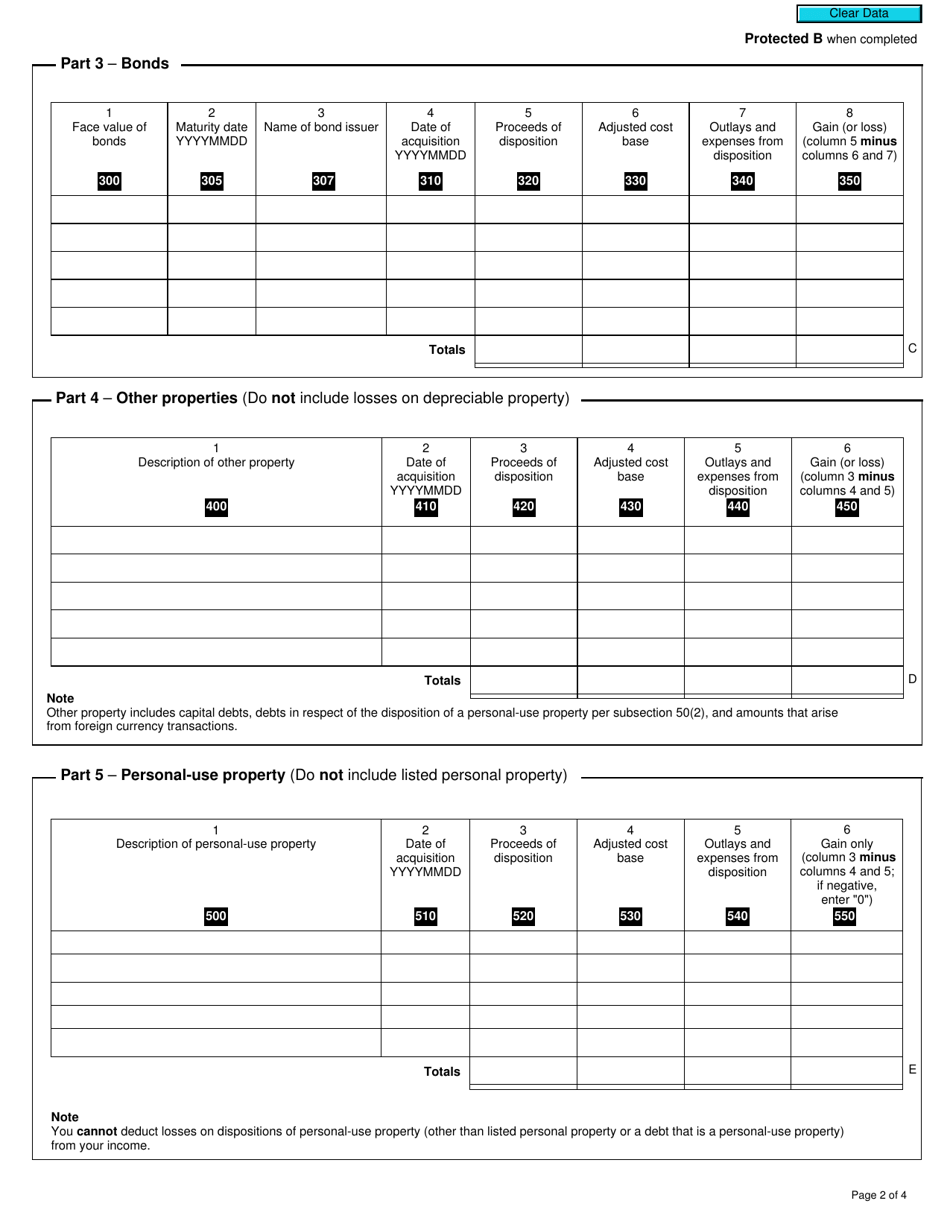

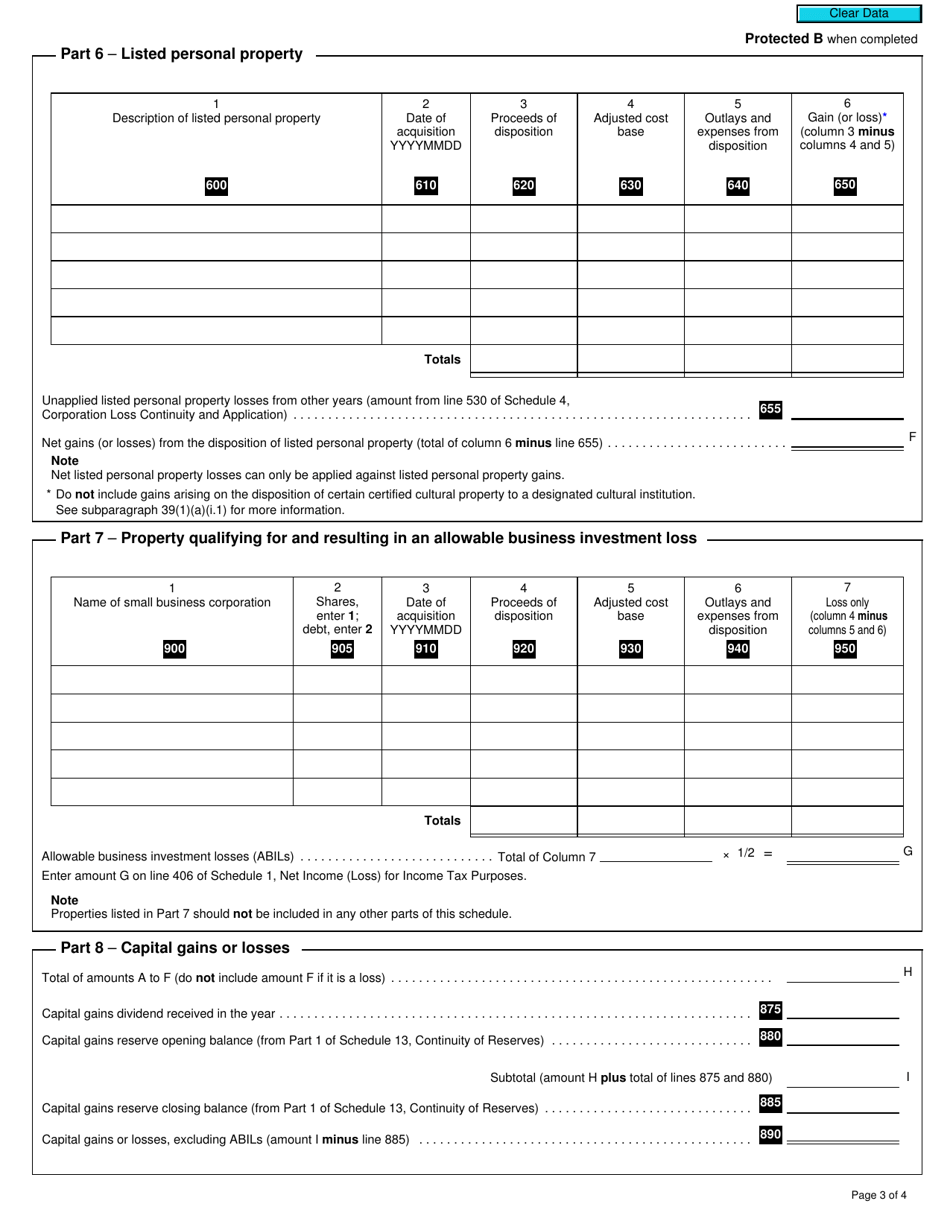

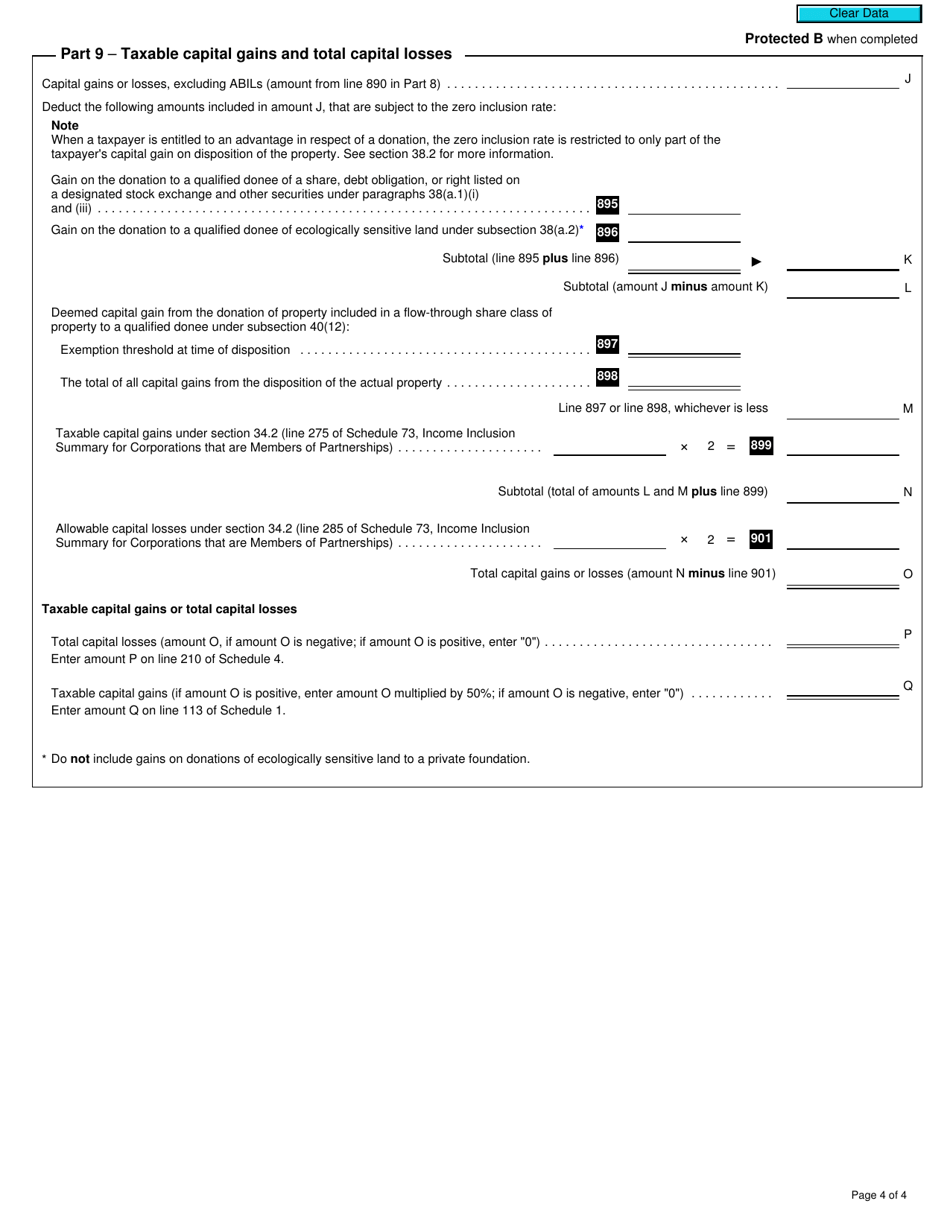

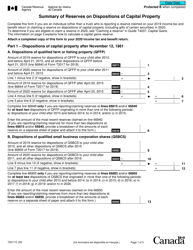

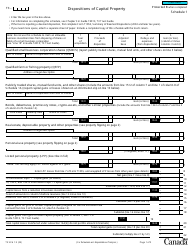

Form T2 Schedule 6 Summary of Dispositions of Capital Property (2011 and Later Tax Years) - Canada

Form T2 Schedule 6 is used in Canada to report the summary of dispositions of capital property for tax years 2011 and later. It is a way for businesses to report any sales or transfers of capital assets that may be subject to tax implications.

The Form T2 Schedule 6 Summary of Dispositions of Capital Property is filed by Canadian corporations when reporting the sale or disposition of capital assets.

FAQ

Q: What is Form T2 Schedule 6?

A: Form T2 Schedule 6 is a tax form used in Canada for reporting the summary of dispositions of capital property in the tax years 2011 and later.

Q: Who needs to fill out Form T2 Schedule 6?

A: Corporations that have disposed of capital property in the tax years 2011 and later need to fill out Form T2 Schedule 6.

Q: What information is required on Form T2 Schedule 6?

A: Form T2 Schedule 6 requires information about the corporation, the type of disposition, and details about the capital property.

Q: When is the deadline for filing Form T2 Schedule 6?

A: The deadline for filing Form T2 Schedule 6 is usually within six months of a corporation's fiscal year-end.

Q: What happens if I don't file Form T2 Schedule 6?

A: Failure to file Form T2 Schedule 6 or providing incorrect information may result in penalties or fines from the CRA.