This version of the form is not currently in use and is provided for reference only. Download this version of

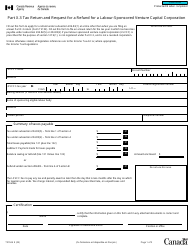

Form T2 Schedule 387

for the current year.

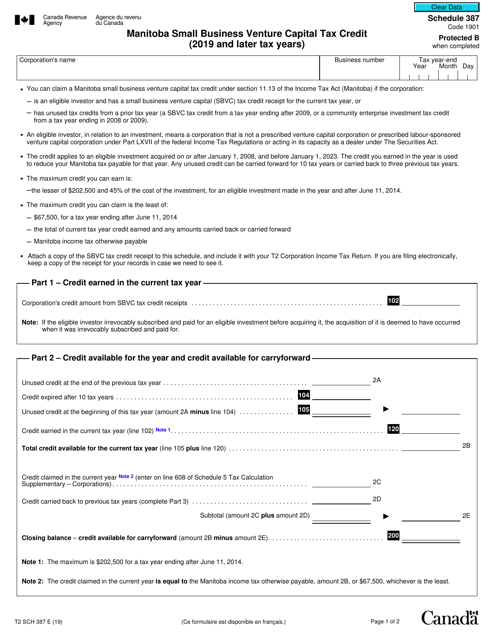

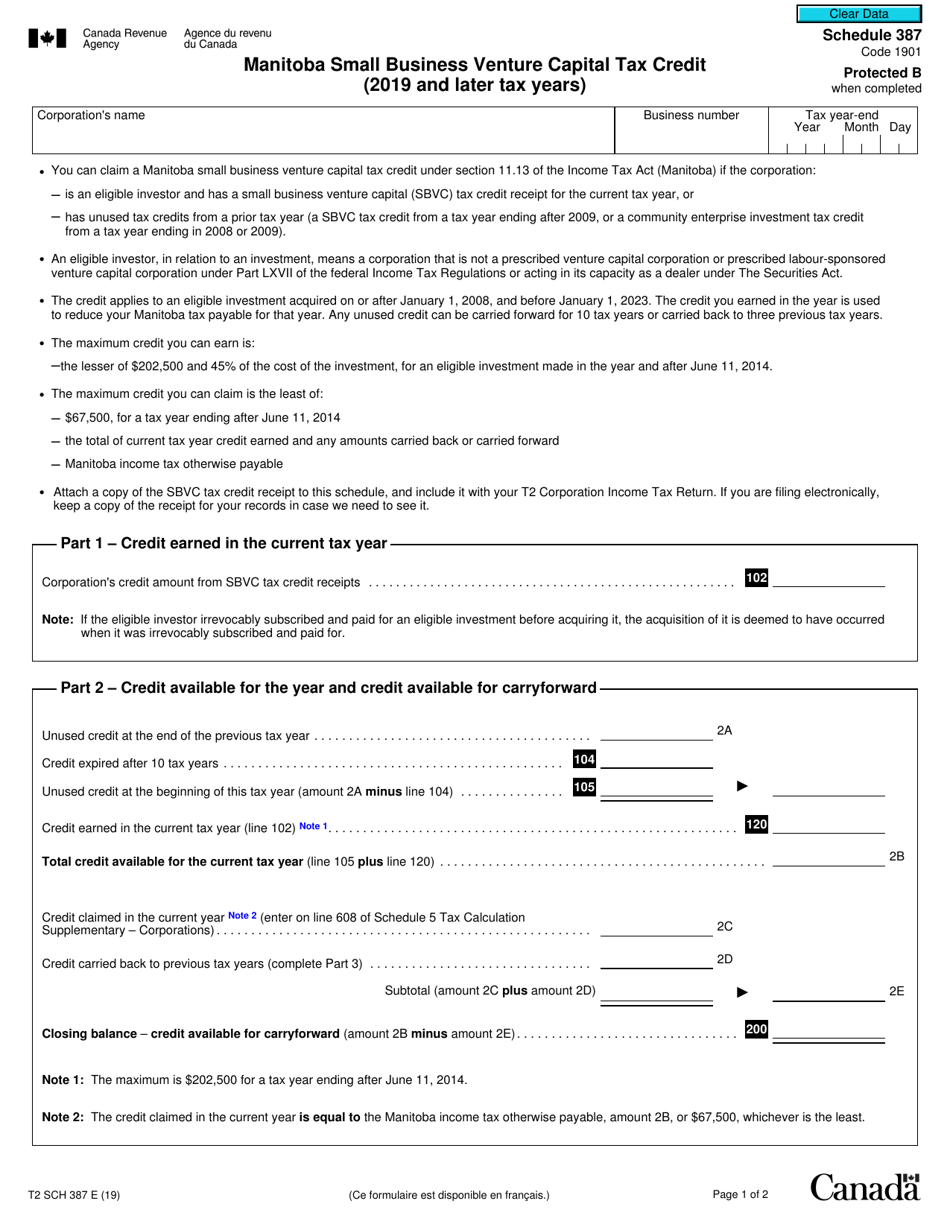

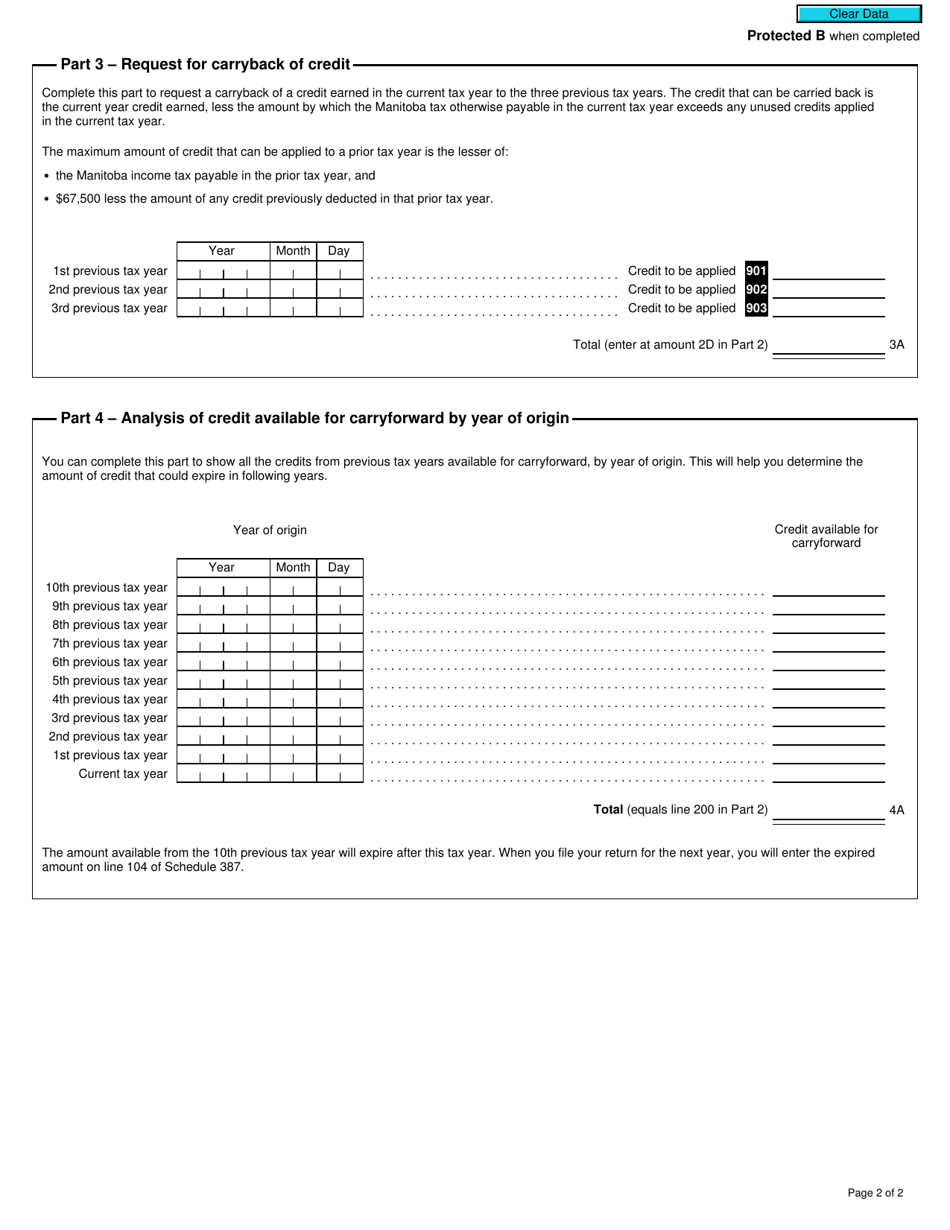

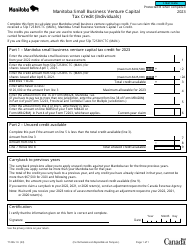

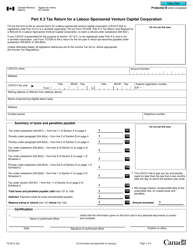

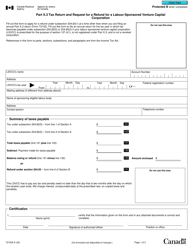

Form T2 Schedule 387 Manitoba Small Business Venture Capital Tax Credit (2019 and Later Tax Years) - Canada

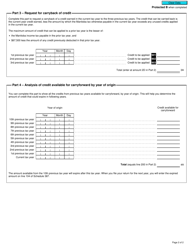

Form T2 Schedule 387 is used in Canada for claiming the Manitoba Small Business Venture Capital Tax Credit for the tax years 2019 and later. This tax credit is intended to support small businesses in Manitoba by providing incentives for individuals or corporations who invest in eligible venture capital corporations.

