This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 411

for the current year.

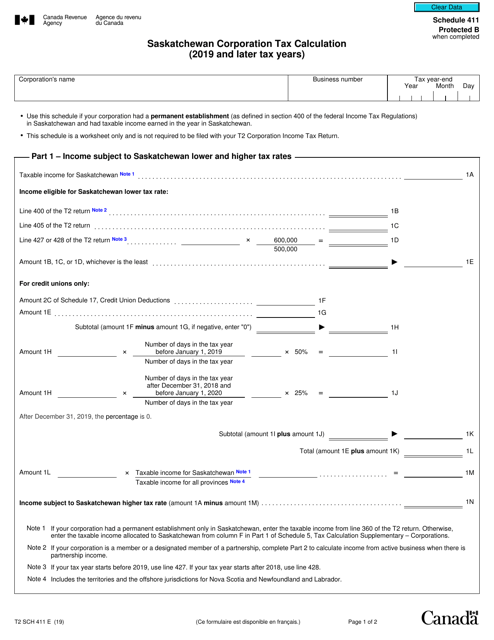

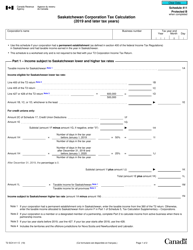

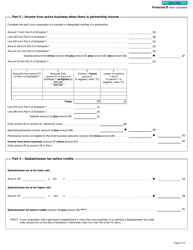

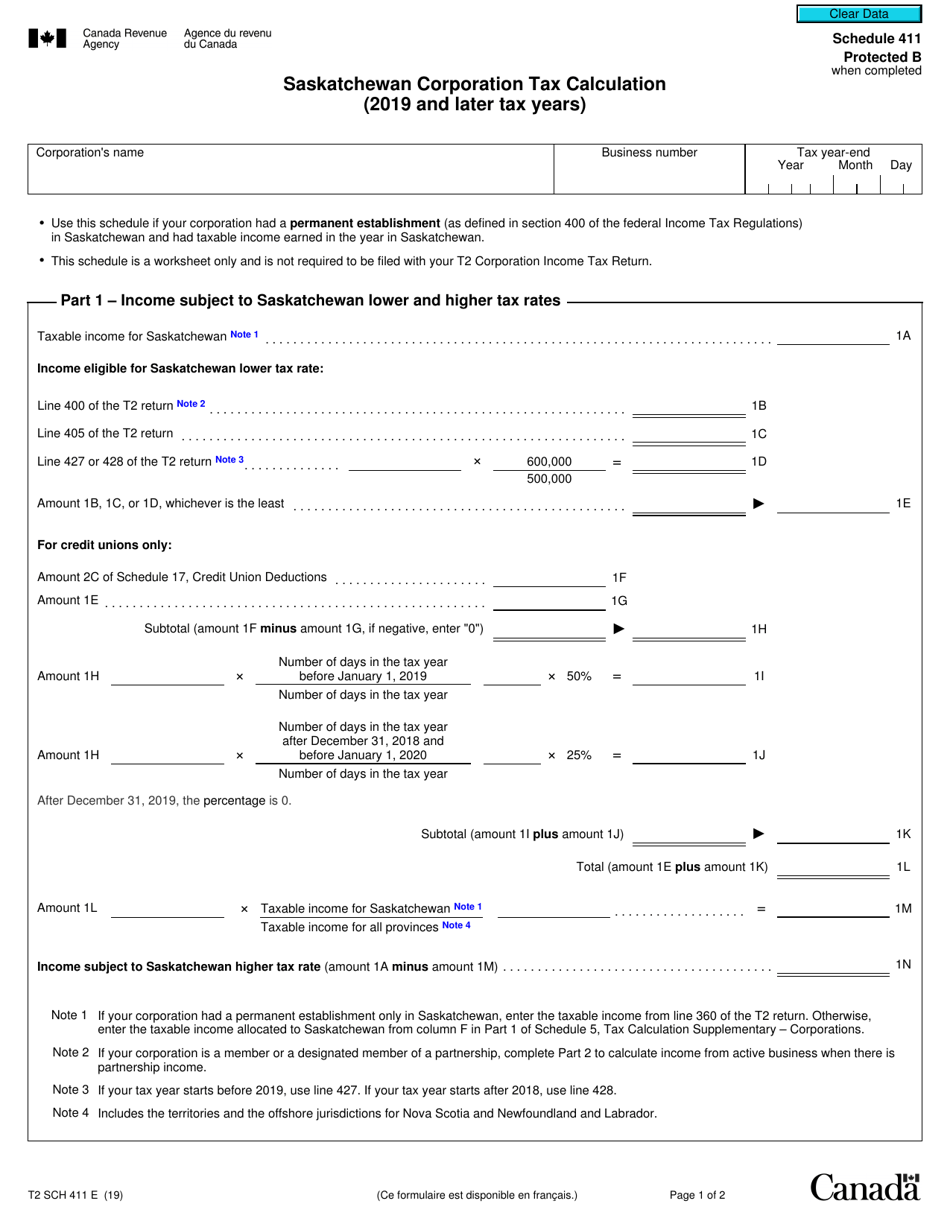

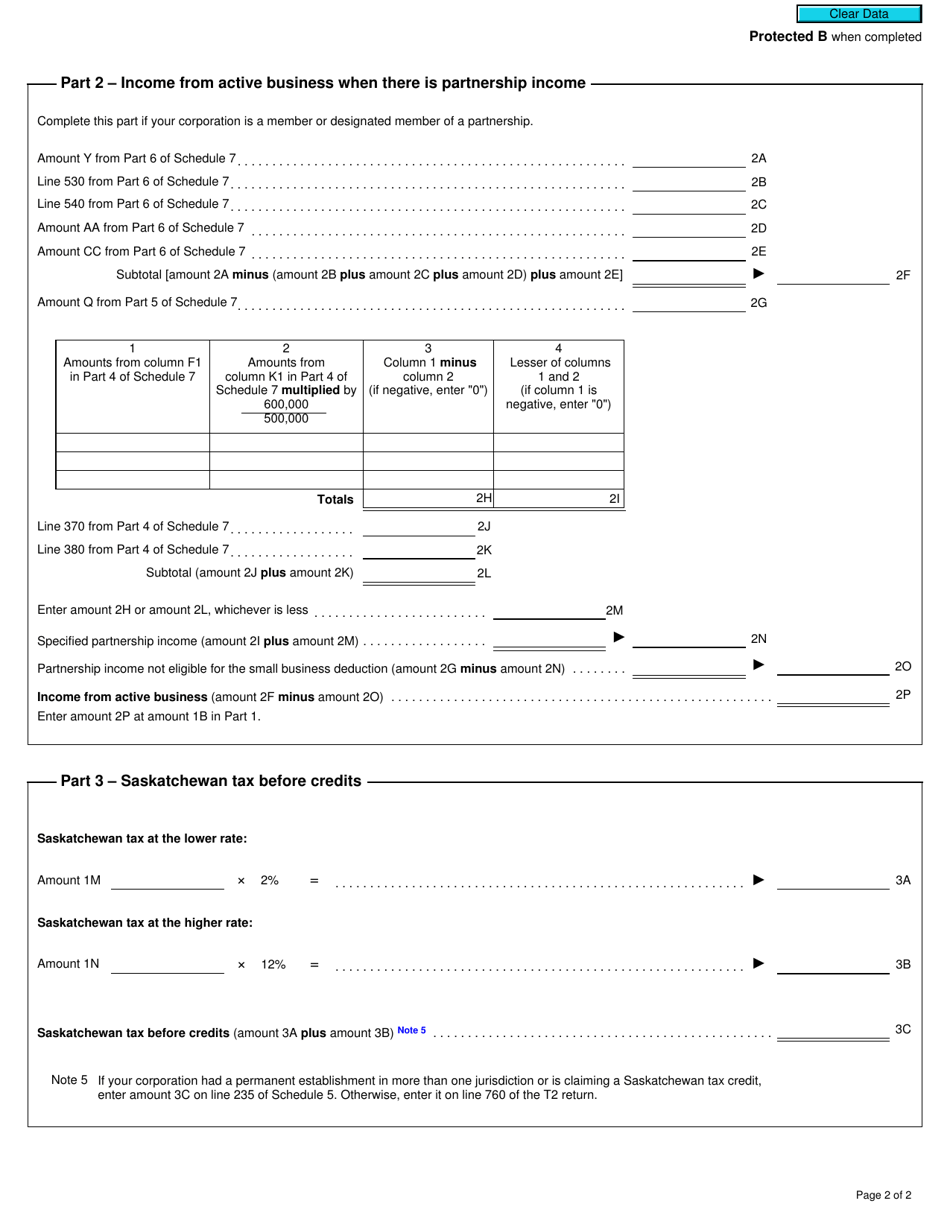

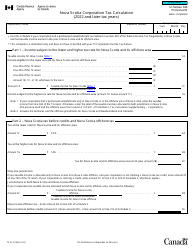

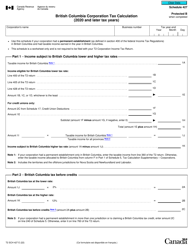

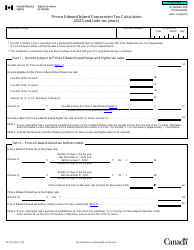

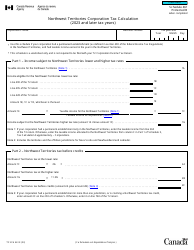

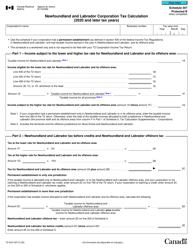

Form T2 Schedule 411 Saskatchewan Corporation Tax Calculation (2019 and Later Tax Years) - Canada

Form T2 Schedule 411 Saskatchewan Corporation Tax Calculation is used in Canada for calculating the provincial tax liability specifically for Saskatchewan corporations. It is utilized for tax years from 2019 onwards. This form assists corporations in determining the amount of provincial tax they are required to pay based on their