This version of the form is not currently in use and is provided for reference only. Download this version of

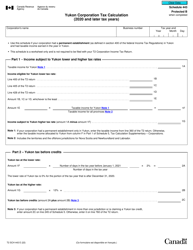

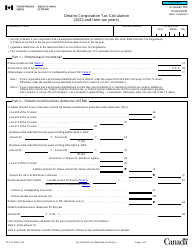

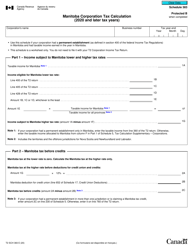

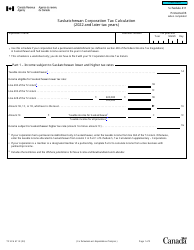

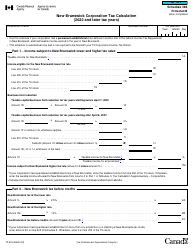

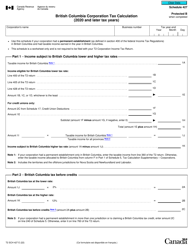

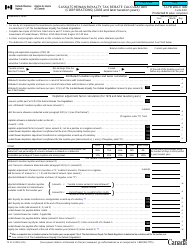

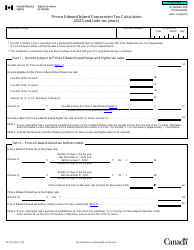

Form T2 Schedule 5

for the current year.