The Form T2 Schedule 387 Manitoba Small Business Venture Capital Tax Credit is filed by corporations in Manitoba, Canada.

FAQ

Q: What is Form T2 Schedule 387?

A: Form T2 Schedule 387 is a tax form used in Canada to claim the Manitoba Small Business Venture Capital Tax Credit.

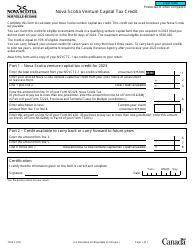

Q: What is the purpose of the Manitoba Small Business Venture Capital Tax Credit?

A: The credit is designed to encourage investment in small businesses by providing a tax credit to individuals who invest in eligible shares of a qualified small business corporation.

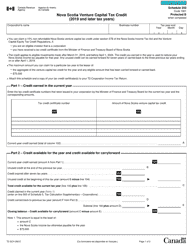

Q: Who is eligible to claim the Manitoba Small Business Venture Capital Tax Credit?

A: Individuals who invest in eligible shares of a qualified small business corporation in Manitoba are eligible to claim the tax credit.

Q: How much is the tax credit?

A: The tax credit is equal to 30% of the eligible investment made in the qualified small business corporation.

Q: What are the requirements to qualify for the tax credit?

A: To qualify, the investment must be made in a qualified small business corporation in Manitoba, and the shares must be held for a minimum of five years.

Q: How do I claim the Manitoba Small Business Venture Capital Tax Credit?

A: To claim the tax credit, you need to complete Form T2 Schedule 387 and include it with your corporate tax return.

Q: Is there a limit to the amount of tax credit I can claim?

A: Yes, there is a limit of $450,000 for each tax year.

Q: Are there any other conditions or restrictions for claiming the tax credit?

A: Yes, there are additional conditions and restrictions outlined in the instructions for Form T2 Schedule 387. It's important to review them carefully before claiming the credit.