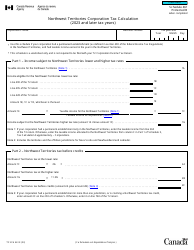

This version of the form is not currently in use and is provided for reference only. Download this version of

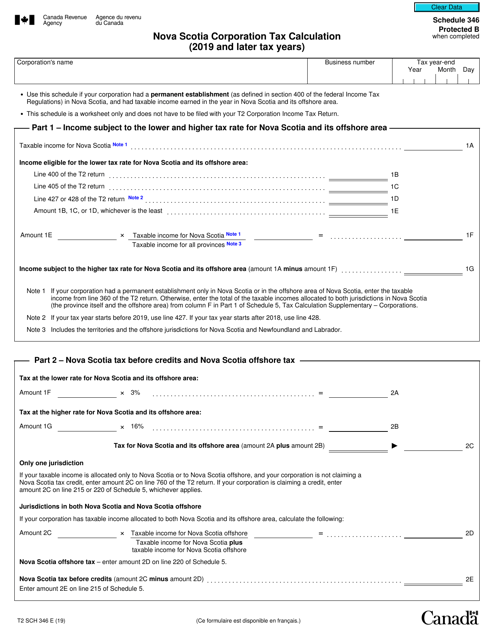

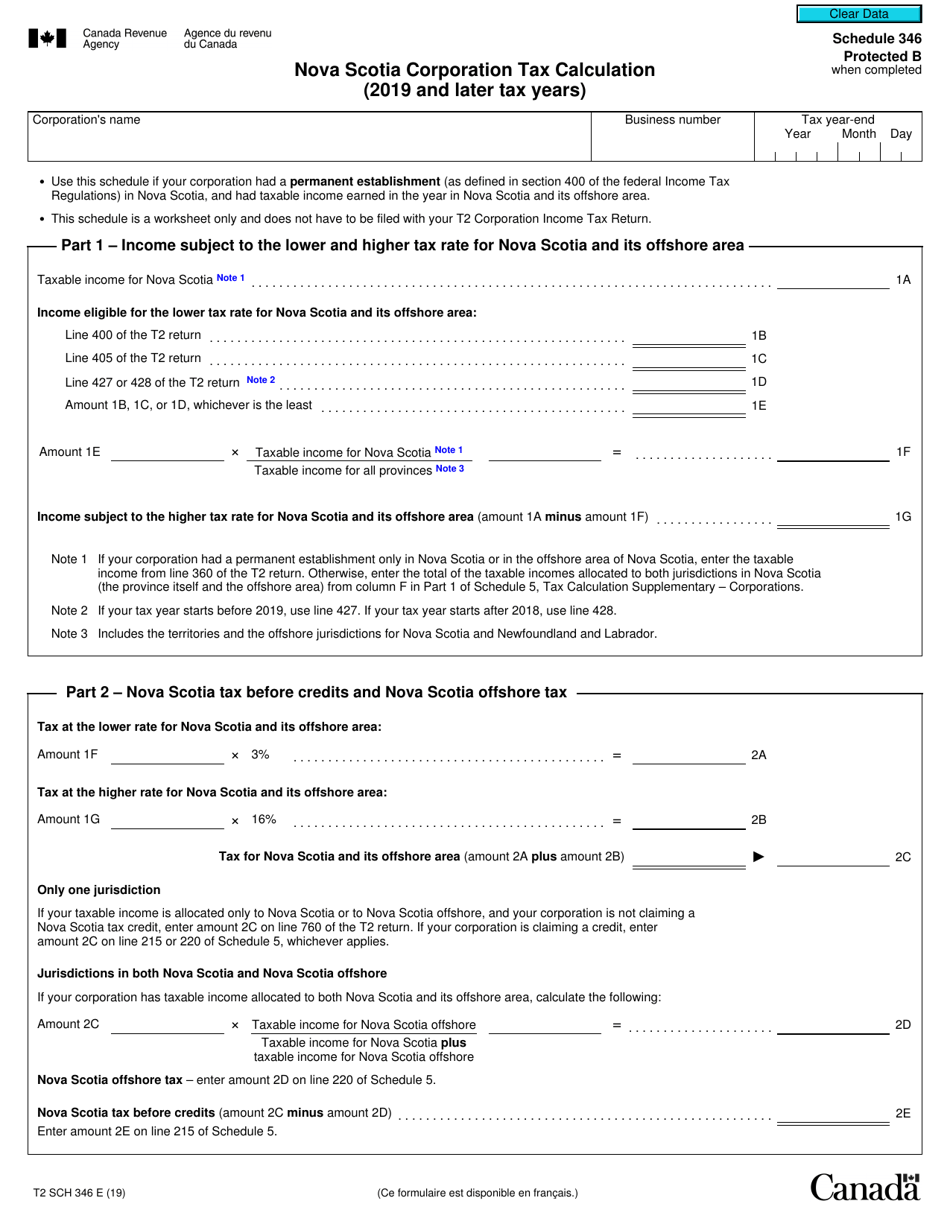

Form T2 Schedule 346

for the current year.

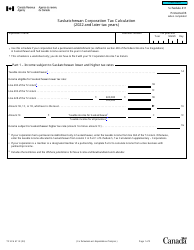

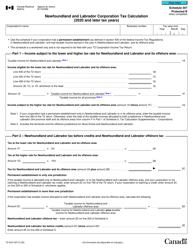

Form T2 Schedule 346 Nova Scotia Corporation Tax Calculation (2019 and Later Tax Years) - Canada

Form T2 Schedule 346 is used to calculate the Nova Scotia corporation tax for tax years 2019 and later in Canada. It provides a breakdown of the calculations and helps corporations determine their tax liability in Nova Scotia.

The Form T2 Schedule 346 Nova Scotia Corporation Tax Calculation is filed by Nova Scotia corporations as part of their tax return in Canada.

FAQ

Q: What is Form T2 Schedule 346?

A: Form T2 Schedule 346 is a tax calculation form for Nova Scotia corporations in Canada.

Q: Which tax years does Form T2 Schedule 346 apply to?

A: Form T2 Schedule 346 applies to tax years starting in 2019 and later.

Q: Who needs to use Form T2 Schedule 346?

A: Nova Scotia corporations that are required to file a Canadian corporate tax return (Form T2) need to use Form T2 Schedule 346 for tax calculations.

Q: What is the purpose of Form T2 Schedule 346?

A: Form T2 Schedule 346 is used to calculate the Nova Scotia corporate tax payable by a corporation.