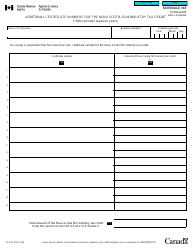

This version of the form is not currently in use and is provided for reference only. Download this version of

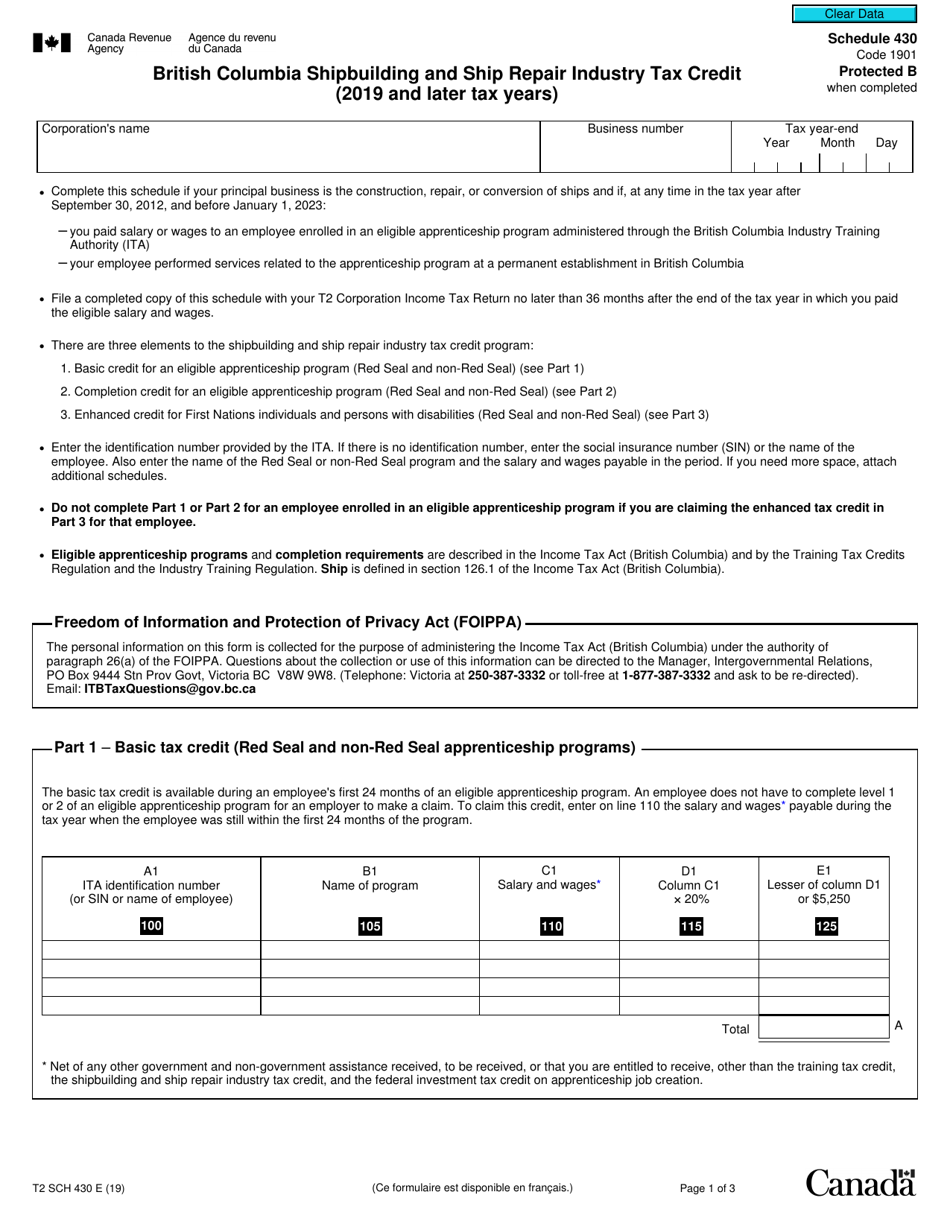

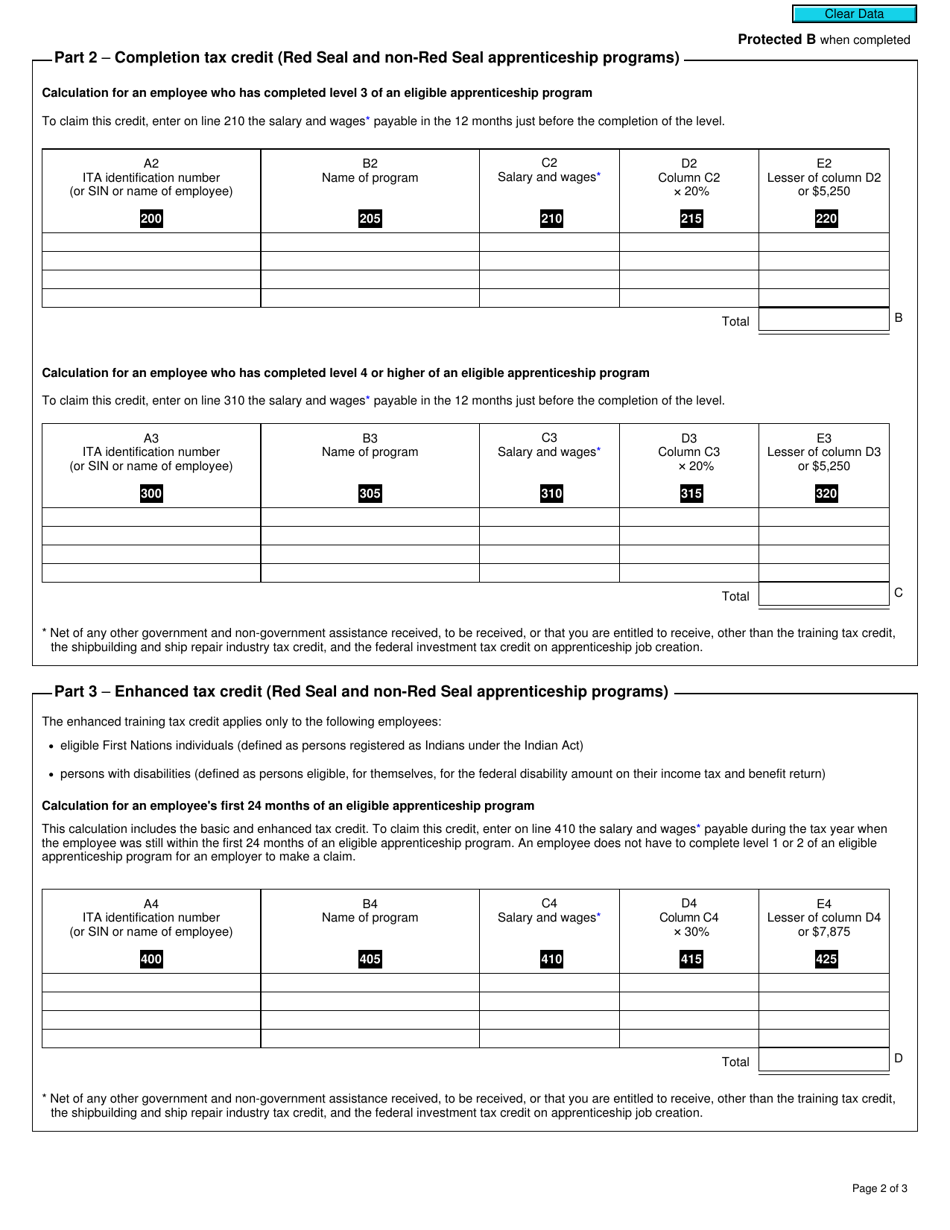