taxable income and other relevant factors. By completing this schedule, Saskatchewan corporations can accurately calculate their provincial tax obligation in accordance with the tax laws and regulations in place.

The Form T2 Schedule 411, which is used for calculating the Saskatchewan Corporation Tax for the tax years 2019 and onward, is filed by corporations operating in the province of Saskatchewan in Canada.

FAQ

Q: What is Form T2 Schedule 411?

A: Form T2 Schedule 411 is a tax form used by Saskatchewan corporations in Canada to calculate their provincial corporation tax liability for tax years starting in 2019 and later.

Q: Who needs to file Form T2 Schedule 411?

A: Saskatchewan corporations that are subject to provincial corporation tax are required to file Form T2 Schedule 411 along with their federal T2 tax return.

Q: What is the purpose of Form T2 Schedule 411?

A: The purpose of Form T2 Schedule 411 is to determine the amount of provincial corporation tax owed by a Saskatchewan corporation, taking into account various deductions, credits, and tax rates specific to the province.

Q: What information is required to complete Form T2 Schedule 411?

A: To complete Form T2 Schedule 411, you will need the financial information of your Saskatchewan corporation, including its taxable income, deductible expenses, and any applicable tax credits.

Q: When is the deadline to file Form T2 Schedule 411?

A: The deadline to file Form T2 Schedule 411 is generally the same as the deadline for filing the federal T2 tax return, which is typically six months after the end of the corporation's fiscal year.

Q: Are there any penalties for failing to file Form T2 Schedule 411?

A: Yes, there may be penalties and interest charges for late or incomplete filing of Form T2 Schedule 411. It is important to file the form accurately and on time to avoid these penalties.