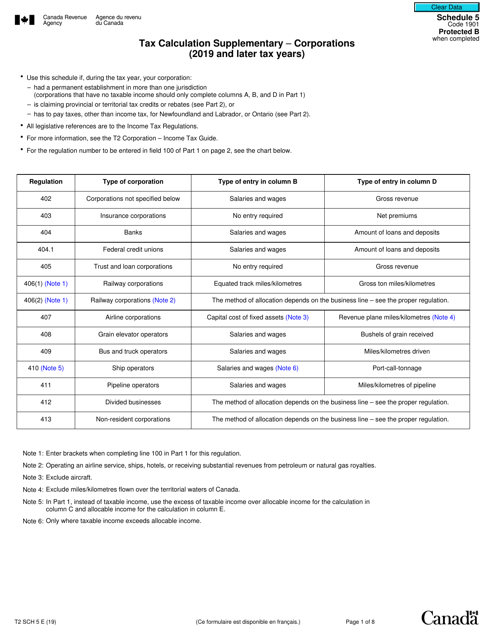

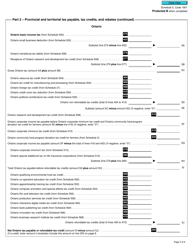

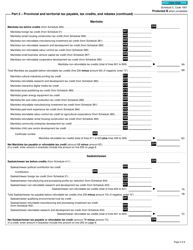

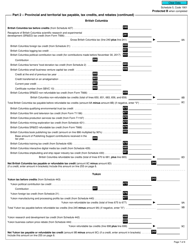

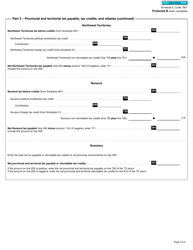

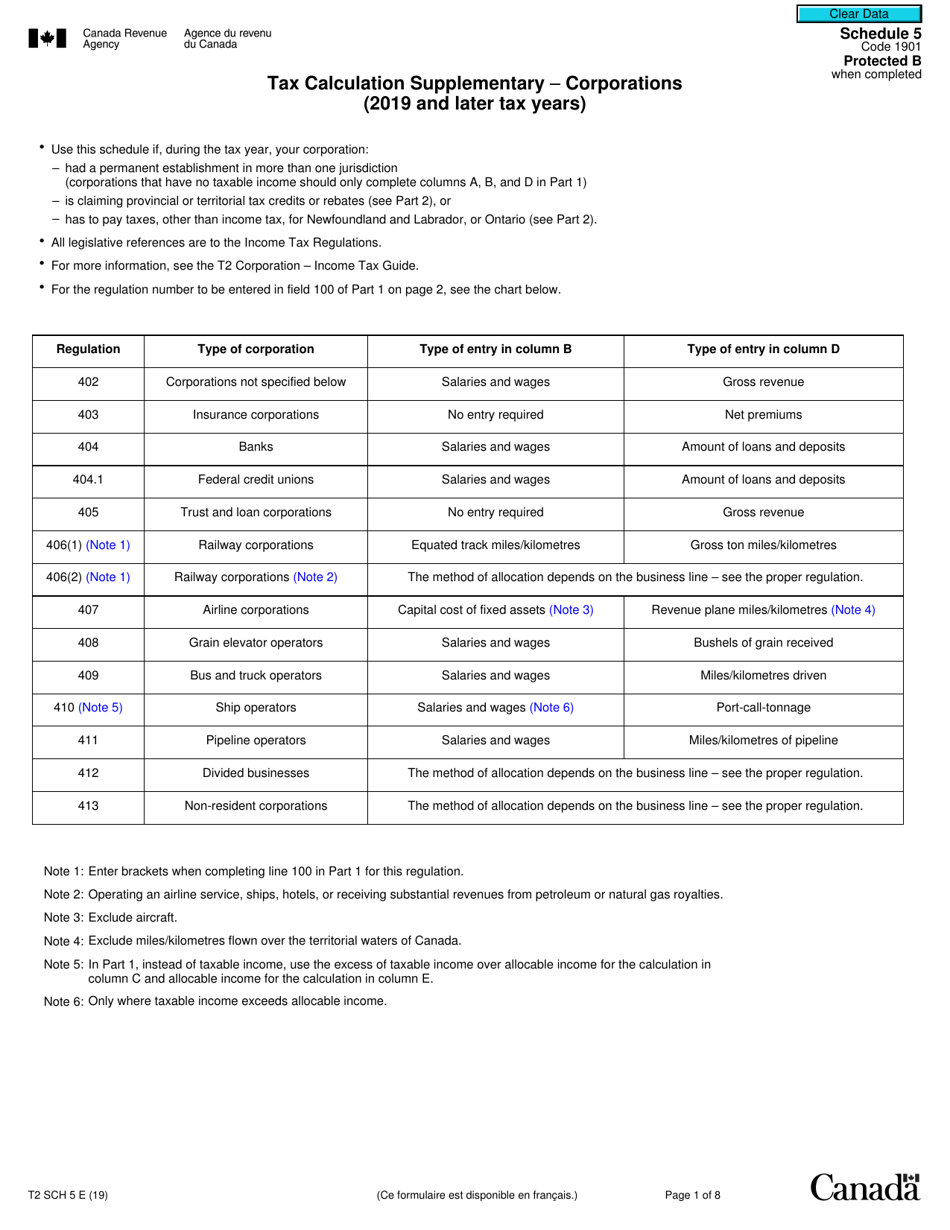

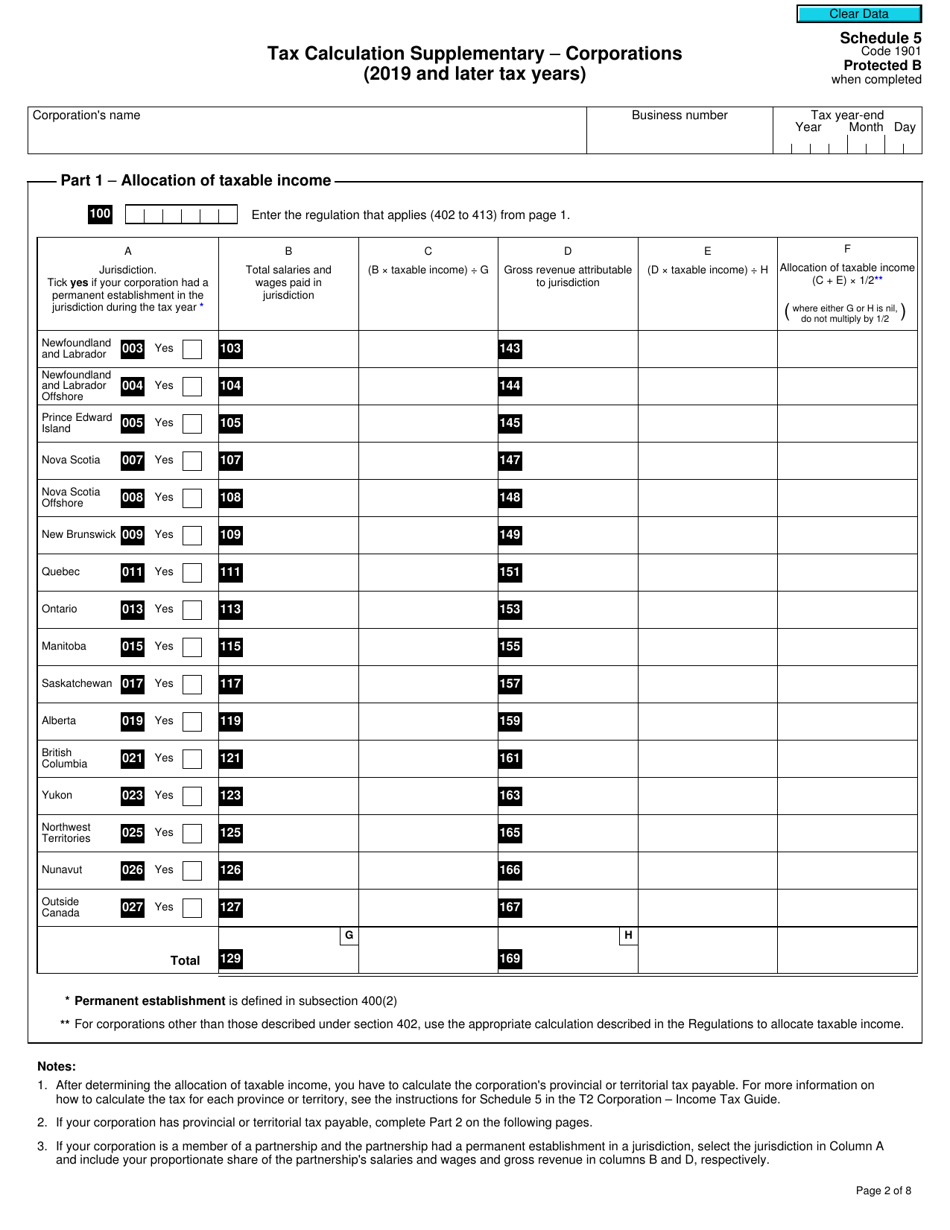