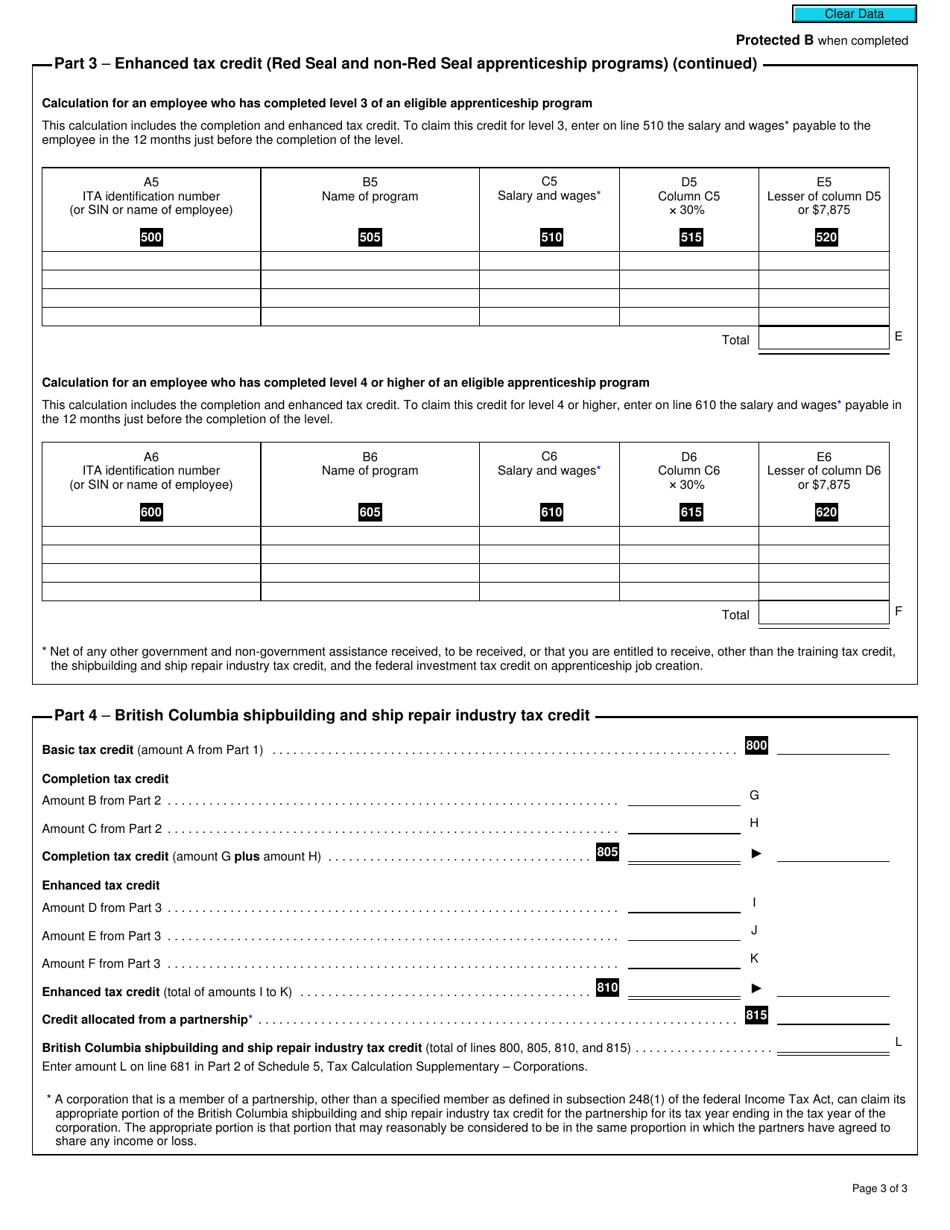

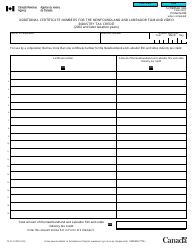

Form T2 Schedule 430

for the current year.

