This version of the form is not currently in use and is provided for reference only. Download this version of

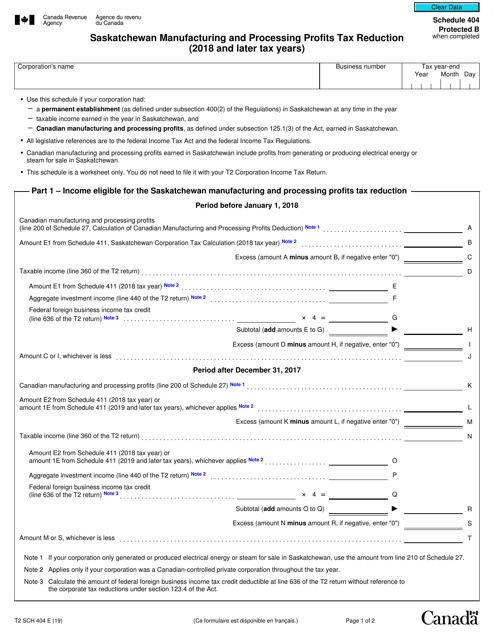

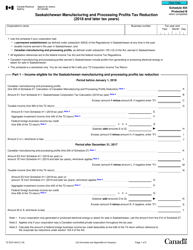

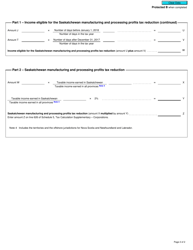

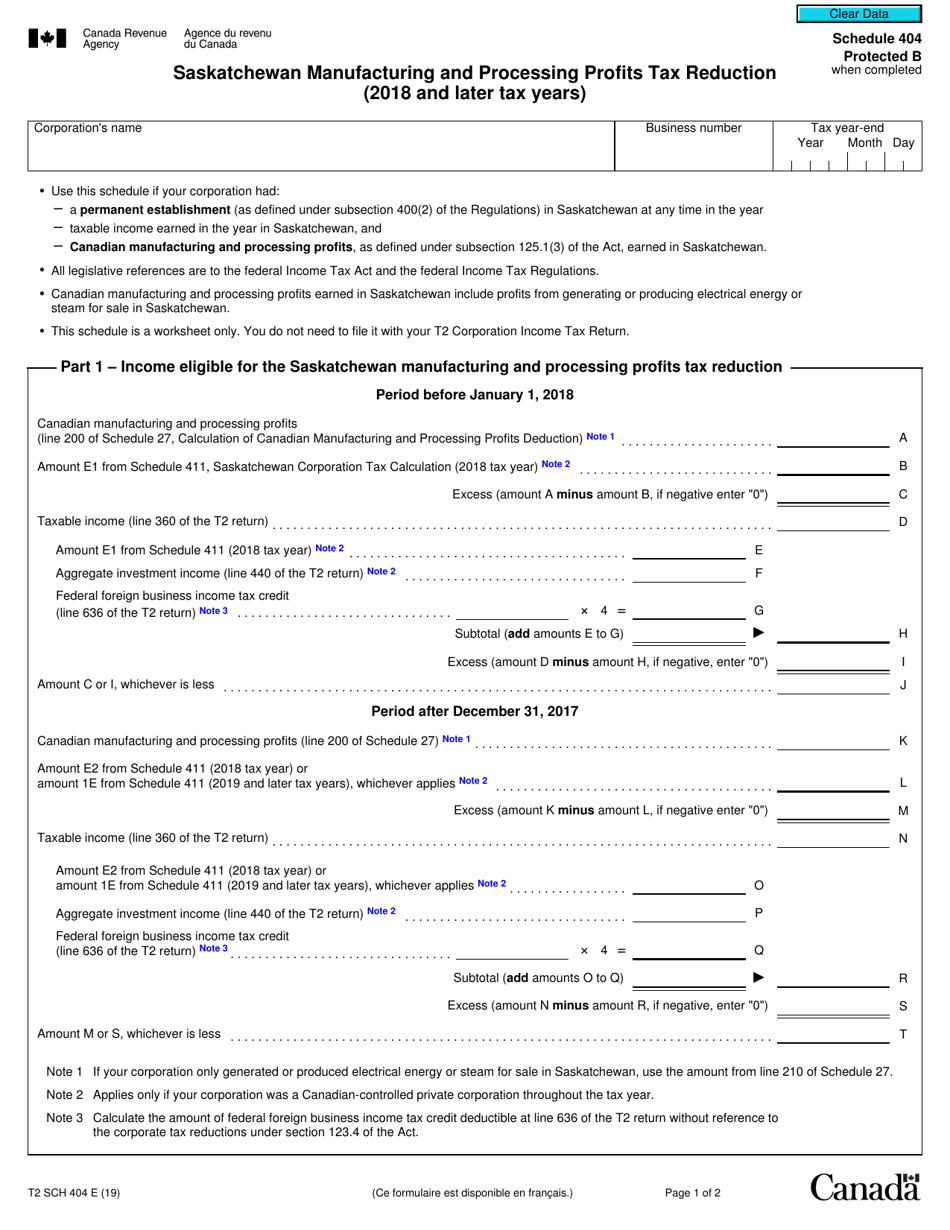

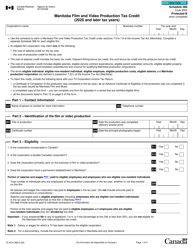

Form T2 Schedule 404

for the current year.

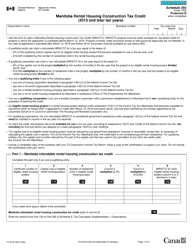

Form T2 Schedule 404 Manitoba Rental Housing Construction Tax Credit (2018 and Later Tax Years) - Canada

Form T2 Schedule 404 is used by corporations to claim the Manitoba Rental Housing Construction Tax Credit for the 2018 and later tax years in Canada. This credit is available to corporations that have built or acquired eligible rental housing properties in Manitoba.

The Form T2 Schedule 404 for the Manitoba Rental Housing Construction Tax Credit in Canada is usually filed by the corporation or entity that is eligible for the credit.

FAQ

Q: What is Form T2 Schedule 404?

A: Form T2 Schedule 404 is a tax form used in Canada for reporting the Manitoba Rental Housing Construction Tax Credit.

Q: What is the purpose of the Manitoba Rental Housing Construction Tax Credit?

A: The purpose of the Manitoba Rental Housing Construction Tax Credit is to provide an incentive for the construction or renovation of rental housing properties in Manitoba.

Q: Who is eligible for the Manitoba Rental Housing Construction Tax Credit?

A: To be eligible for the Manitoba Rental Housing Construction Tax Credit, you must be a corporation that has completed the construction or renovation of eligible rental housing properties in Manitoba.