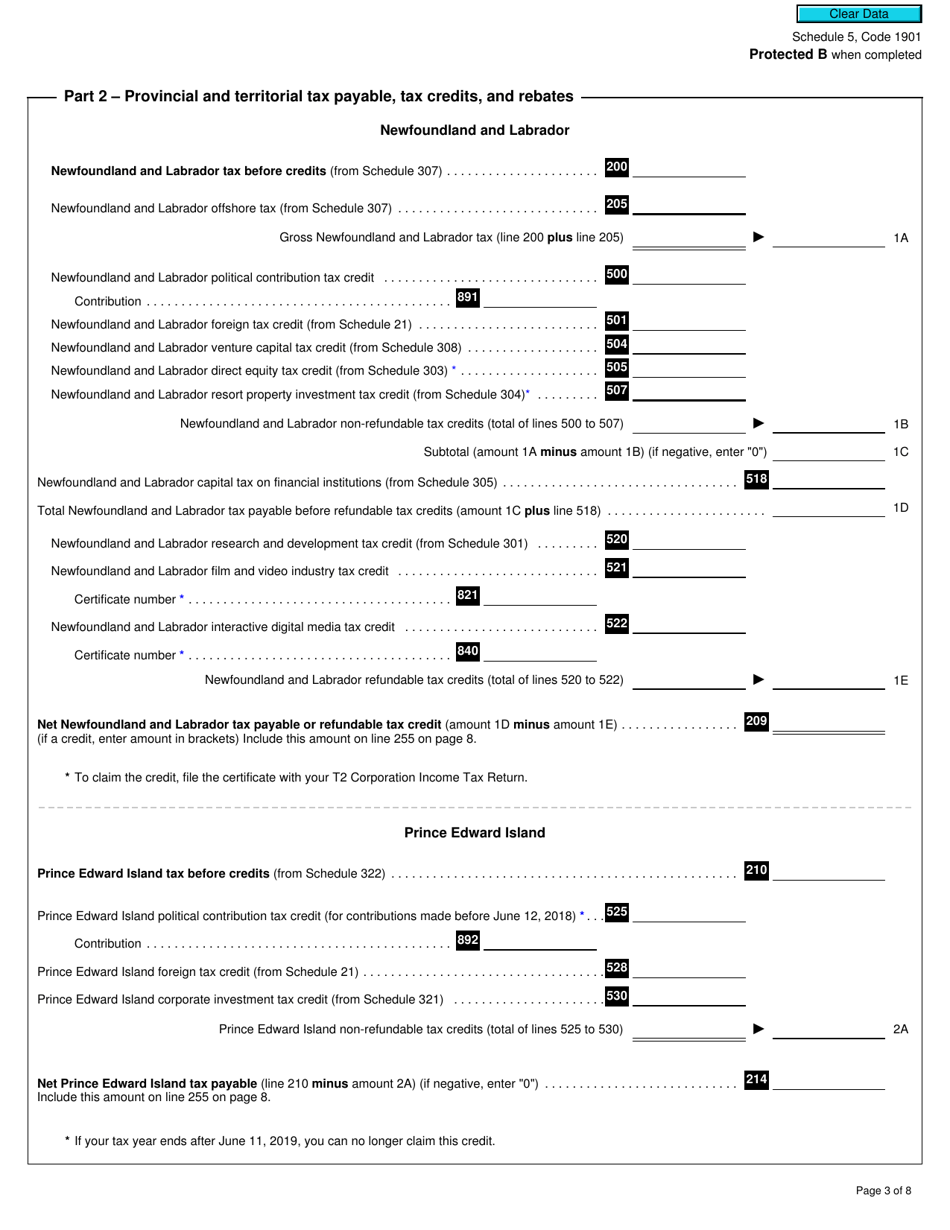

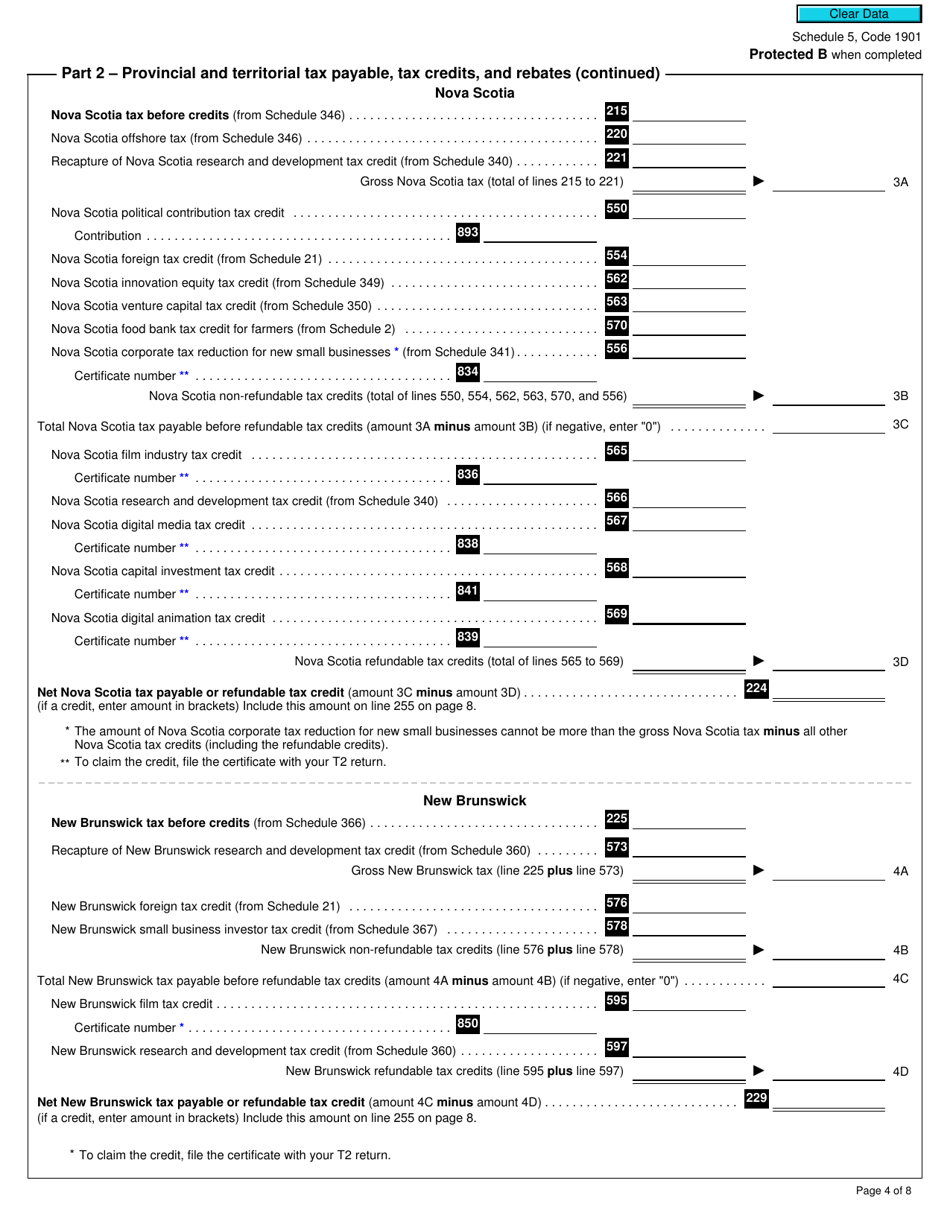

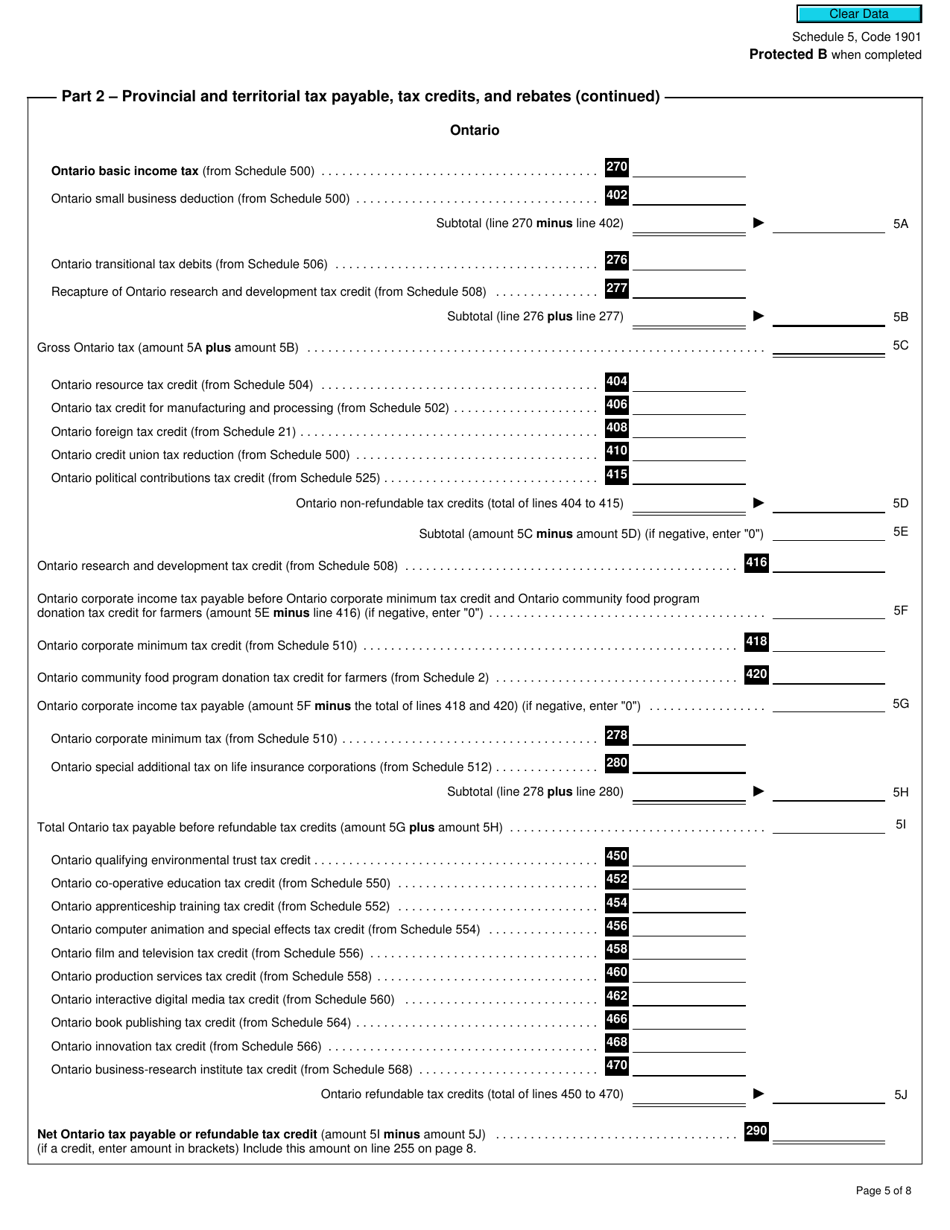

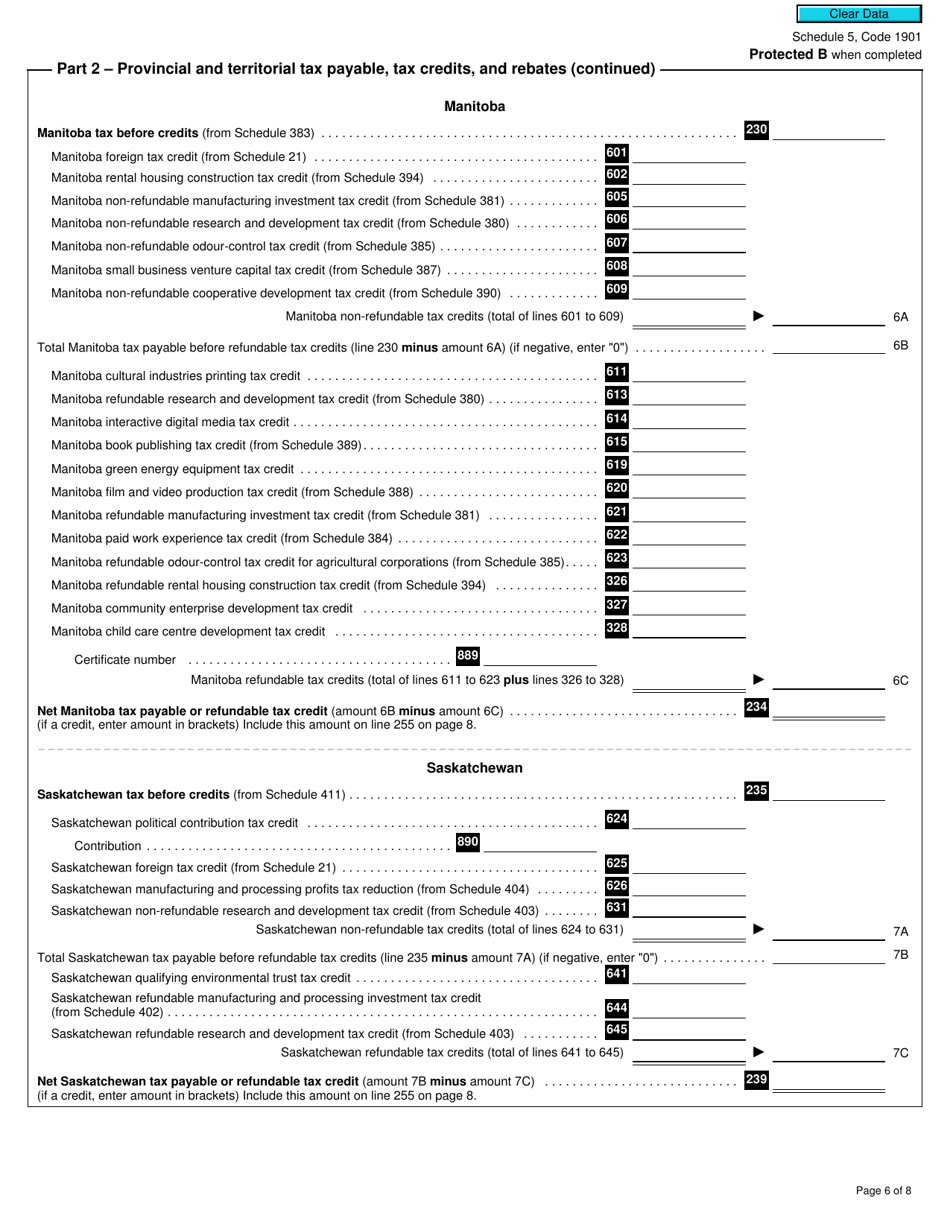

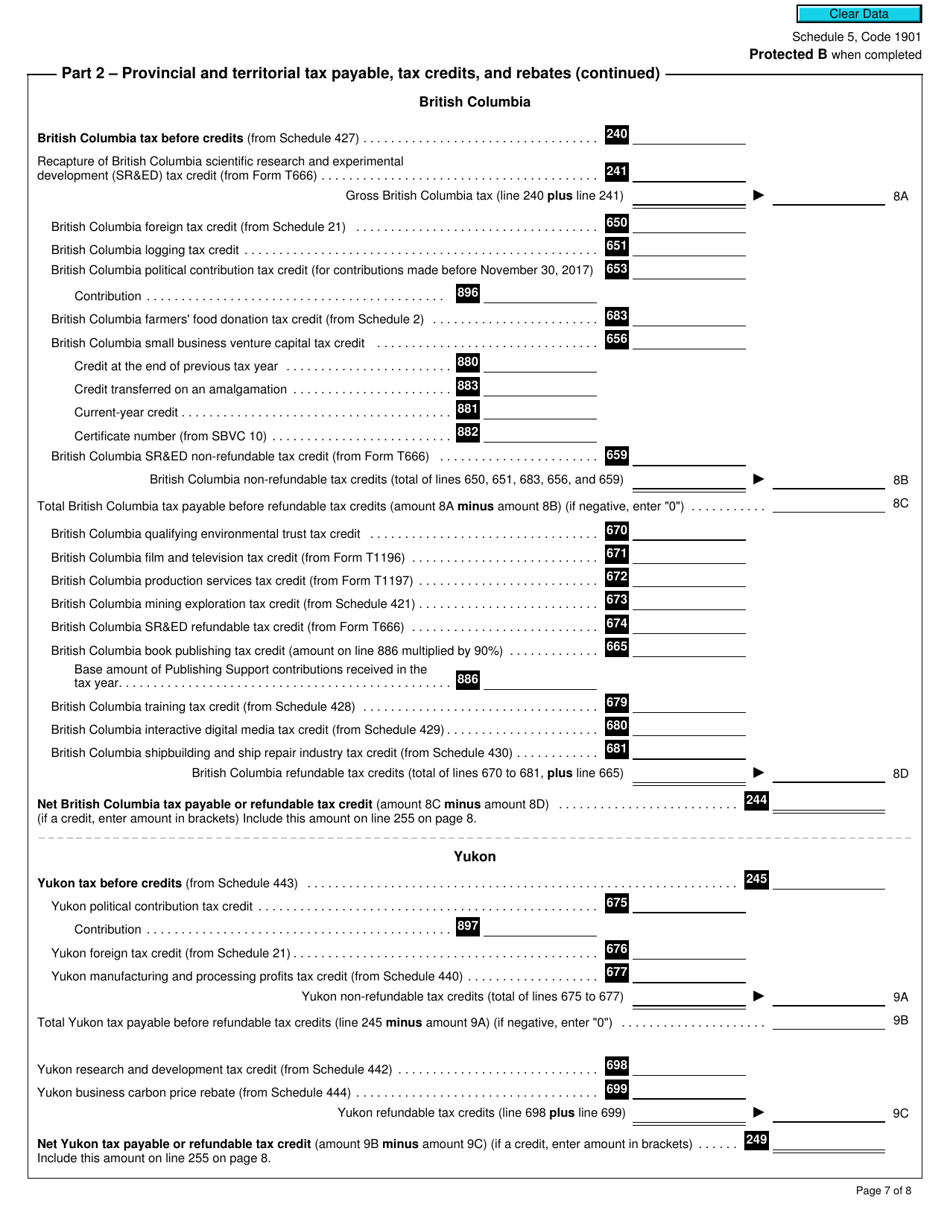

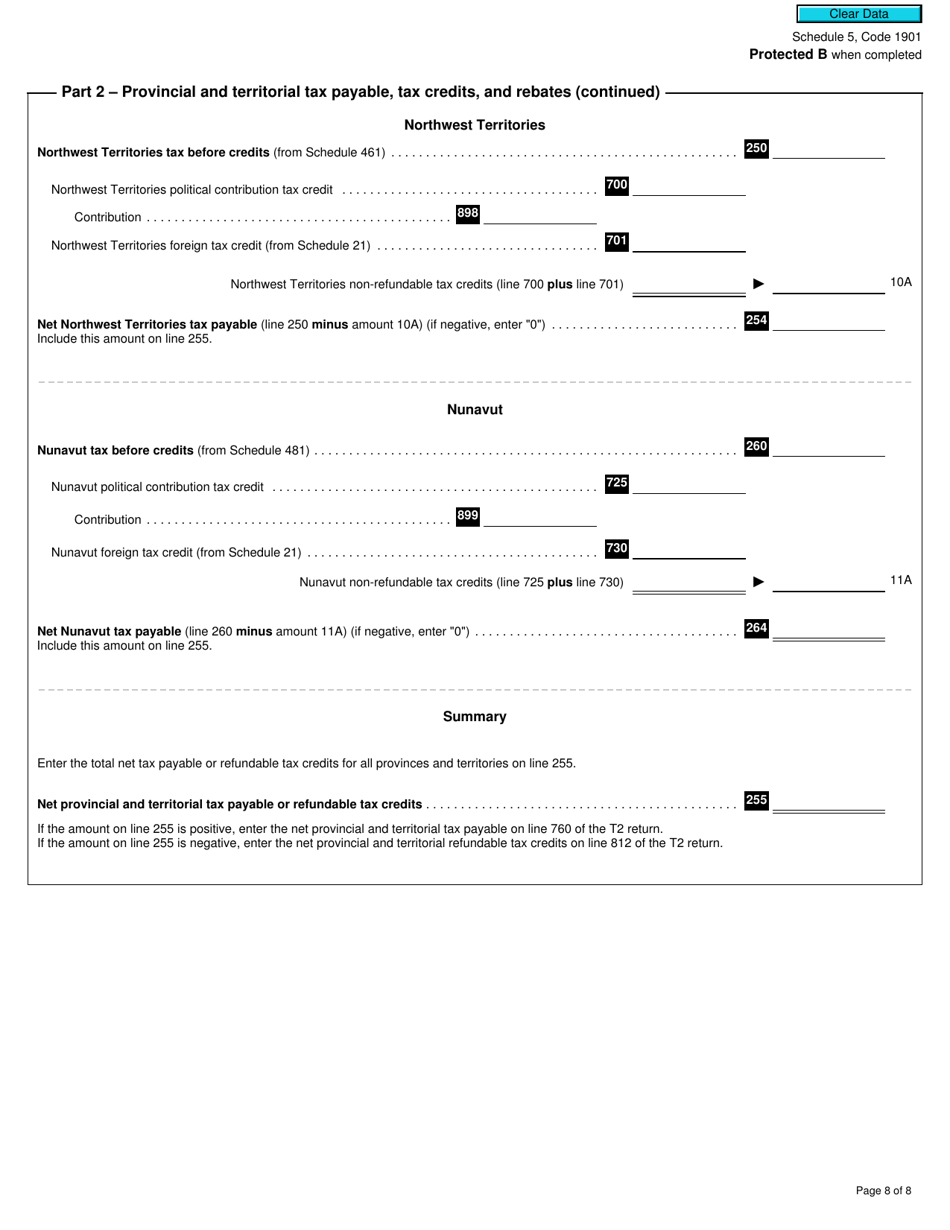