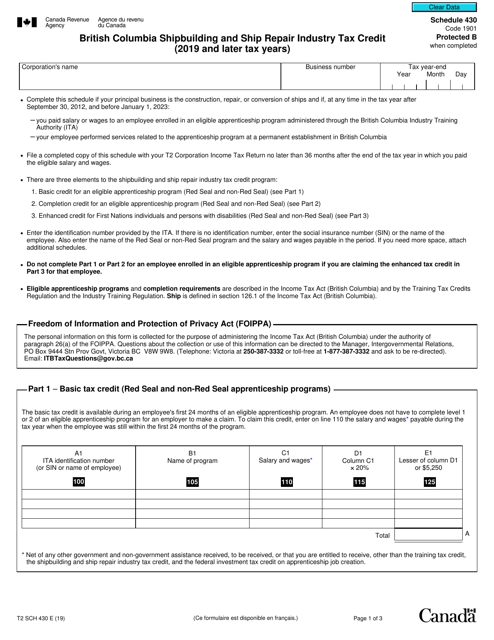

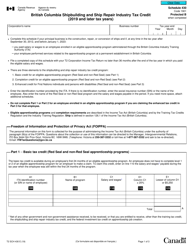

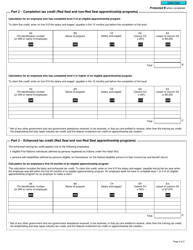

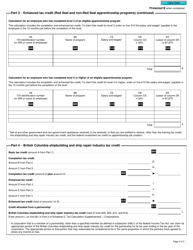

Form T2 Schedule 430 British Columbia Shipbuilding and Ship Repair Industry Tax Credit (2019 and Later Tax Years) - Canada

Form T2 Schedule 430 is used by businesses in British Columbia, Canada to claim the Shipbuilding and Ship Repair Industry Tax Credit. This credit provides tax relief for eligible activities related to shipbuilding and ship repair in the province.

The British Columbia shipbuilding and ship repair industry tax credit is claimed by corporations that are eligible for the credit and have completed the necessary requirements.

FAQ

Q: What is Form T2 Schedule 430?

A: Form T2 Schedule 430 is a tax form used in Canada for claiming the British Columbia Shipbuilding and Ship Repair Industry Tax Credit.

Q: What is the purpose of Form T2 Schedule 430?

A: The purpose of Form T2 Schedule 430 is to calculate and claim the British Columbia Shipbuilding and Ship Repair Industry Tax Credit.

Q: What is the British Columbia Shipbuilding and Ship Repair Industry Tax Credit?

A: The British Columbia Shipbuilding and Ship Repair Industry Tax Credit is a tax credit available to businesses in British Columbia that engage in shipbuilding and ship repair activities.

Q: Who is eligible for the British Columbia Shipbuilding and Ship Repair Industry Tax Credit?

A: Businesses that engage in shipbuilding and ship repair activities in British Columbia may be eligible for the tax credit.

Q: How do I claim the British Columbia Shipbuilding and Ship Repair Industry Tax Credit?

A: To claim the tax credit, businesses must complete and file Form T2 Schedule 430 along with their corporate tax return.

Q: Is there a deadline for claiming the British Columbia Shipbuilding and Ship Repair Industry Tax Credit?

A: The deadline for claiming the tax credit is the same as the deadline for filing the corporate tax return, which is generally six months after the end of the tax year.

Q: Are there any other conditions or requirements for claiming the British Columbia Shipbuilding and Ship Repair Industry Tax Credit?

A: Yes, there are certain conditions and requirements that must be met in order to be eligible for the tax credit. These can be found in the instructions for Form T2 Schedule 430.

Q: Can I claim the British Columbia Shipbuilding and Ship Repair Industry Tax Credit for past tax years?

A: The tax credit is available for the 2019 and later tax years. It cannot be claimed for past tax years.

Q: Is the British Columbia Shipbuilding and Ship Repair Industry Tax Credit refundable?

A: No, the tax credit is non-refundable. It can only be used to reduce the amount of tax owed.