Q: What are eligible rental housing properties?

A: Eligible rental housing properties are residential properties that are newly constructed or newly renovated and meet certain criteria specified by the Manitoba government.

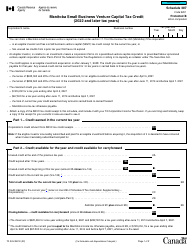

Q: How is the Manitoba Rental Housing Construction Tax Credit calculated?

A: The Manitoba Rental Housing Construction Tax Credit is calculated as a percentage of the eligible construction or renovation costs incurred.

Q: How is the Manitoba Rental Housing Construction Tax Credit claimed?

A: The Manitoba Rental Housing Construction Tax Credit is claimed by completing Form T2 Schedule 404 and attaching it to the corporation's income tax return.

Q: Can the Manitoba Rental Housing Construction Tax Credit be carried forward?

A: Yes, the Manitoba Rental Housing Construction Tax Credit can be carried forward for up to 20 years if it is not fully used in the current tax year.

Q: Is there a deadline for claiming the Manitoba Rental Housing Construction Tax Credit?

A: Yes, the deadline for claiming the Manitoba Rental Housing Construction Tax Credit is generally within 18 months from the end of the tax year in which the eligible expenses were incurred.

Q: Are there any other tax credits available for rental housing construction in Canada?

A: Yes, there may be other tax credits available at the federal and provincial levels in Canada for rental housing construction or renovation projects.