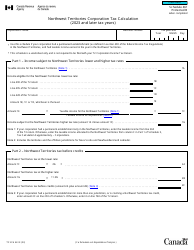

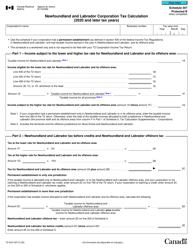

Form T2 Schedule 5 Tax Calculation Supplementary - Corporations (2019 and Later Tax Years) - Canada

Form T2 Schedule 5 Tax Calculation Supplementary - Corporations (2019 and Later Tax Years) is used in Canada to calculate the income tax owed by corporations. It provides additional details and calculations to support the main T2 Corporation Income Tax Return form.

The Form T2 Schedule 5 Tax Calculation Supplementary - Corporations (2019 and Later Tax Years) in Canada is filed by corporations when calculating their taxes.

FAQ

Q: What is Form T2 Schedule 5?

A: Form T2 Schedule 5 is a tax form used by corporations in Canada to calculate their tax liability.

Q: Who is required to file Form T2 Schedule 5?

A: Corporations in Canada are required to file Form T2 Schedule 5 if they have a tax year that begins after 2018.

Q: What is the purpose of Form T2 Schedule 5?

A: The purpose of Form T2 Schedule 5 is to calculate the corporation's taxable income and tax payable.

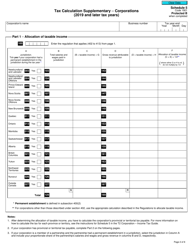

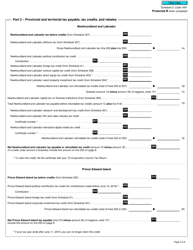

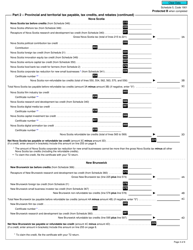

Q: What is included in the tax calculation on Form T2 Schedule 5?

A: The tax calculation on Form T2 Schedule 5 includes various factors such as taxable income, federal and provincial tax rates, and tax credits.